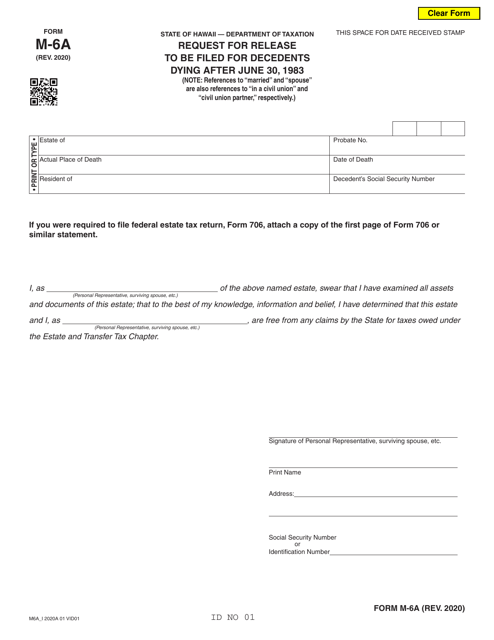

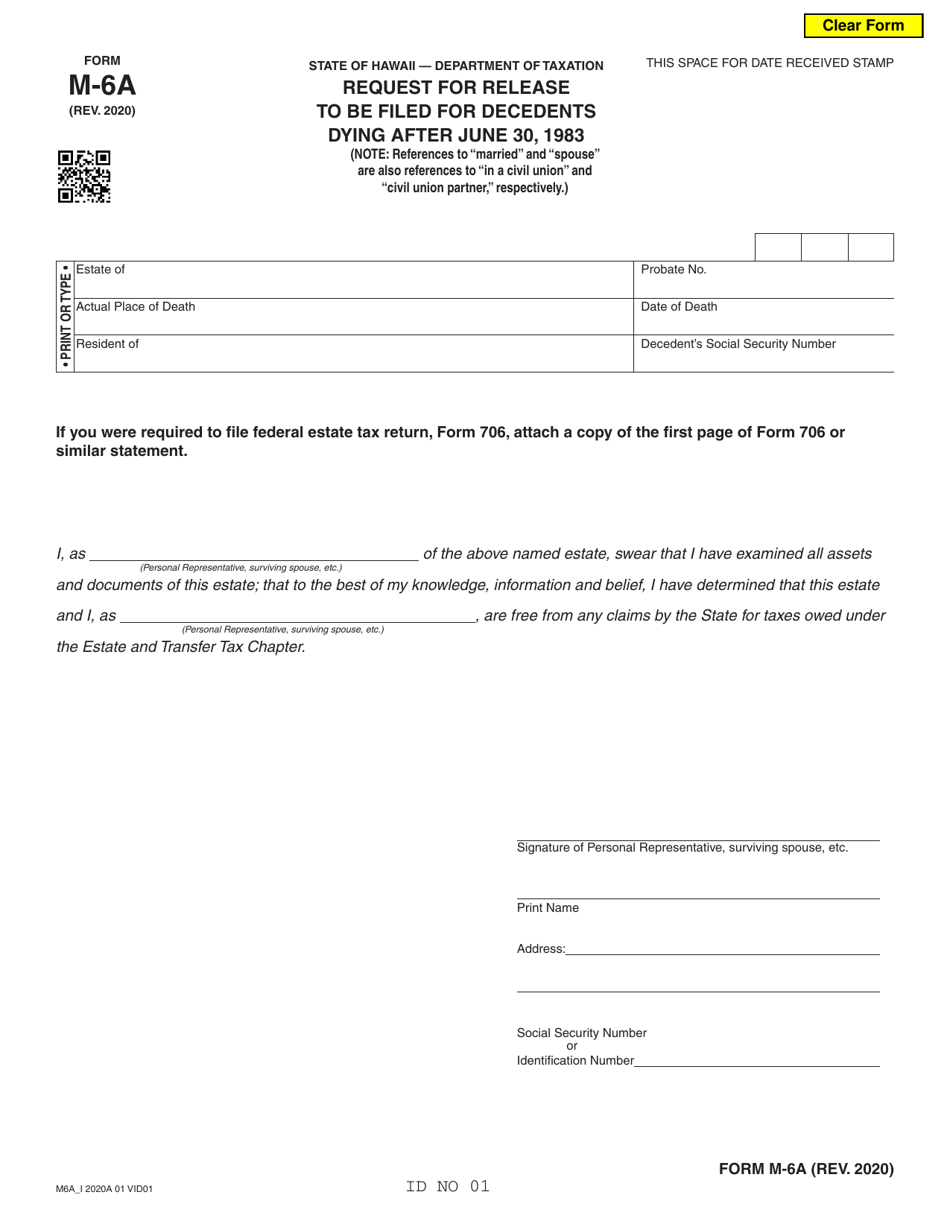

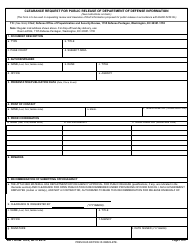

This version of the form is not currently in use and is provided for reference only. Download this version of

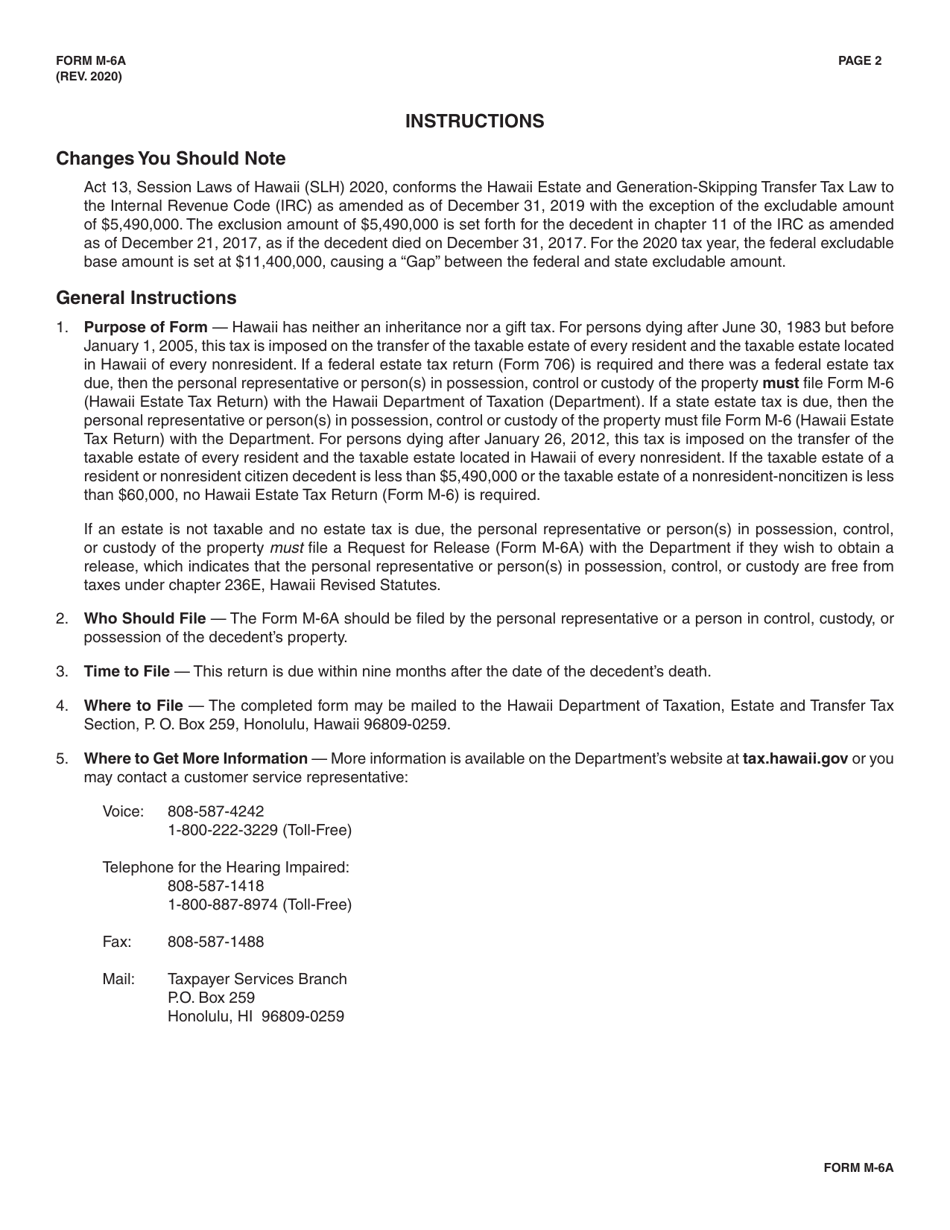

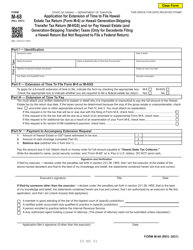

Form M-6A

for the current year.

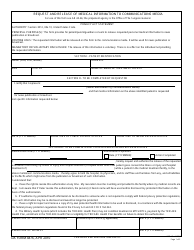

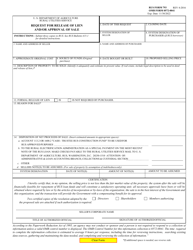

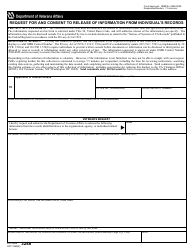

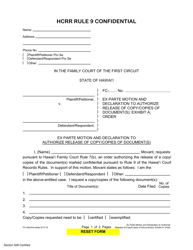

Form M-6A Request for Release to Be Filed for Decedents Dying After June 30, 1983 - Hawaii

What Is Form M-6A?

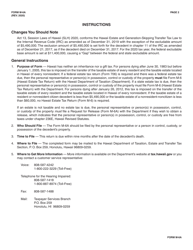

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form M-6A?

A: Form M-6A is a request for release to be filed for decedents dying after June 30, 1983 in Hawaii.

Q: Who should file Form M-6A?

A: Form M-6A should be filed by the executor or administrator of the decedent's estate.

Q: When should Form M-6A be filed?

A: Form M-6A should be filed within 18 months from the date of death.

Q: Do I need to include any supporting documents with Form M-6A?

A: Yes, you should include a copy of the decedent's will or trust agreement, and a certified copy of the death certificate.

Q: Is there a filing fee for Form M-6A?

A: No, there is no filing fee for Form M-6A.

Q: What happens after I file Form M-6A?

A: Once Form M-6A is filed, the Hawaii Department of Taxation will review the request and release any assets held by the department to the executor or administrator of the estate.

Form Details:

- Released on January 1, 2020;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form M-6A by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.