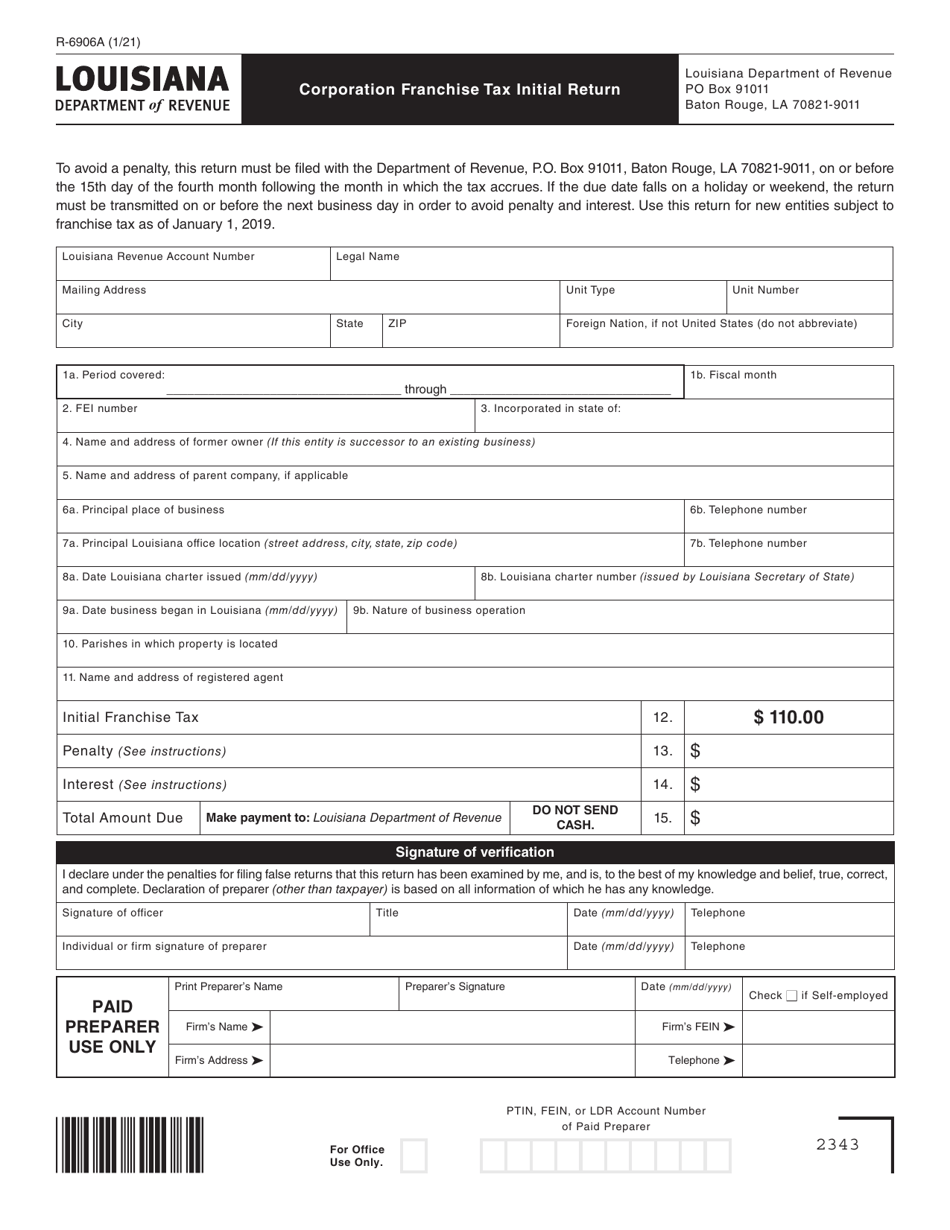

This version of the form is not currently in use and is provided for reference only. Download this version of

Form R-6906A

for the current year.

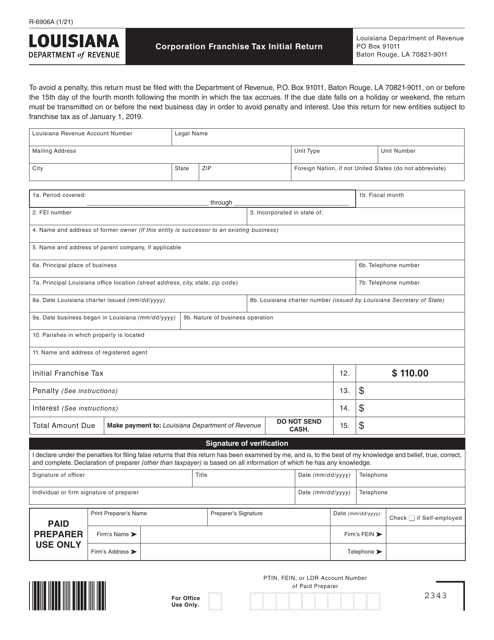

Form R-6906A Corporation Franchise Initial Tax Return - Louisiana

What Is Form R-6906A?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form R-6906A?

A: Form R-6906A is the Corporation Franchise Initial Tax Return for the state of Louisiana.

Q: Who needs to file Form R-6906A?

A: Corporations that are subject to Louisiana franchise tax and have just started doing business in the state need to file Form R-6906A.

Q: What is the purpose of Form R-6906A?

A: The purpose of Form R-6906A is to report and pay the initial franchise tax for corporations starting business operations in Louisiana.

Q: When should Form R-6906A be filed?

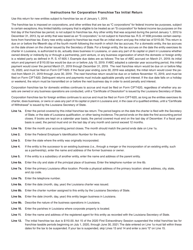

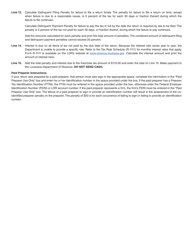

A: Form R-6906A should be filed within 60 days after the corporation starts doing business in Louisiana.

Q: Are there any penalties for late filing of Form R-6906A?

A: Yes, there are penalties for late filing of Form R-6906A, including penalties for failure to file and failure to pay the tax.

Q: Are there any exemptions from filing Form R-6906A?

A: Certain types of corporations may be exempt from filing Form R-6906A. It is recommended to consult the Louisiana Department of Revenue or a tax professional to determine if you qualify for an exemption.

Q: What supporting documents are required to be submitted with Form R-6906A?

A: Generally, no supporting documents are required to be submitted with Form R-6906A. However, it is advised to keep accurate records and supporting documents in case of an audit.

Q: Is there an extension available for filing Form R-6906A?

A: No, there is no extension available for filing Form R-6906A. It must be filed within the specified timeframe.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-6906A by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.