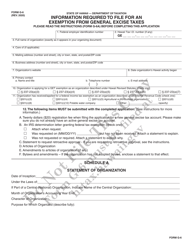

This version of the form is not currently in use and is provided for reference only. Download this version of

Form G-45 (G-49) Schedule GE

for the current year.

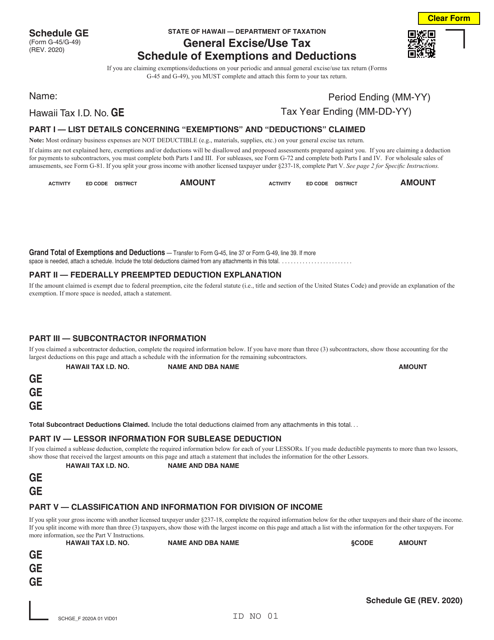

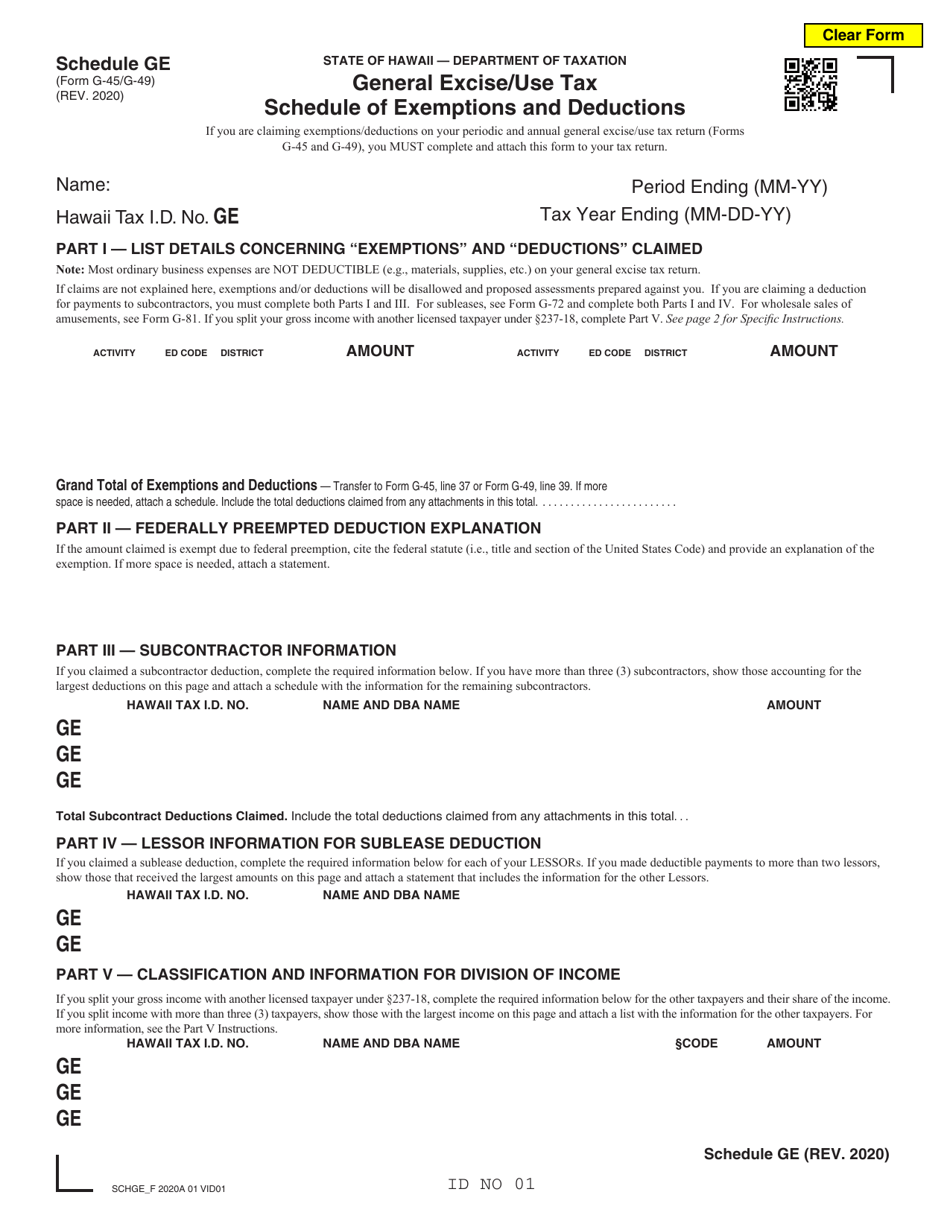

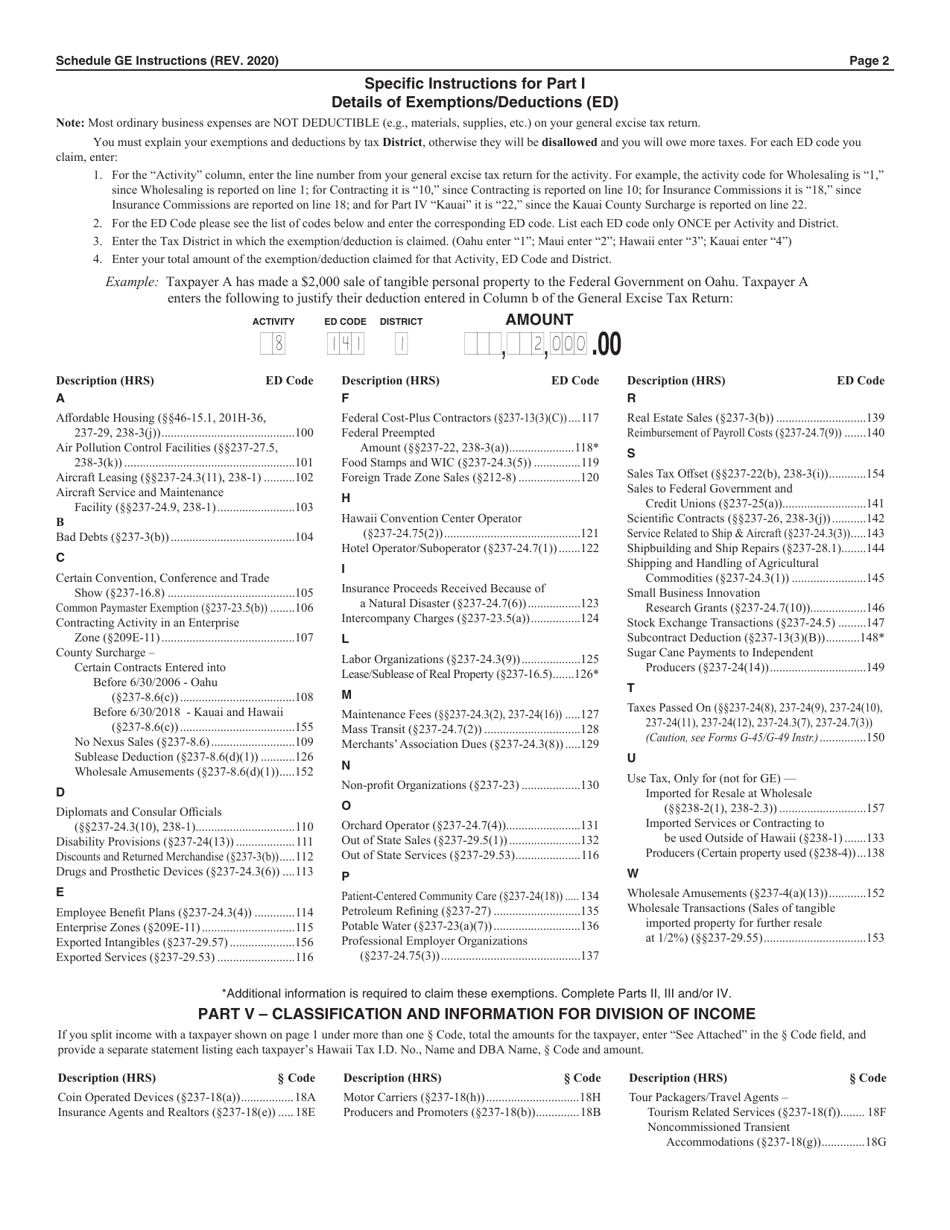

Form G-45 (G-49) Schedule GE General Excise / Use Tax Schedule of Exemptions and Deductions - Hawaii

What Is Form G-45 (G-49) Schedule GE?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii.The document is a supplement to Form G-45, and Form G-49. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form G-45 (G-49)?

A: Form G-45 (G-49) is the General Excise/Use Tax Schedule of Exemptions and Deductions in Hawaii.

Q: What is the purpose of Form G-45 (G-49)?

A: The purpose of Form G-45 (G-49) is to claim exemptions and deductions for the General Excise/Use Tax in Hawaii.

Q: Who needs to fill out Form G-45 (G-49)?

A: Anyone who wants to claim exemptions or deductions for the General Excise/Use Tax in Hawaii needs to fill out this form.

Q: What does the General Excise/Use Tax apply to?

A: The General Excise/Use Tax applies to the gross income received by businesses engaging in certain activities in Hawaii.

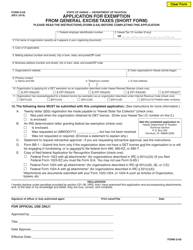

Q: What exemptions and deductions can be claimed on Form G-45 (G-49)?

A: Form G-45 (G-49) allows for various exemptions and deductions, such as sales made to the federal government, sales of certain medical services, and sales of prescription drugs.

Form Details:

- Released on January 1, 2020;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form G-45 (G-49) Schedule GE by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.