This version of the form is not currently in use and is provided for reference only. Download this version of

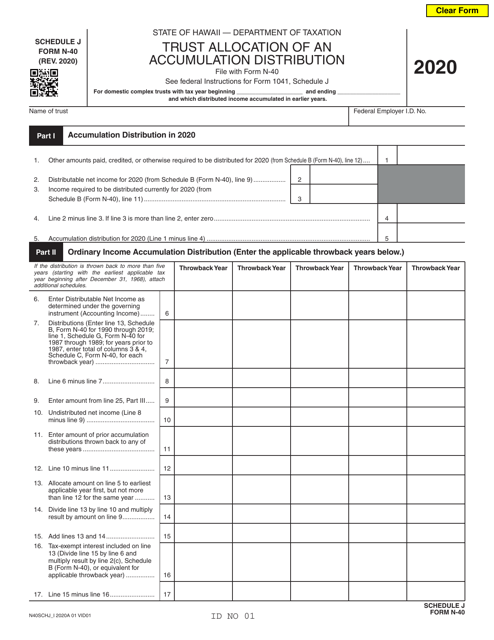

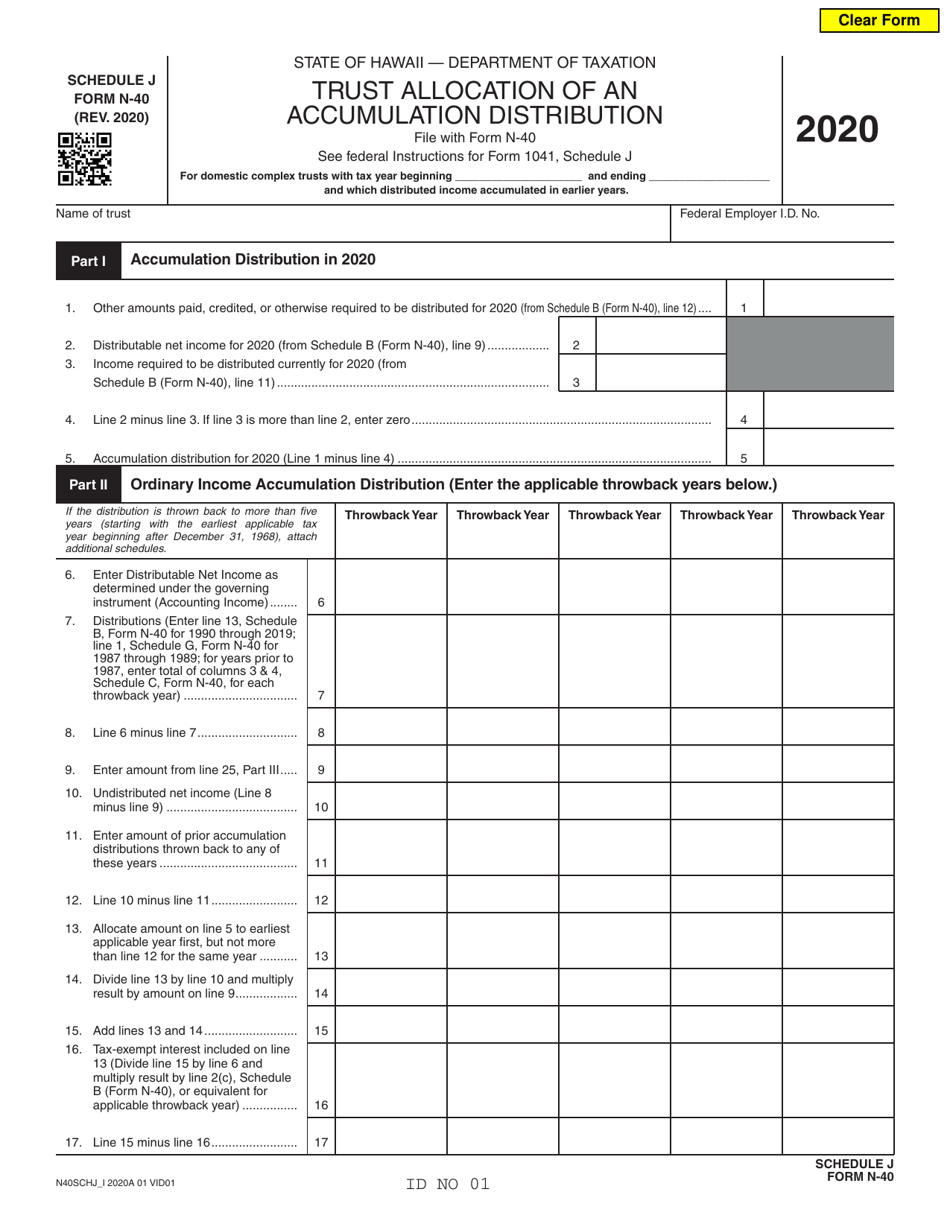

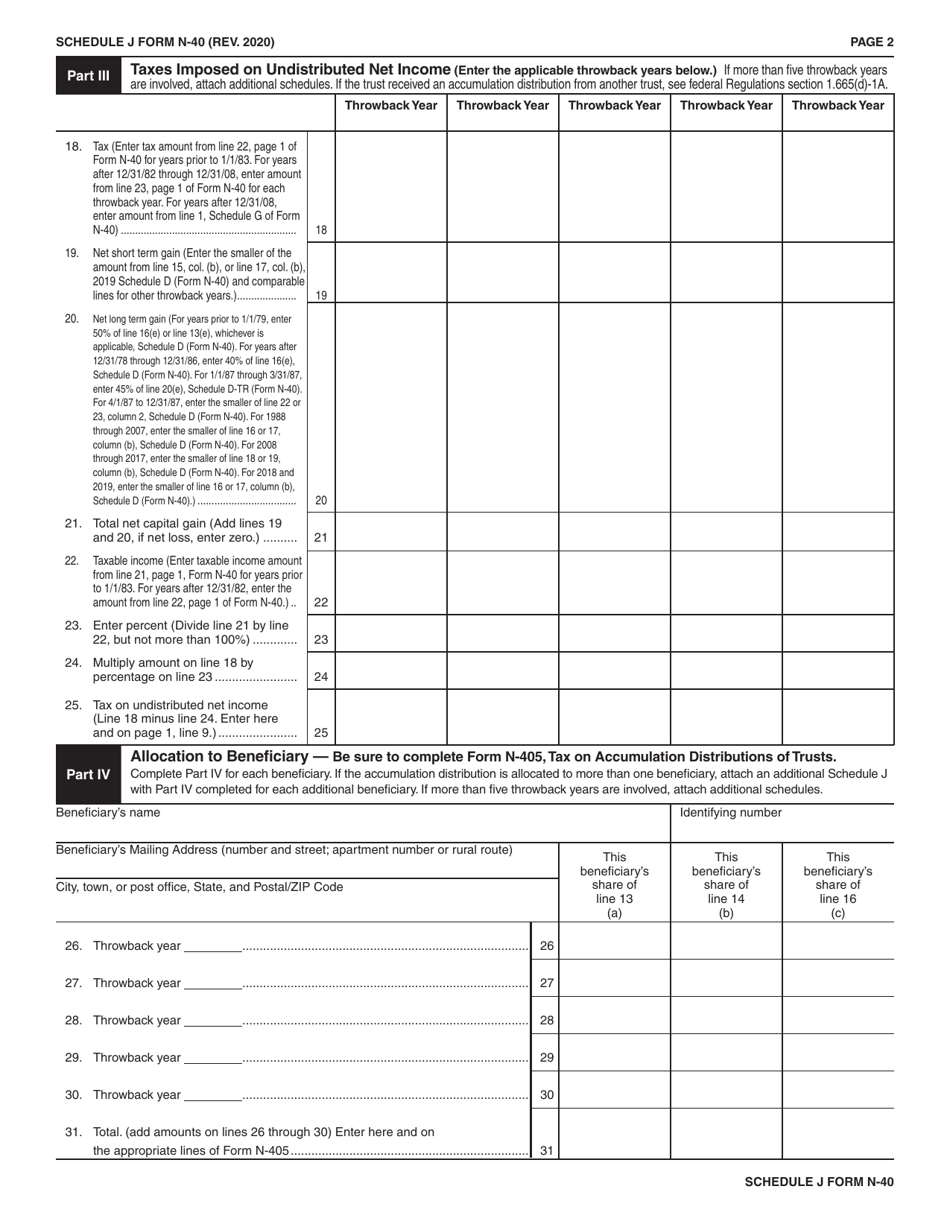

Form N-40 Schedule J

for the current year.

Form N-40 Schedule J Trust Allocation of an Accumulation Distribution - Hawaii

What Is Form N-40 Schedule J?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii.The document is a supplement to Form N-40, Fiduciary Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form N-40 Schedule J?

A: Form N-40 Schedule J is a form used in Hawaii to report and allocate accumulation distributions received by a trust.

Q: What is an accumulation distribution?

A: An accumulation distribution is a payment made by a trust to its beneficiaries from its accumulated income.

Q: Why is Form N-40 Schedule J used?

A: Form N-40 Schedule J is used to allocate the accumulation distribution among the trust beneficiaries for tax purposes.

Q: Who needs to file Form N-40 Schedule J?

A: Any trust that has made an accumulation distribution to its beneficiaries in Hawaii needs to file Form N-40 Schedule J.

Q: What information is required on Form N-40 Schedule J?

A: Form N-40 Schedule J requires information about the trust, the accumulation distribution, and the allocation of the distribution among beneficiaries.

Q: Are there any deadlines for filing Form N-40 Schedule J?

A: The deadline for filing Form N-40 Schedule J is the same as the deadline for filing the trust's income tax return in Hawaii.

Form Details:

- Released on January 1, 2020;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-40 Schedule J by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.