This version of the form is not currently in use and is provided for reference only. Download this version of

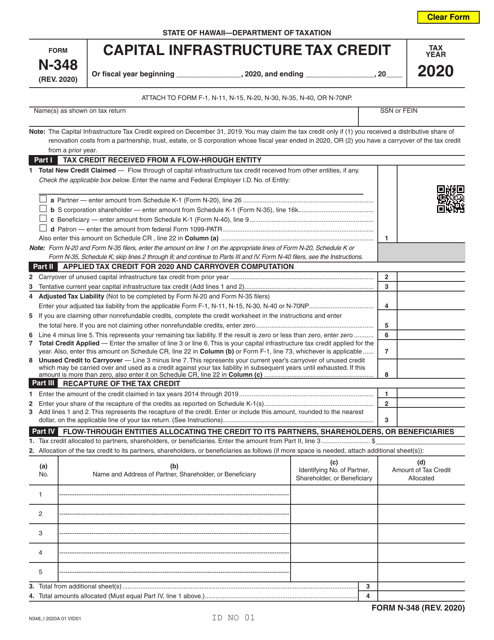

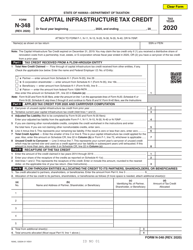

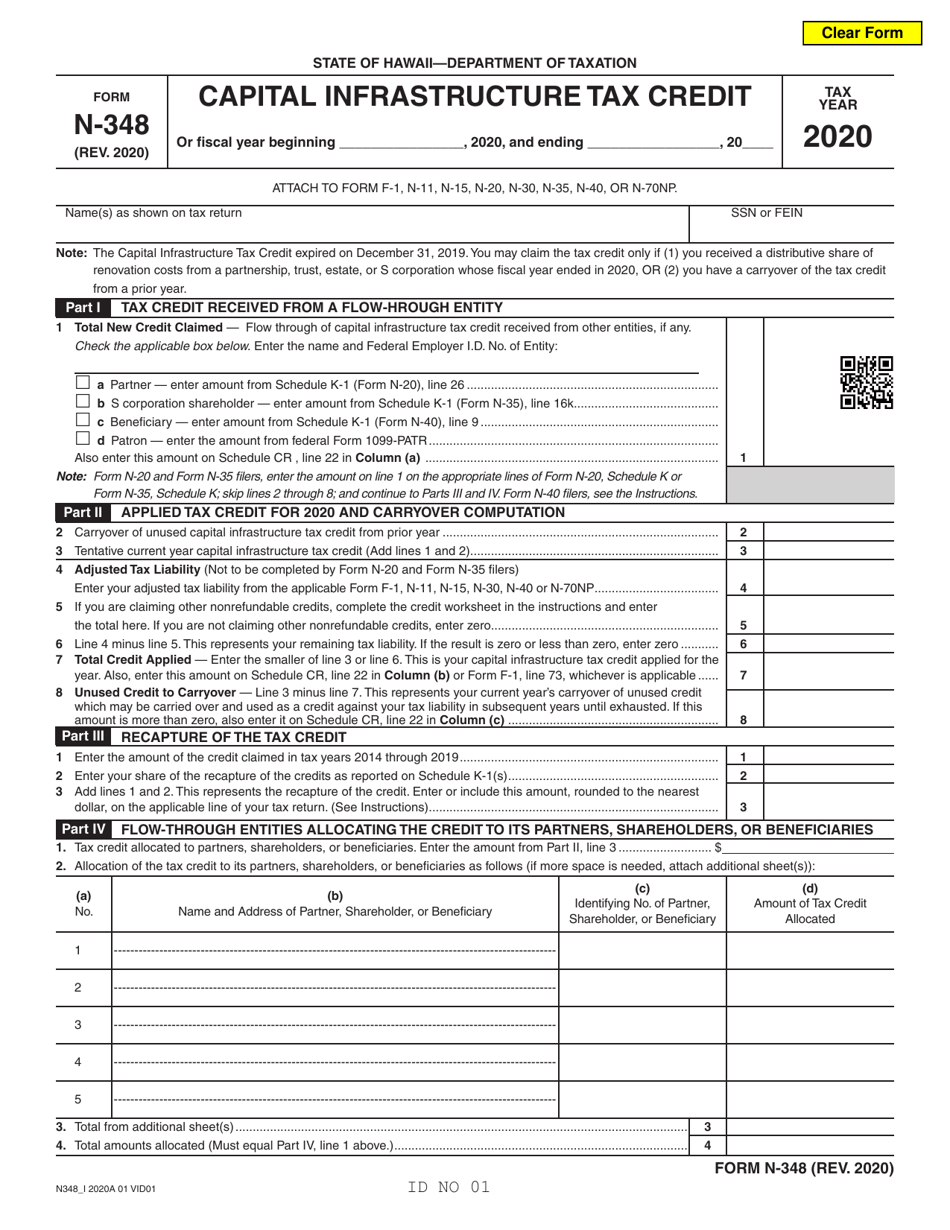

Form N-348

for the current year.

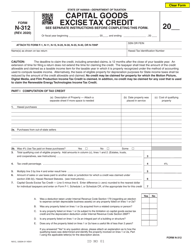

Form N-348 Capital Infrastructure Tax Credit - Hawaii

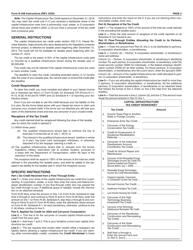

What Is Form N-348?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form N-348?

A: Form N-348 is the Capital Infrastructure Tax Credit form for Hawaii.

Q: What is the Capital Infrastructure Tax Credit?

A: The Capital Infrastructure Tax Credit is a credit for qualified infrastructure costs incurred in Hawaii.

Q: Who is eligible for the Capital Infrastructure Tax Credit?

A: Eligible taxpayers and dealers who incur qualified infrastructure costs in Hawaii may claim the credit.

Q: What are qualified infrastructure costs?

A: Qualified infrastructure costs include costs for construction, improvement, or substantial rehabilitation of qualified infrastructure.

Q: What is qualified infrastructure?

A: Qualified infrastructure includes highways, public transportation systems, water systems, energy generation and distribution systems, and more.

Q: How do I claim the Capital Infrastructure Tax Credit?

A: To claim the credit, you must complete Form N-348 and attach it to your Hawaii income tax return.

Q: Is there a limit to the amount of the credit?

A: Yes, the total credit allowed in any taxable year for all qualified infrastructure costs is limited to $500,000.

Q: Are there any carryover provisions for unused credit?

A: Yes, any excess credit may be carried forward for up to five years.

Form Details:

- Released on January 1, 2020;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-348 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.