This version of the form is not currently in use and is provided for reference only. Download this version of

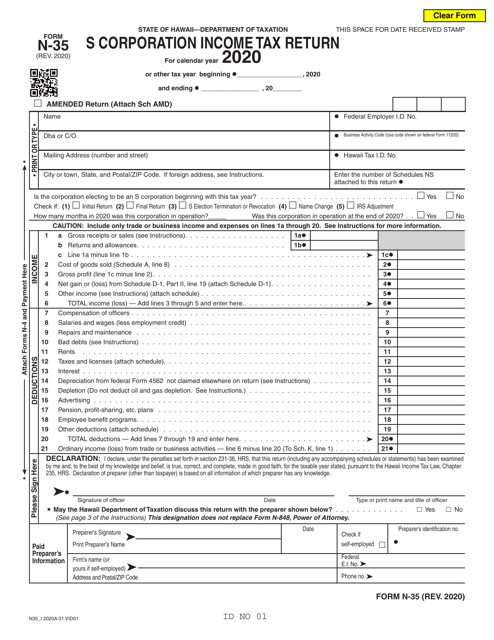

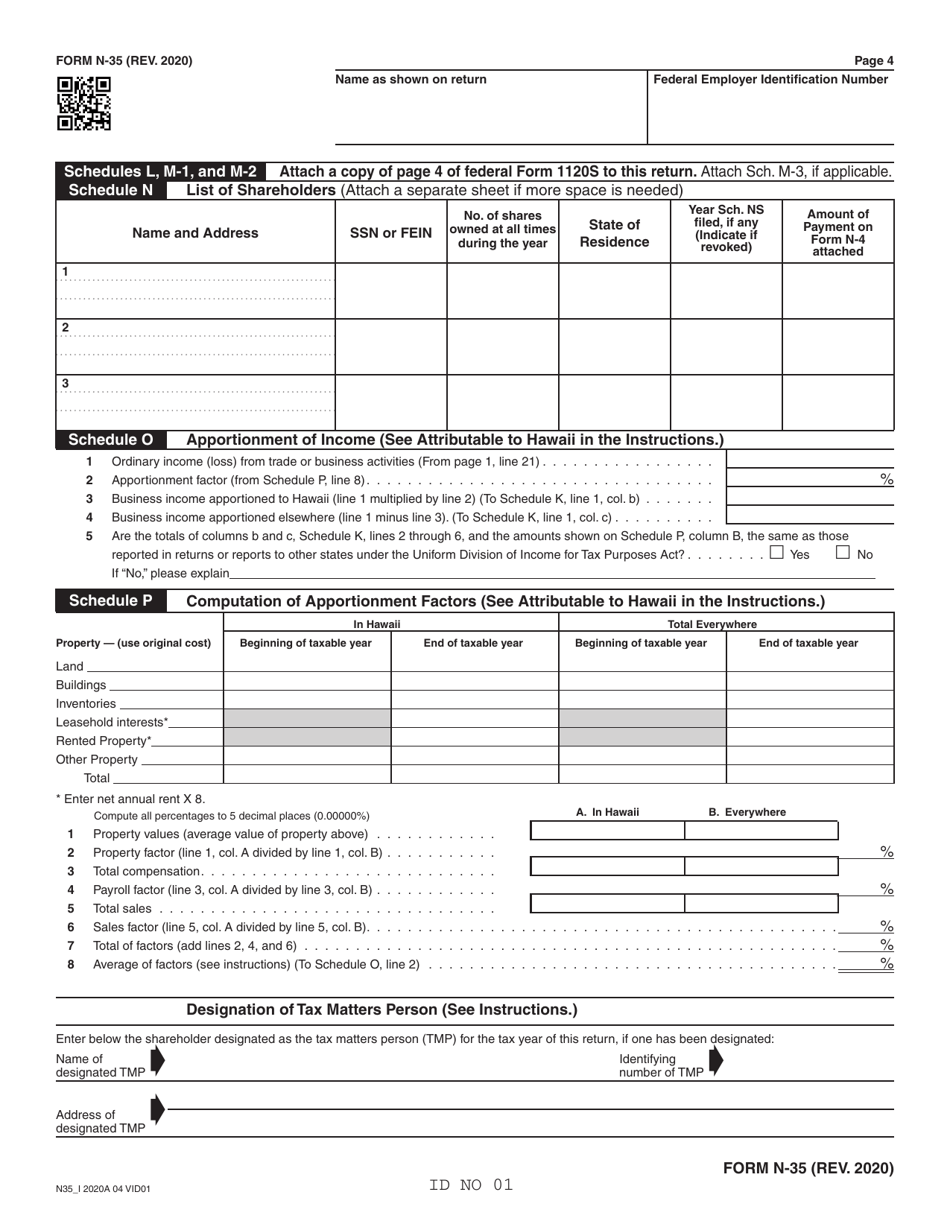

Form N-35

for the current year.

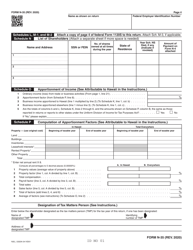

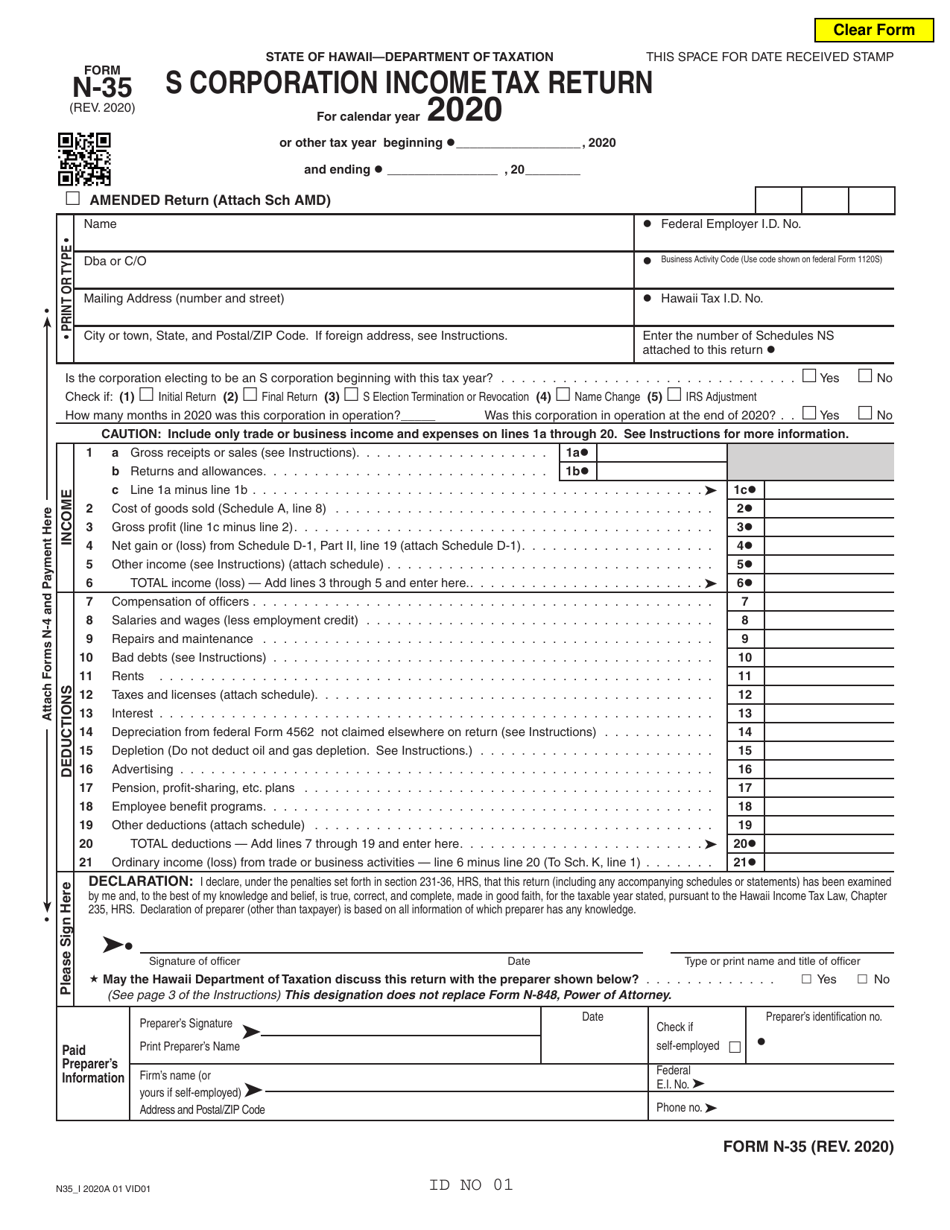

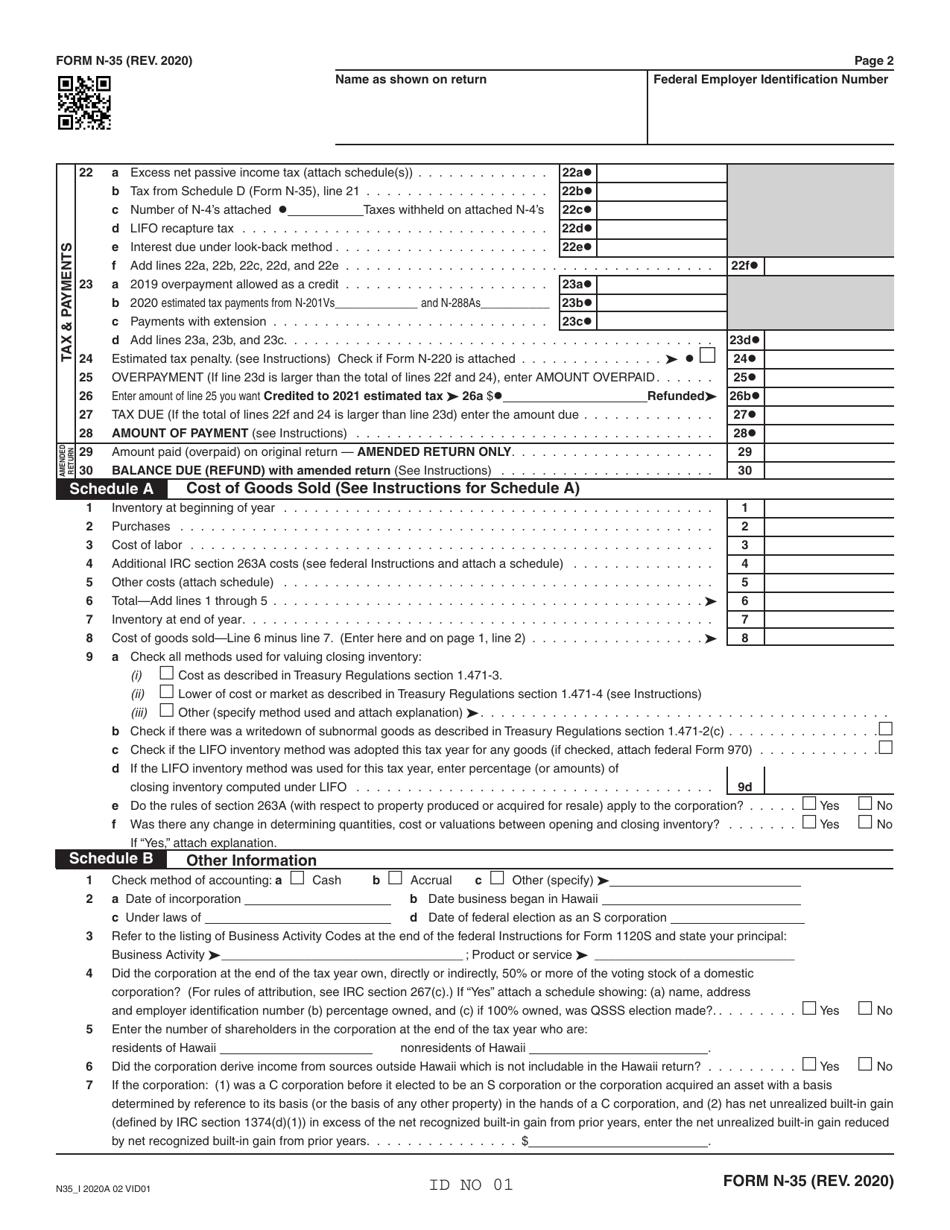

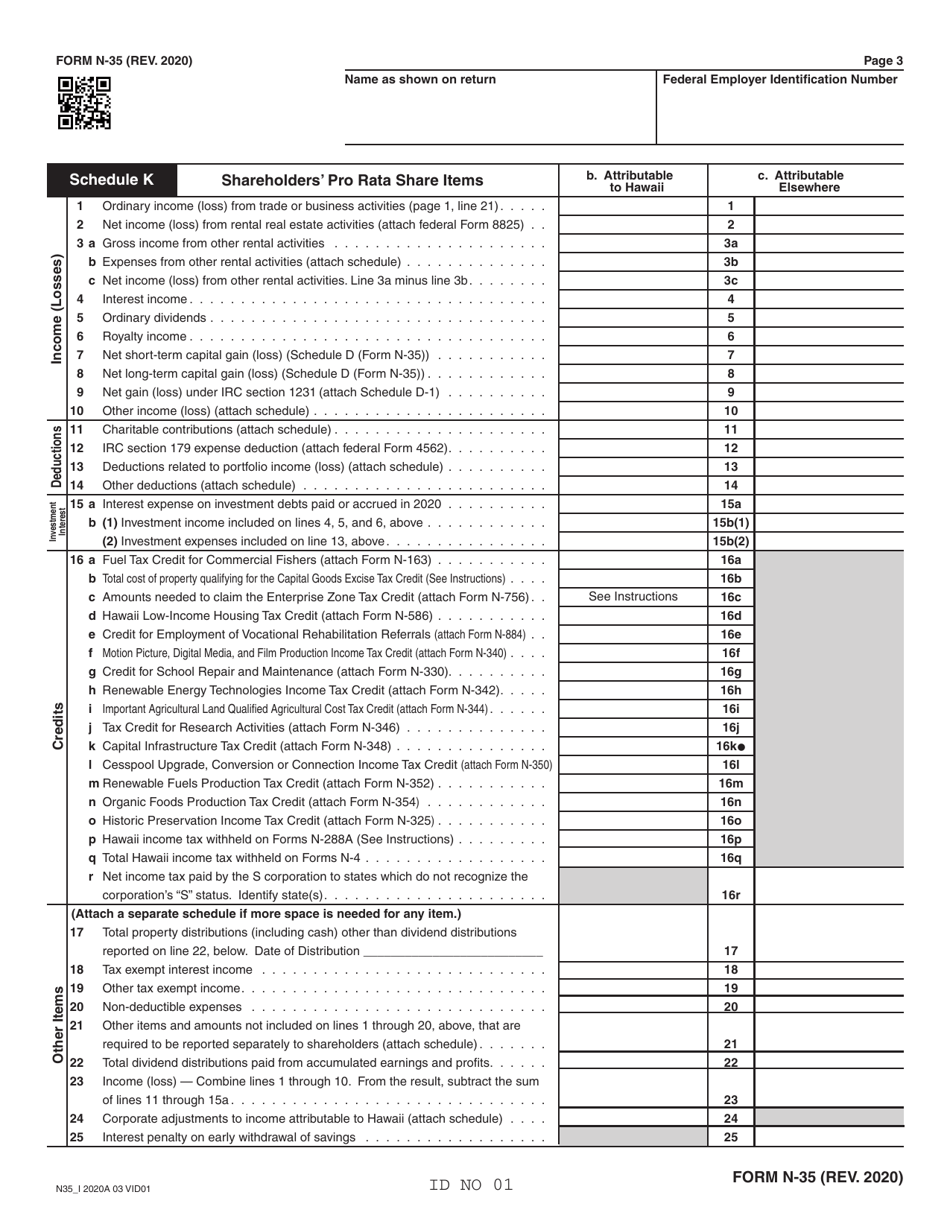

Form N-35 S Corporation Income Tax Return - Hawaii

What Is Form N-35?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form N-35?

A: Form N-35 is the S Corporation Income Tax Return for Hawaii.

Q: Who needs to file Form N-35?

A: S corporations in Hawaii need to file Form N-35.

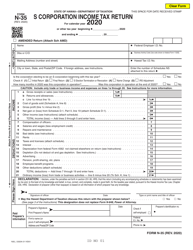

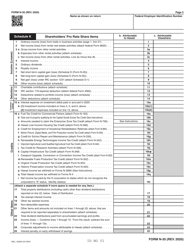

Q: What is the purpose of Form N-35?

A: Form N-35 is used to report the income, deductions, and credits of S corporations in Hawaii.

Q: What information do I need to fill out Form N-35?

A: You will need information about your S corporation's income, deductions, and credits, as well as any other required supporting documentation.

Q: When is the deadline to file Form N-35?

A: The deadline to file Form N-35 is the 20th day of the 4th month following the close of the S corporation's tax year.

Q: Are there any penalties for late filing of Form N-35?

A: Yes, there may be penalties for late filing of Form N-35. It is important to file the form by the deadline to avoid any penalties.

Q: Is there a separate form for S corporations in Hawaii?

A: Yes, Form N-35 is specifically for S corporations in Hawaii. Other types of corporations may have different forms to use.

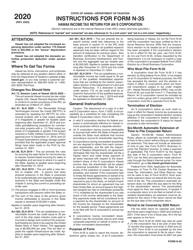

Q: Are there any special instructions for filling out Form N-35?

A: Yes, it is important to carefully read the instructions provided with Form N-35 before filling it out to ensure that you include all required information and supporting documentation.

Form Details:

- Released on January 1, 2020;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-35 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.