This version of the form is not currently in use and is provided for reference only. Download this version of

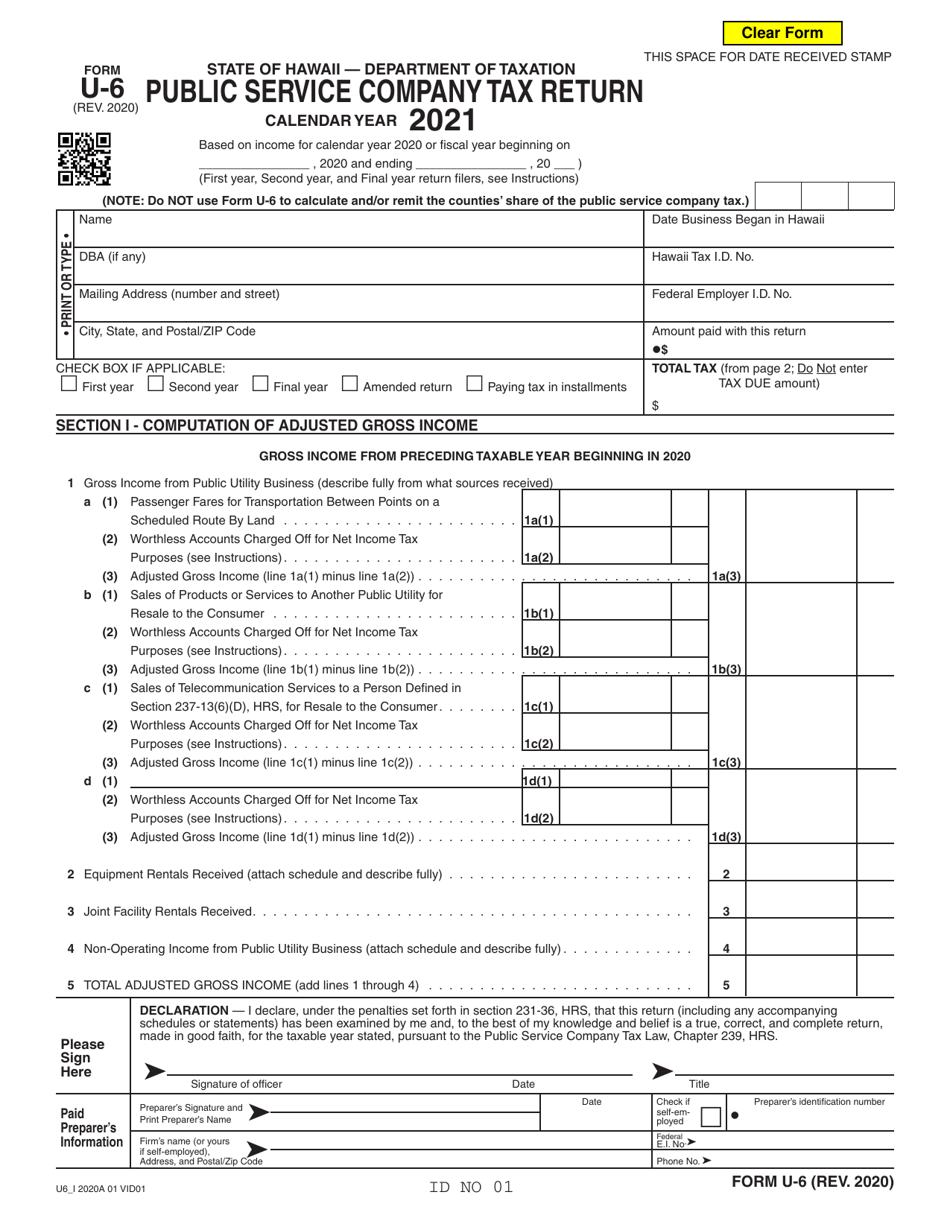

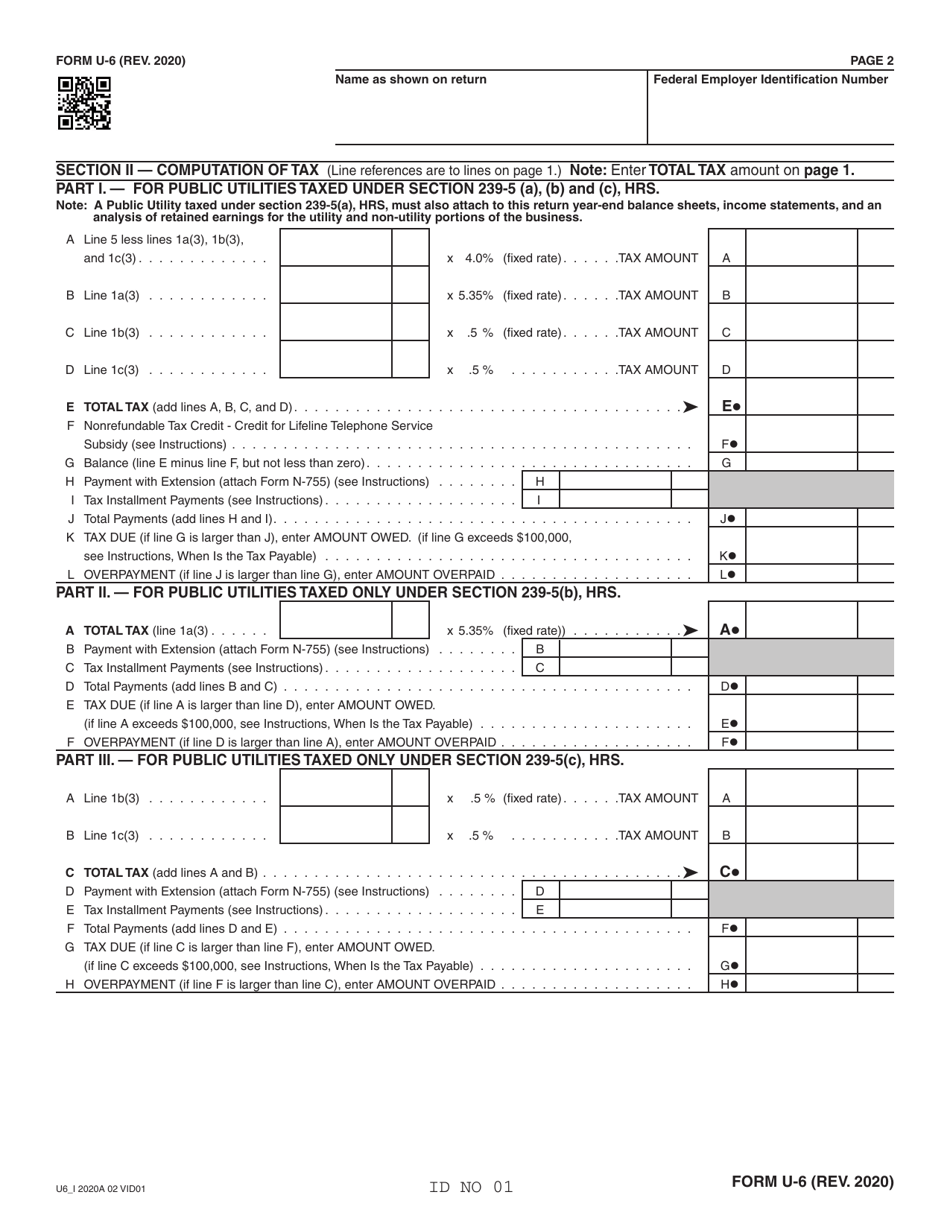

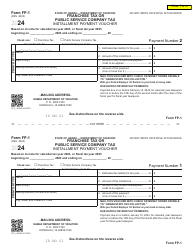

Form U-6

for the current year.

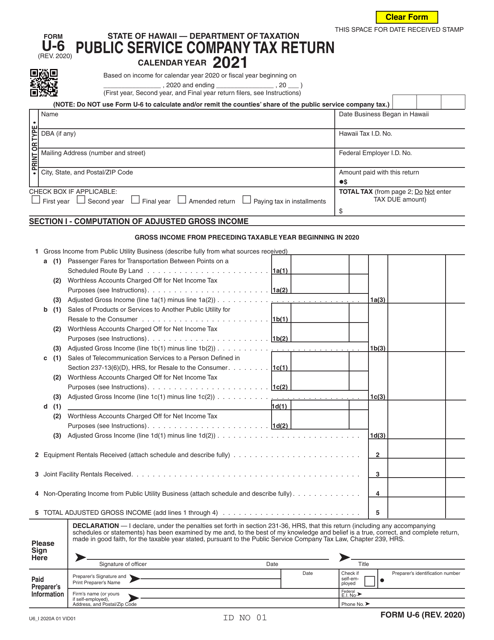

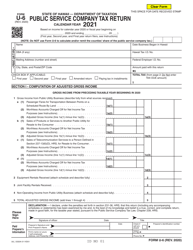

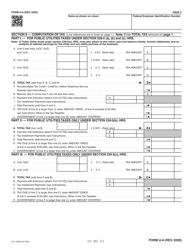

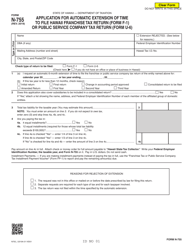

Form U-6 Public Service Company Tax Return - Hawaii

What Is Form U-6?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form U-6?

A: Form U-6 is the Public Service Company Tax Return specifically for companies operating in Hawaii.

Q: Who is required to file Form U-6?

A: Public service companies operating in Hawaii are required to file Form U-6.

Q: What is the purpose of Form U-6?

A: The purpose of Form U-6 is to report and calculate the tax liability for public service companies in Hawaii.

Q: Are there any special requirements for completing Form U-6?

A: Yes, public service companies must follow the instructions provided by the Hawaii Department of Taxation.

Q: When is Form U-6 due?

A: Form U-6 is due on or before the 20th day of the fourth month following the end of the company's fiscal year.

Form Details:

- Released on January 1, 2020;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form U-6 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.