This version of the form is not currently in use and is provided for reference only. Download this version of

Form CG (EFO00093)

for the current year.

Form CG (EFO00093) Capital Gains Deduction - Idaho

What Is Form CG (EFO00093)?

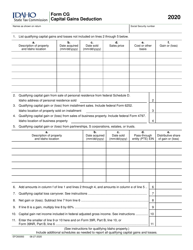

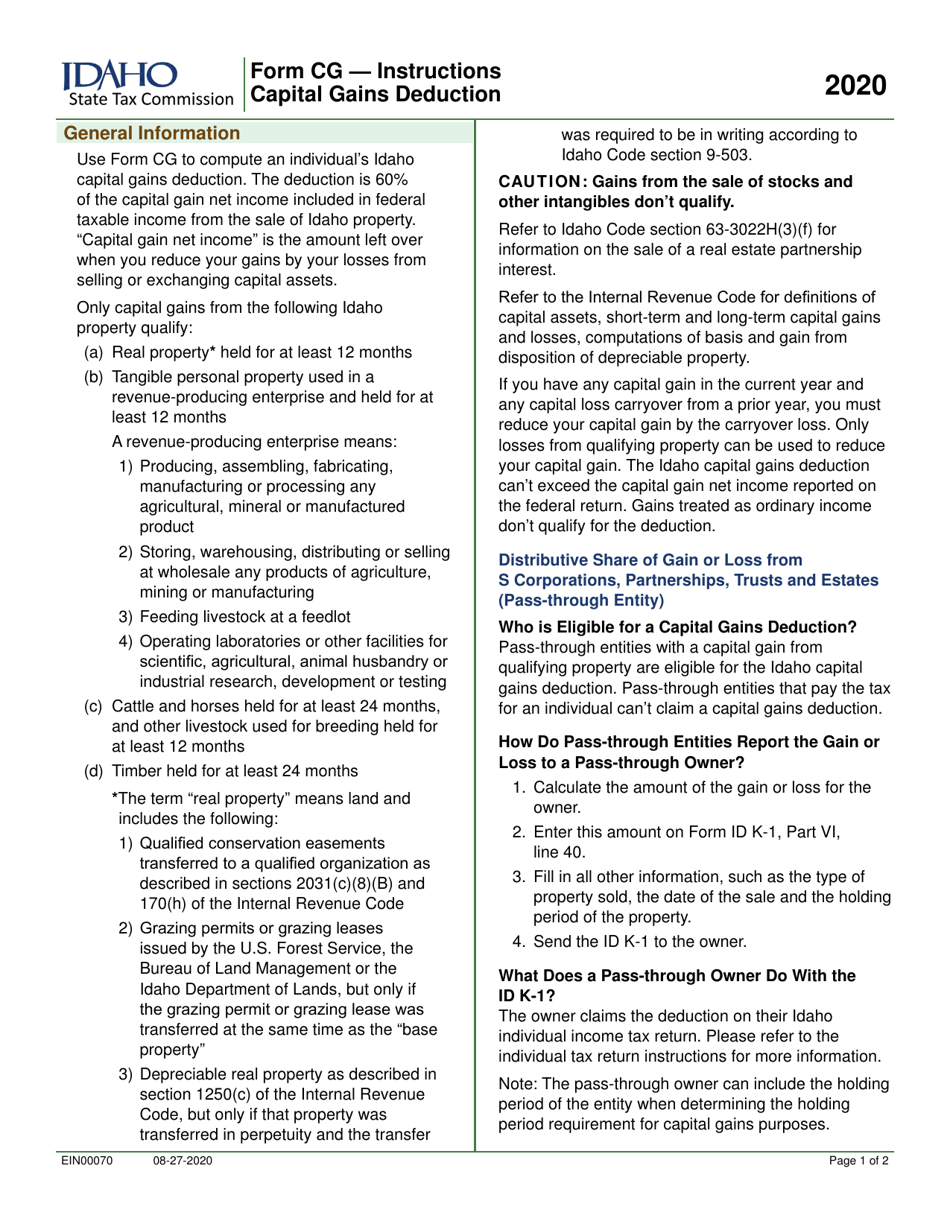

This is a legal form that was released by the Idaho State Tax Commission - a government authority operating within Idaho. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CG (EFO00093)?

A: Form CG (EFO00093) is a tax form used to claim the Capital Gains Deduction in Idaho.

Q: What is the Capital Gains Deduction?

A: The Capital Gains Deduction is a tax benefit that allows individuals to exclude a portion of their capital gains from their taxable income.

Q: Who can claim the Capital Gains Deduction in Idaho?

A: Individuals who meet certain qualifications, such as being a resident of Idaho and meeting ownership requirements, can claim the Capital Gains Deduction.

Q: What is the purpose of the Capital Gains Deduction?

A: The purpose of the Capital Gains Deduction is to provide tax relief for individuals who have realized a capital gain on the sale of qualified assets.

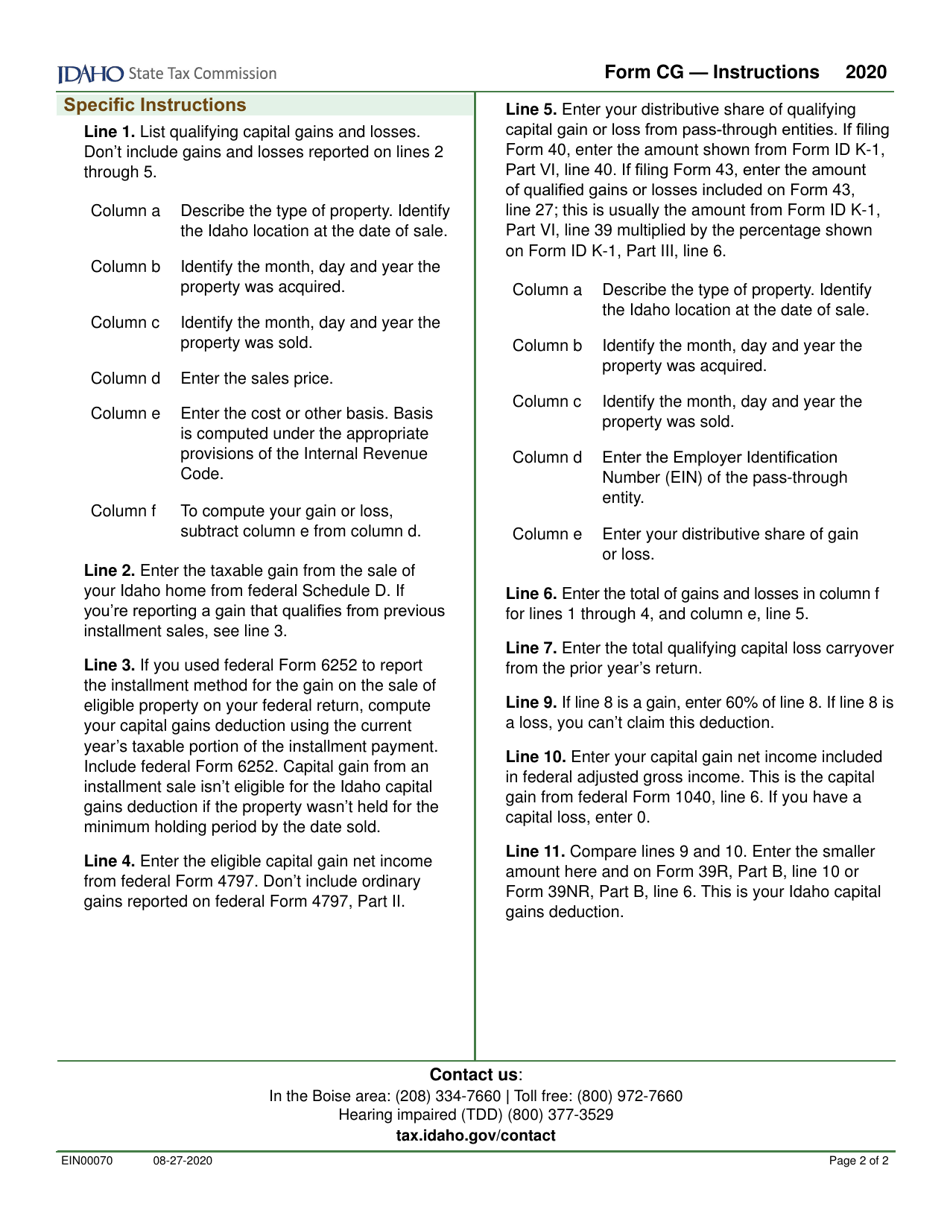

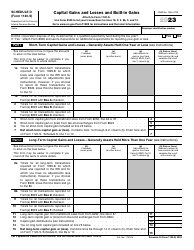

Q: How do I fill out Form CG (EFO00093)?

A: To fill out Form CG (EFO00093), you will need to provide information about the property sold, the capital gain realized, and any other required details as outlined in the form's instructions.

Q: When is the deadline to file Form CG (EFO00093)?

A: The deadline to file Form CG (EFO00093) is generally the same as the deadline for filing your Idaho state tax return, which is typically April 15th.

Q: Are there any limits to the amount of capital gains that can be deducted?

A: Yes, there are limits to the amount of capital gains that can be deducted. The specific limits vary depending on the tax year and other factors, so it is important to consult the instructions for Form CG (EFO00093) or contact the Idaho State Tax Commission for more information.

Q: Can I claim the Capital Gains Deduction if I sold property outside of Idaho?

A: No, the Capital Gains Deduction in Idaho can only be claimed for the sale of qualified assets located within the state of Idaho.

Q: What happens if I do not qualify for the Capital Gains Deduction?

A: If you do not qualify for the Capital Gains Deduction, you will not be able to exclude a portion of your capital gains from your taxable income. You will need to report the full amount of your capital gains on your tax return and pay taxes on them accordingly.

Form Details:

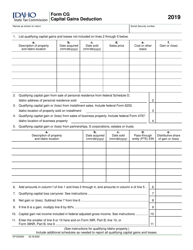

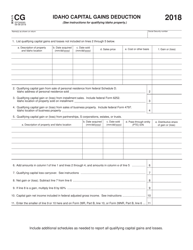

- Released on August 27, 2020;

- The latest edition provided by the Idaho State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CG (EFO00093) by clicking the link below or browse more documents and templates provided by the Idaho State Tax Commission.