This version of the form is not currently in use and is provided for reference only. Download this version of

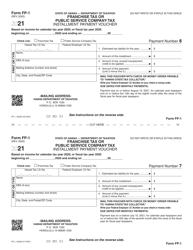

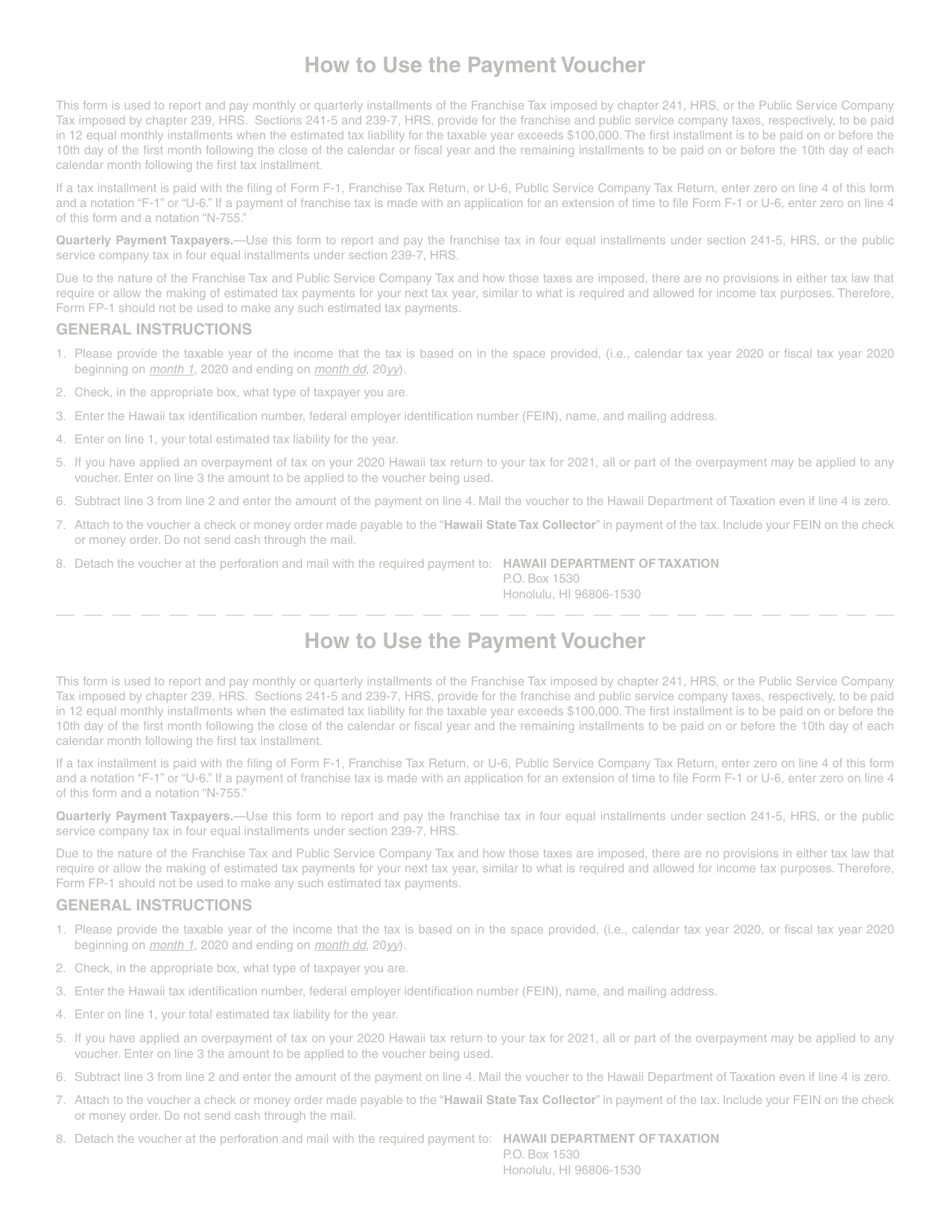

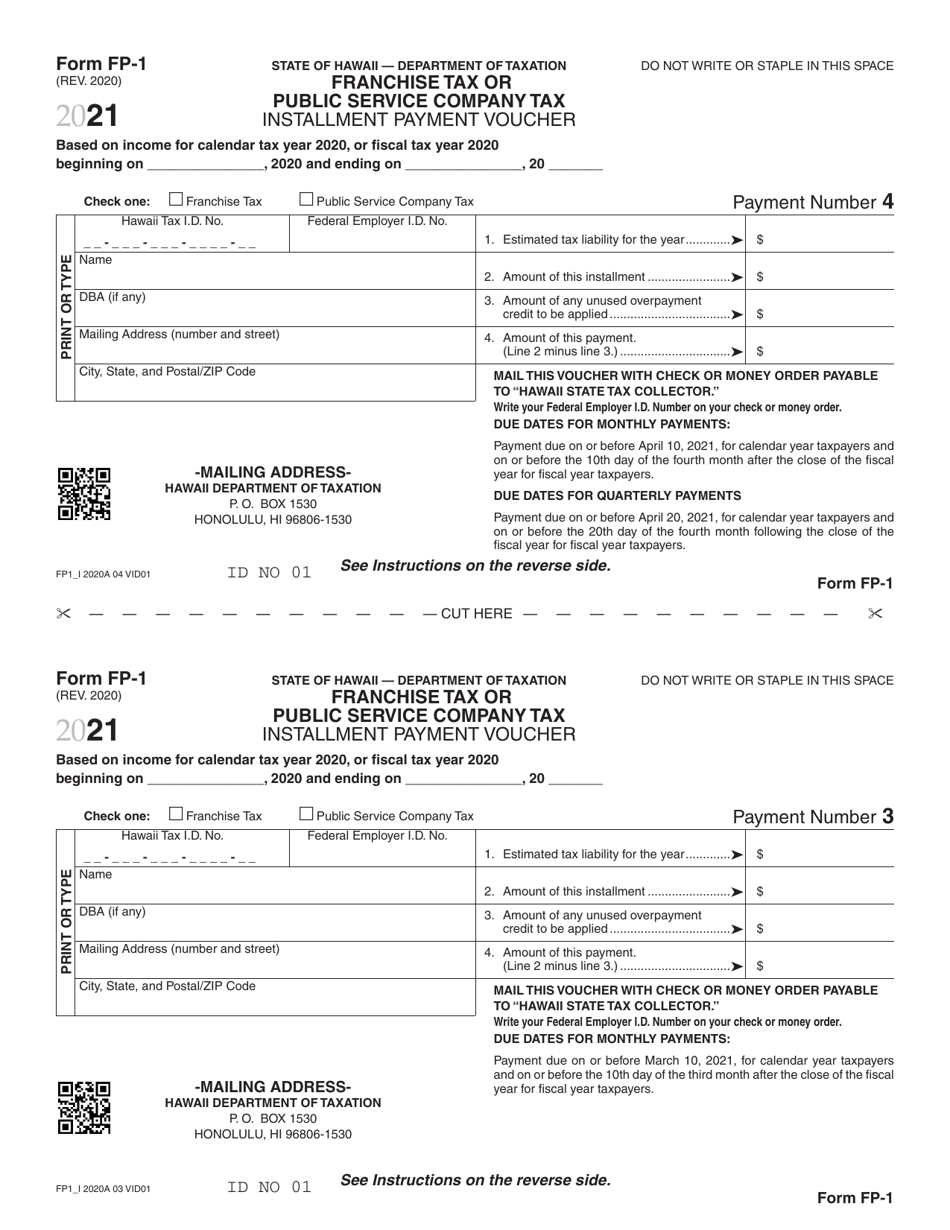

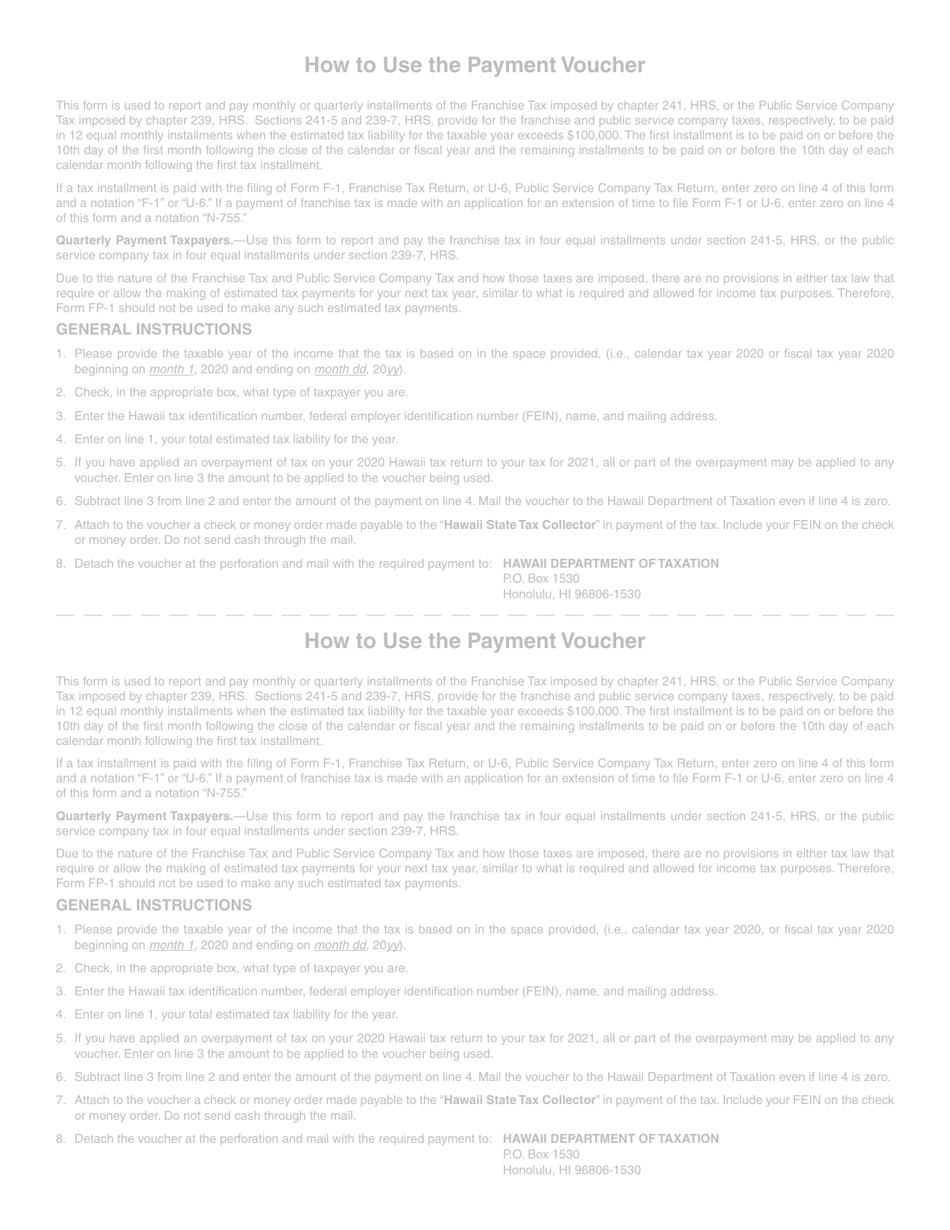

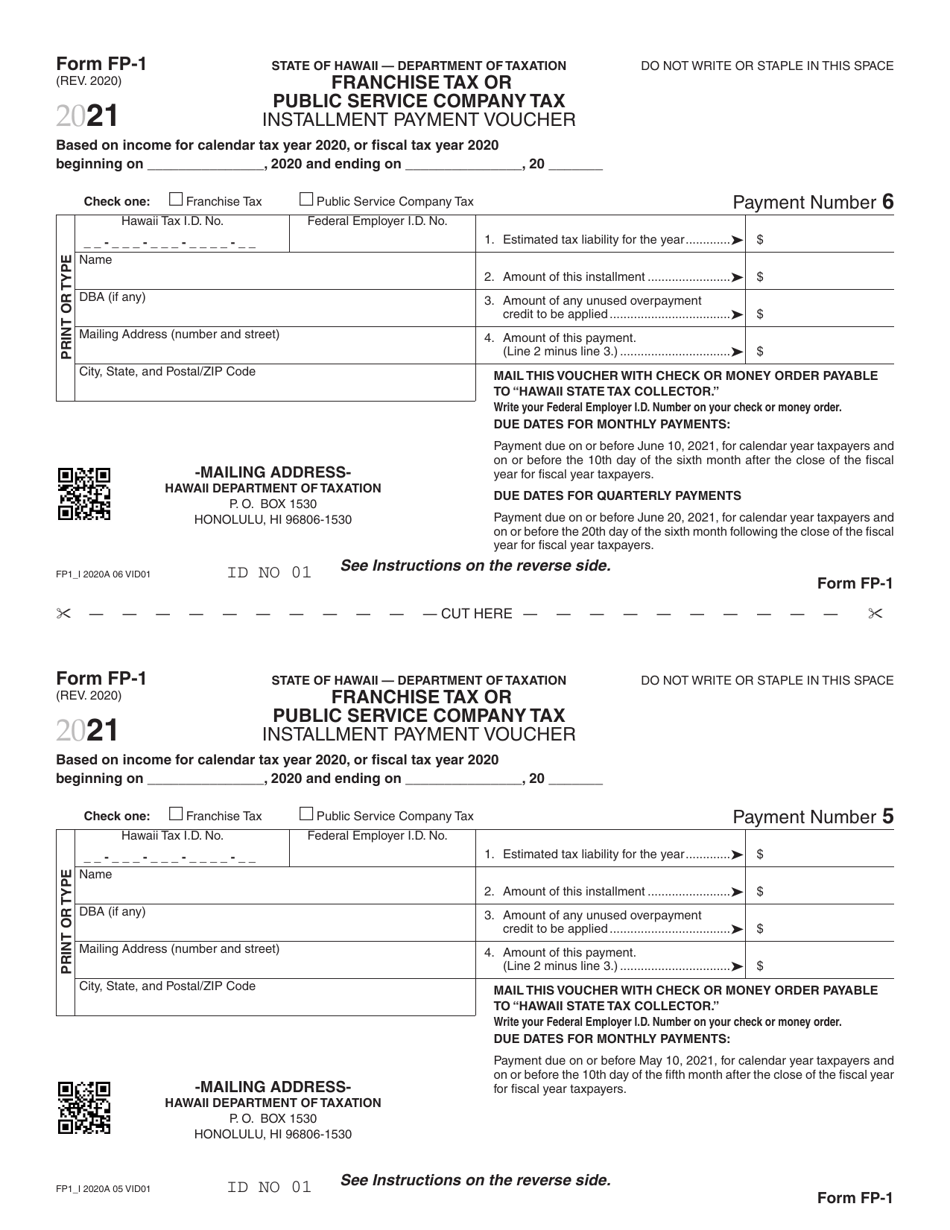

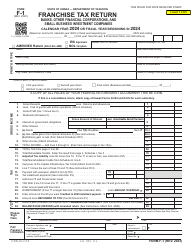

Form FP-1

for the current year.

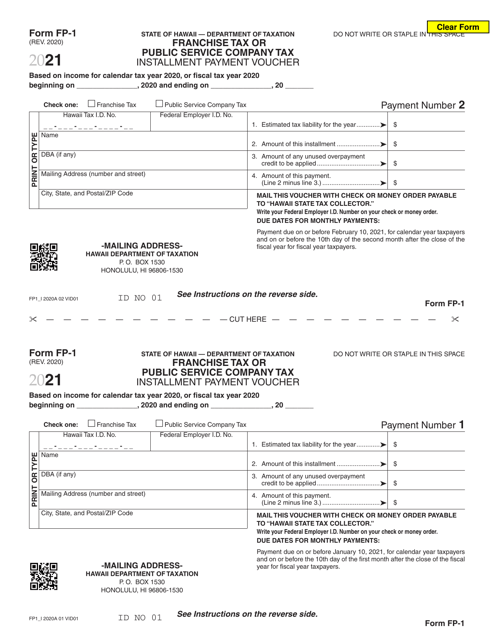

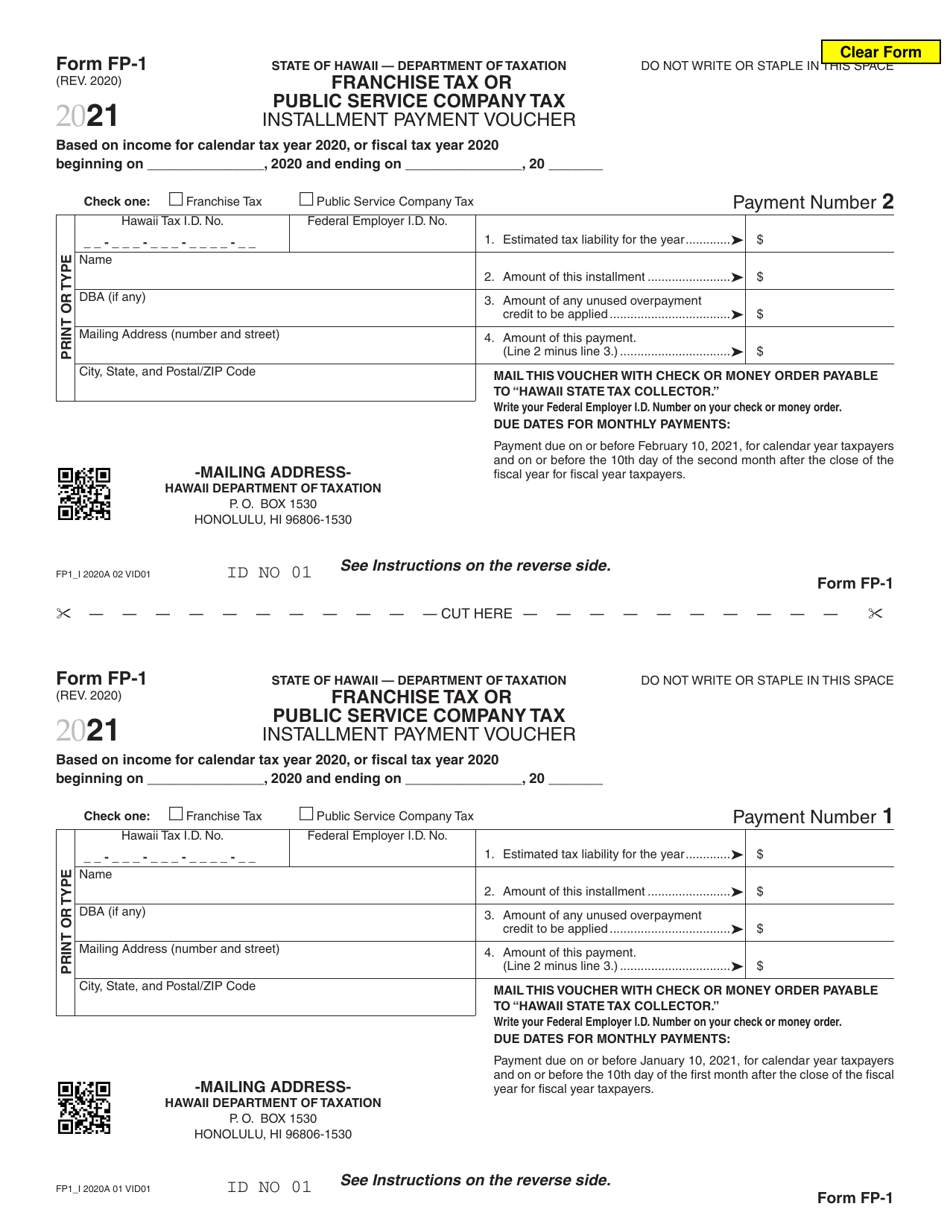

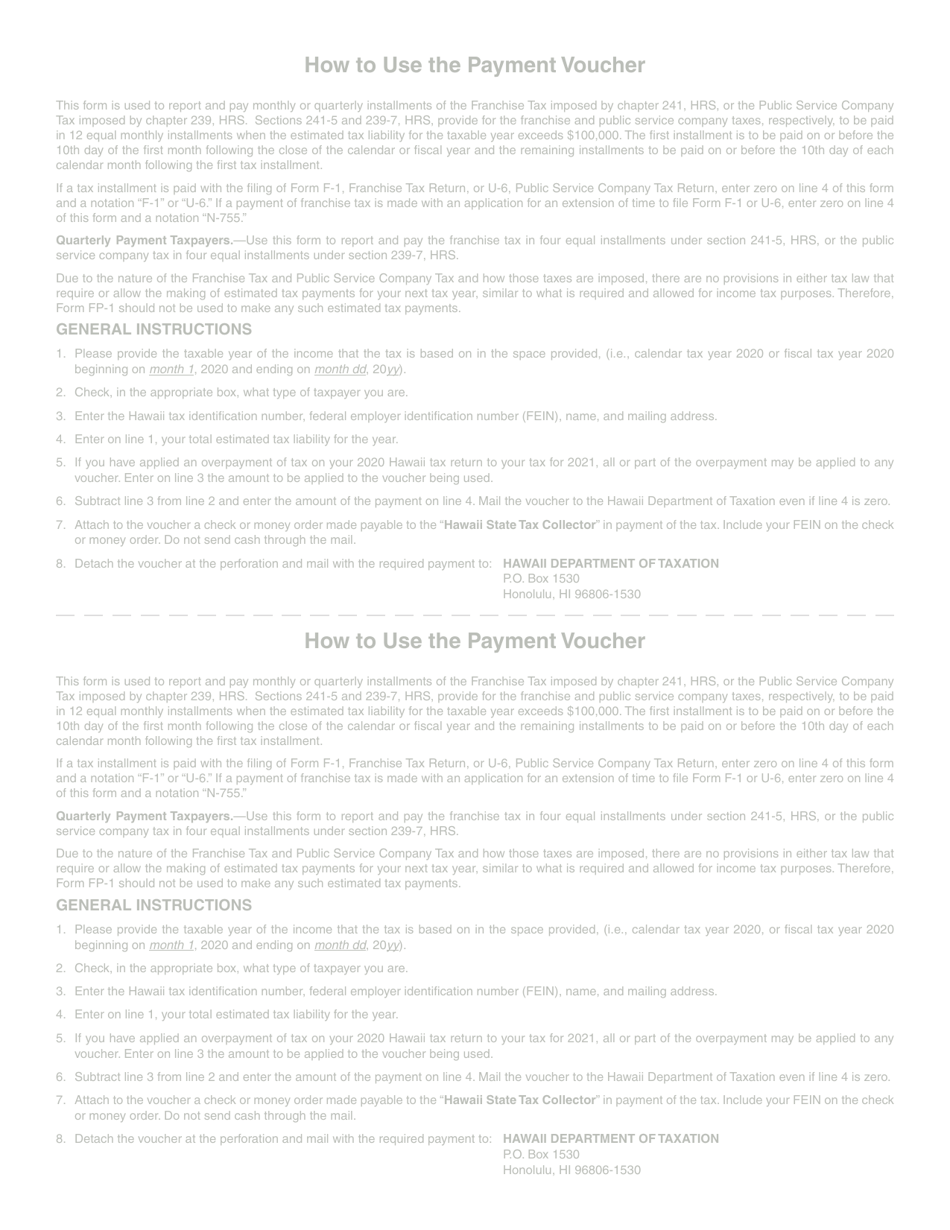

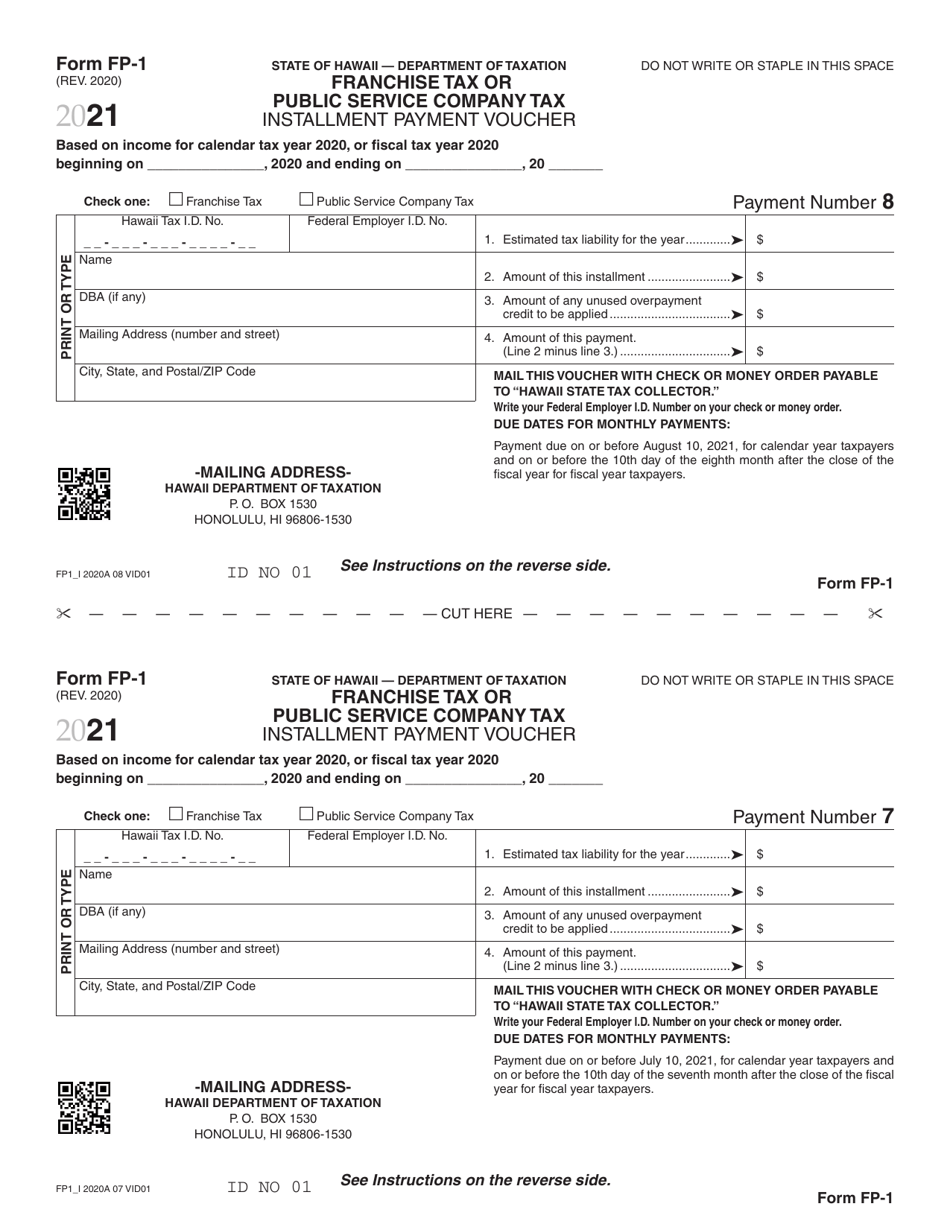

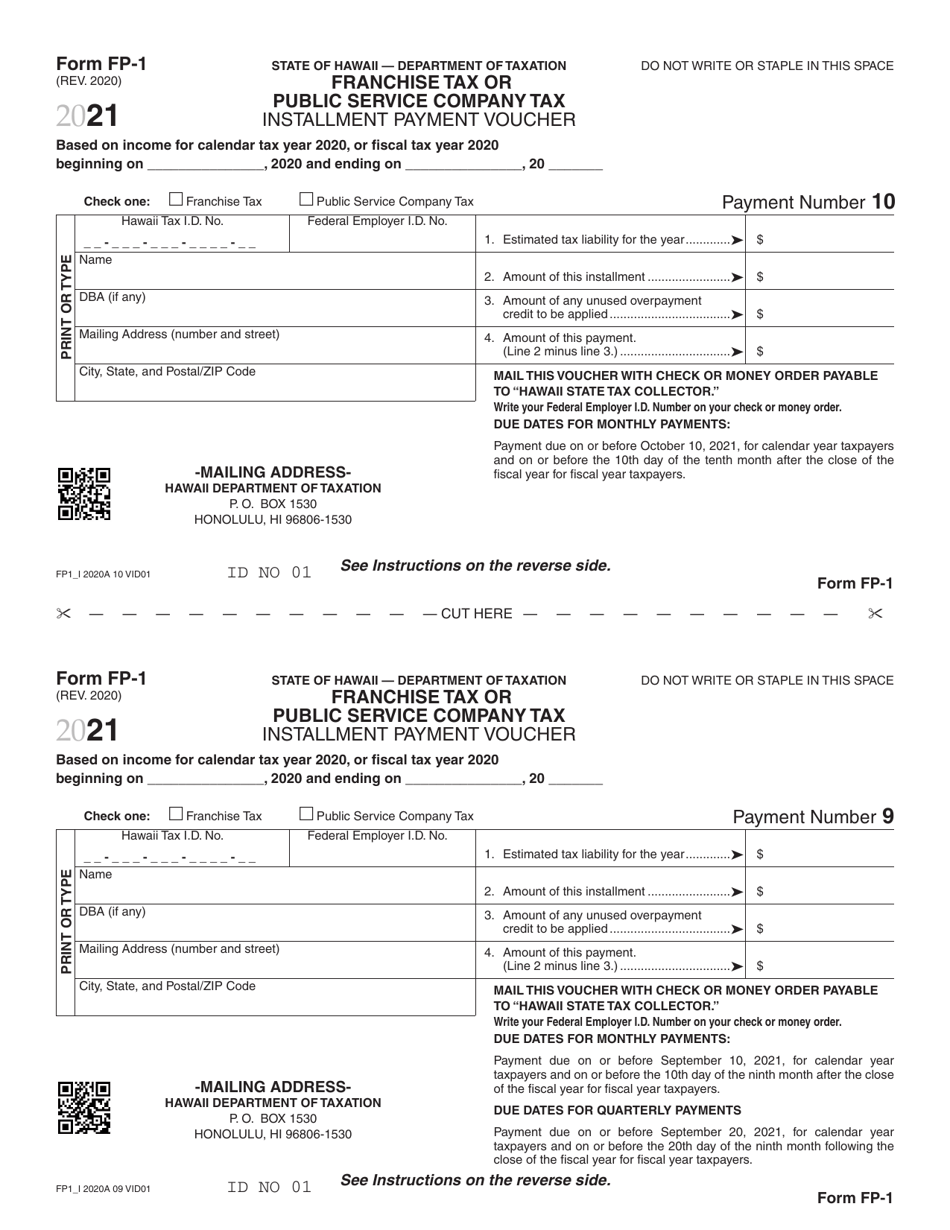

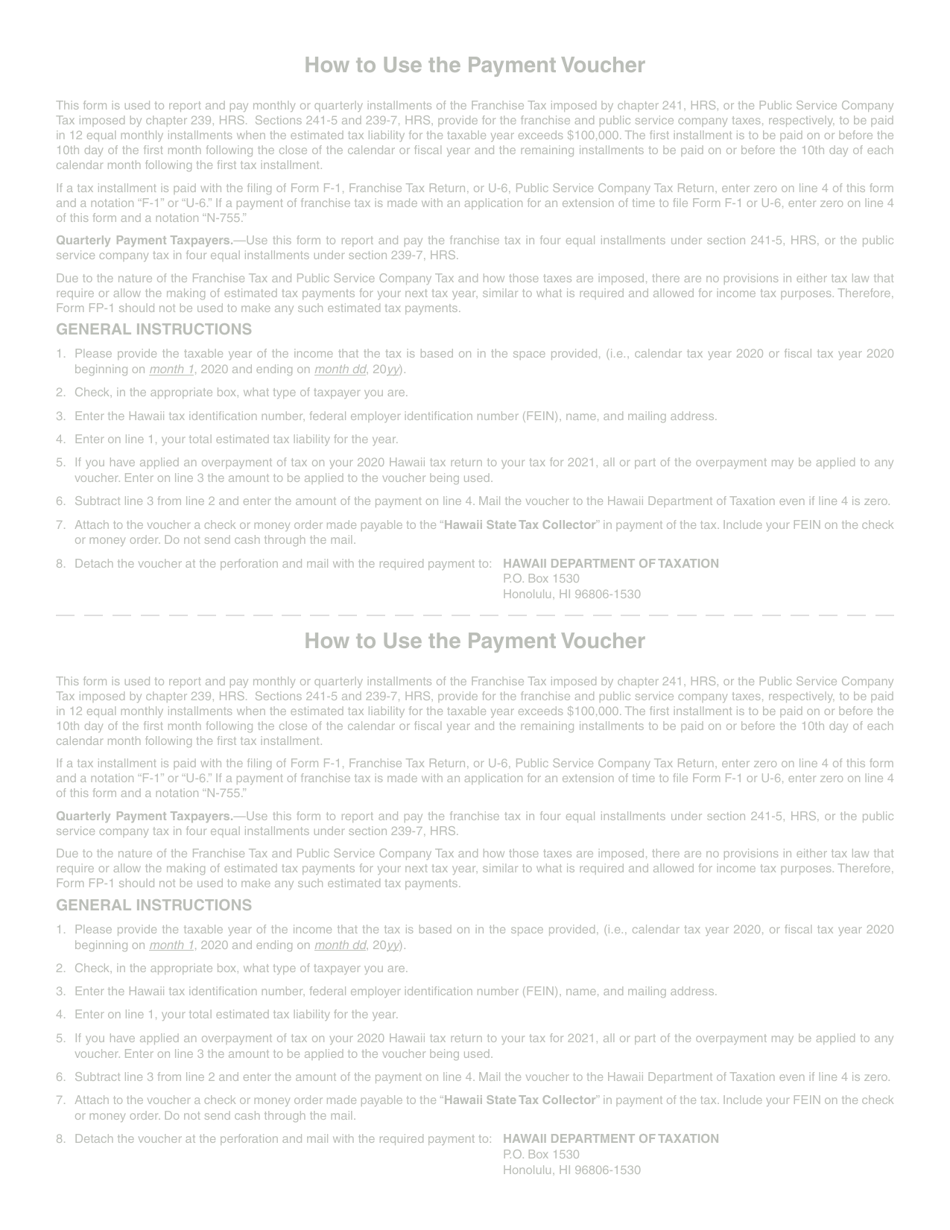

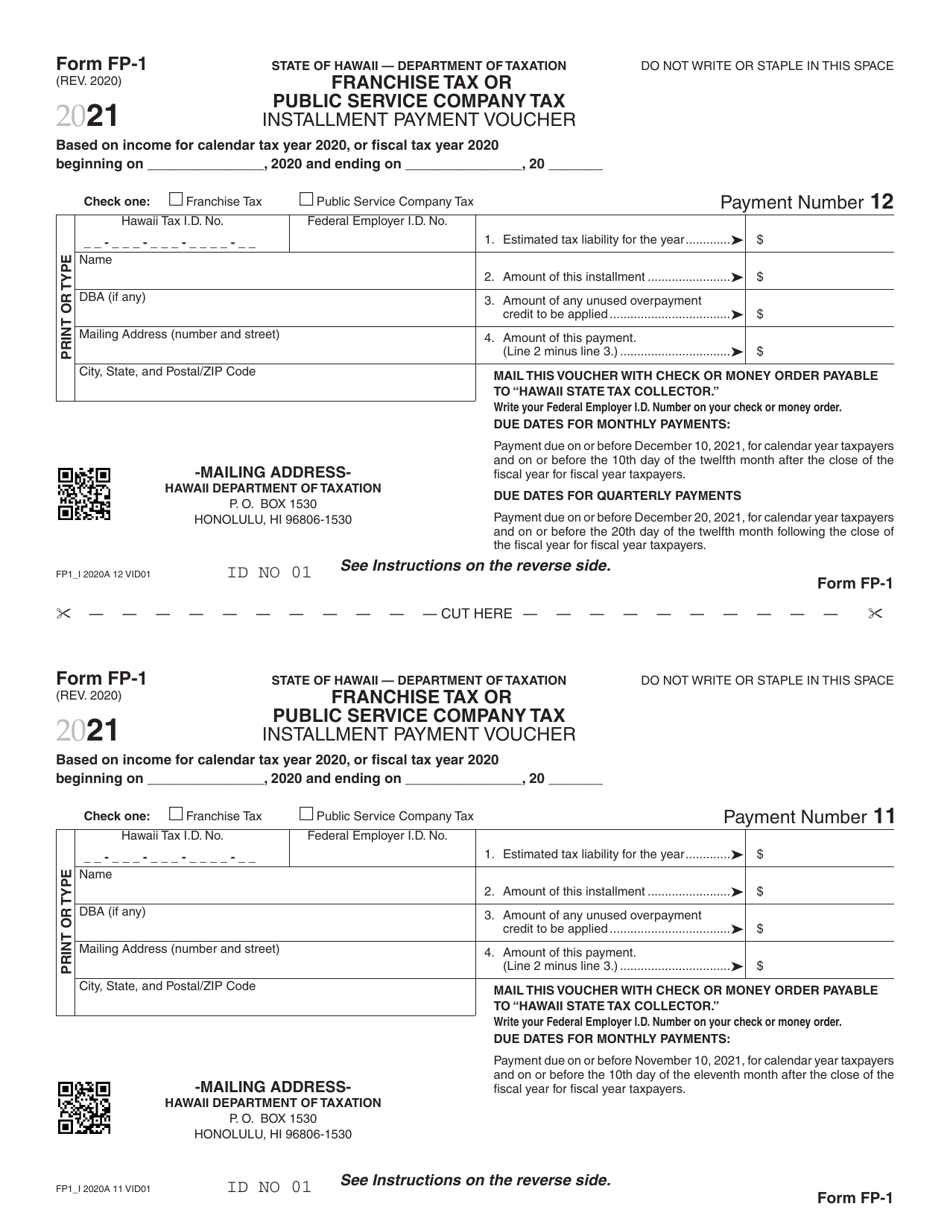

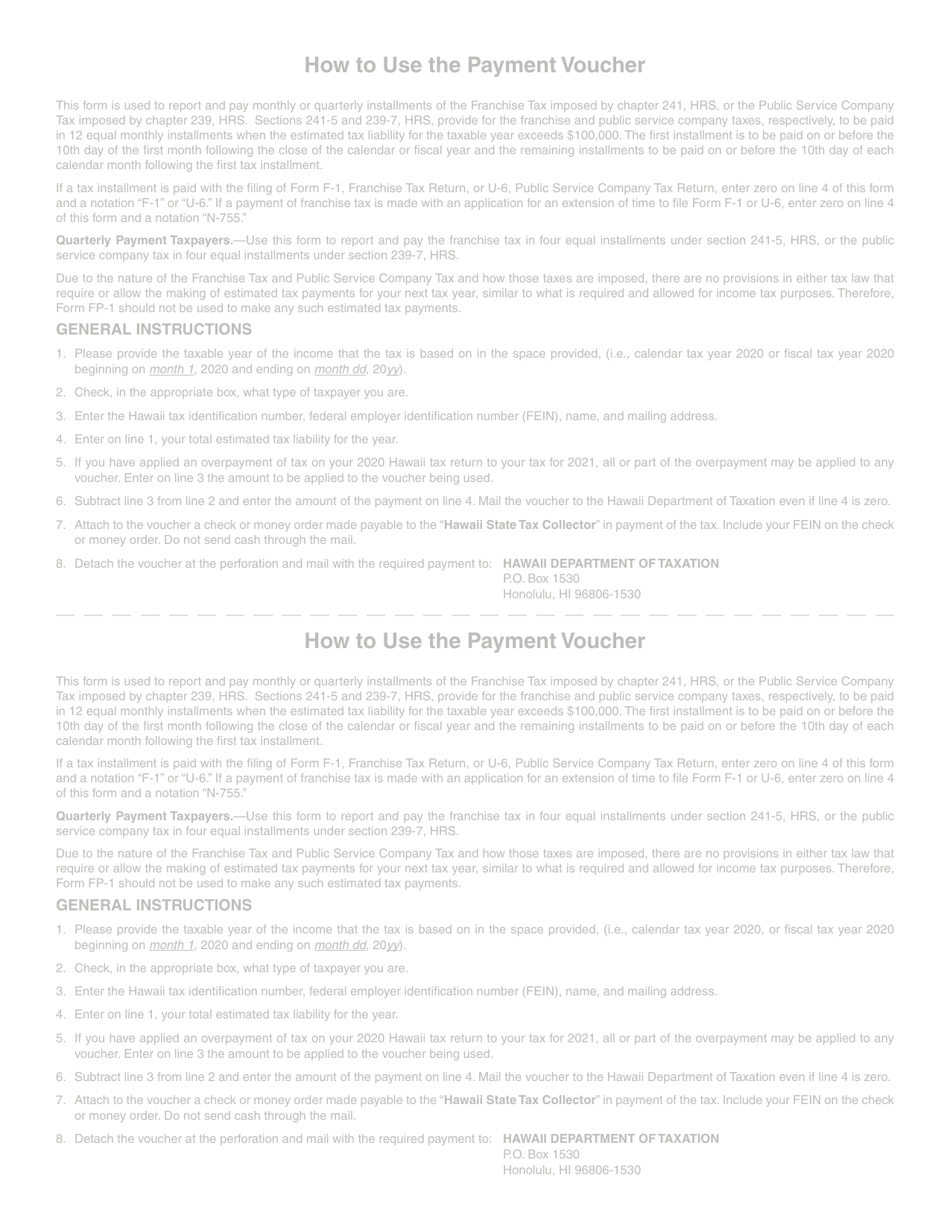

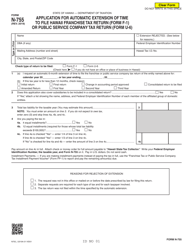

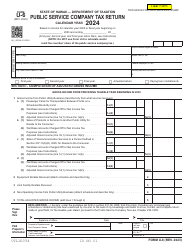

Form FP-1 Franchise Tax or Public Service Company Tax Installment Payment Voucher - Hawaii

What Is Form FP-1?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

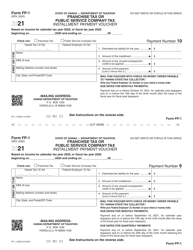

Q: What is Form FP-1?

A: Form FP-1 is the Franchise Tax or Public Service Company Tax Installment Payment Voucher for Hawaii.

Q: What is the purpose of Form FP-1?

A: The purpose of Form FP-1 is to make installment payments for the Franchise Tax or Public Service Company Tax in Hawaii.

Q: Who needs to file Form FP-1?

A: Anyone who is required to pay the Franchise Tax or Public Service Company Tax in Hawaii needs to file Form FP-1.

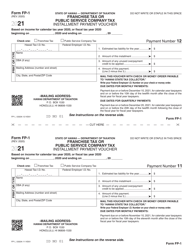

Q: How often do I need to file Form FP-1?

A: Form FP-1 needs to be filed quarterly, with the installment payments due on the 15th day of April, June, September, and December.

Q: What information is needed to complete Form FP-1?

A: To complete Form FP-1, you will need to provide your taxpayer identification number, installment period, and the amount of tax due.

Q: Are there any penalties for not filing Form FP-1?

A: Yes, there may be penalties for late or non-filing of Form FP-1, including interest charges on any unpaid tax amounts.

Q: Can I pay the Franchise Tax or Public Service Company Tax in Hawaii by mail?

A: Yes, you can mail your payment for the Franchise Tax or Public Service Company Tax in Hawaii along with Form FP-1.

Q: Is Form FP-1 the only tax form needed for the Franchise Tax or Public Service Company Tax in Hawaii?

A: No, Form FP-1 is just the installment payment voucher. You may need to file additional forms for the Franchise Tax or Public Service Company Tax, depending on your tax situation.

Form Details:

- Released on January 1, 2020;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FP-1 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.