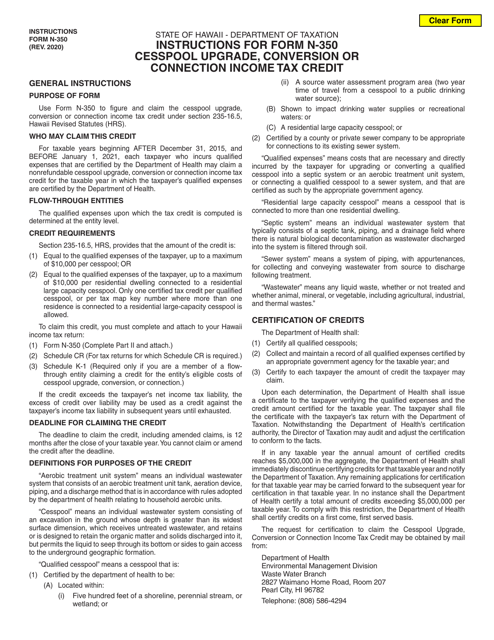

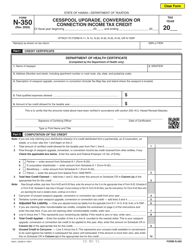

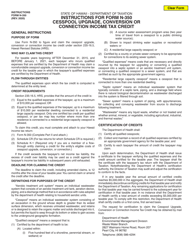

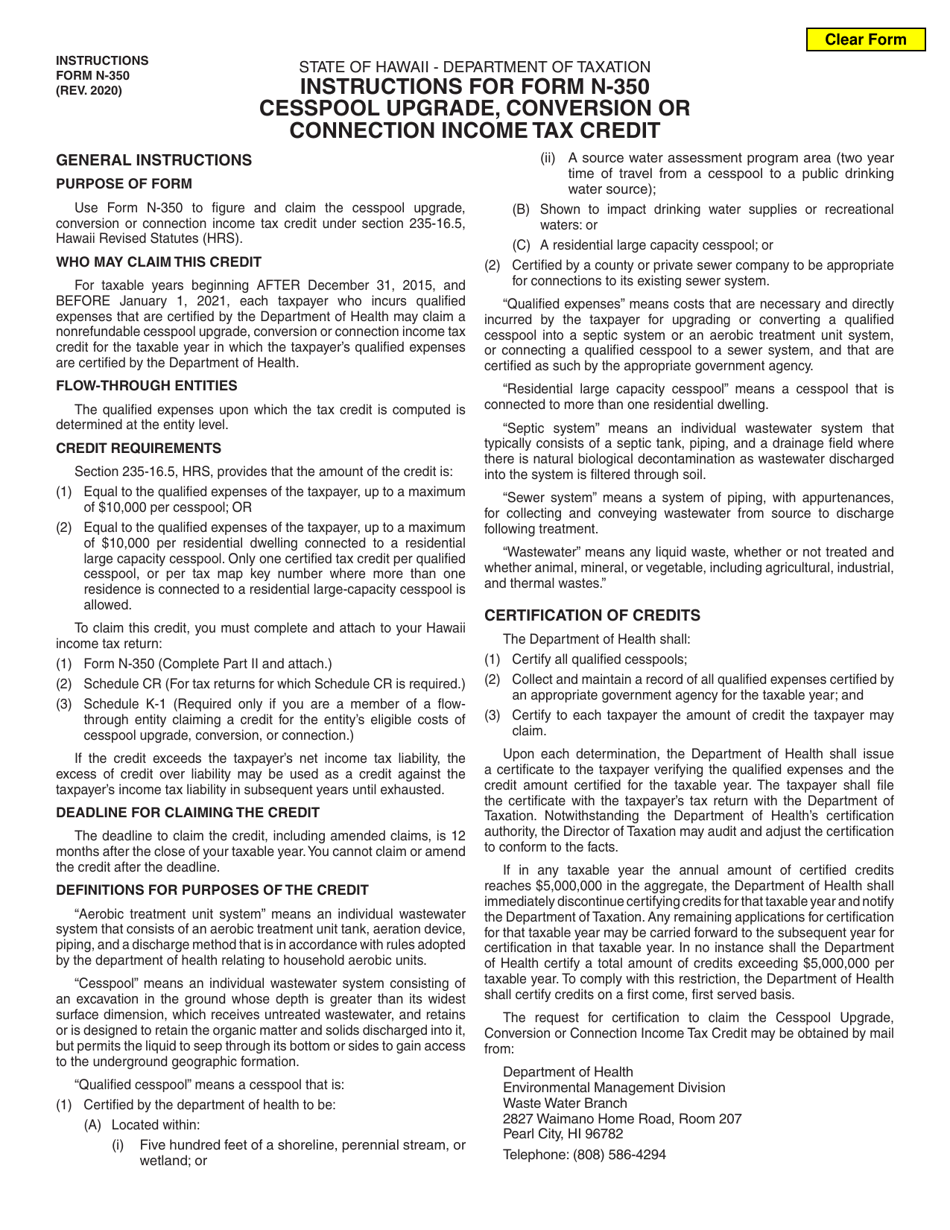

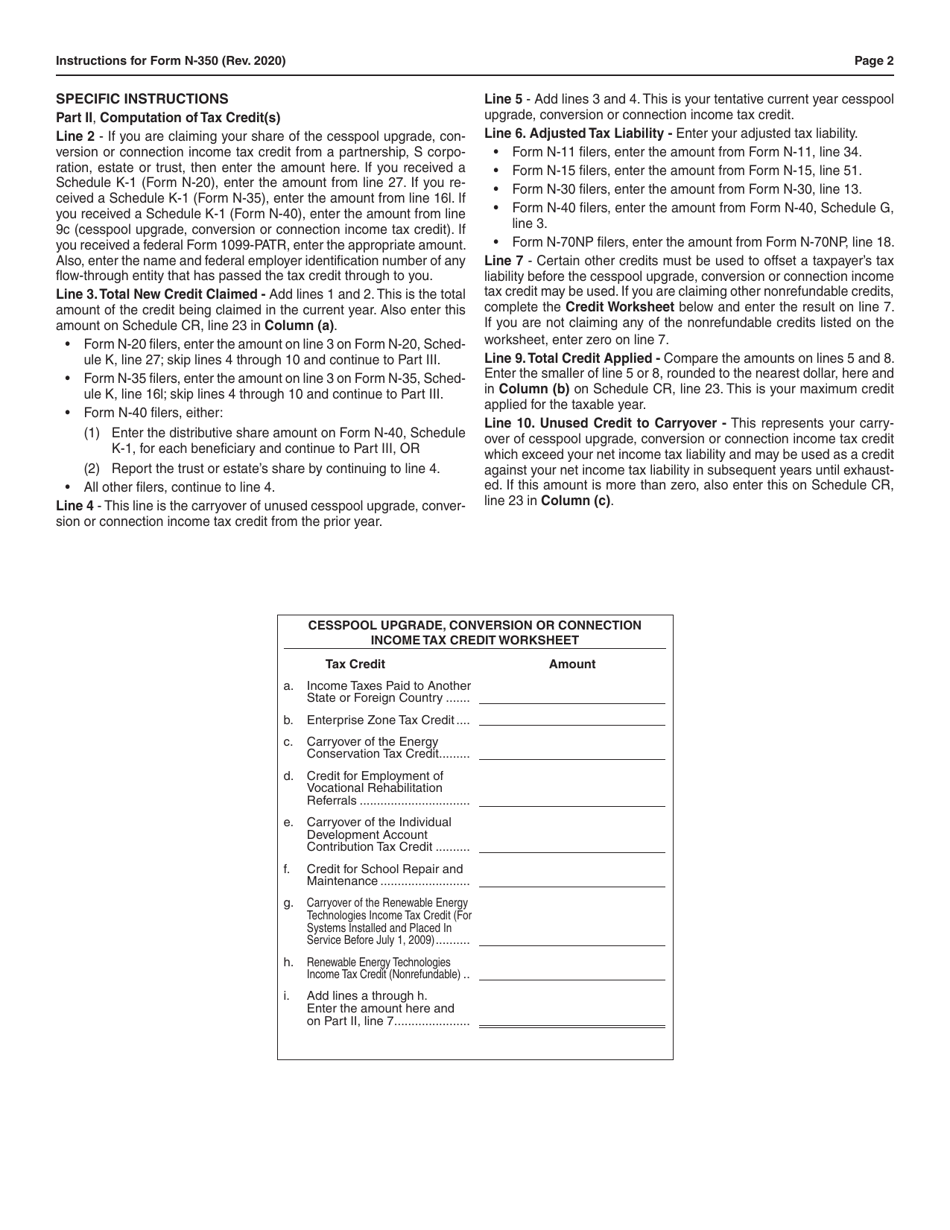

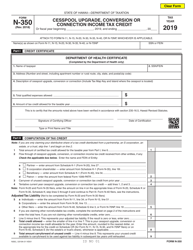

Instructions for Form N-350 Cesspool Upgrade, Conversion or Connection Income Tax Credit - Hawaii

This document contains official instructions for Form N-350 , Cesspool Upgrade, Conversion or Connection Income Tax Credit - a form released and collected by the Hawaii Department of Taxation. An up-to-date fillable Form N-350 is available for download through this link.

FAQ

Q: What is Form N-350?

A: Form N-350 is a tax form used in Hawaii to claim an income tax credit for upgrading, converting, or connecting a cesspool.

Q: What is a cesspool?

A: A cesspool is an underground tank or pit used for the disposal of wastewater or sewage.

Q: What is the purpose of the income tax credit?

A: The income tax credit is designed to encourage homeowners in Hawaii to upgrade their cesspools to more environmentally friendlywaste disposal systems.

Q: Who is eligible for the income tax credit?

A: Homeowners who have upgraded, converted, or connected their cesspools between January 1, 2016, and December 31, 2025, are eligible for the tax credit.

Q: How much is the income tax credit?

A: The tax credit is equal to 50% of the costs incurred for the upgrade, conversion, or connection, up to a maximum of $10,000 per qualified improvement.

Q: How do I claim the income tax credit?

A: To claim the tax credit, you need to complete and file Form N-350 with your Hawaii state tax return.

Q: Are there any documentation requirements?

A: Yes, you must provide documentation that proves the costs incurred for the cesspool upgrade, conversion, or connection, such as receipts or invoices.

Q: What is the deadline for filing Form N-350?

A: Form N-350 must be filed with your Hawaii state tax return by the due date, which is usually April 20th for most taxpayers.

Q: Can I claim the income tax credit for multiple cesspool upgrades?

A: Yes, you can claim the tax credit for each qualified improvement, as long as each upgrade, conversion, or connection meets the eligibility requirements.

Q: What if I have already claimed the income tax credit in a previous year?

A: If you have already claimed the tax credit in a previous year, you cannot claim it again for the same improvement.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Hawaii Department of Taxation.