This version of the form is not currently in use and is provided for reference only. Download this version of

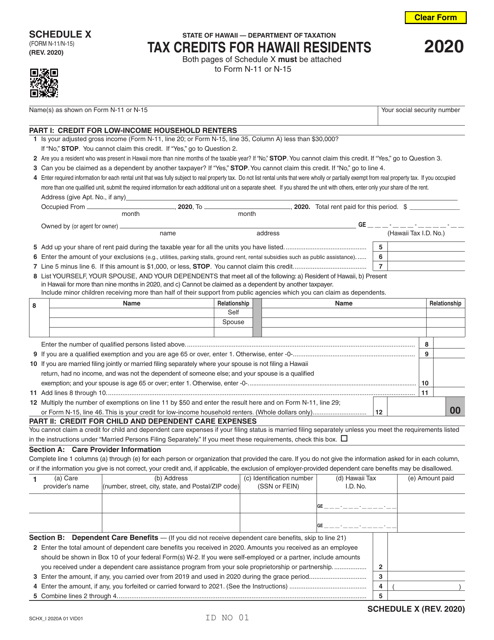

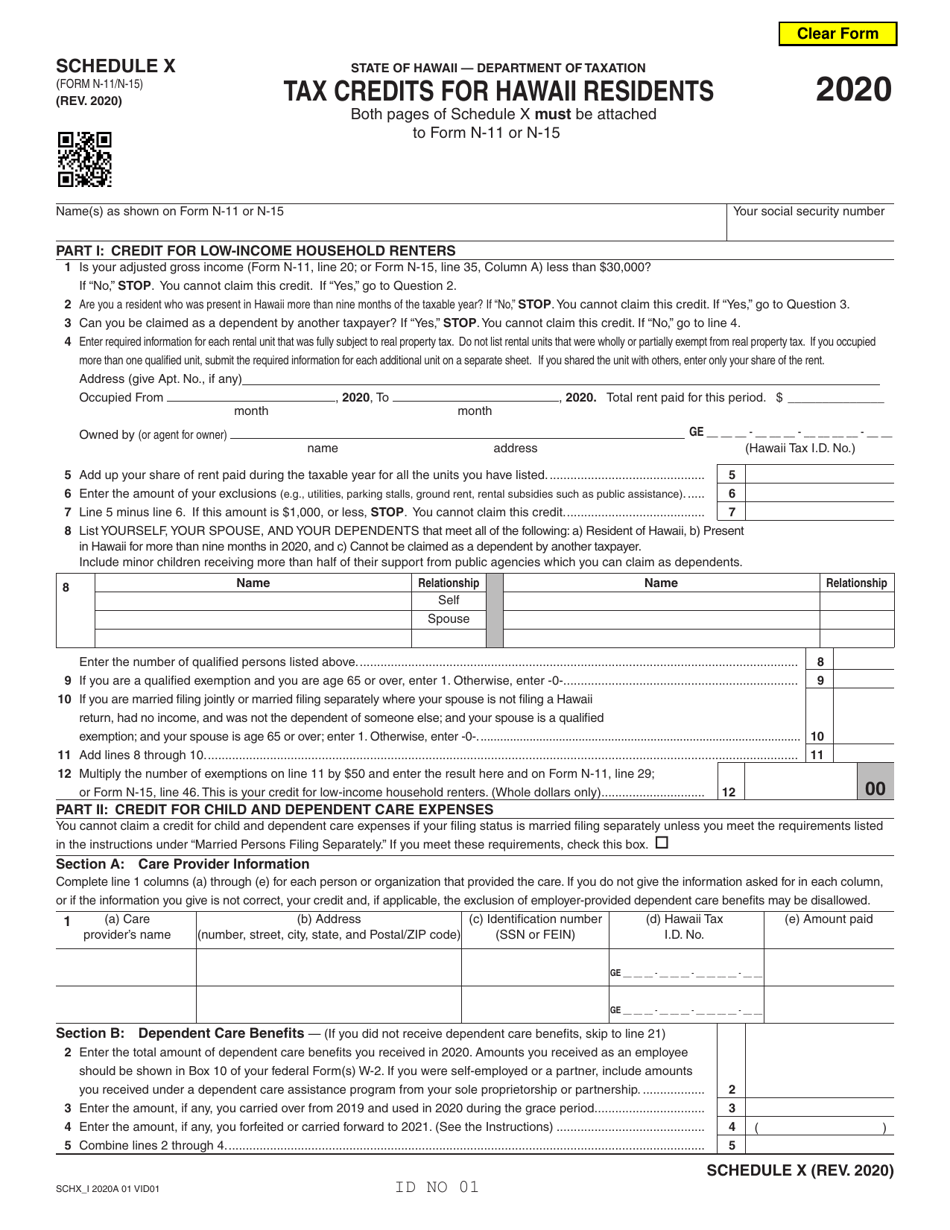

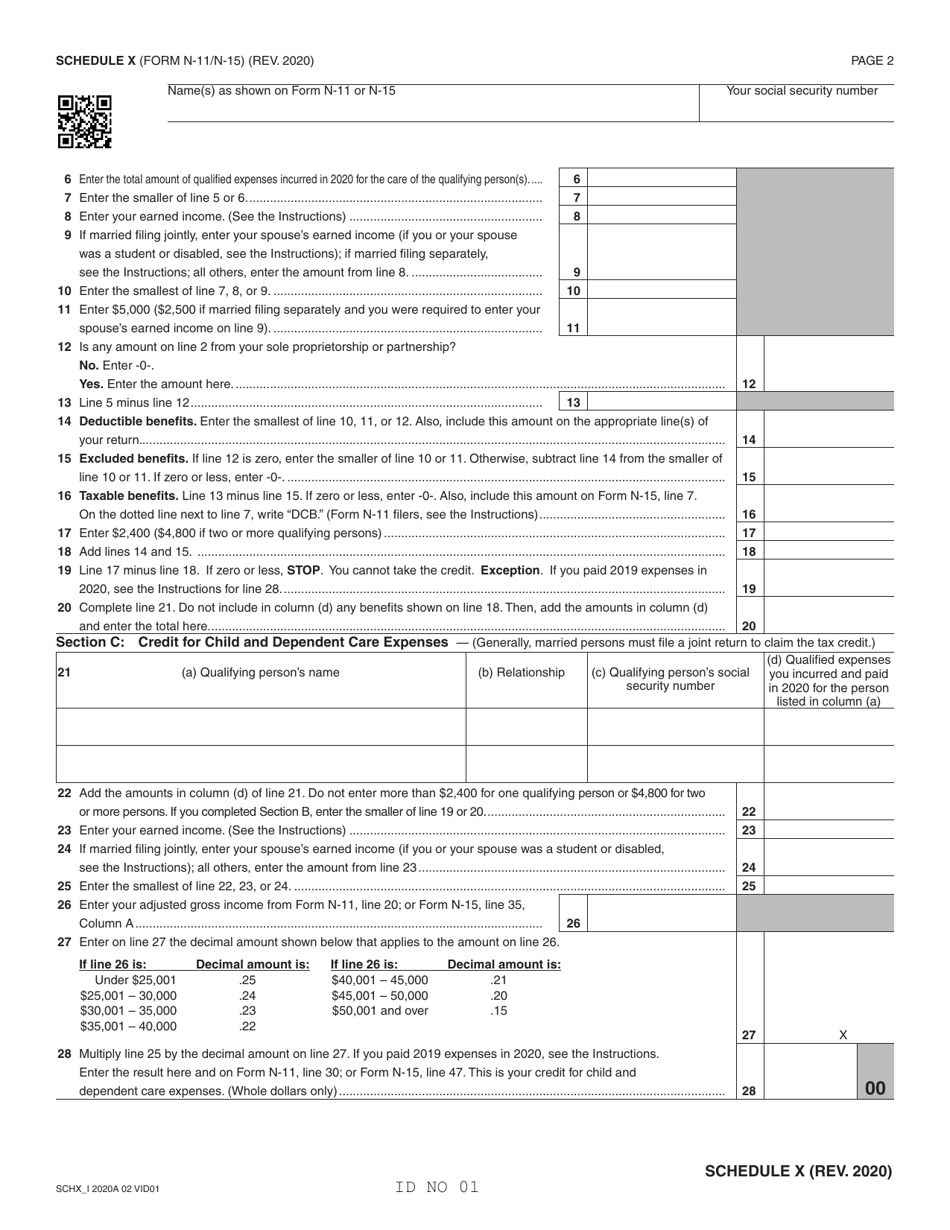

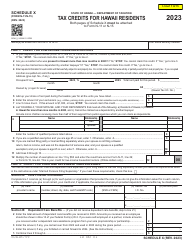

Schedule X

for the current year.

Schedule X Tax Credits for Hawaii Residents - Hawaii

What Is Schedule X?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule X?

A: Schedule X is a tax schedule specifically for Hawaii residents.

Q: What are tax credits?

A: Tax credits are deductions from the amount of tax that you owe, reducing your tax liability.

Q: Who is eligible for Schedule X?

A: Hawaii residents who meet certain criteria are eligible for Schedule X.

Q: What tax credits are available on Schedule X for Hawaii residents?

A: Schedule X provides tax credits for various expenses such as childcare, education, and renewable energy.

Q: How do I claim tax credits on Schedule X?

A: You need to fill out the appropriate sections of Schedule X and include it with your state tax return.

Q: Can I claim tax credits from other states on Schedule X?

A: No, Schedule X is specific to Hawaii and only allows for tax credits related to Hawaii expenses.

Q: Are there any limitations on the tax credits I can claim on Schedule X?

A: Yes, there may be income limitations or other criteria that determine eligibility for specific tax credits.

Q: When is the deadline to file Schedule X?

A: The deadline to file Schedule X is the same as the deadline for your Hawaii state tax return, typically April 20th or the next business day.

Form Details:

- Released on January 1, 2020;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule X by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.