This version of the form is not currently in use and is provided for reference only. Download this version of

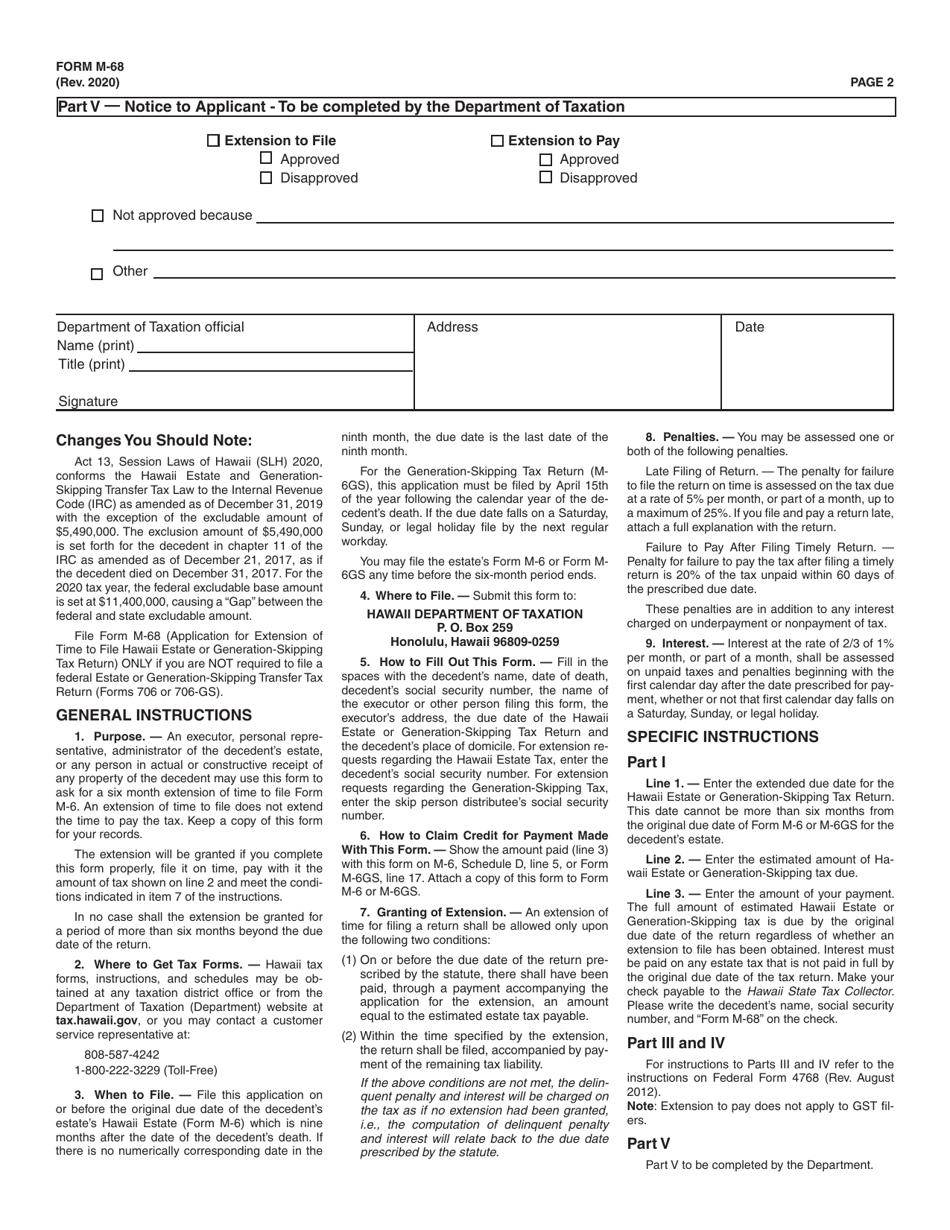

Form M-68

for the current year.

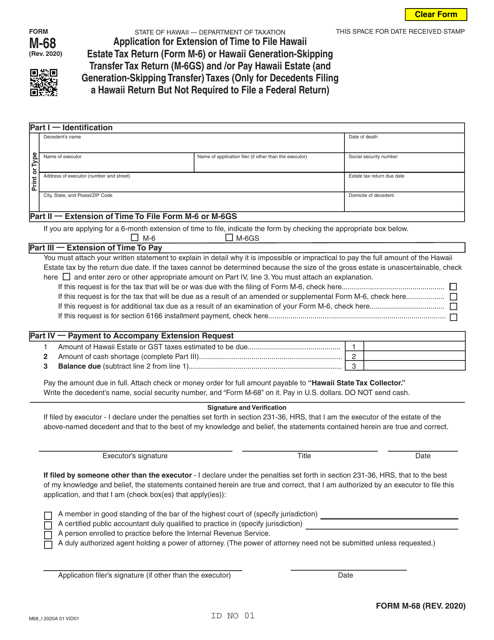

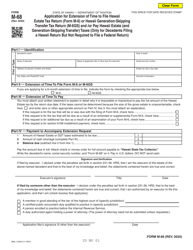

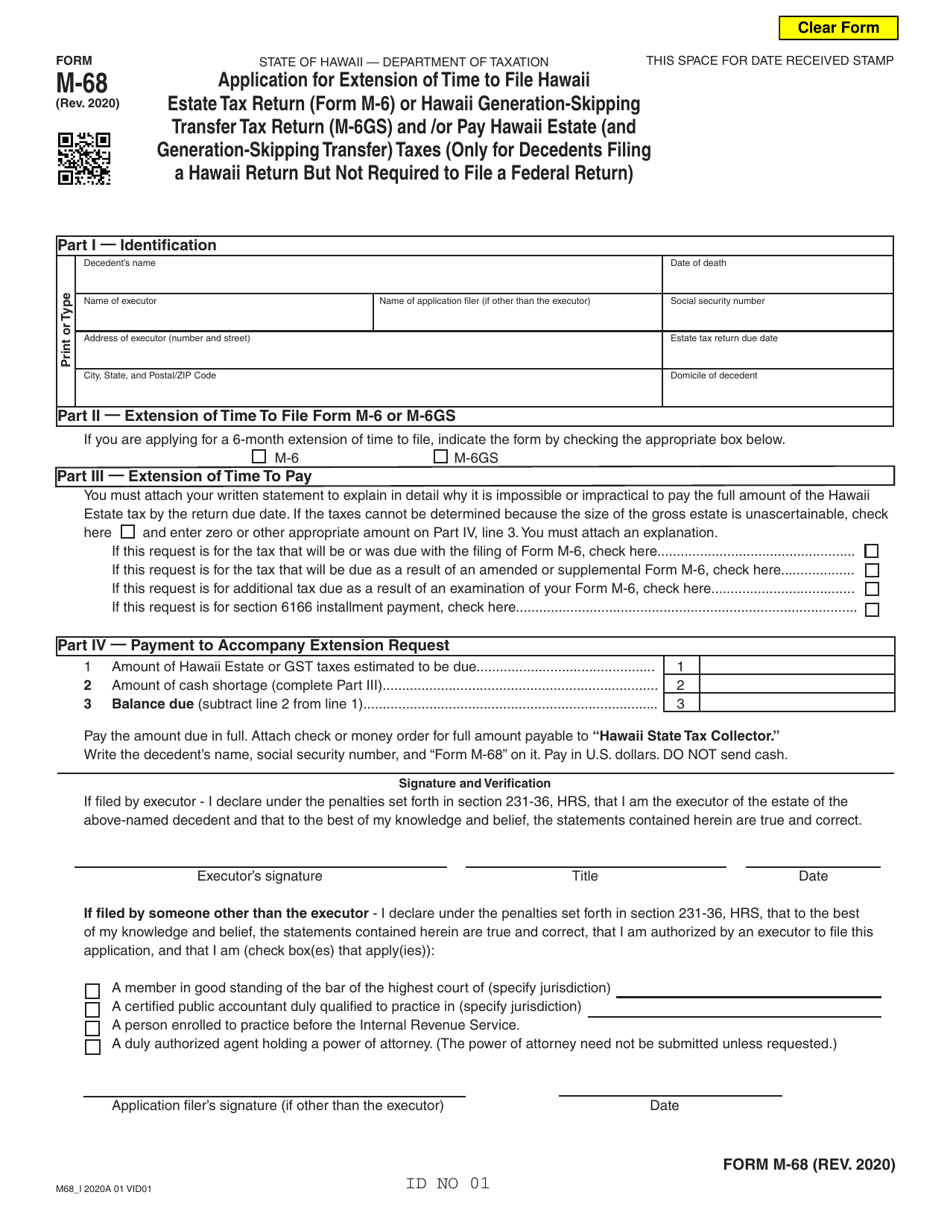

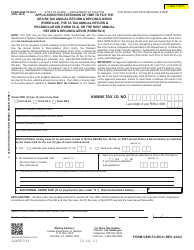

Form M-68 Application for Extension of Time to File Hawaii Estate Tax Return (Form M-6) or Hawaii Generation-Skipping Transfer Tax Return (M-6gs) and / or Pay Hawaii Estate (And Generation-Skipping Transfer) Taxes - Hawaii

What Is Form M-68?

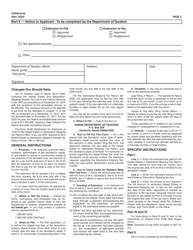

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form M-68?

A: Form M-68 is an application for extension of time to file Hawaii Estate Tax Return (Form M-6) or Hawaii Generation-Skipping Transfer Tax Return (M-6gs) and/or pay Hawaii Estate (and Generation-Skipping Transfer) Taxes.

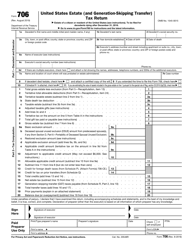

Q: What does Form M-68 allow you to do?

A: Form M-68 allows you to request an extension of time to file your Hawaii estate tax return or Hawaii generation-skipping transfer tax return, as well as to pay the corresponding taxes.

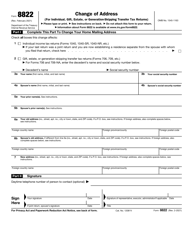

Q: When should Form M-68 be filed?

A: Form M-68 should be filed on or before the original due date of your Hawaii estate tax return or Hawaii generation-skipping transfer tax return.

Q: What taxes are covered by Form M-68?

A: Form M-68 covers both Hawaii estate tax and Hawaii generation-skipping transfer tax.

Q: Is there a fee for filing Form M-68?

A: No, there is no fee for filing Form M-68.

Q: What happens if I file Form M-68 after the original due date?

A: If you file Form M-68 after the original due date, it may result in penalties and interest.

Q: How long is the extension granted by filing Form M-68?

A: The extension granted by filing Form M-68 is generally six months.

Q: Can I use Form M-68 to request multiple extensions?

A: No, Form M-68 can only be used to request a single extension.

Form Details:

- Released on January 1, 2020;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form M-68 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.