This version of the form is not currently in use and is provided for reference only. Download this version of

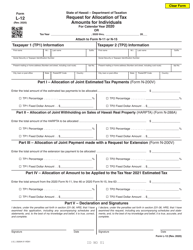

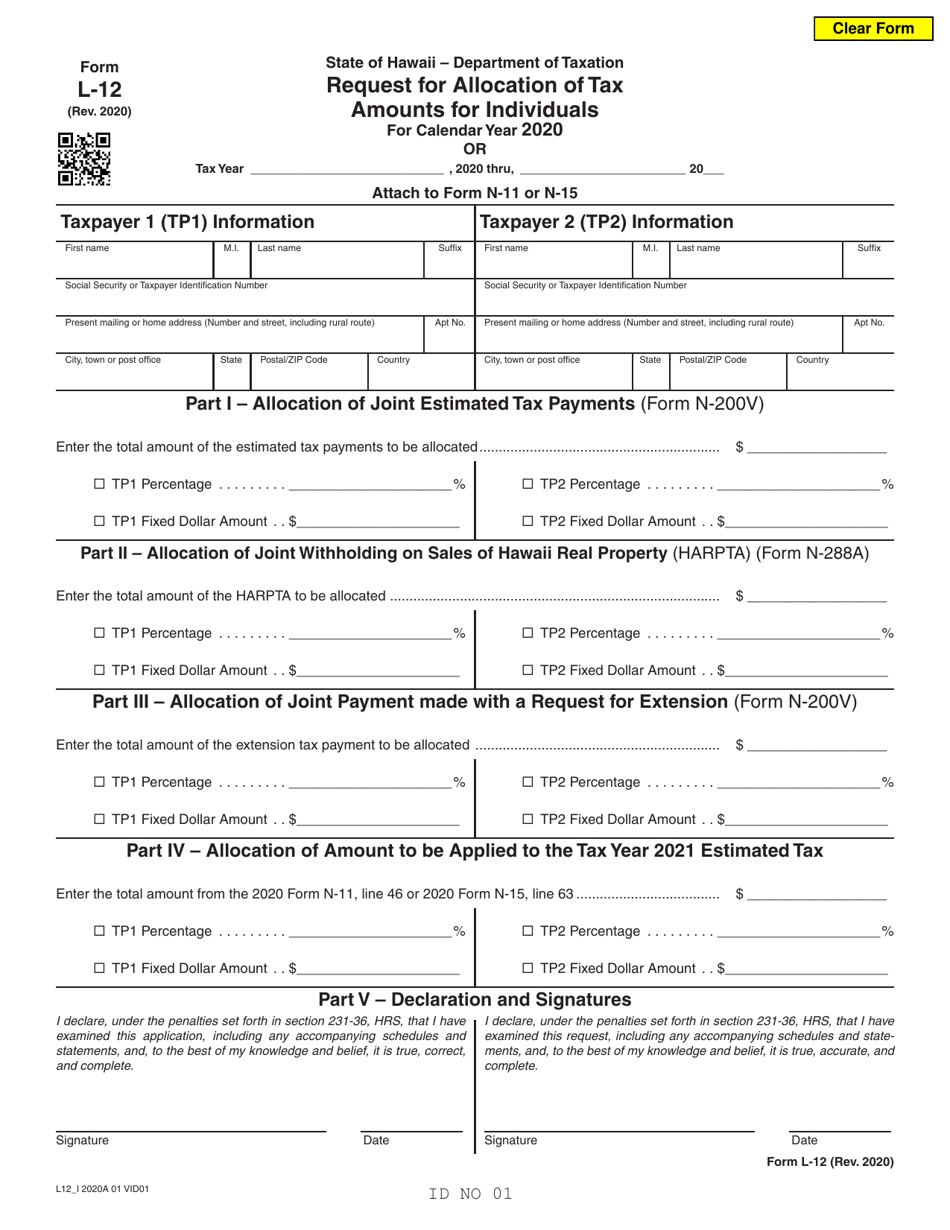

Form L-12

for the current year.

Form L-12 Request for Allocation of Tax Amounts for Individuals - Hawaii

What Is Form L-12?

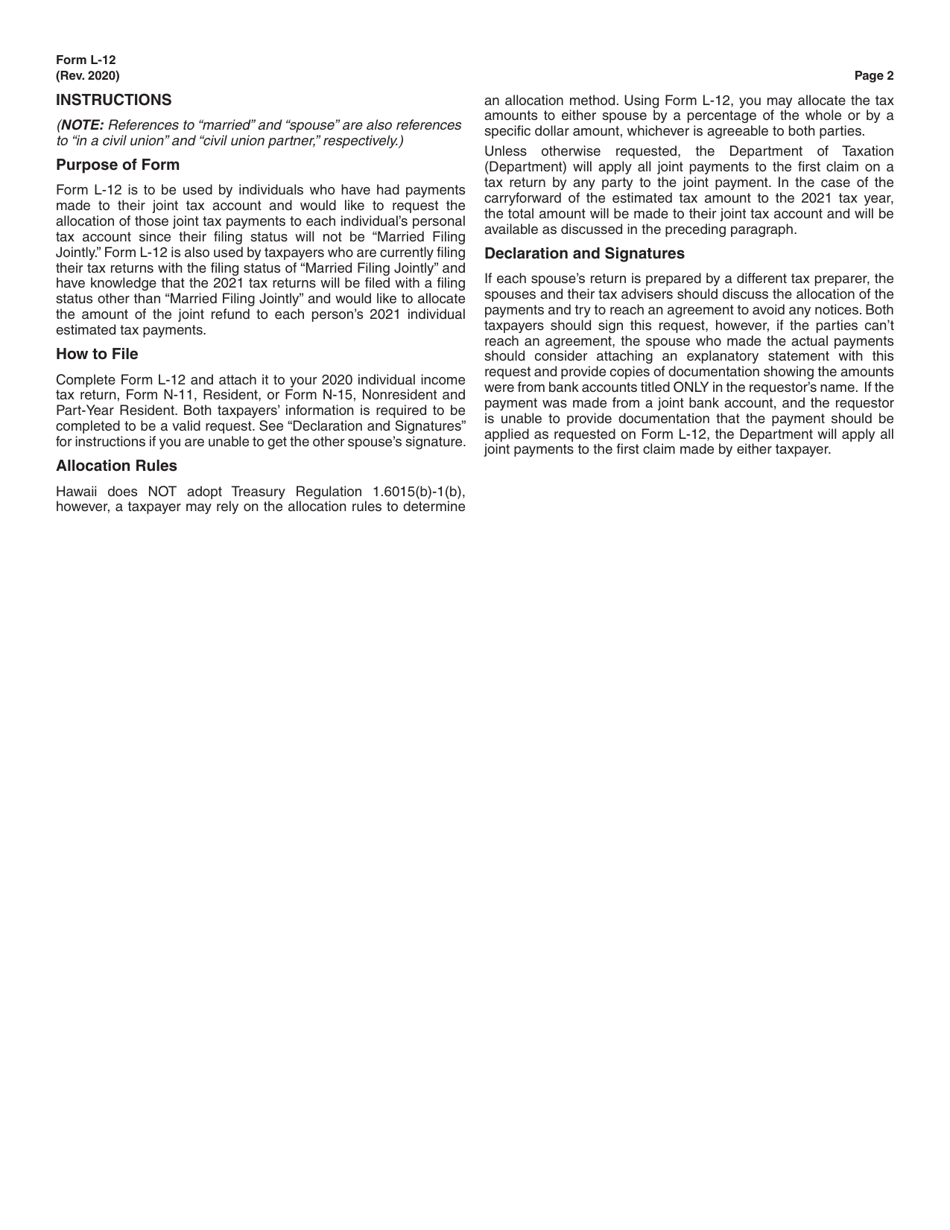

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form L-12?

A: Form L-12 is a form used in Hawaii for requesting the allocation of tax amounts for individuals.

Q: Who can use Form L-12?

A: Individual taxpayers in Hawaii can use Form L-12.

Q: What is the purpose of Form L-12?

A: The purpose of Form L-12 is to allocate tax amounts among spouses or domestic partners in Hawaii.

Q: When should Form L-12 be filed?

A: Form L-12 should be filed when a taxpayer wants to allocate tax amounts with their spouse or domestic partner.

Form Details:

- Released on January 1, 2020;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form L-12 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.