This version of the form is not currently in use and is provided for reference only. Download this version of

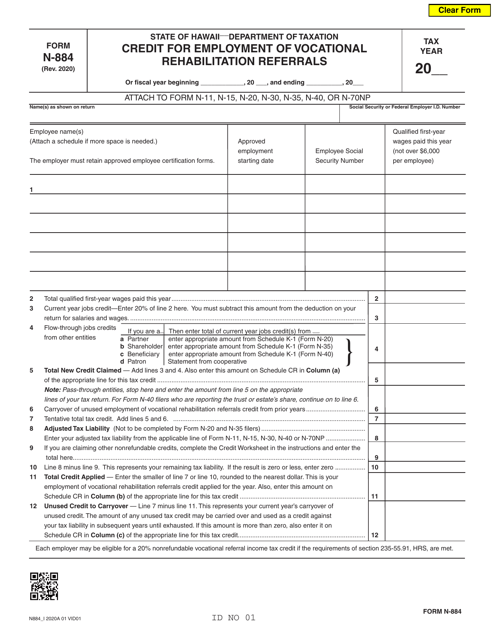

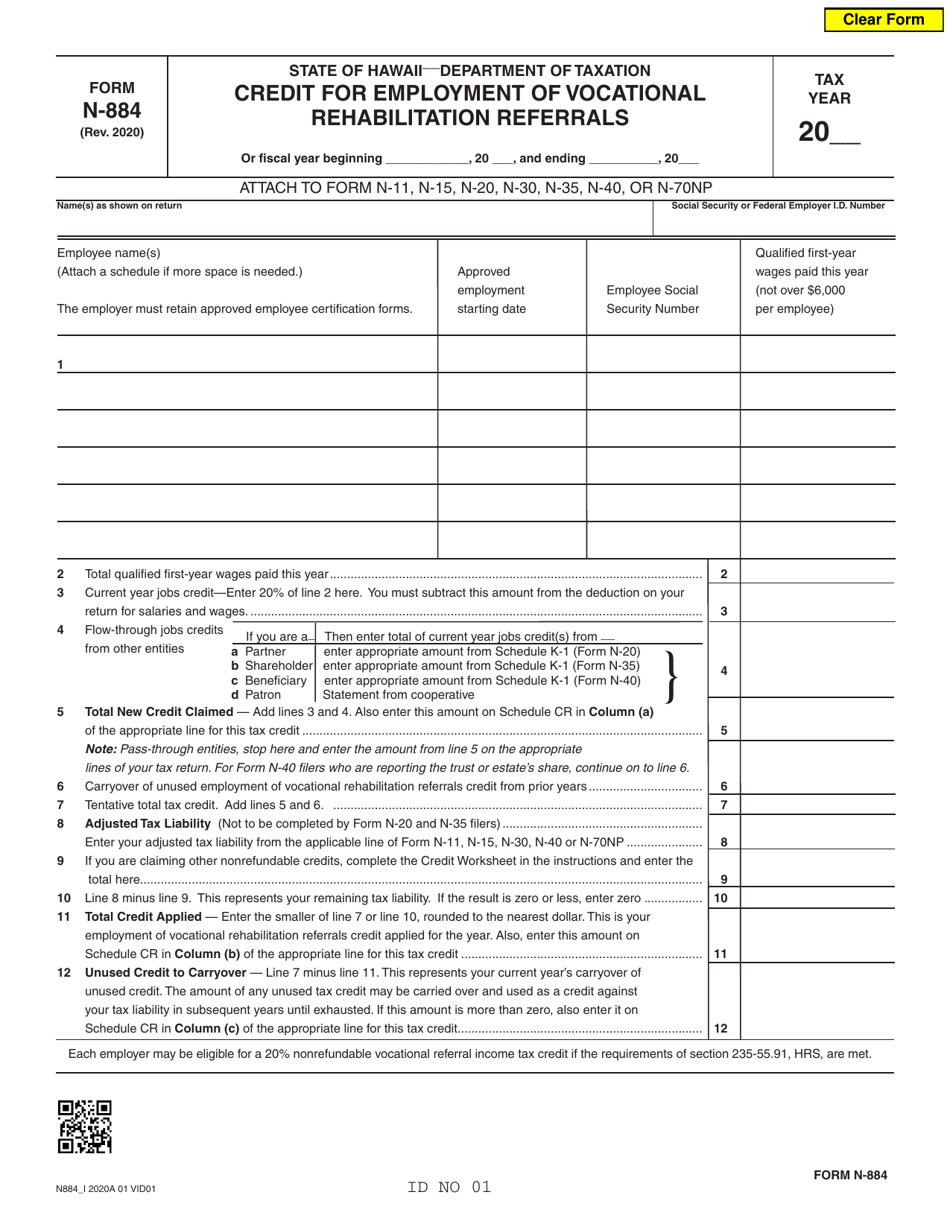

Form N-884

for the current year.

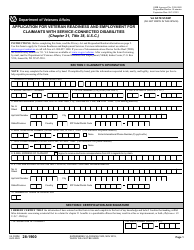

Form N-884 Credit for Employment of Vocational Rehabilitation Referrals - Hawaii

What Is Form N-884?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form N-884?

A: Form N-884 is a form used to claim the credit for employment of vocational rehabilitation referrals in the state of Hawaii.

Q: Who can claim the credit for employment of vocational rehabilitation referrals?

A: Employers in the state of Hawaii who hire individuals referred by vocational rehabilitation services can claim the credit.

Q: What is the purpose of Form N-884?

A: The purpose of Form N-884 is to allow employers to claim a tax credit for hiring individuals referred by vocational rehabilitation services.

Q: What information is required on Form N-884?

A: Form N-884 requires the employer to provide details about the individual hired, such as their name, social security number, and the date of employment.

Q: How much is the credit for employment of vocational rehabilitation referrals?

A: The amount of the credit can vary, but it is generally 40% of the first year's wages paid to the individual, up to a maximum of $5,000.

Q: Are there any eligibility requirements to claim the credit?

A: Yes, the employer must meet certain requirements, including being registered with the Hawaii Department of Labor and Industrial Relations and maintaining adequate records.

Q: How and when should Form N-884 be filed?

A: Form N-884 should be filed with the Hawaii Department of Labor and Industrial Relations within 90 days after the individual's employment begins.

Q: Is there a deadline to claim the credit?

A: Yes, Form N-884 must be filed within 3 years from the close of the taxable year in which the credit is claimed.

Q: Are there any other forms or documents that need to be filed along with Form N-884?

A: No, Form N-884 is generally filed independently, but employers should keep supporting documentation and records to substantiate the credit claim.

Form Details:

- Released on January 1, 2020;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-884 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.