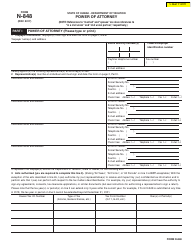

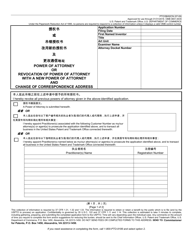

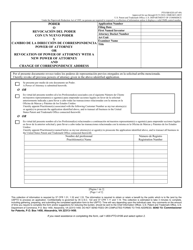

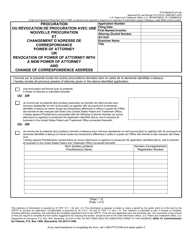

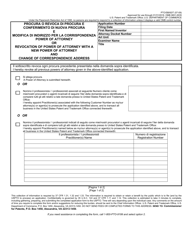

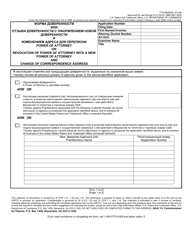

This version of the form is not currently in use and is provided for reference only. Download this version of

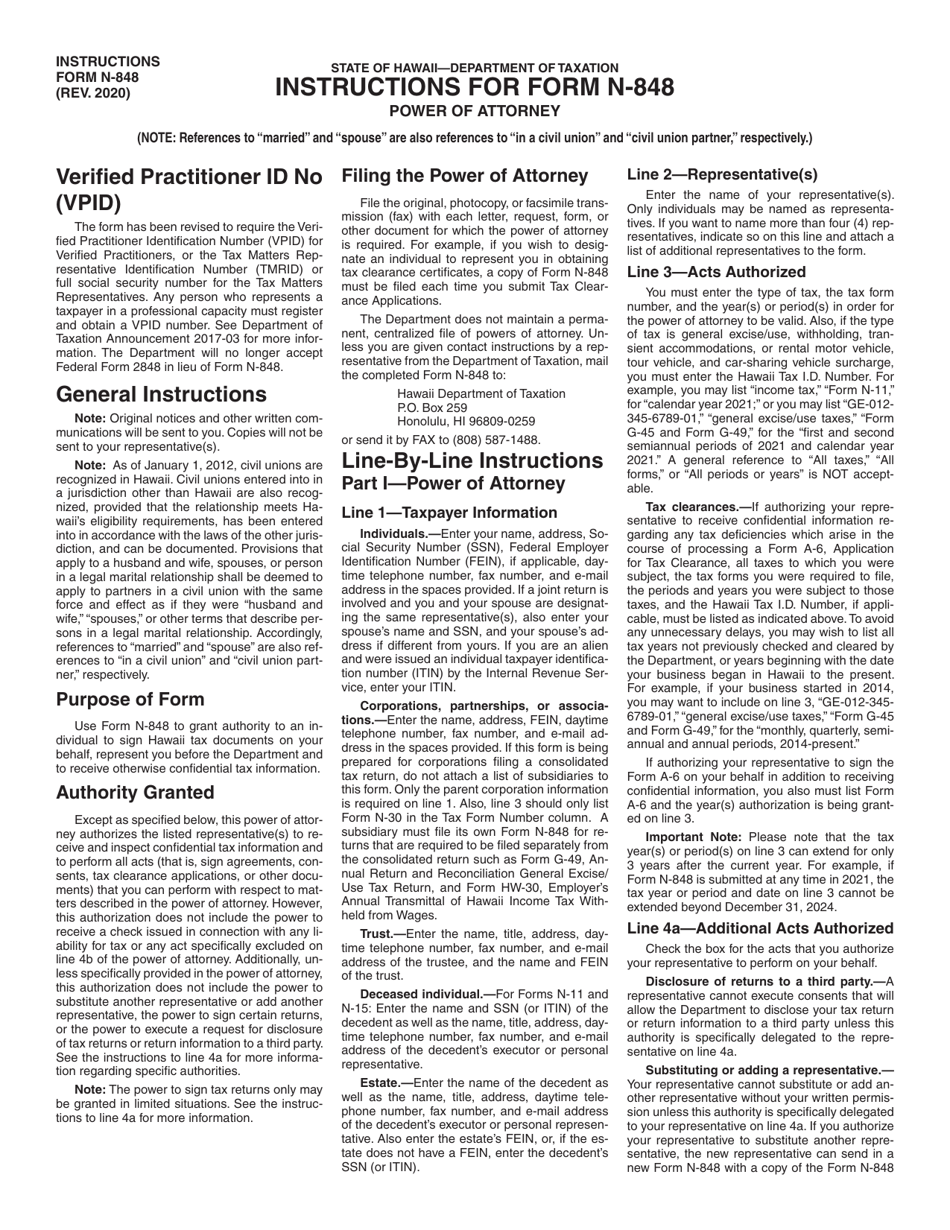

Instructions for Form N-848

for the current year.

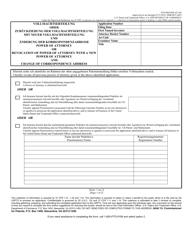

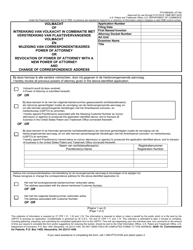

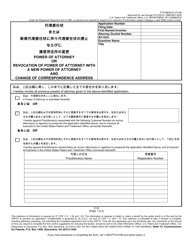

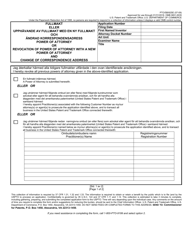

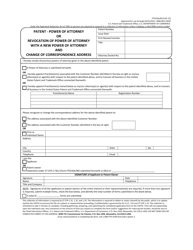

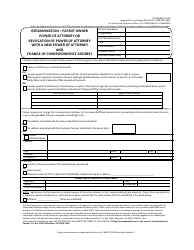

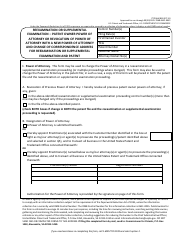

Instructions for Form N-848 Power of Attorney - Hawaii

This document contains official instructions for Form N-848 , Power of Attorney - a form released and collected by the Hawaii Department of Taxation. An up-to-date fillable Form N-848 is available for download through this link.

FAQ

Q: What is Form N-848?

A: Form N-848 is a Power of Attorney form for individuals in Hawaii.

Q: What is a Power of Attorney?

A: A Power of Attorney is a legal document that grants someone else the authority to act on your behalf.

Q: Who should use Form N-848?

A: Individuals in Hawaii who want to grant someone else the authority to handle their tax matters should use Form N-848.

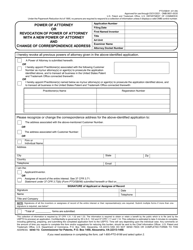

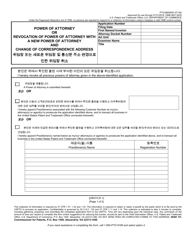

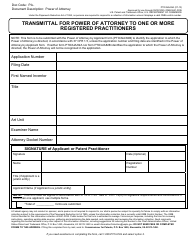

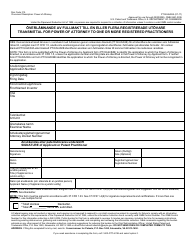

Q: What information is required on Form N-848?

A: Form N-848 requires the taxpayer's name, taxpayer identification number, and the name and contact information of the designated representative.

Q: How should Form N-848 be completed?

A: Form N-848 should be completed with accurate and complete information, signed by the taxpayer, and submitted to the Hawaii Department of Taxation.

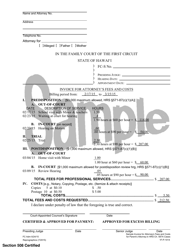

Q: Is there a fee for using Form N-848?

A: No, there is no fee for using Form N-848.

Q: How long does it take for Form N-848 to be processed?

A: The processing time for Form N-848 can vary, but it is typically processed within a few weeks.

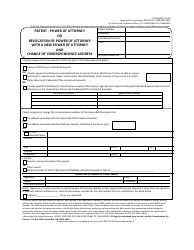

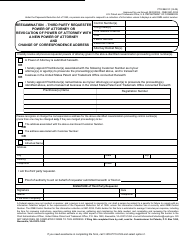

Q: Can Form N-848 be revoked?

A: Yes, Form N-848 can be revoked by submitting a written notice to the Hawaii Department of Taxation.

Q: What if I have questions or need assistance with Form N-848?

A: If you have questions or need assistance with Form N-848, you can contact the Hawaii Department of Taxation or consult with a tax professional.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Hawaii Department of Taxation.