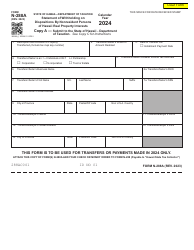

This version of the form is not currently in use and is provided for reference only. Download this version of

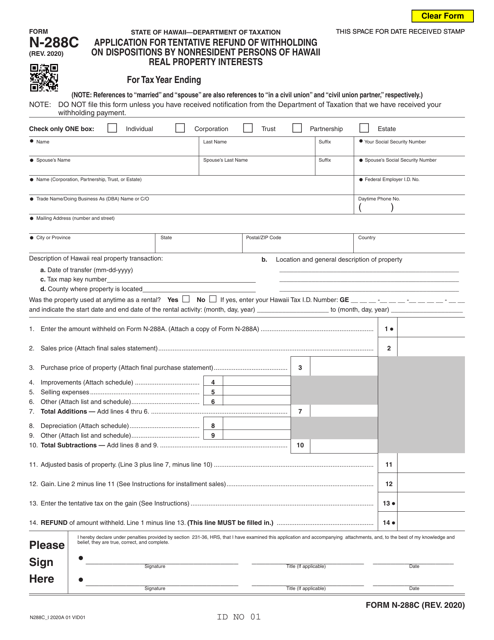

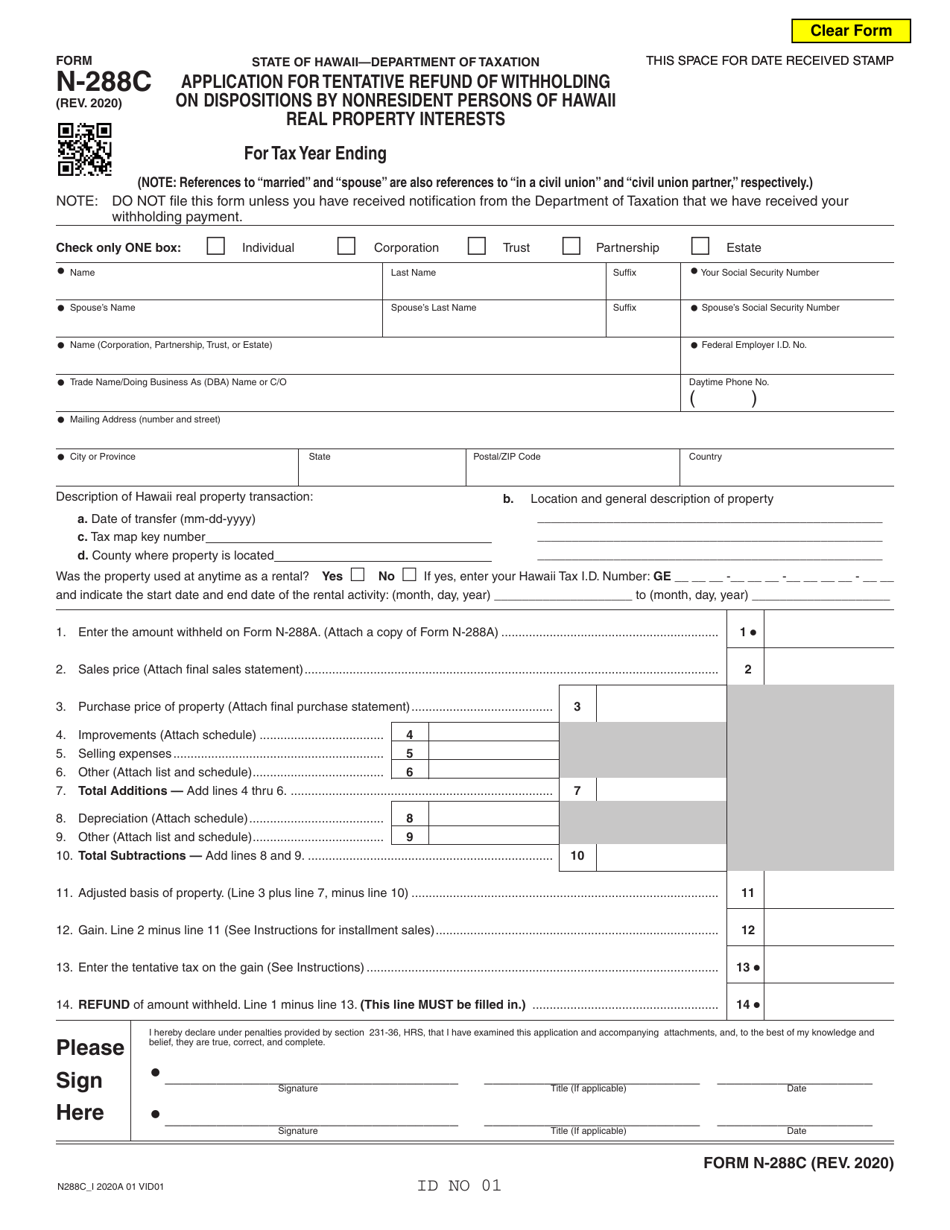

Form N-288C

for the current year.

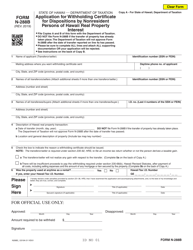

Form N-288C Application for Tentative Refund of Withholding on Dispositions by Nonresident Persons of Hawaii Real Property Interests - Hawaii

What Is Form N-288C?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form N-288C?

A: Form N-288C is the Application for Tentative Refund of Withholding on Dispositions by Nonresident Persons of Hawaii Real Property Interests.

Q: Who can use Form N-288C?

A: Nonresident persons who have sold or transferred Hawaii real property interests can use Form N-288C.

Q: What is the purpose of Form N-288C?

A: The purpose of Form N-288C is to request a tentative refund of withholding on the disposition of Hawaii real property interests.

Q: What information is required on Form N-288C?

A: Form N-288C requires information such as the taxpayer's name, address, social security number or TIN, details of the disposition, and the amount of withholding.

Form Details:

- Released on January 1, 2020;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-288C by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.