This version of the form is not currently in use and is provided for reference only. Download this version of

Form N-40

for the current year.

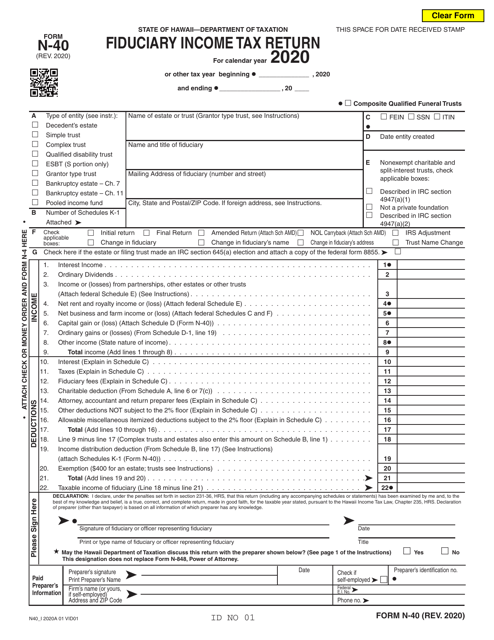

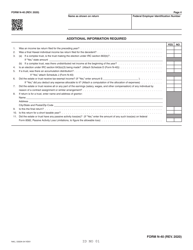

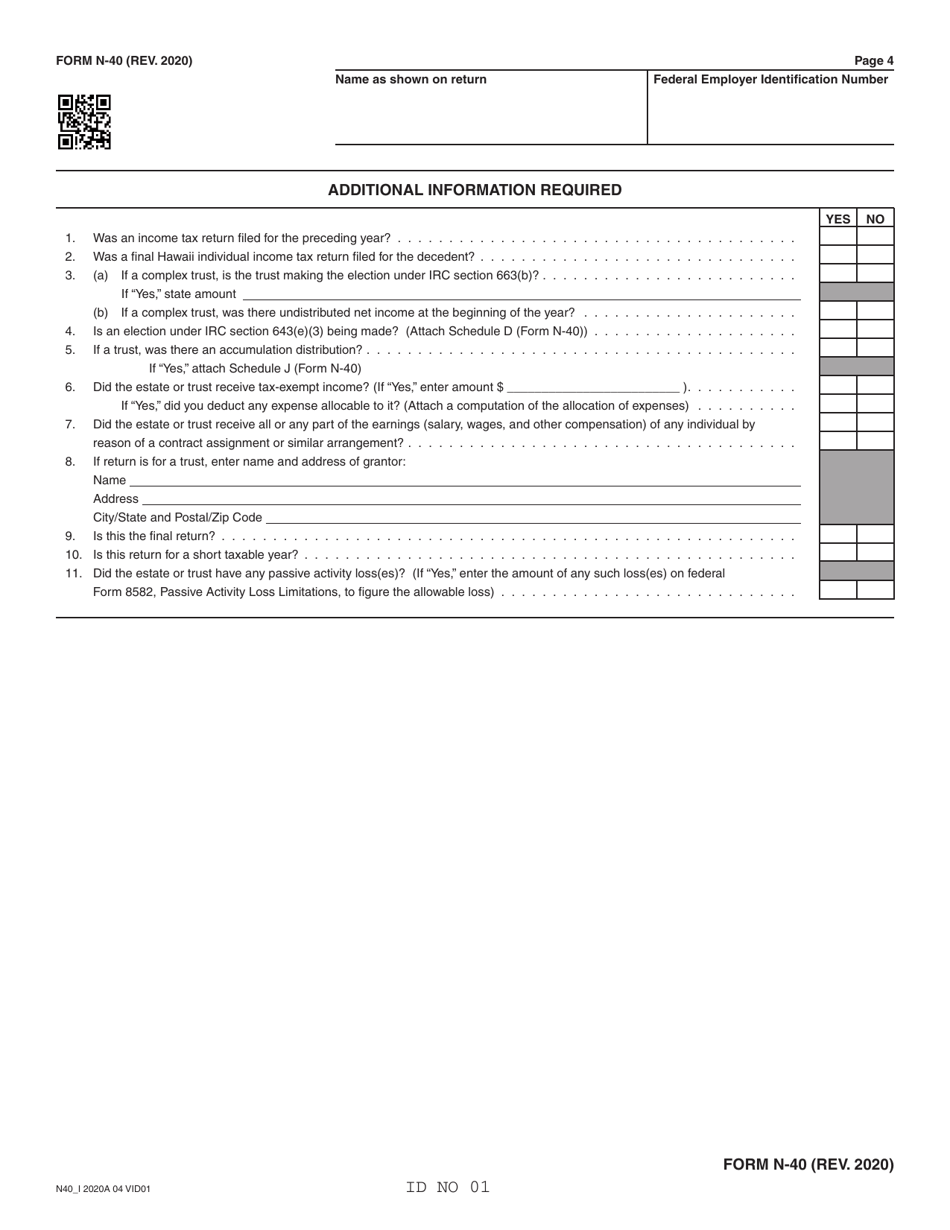

Form N-40 Fiduciary Income Tax Return - Hawaii

What Is Form N-40?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form N-40?

A: Form N-40 is the Fiduciary Income Tax Return for the state of Hawaii.

Q: Who is required to file Form N-40?

A: Form N-40 is filed by fiduciaries, such as trustees or executors, who are responsible for filing income tax returns on behalf of an estate, trust, or other fiduciary entity.

Q: What information is needed to complete Form N-40?

A: You will need information on the income, deductions, credits, and payments for the estate, trust, or other fiduciary entity.

Q: When is Form N-40 due?

A: Form N-40 is due on or before the 20th day of the 4th month following the close of the taxable year.

Q: Can Form N-40 be filed electronically?

A: Yes, Form N-40 can be filed electronically using Hawaii's e-filing system.

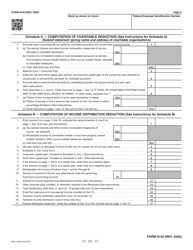

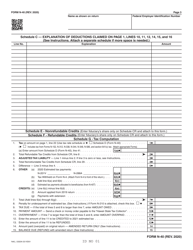

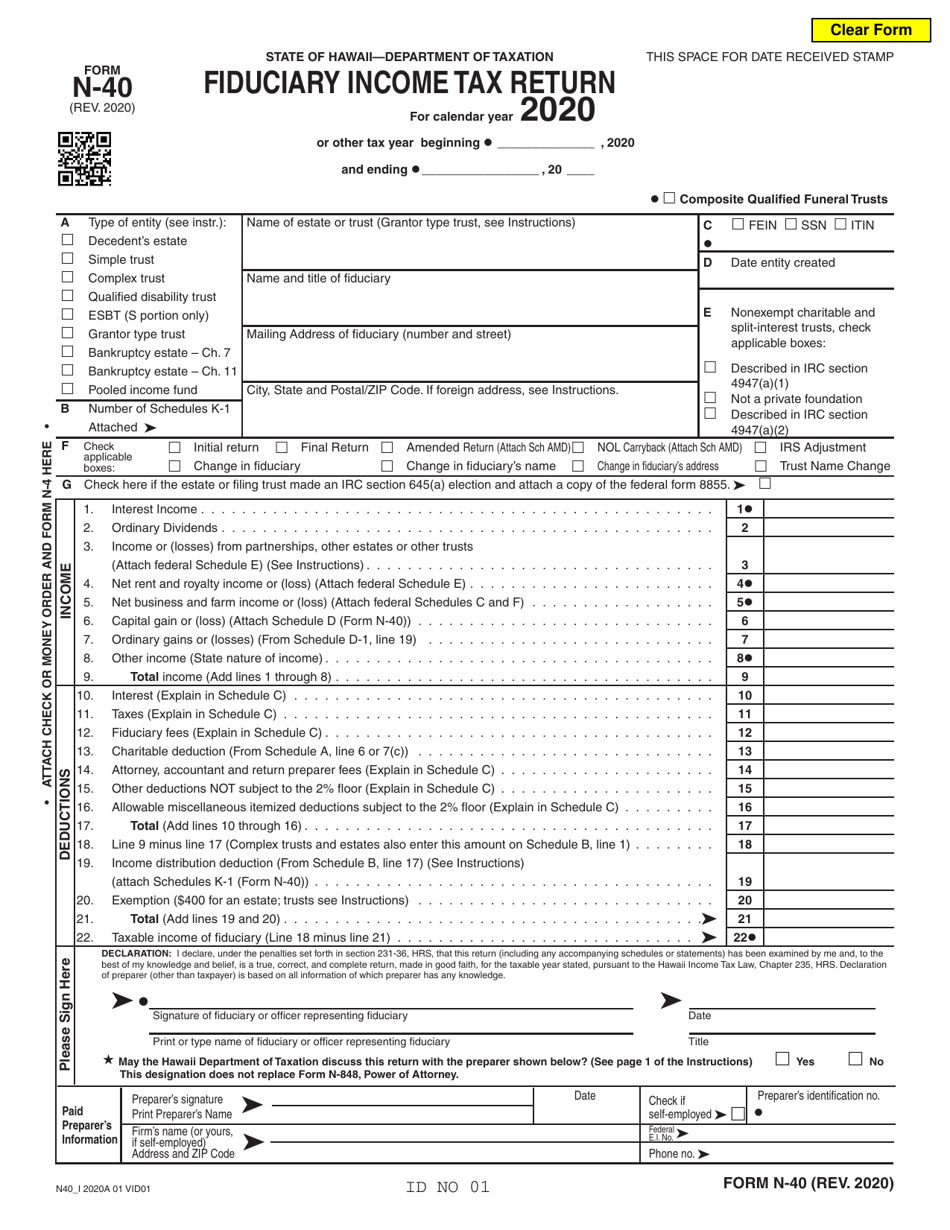

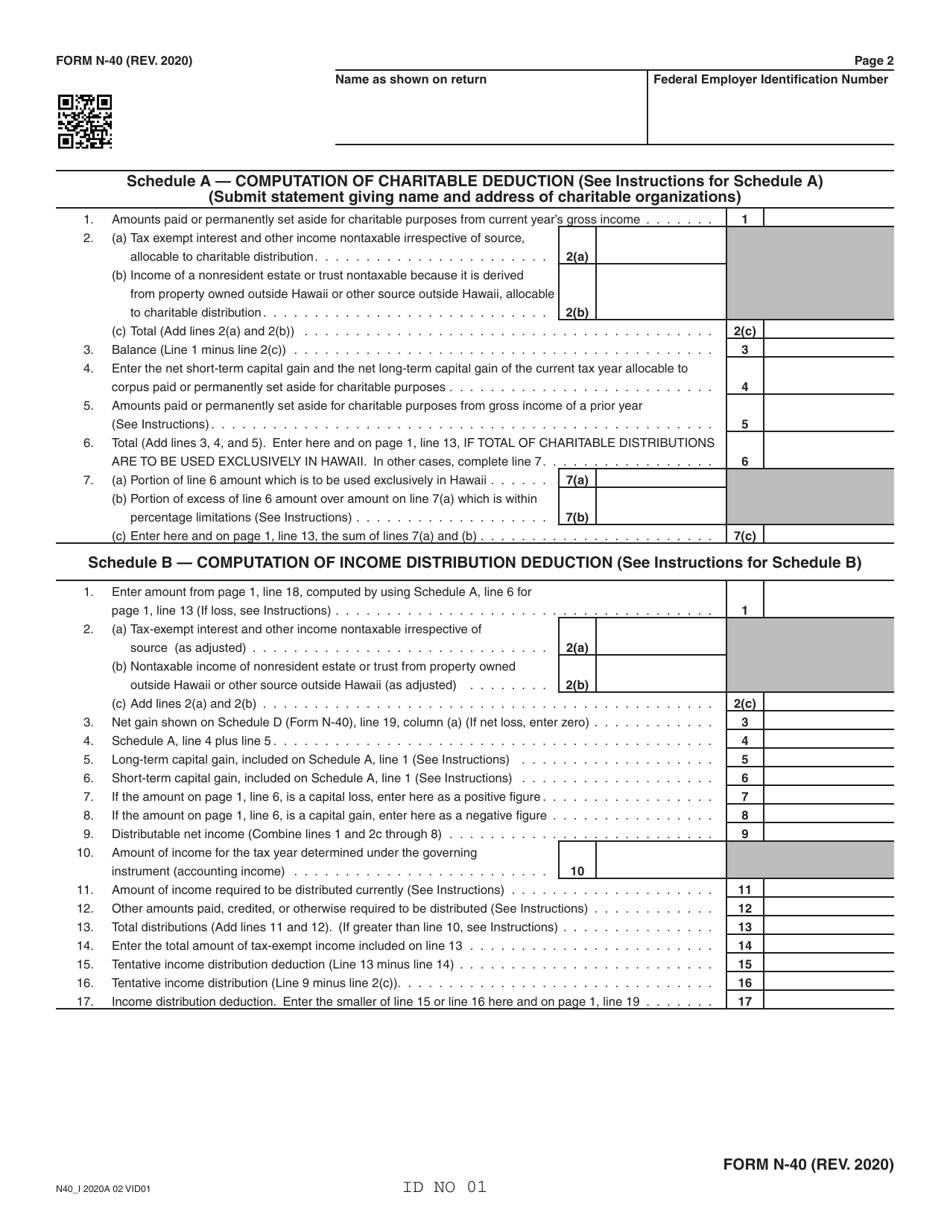

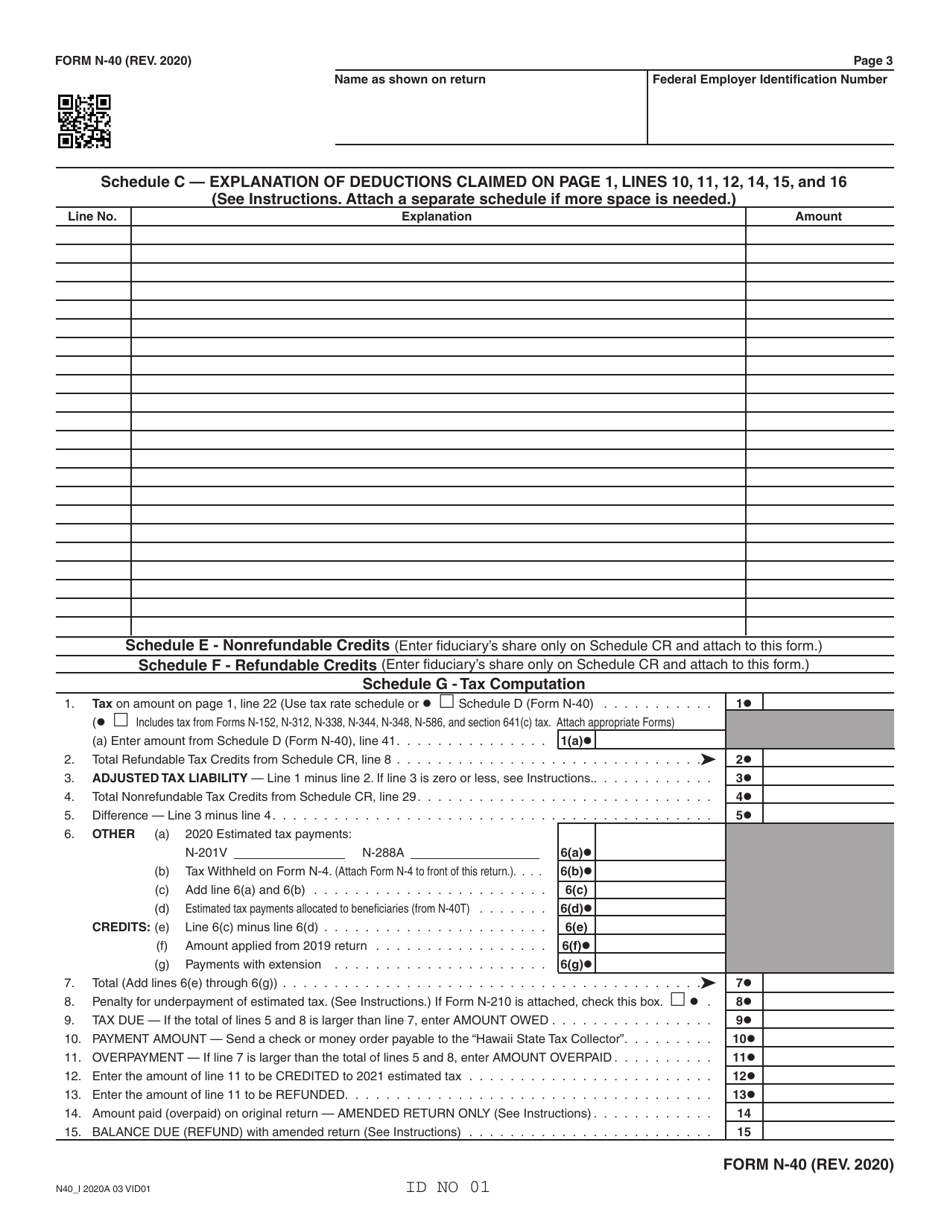

Q: Are there any additional forms or schedules that need to be attached to Form N-40?

A: Yes, you may need to attach various schedules, such as Schedule G for claiming the child care and education tax credit, or Schedule J for reporting passive activity loss limitations.

Form Details:

- Released on January 1, 2020;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-40 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.