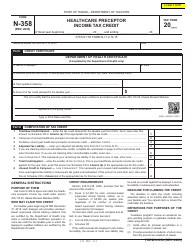

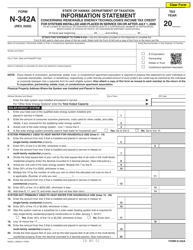

This version of the form is not currently in use and is provided for reference only. Download this version of

Form N-356

for the current year.

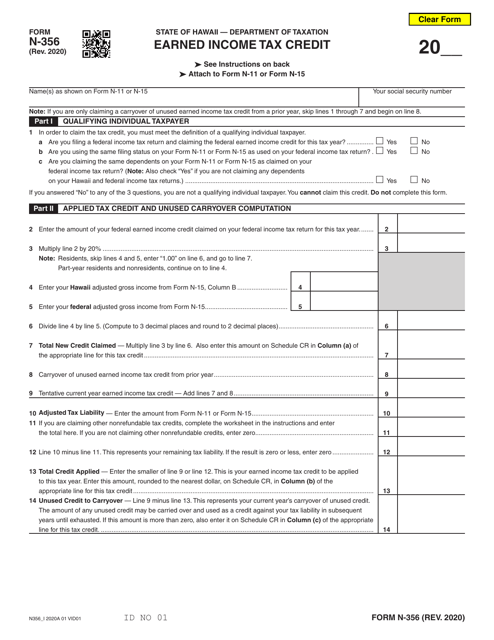

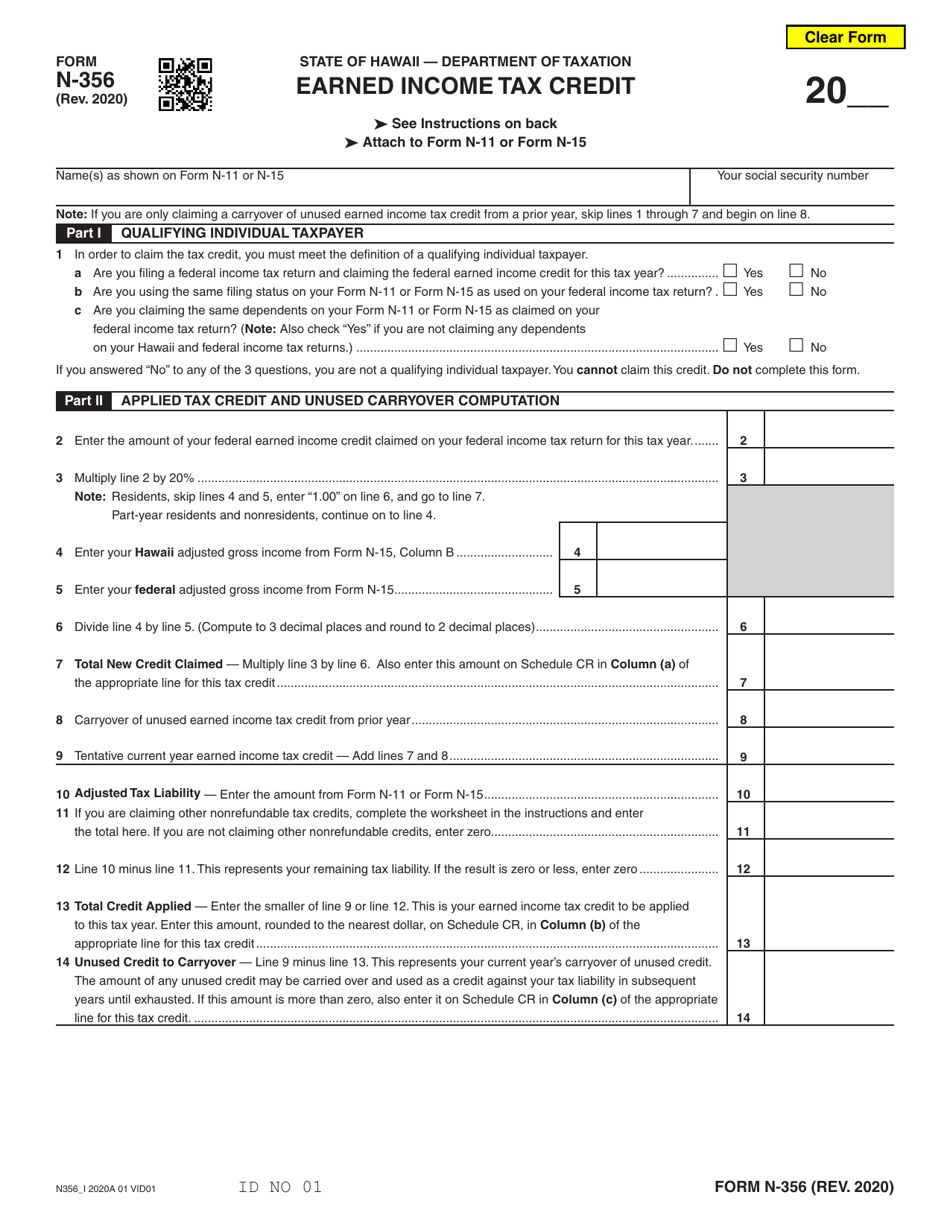

Form N-356 Earned Income Tax Credit - Hawaii

What Is Form N-356?

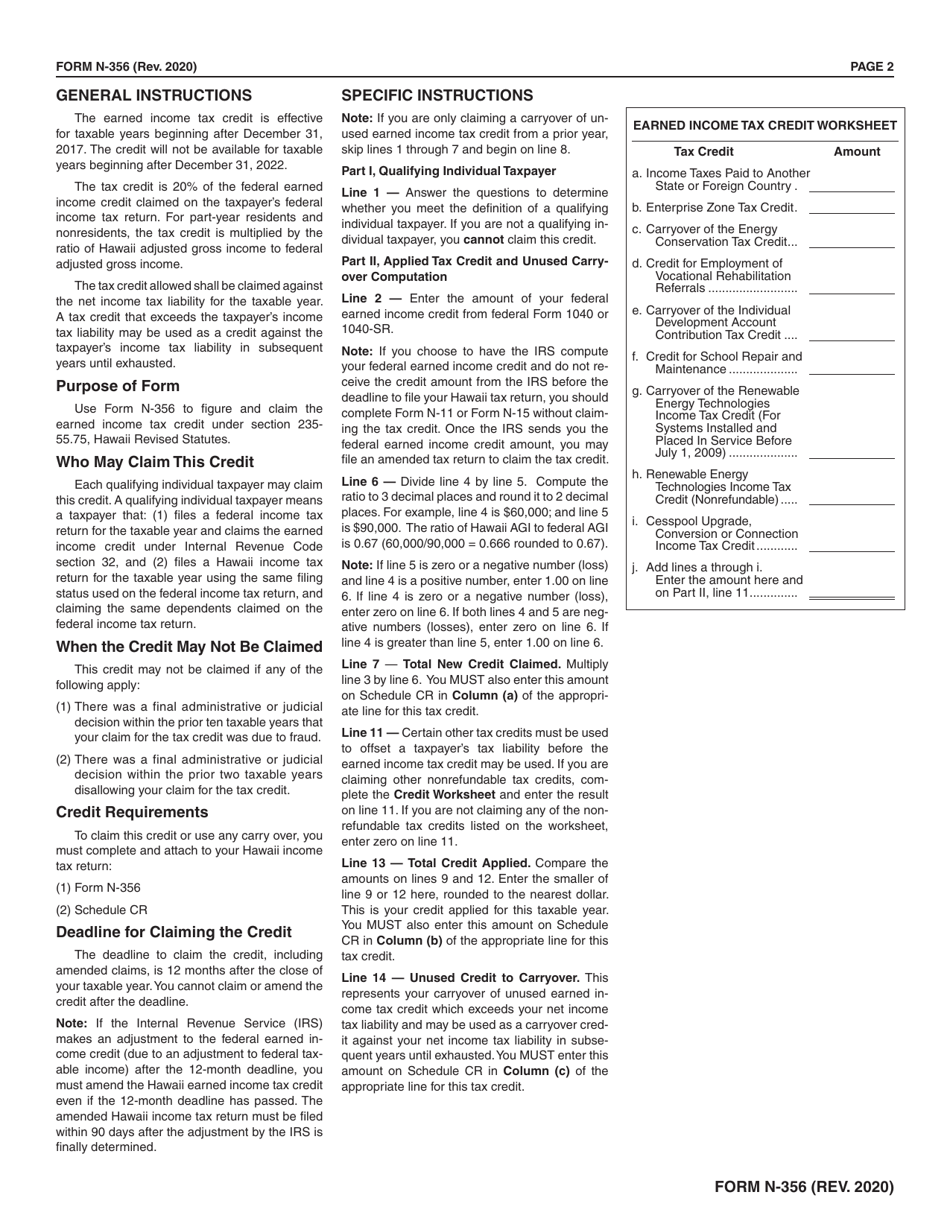

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form N-356?

A: Form N-356 is the form used to claim the Earned Income Tax Credit (EITC) in Hawaii.

Q: What is the Earned Income Tax Credit?

A: The Earned IncomeTax Credit is a tax benefit for low to moderate-income working individuals and families.

Q: Who is eligible for the Earned Income Tax Credit?

A: Eligibility for the Earned Income Tax Credit is based on income and filing status. It is primarily designed for individuals and families with low to moderate incomes.

Q: How do I claim the Earned Income Tax Credit in Hawaii?

A: To claim the Earned Income Tax Credit in Hawaii, you need to file Form N-356 and meet the income and other eligibility requirements.

Q: What are the income limits for the Earned Income Tax Credit in Hawaii?

A: The income limits for the Earned Income Tax Credit in Hawaii vary based on filing status and the number of qualifying children. You can refer to the instructions for Form N-356 for the specific income limits.

Q: Is the Earned Income Tax Credit refundable?

A: Yes, the Earned Income Tax Credit is a refundable credit, which means that if the credit exceeds your tax liability, you may receive a refund.

Q: Is the Earned Income Tax Credit available in other states?

A: Yes, the Earned Income Tax Credit is a federal tax credit available in all states, including Hawaii.

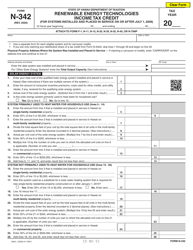

Q: Are there any other tax credits available in Hawaii?

A: Yes, Hawaii offers various tax credits, in addition to the Earned Income Tax Credit, such as the Child and Dependent Care Expenses Credit and the Renewable Energy Technologies Credit. You can consult the Hawaii Department of Taxation or a tax professional for more information.

Form Details:

- Released on January 1, 2020;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-356 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.