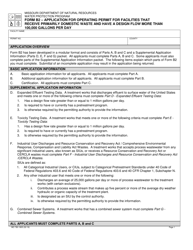

This version of the form is not currently in use and is provided for reference only. Download this version of

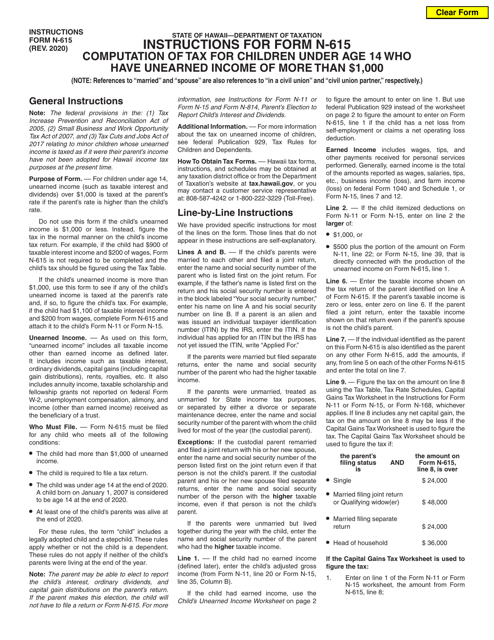

Instructions for Form N-615

for the current year.

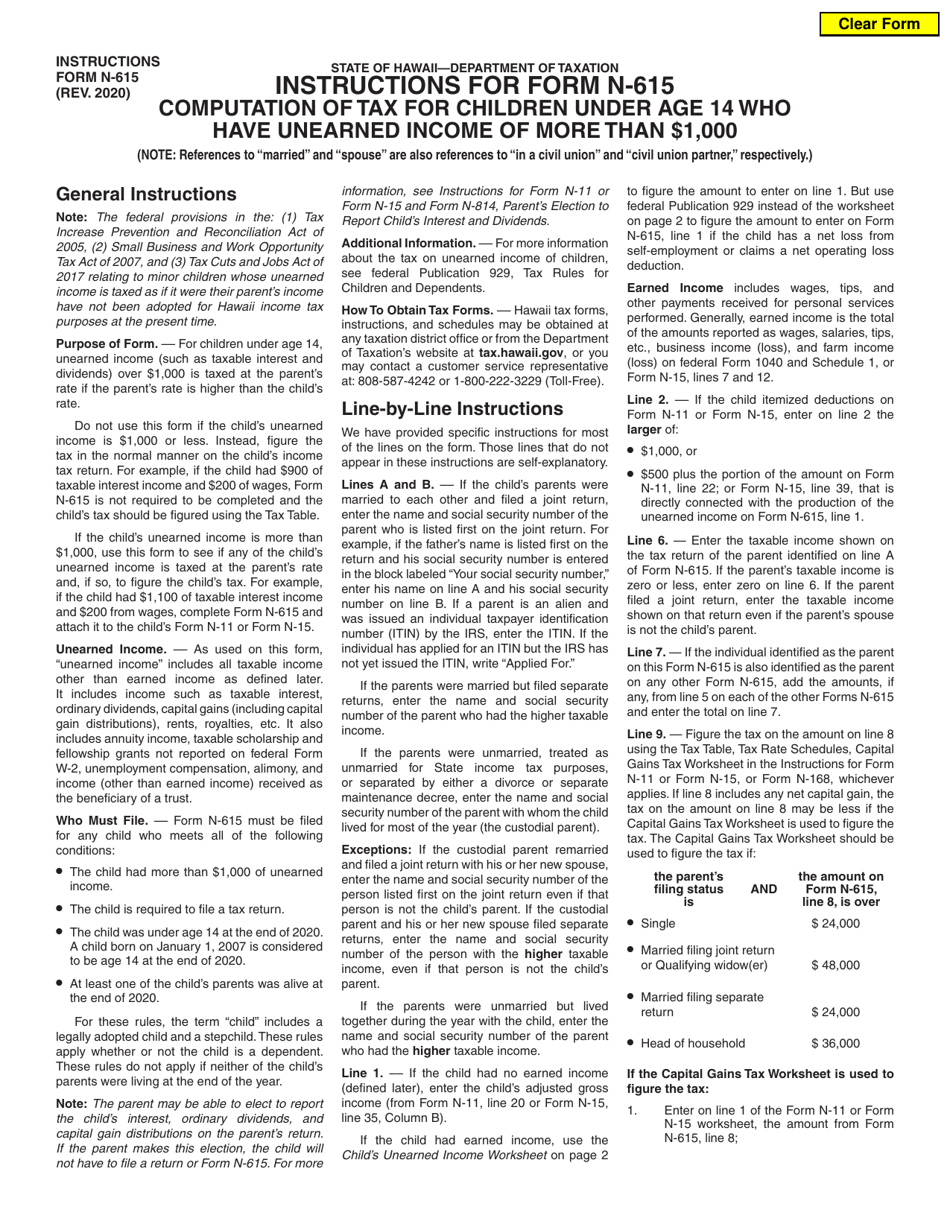

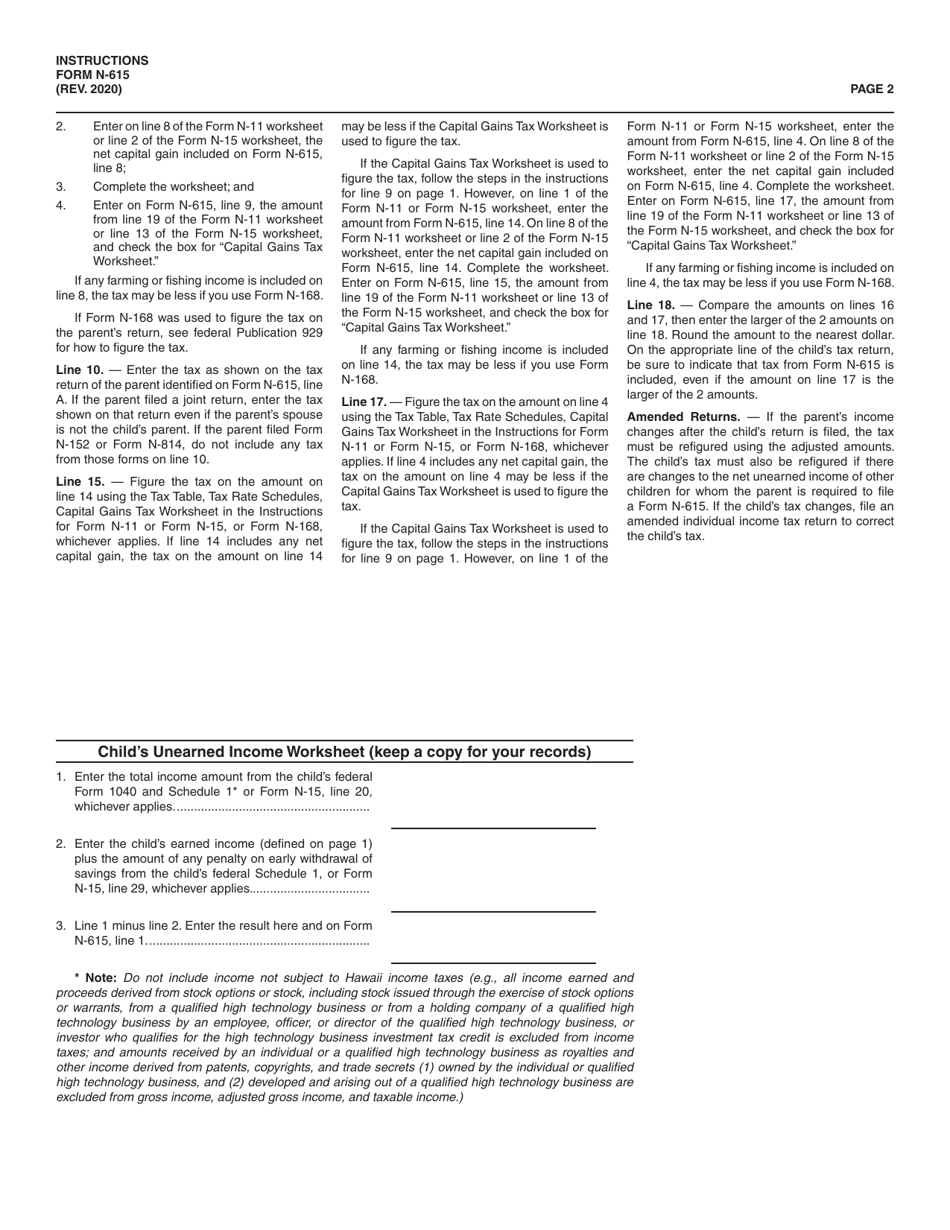

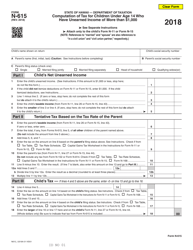

Instructions for Form N-615 Computation of Tax for Children Under Age 14 Who Have Unearned Income of More Than $1,000 - Hawaii

This document contains official instructions for Form N-615 , Computation of Tax for Children Under Age 14 Who Have Unearned Income of More Than $1,000 - a form released and collected by the Hawaii Department of Taxation.

FAQ

Q: What is Form N-615?

A: Form N-615 is used to compute tax for children under age 14 with unearned income over $1,000 in Hawaii.

Q: Who needs to file Form N-615?

A: Children under age 14 who have unearned income of more than $1,000 in Hawaii need to file Form N-615.

Q: What does Form N-615 calculate?

A: Form N-615 calculates the tax owed by children under age 14 with unearned income exceeding $1,000.

Q: Is there a deadline for filing Form N-615?

A: Yes, the deadline for filing Form N-615 is the same as the due date for the child's federal income tax return.

Q: Is Form N-615 specific to Hawaii residents only?

A: Yes, Form N-615 is specific to residents of Hawaii.

Q: What happens if I don't file Form N-615?

A: If you are required to file Form N-615 but fail to do so, you may face penalties and fines from the Hawaii Department of Taxation.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Hawaii Department of Taxation.