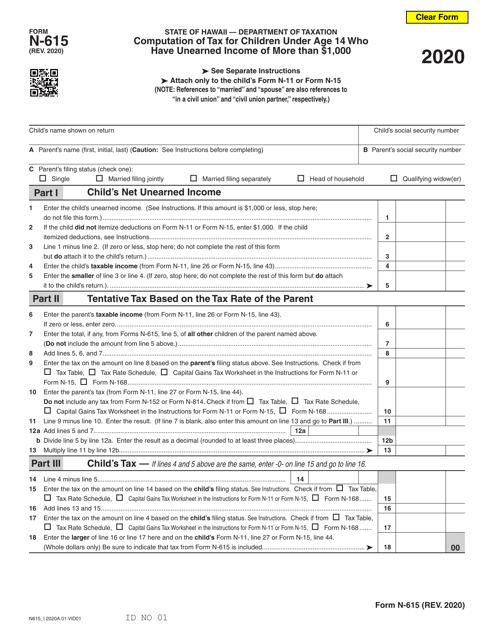

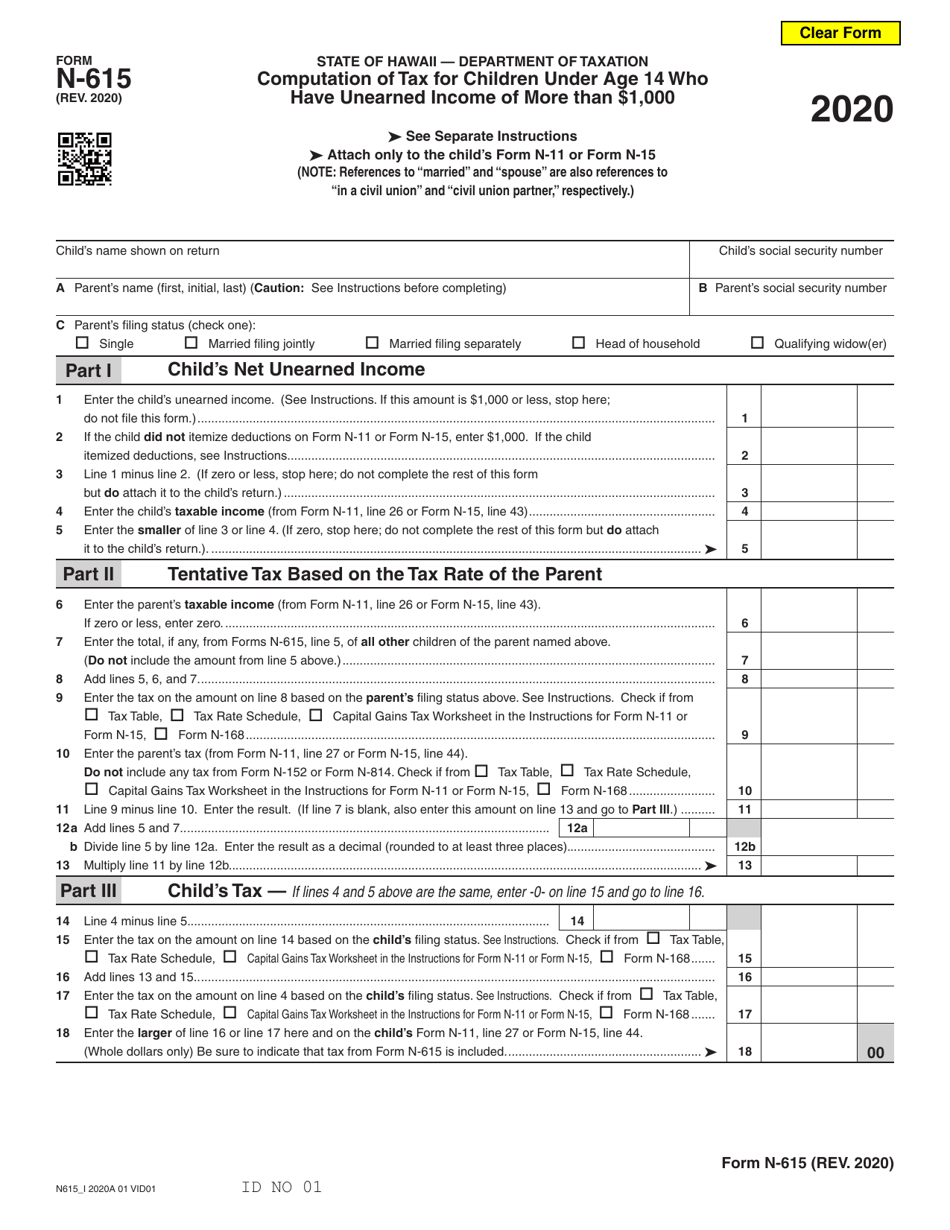

This version of the form is not currently in use and is provided for reference only. Download this version of

Form N-615

for the current year.

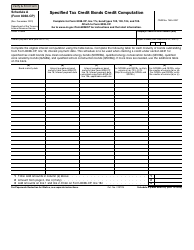

Form N-615 Computation of Tax for Children Under Age 14 Who Have Unearned Income of More Than $1,000 - Hawaii

What Is Form N-615?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form N-615?

A: Form N-615 is used to compute the tax for children under age 14 in Hawaii who have unearned income of more than $1,000.

Q: Who should use Form N-615?

A: Children under age 14 in Hawaii who have unearned income of more than $1,000 should use Form N-615.

Q: What is unearned income?

A: Unearned income refers to income from sources other than employment, such as investment income, rental income, or interest and dividends.

Q: What is the purpose of Form N-615?

A: The purpose of Form N-615 is to calculate the tax owed by children under age 14 in Hawaii who have unearned income exceeding $1,000.

Q: What is the threshold for unearned income on Form N-615?

A: The threshold for unearned income on Form N-615 is $1,000. Children with unearned income below this threshold may not need to file the form.

Q: What other forms may be required for children with unearned income?

A: Children with unearned income may also need to file Form N-11, Hawaii Individual Income Tax Return, or Form N-200V, Hawaii Individual Income Tax Payment Voucher.

Form Details:

- Released on January 1, 2020;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-615 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.