This version of the form is not currently in use and is provided for reference only. Download this version of

Schedule J

for the current year.

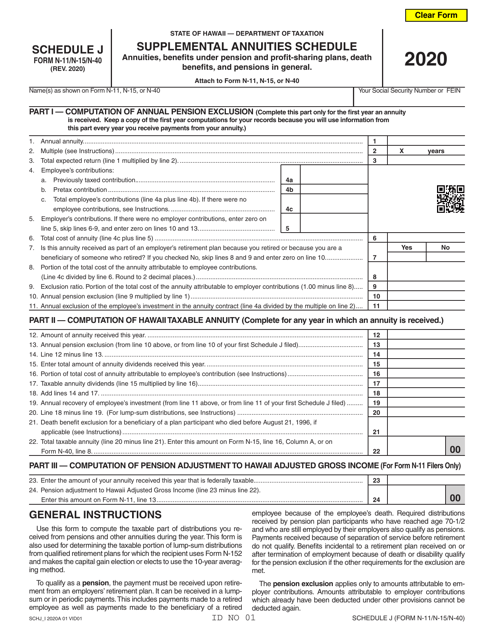

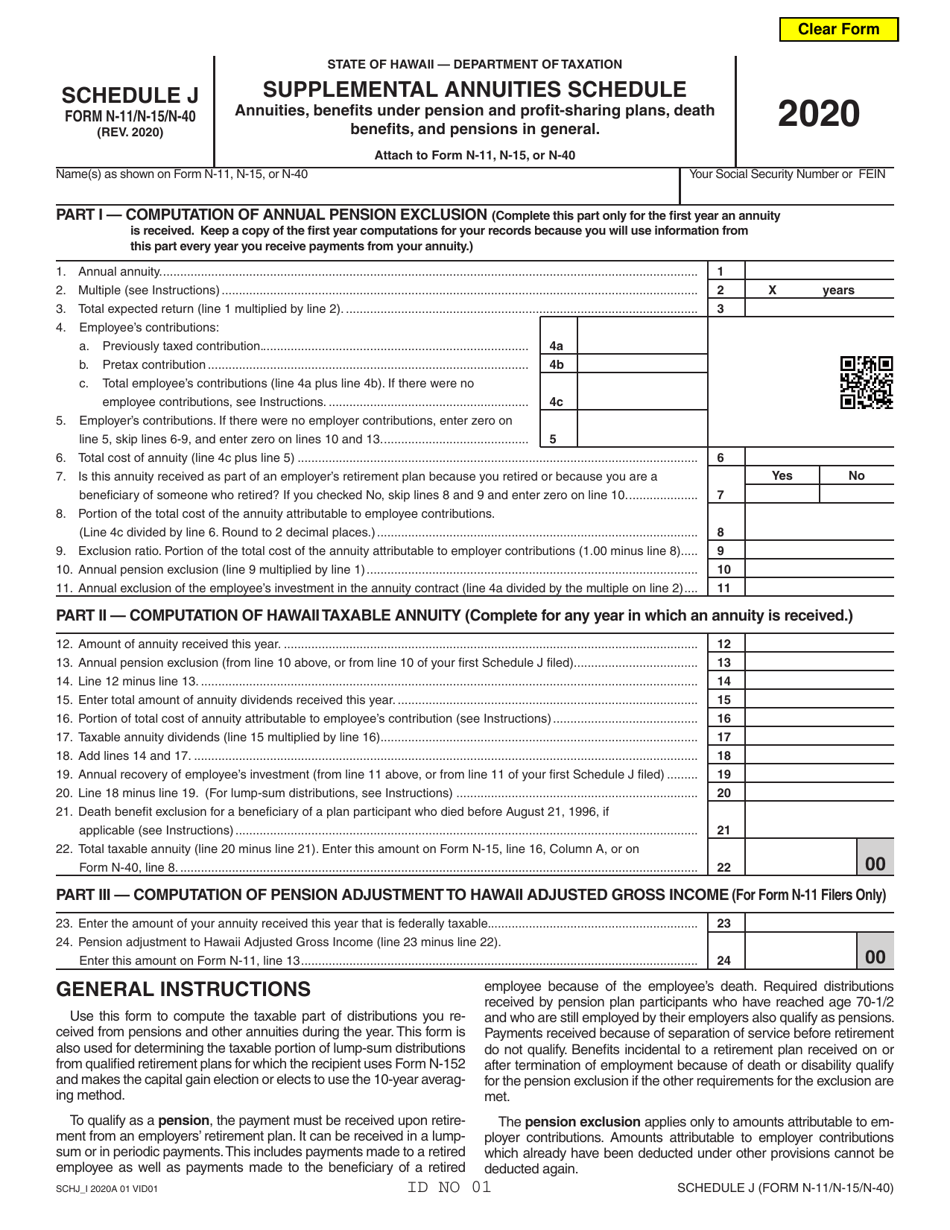

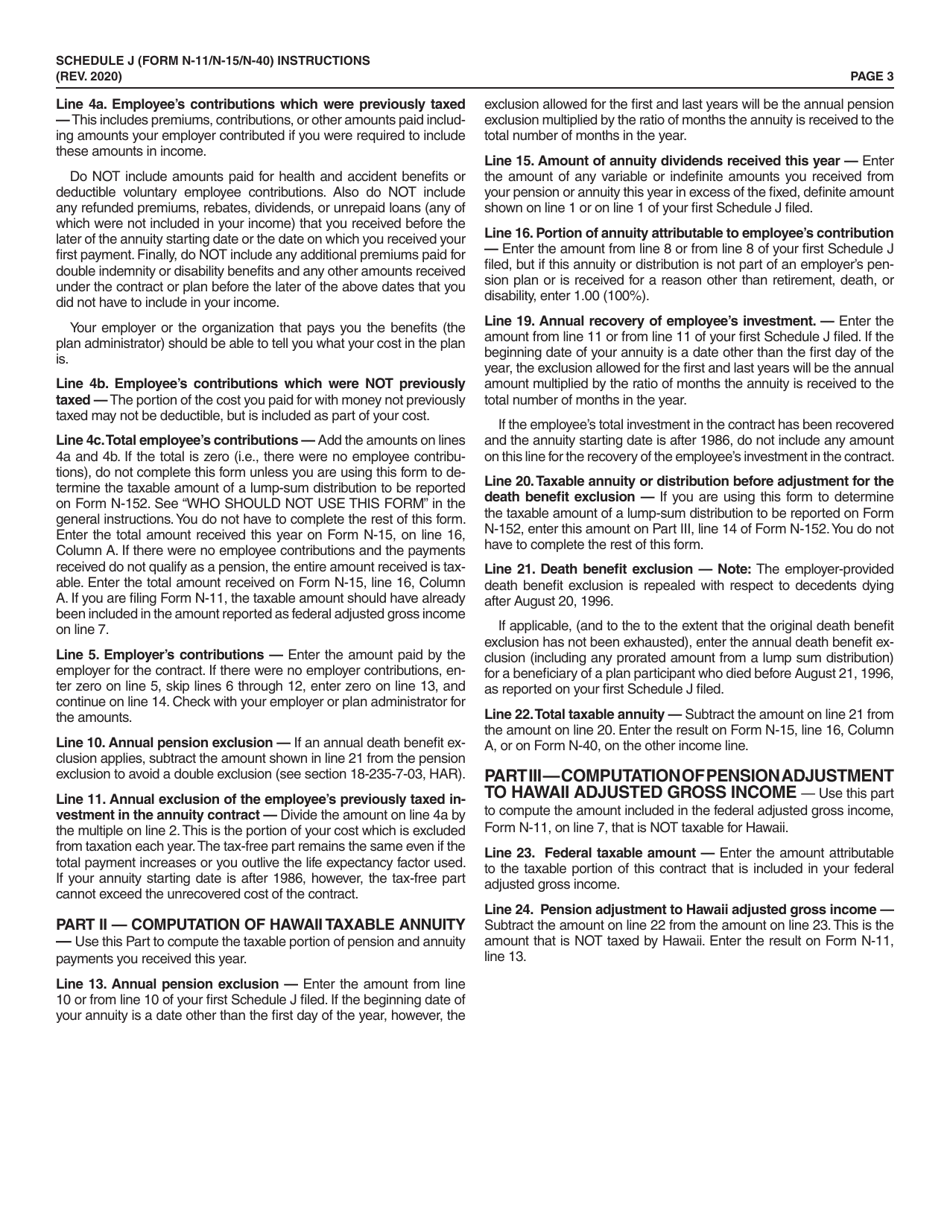

Schedule J Supplemental Annuities Schedule - Hawaii

What Is Schedule J?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Schedule J Supplemental Annuities Schedule?

A: The Schedule J Supplemental Annuities Schedule is a form used for reporting supplemental annuity income in Hawaii.

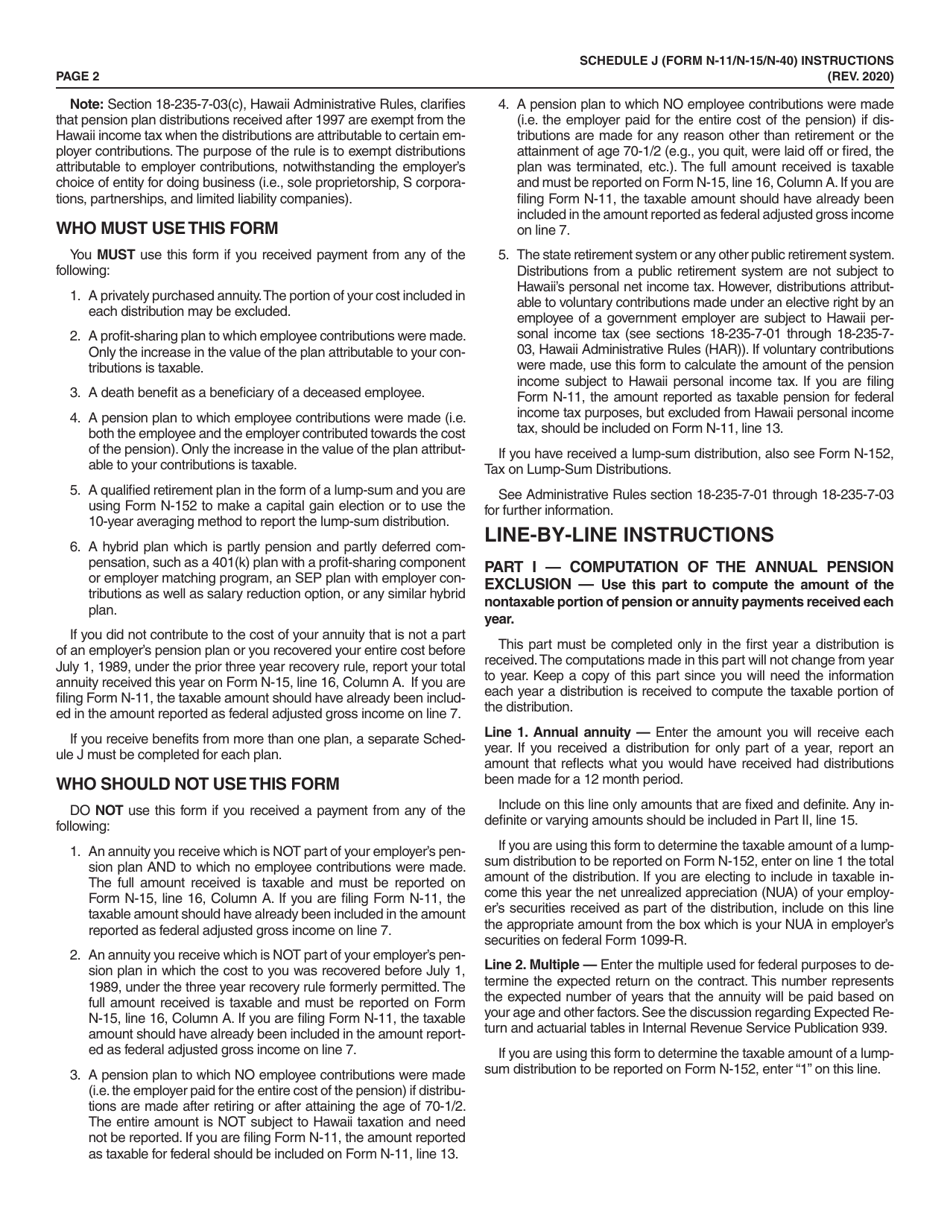

Q: Who needs to fill out the Schedule J Supplemental Annuities Schedule?

A: Individuals who receive supplemental annuity income in Hawaii need to fill out the Schedule J Supplemental Annuities Schedule.

Q: What information is required on the Schedule J Supplemental Annuities Schedule?

A: The Schedule J Supplemental Annuities Schedule requires information about the amount of supplemental annuity income received and any taxes withheld.

Q: When is the deadline for filing the Schedule J Supplemental Annuities Schedule?

A: The deadline for filing the Schedule J Supplemental Annuities Schedule is the same as the Hawaii state tax returnfiling deadline, typically April 20th or the next business day if it falls on a weekend or holiday.

Form Details:

- Released on January 1, 2020;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule J by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.