This version of the form is not currently in use and is provided for reference only. Download this version of

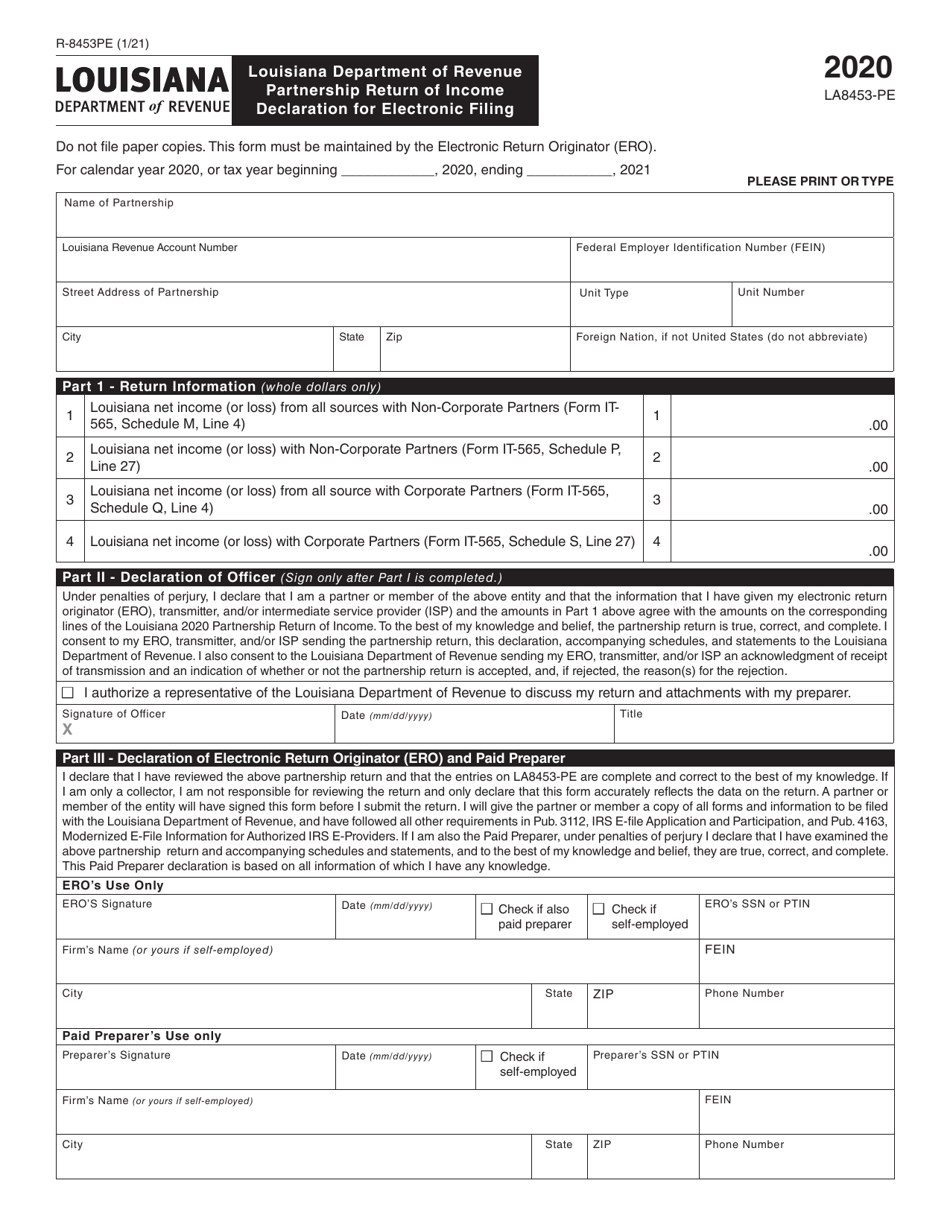

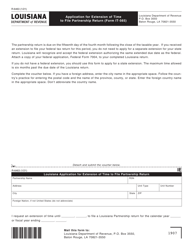

Form R-8453PE (LA8453-PE)

for the current year.

Form R-8453PE (LA8453-PE) Partnership Return of Income Declaration for Electronic Filing - Louisiana

What Is Form R-8453PE (LA8453-PE)?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-8453PE?

A: Form R-8453PE is the Partnership Return of Income Declaration for Electronic Filing specifically for the state of Louisiana.

Q: What is the purpose of Form R-8453PE?

A: Form R-8453PE is used to declare that a partnership return of income is being filed electronically.

Q: Who needs to file Form R-8453PE?

A: Partnerships in Louisiana that are filing their income tax return electronically.

Q: Is Form R-8453PE required for paper filing?

A: No, Form R-8453PE is specifically for electronic filing and is not required for paper filing.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-8453PE (LA8453-PE) by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.