This version of the form is not currently in use and is provided for reference only. Download this version of

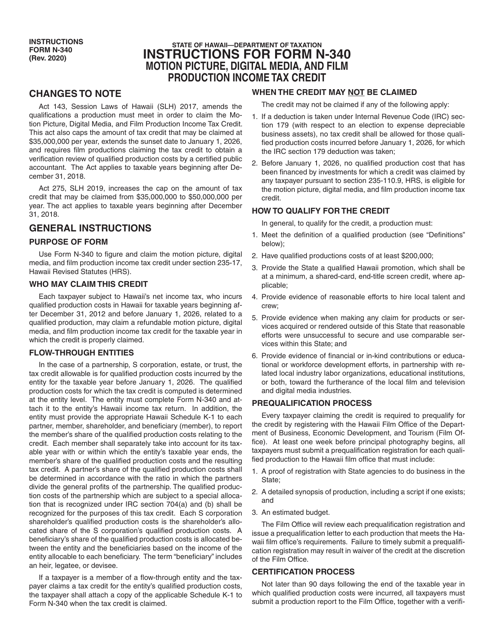

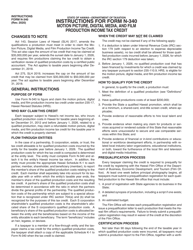

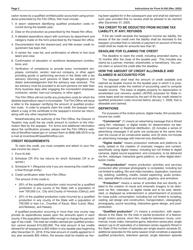

Instructions for Form N-340

for the current year.

Instructions for Form N-340 Motion Picture, Digital Media, and Film Production Income Tax Credit - Hawaii

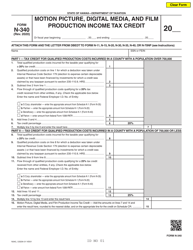

This document contains official instructions for Form N-340 , Motion Picture, Film Production Income Tax Credit - a form released and collected by the Hawaii Department of Taxation. An up-to-date fillable Form N-340 is available for download through this link.

FAQ

Q: What is Form N-340?

A: Form N-340 is a tax form used in Hawaii for claiming the Motion Picture, Digital Media, and Film Production Income Tax Credit.

Q: What is the purpose of the Motion Picture, Digital Media, and Film Production Income Tax Credit?

A: The purpose of this tax credit is to encourage the production of motion pictures, digital media, and film in Hawaii.

Q: Who can claim this tax credit?

A: Production companies that meet certain requirements can claim this tax credit.

Q: What types of production qualify for this tax credit?

A: Motion pictures, digital media, and film productions that meet certain criteria can qualify for this tax credit.

Q: What are the requirements for claiming this tax credit?

A: There are various requirements, including a minimum spending requirement, local hiring requirements, and certification from the Hawaii Film Office.

Q: How much is the tax credit?

A: The tax credit amount depends on the type of production and other factors. It can range from 20% to 25% of qualified expenditures.

Q: How do I fill out Form N-340?

A: Form N-340 has various sections where you need to provide information about the production company, production details, and qualified expenditures.

Q: What is the deadline for filing Form N-340?

A: The deadline for filing Form N-340 is generally within 12 months after the end of the taxable year.

Q: Can the tax credit be carried forward or transferred?

A: Yes, any unused tax credit can be carried forward for up to five years or transferred to another eligible taxpayer.

Q: Are there any limitations on the tax credit?

A: Yes, there are limitations on the total amount of tax credits that can be claimed in a given year.

Instruction Details:

- This 3-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Hawaii Department of Taxation.