This version of the form is not currently in use and is provided for reference only. Download this version of

Form ID-MS1 (EFO00226)

for the current year.

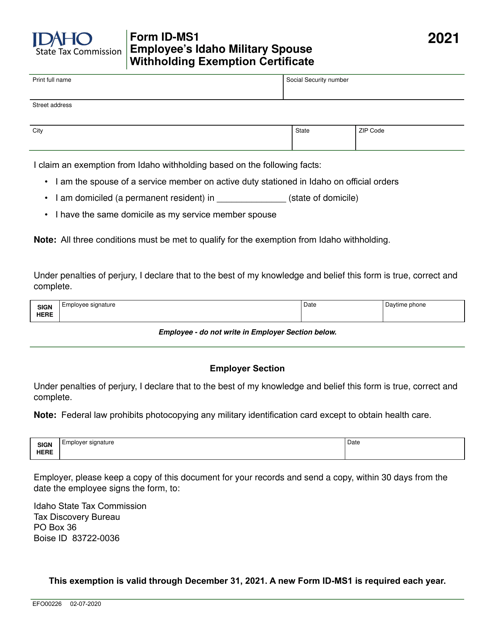

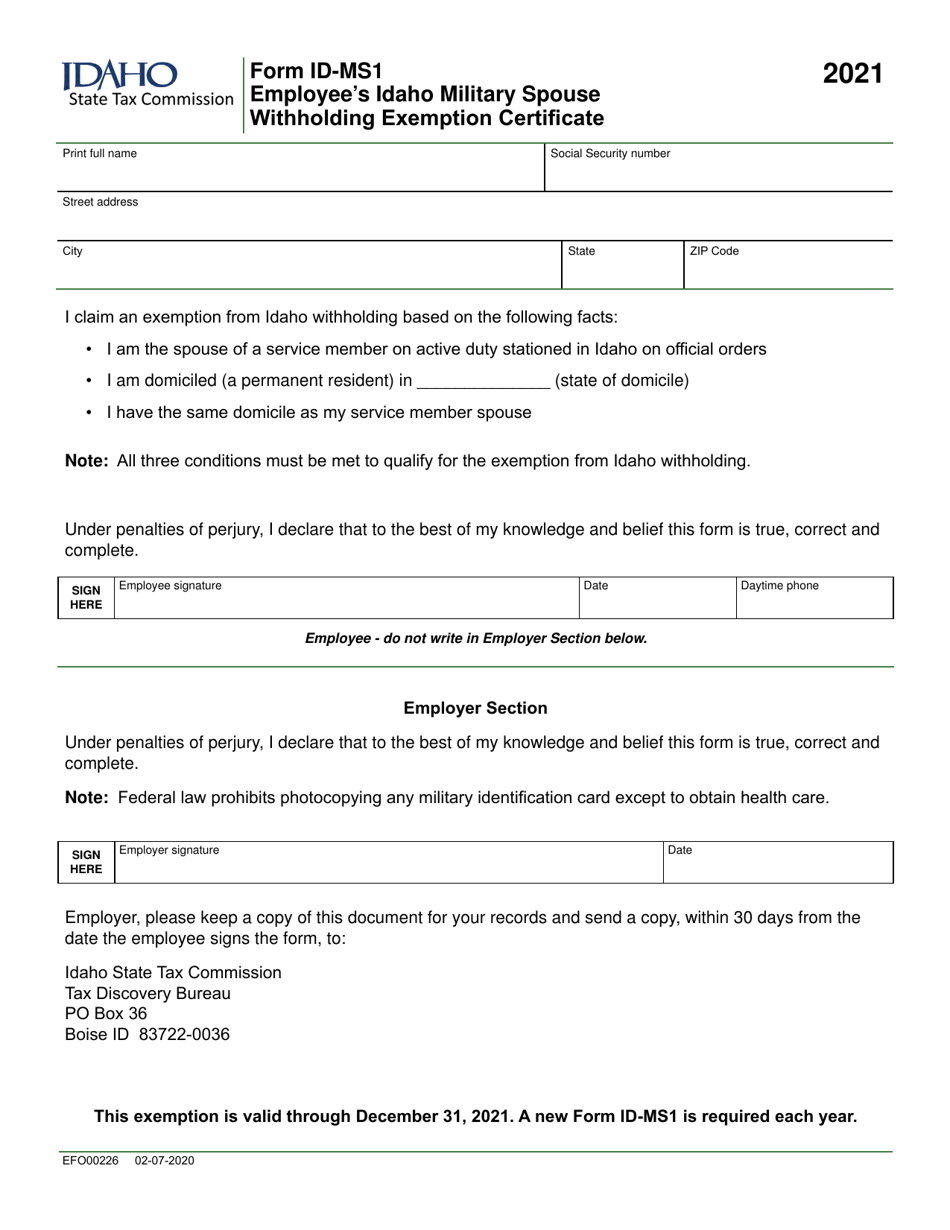

Form ID-MS1 (EFO00226) Employee's Idaho Military Spouse Withholding Exemption Certificate - Idaho

What Is Form ID-MS1 (EFO00226)?

This is a legal form that was released by the Idaho State Tax Commission - a government authority operating within Idaho. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ID-MS1?

A: Form ID-MS1 is the Employee's Idaho Military Spouse Withholding Exemption Certificate.

Q: What is the purpose of Form ID-MS1?

A: The purpose of Form ID-MS1 is to claim exemption from Idaho state withholding tax as a military spouse.

Q: Who is eligible to use Form ID-MS1?

A: Only military spouses who are residents of another state, but work in Idaho, are eligible to use Form ID-MS1.

Q: How do I complete Form ID-MS1?

A: You need to provide your personal information, including your name, address, and Social Security Number, and indicate your military spouse status.

Q: How long is Form ID-MS1 valid?

A: Form ID-MS1 is valid until the end of the calendar year in which it was filed, unless a new form is filed or the exemption is no longer valid.

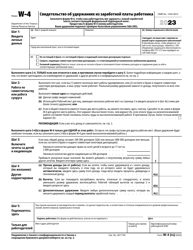

Q: Can I claim exemption from federal withholding tax with Form ID-MS1?

A: No, Form ID-MS1 only applies to Idaho state withholding tax. To claim exemption from federal withholding tax, you need to submit Form W-4 with your employer.

Form Details:

- Released on February 7, 2020;

- The latest edition provided by the Idaho State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ID-MS1 (EFO00226) by clicking the link below or browse more documents and templates provided by the Idaho State Tax Commission.