This version of the form is not currently in use and is provided for reference only. Download this version of

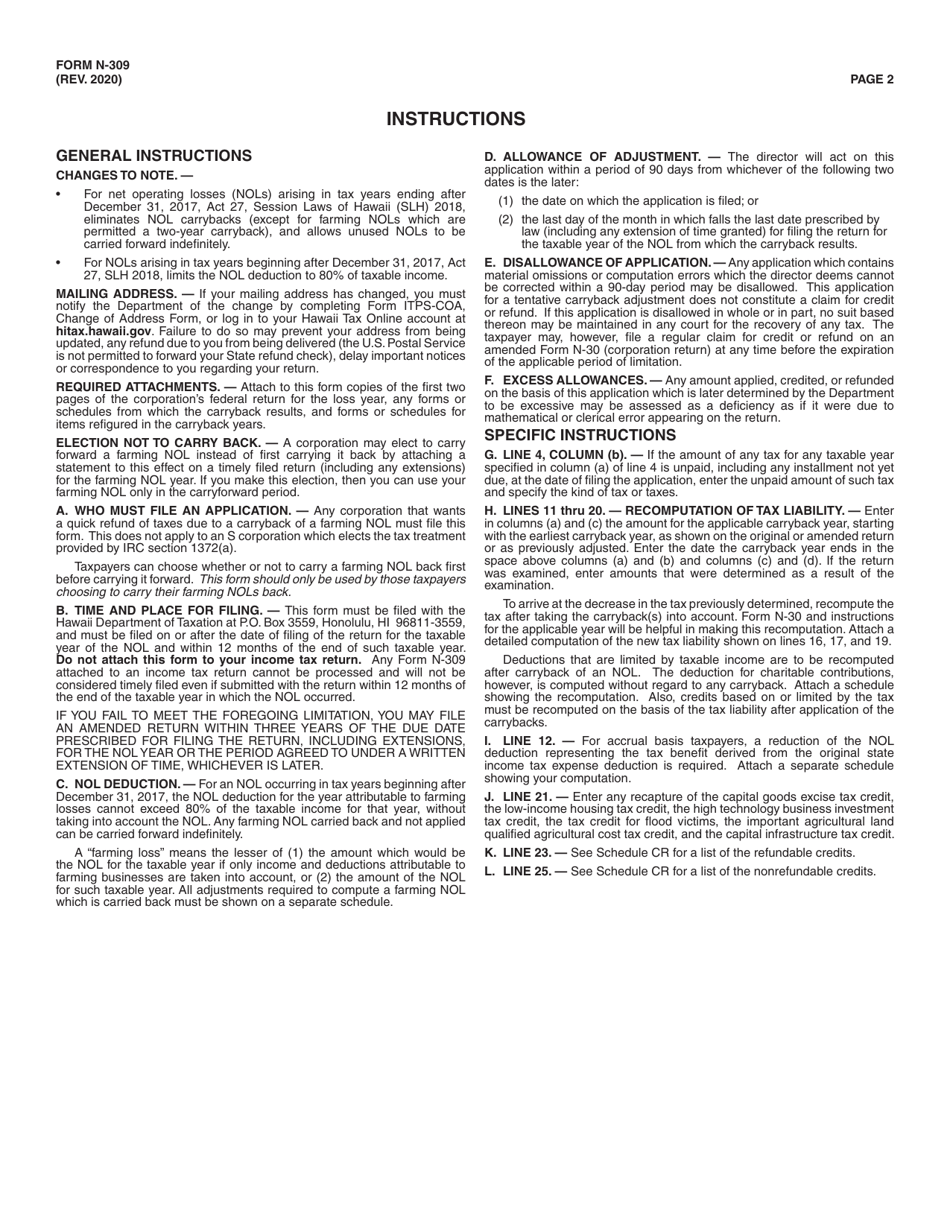

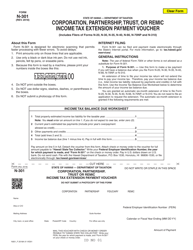

Form N-309

for the current year.

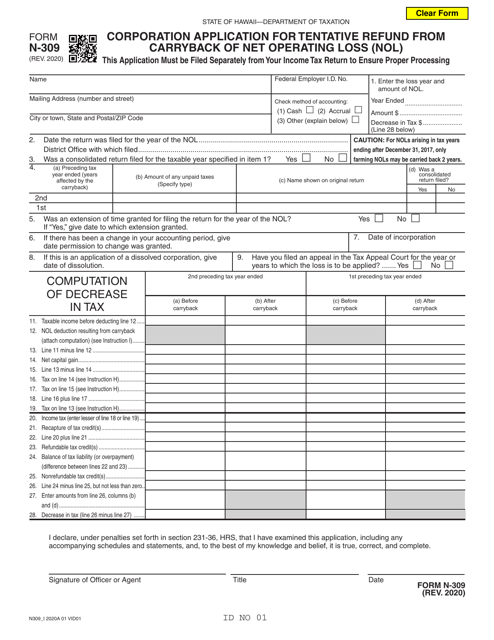

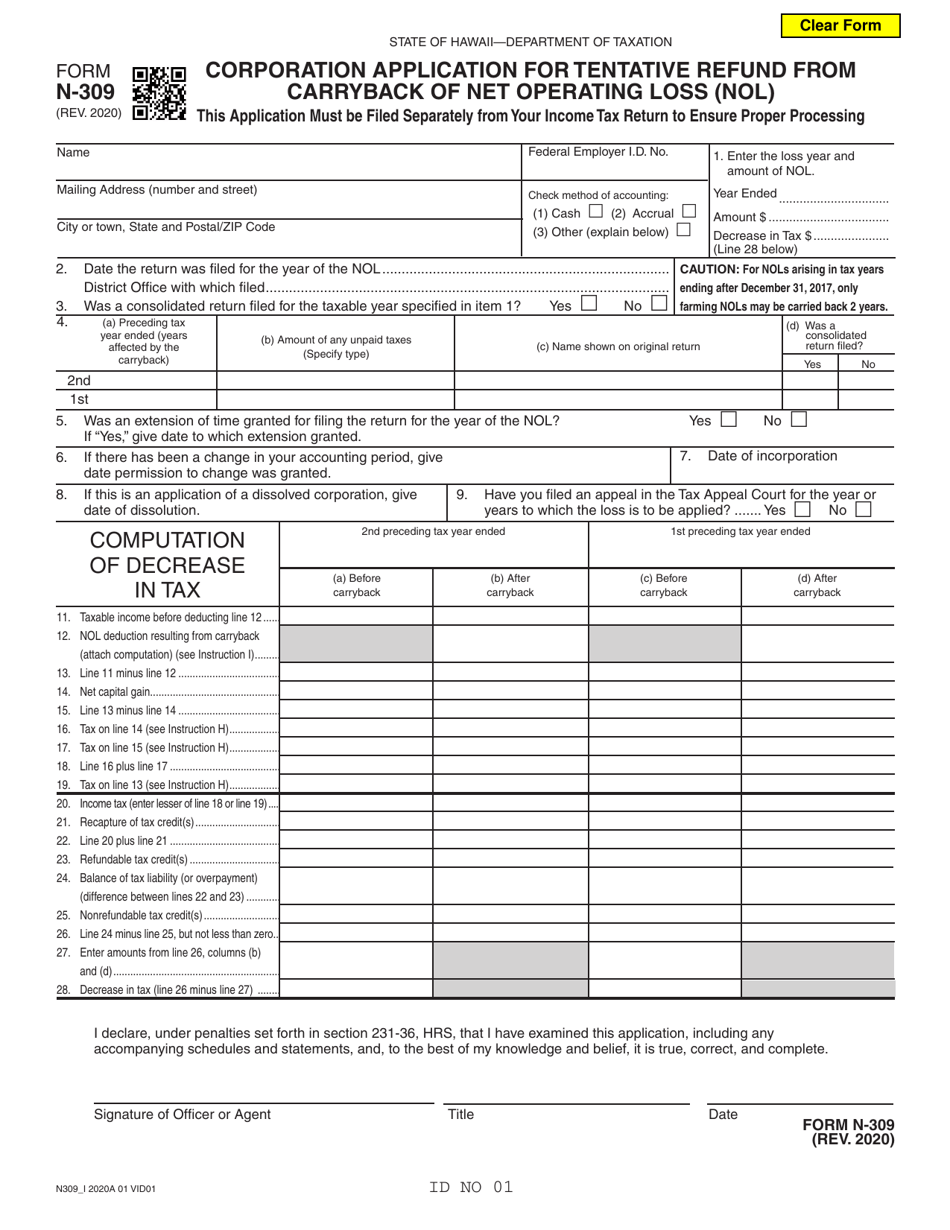

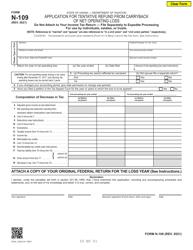

Form N-309 Corporation Application for Tentative Refund From Carryback of Net Operating Loss (Nol) - Hawaii

What Is Form N-309?

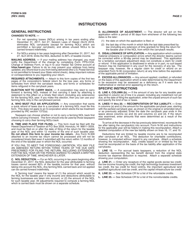

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form N-309?

A: Form N-309 is the Corporation Application for Tentative Refund from Carryback of Net Operating Loss (NOL) in Hawaii.

Q: What is the purpose of Form N-309?

A: The purpose of Form N-309 is to request a tentative refund of net operating loss (NOL) carryback in Hawaii.

Q: Who is eligible to use Form N-309?

A: Corporations in Hawaii who have incurred a net operating loss (NOL) and want to carry it back and receive a refund.

Q: How do I file Form N-309?

A: You can file Form N-309 by mail to the Hawaii Department of Taxation.

Q: Is there a deadline for filing Form N-309?

A: Yes, Form N-309 must be filed no later than 90 days after the due date (excluding extensions) of the NOL year from which the loss is being carried back.

Form Details:

- Released on January 1, 2020;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-309 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.