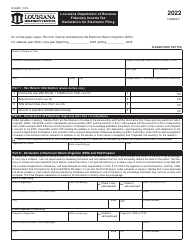

This version of the form is not currently in use and is provided for reference only. Download this version of

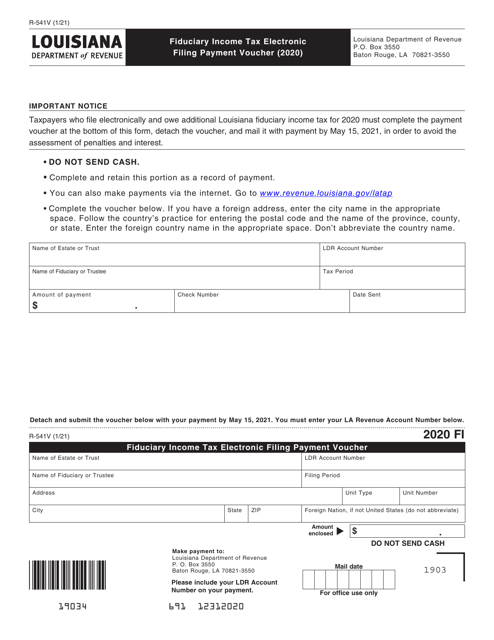

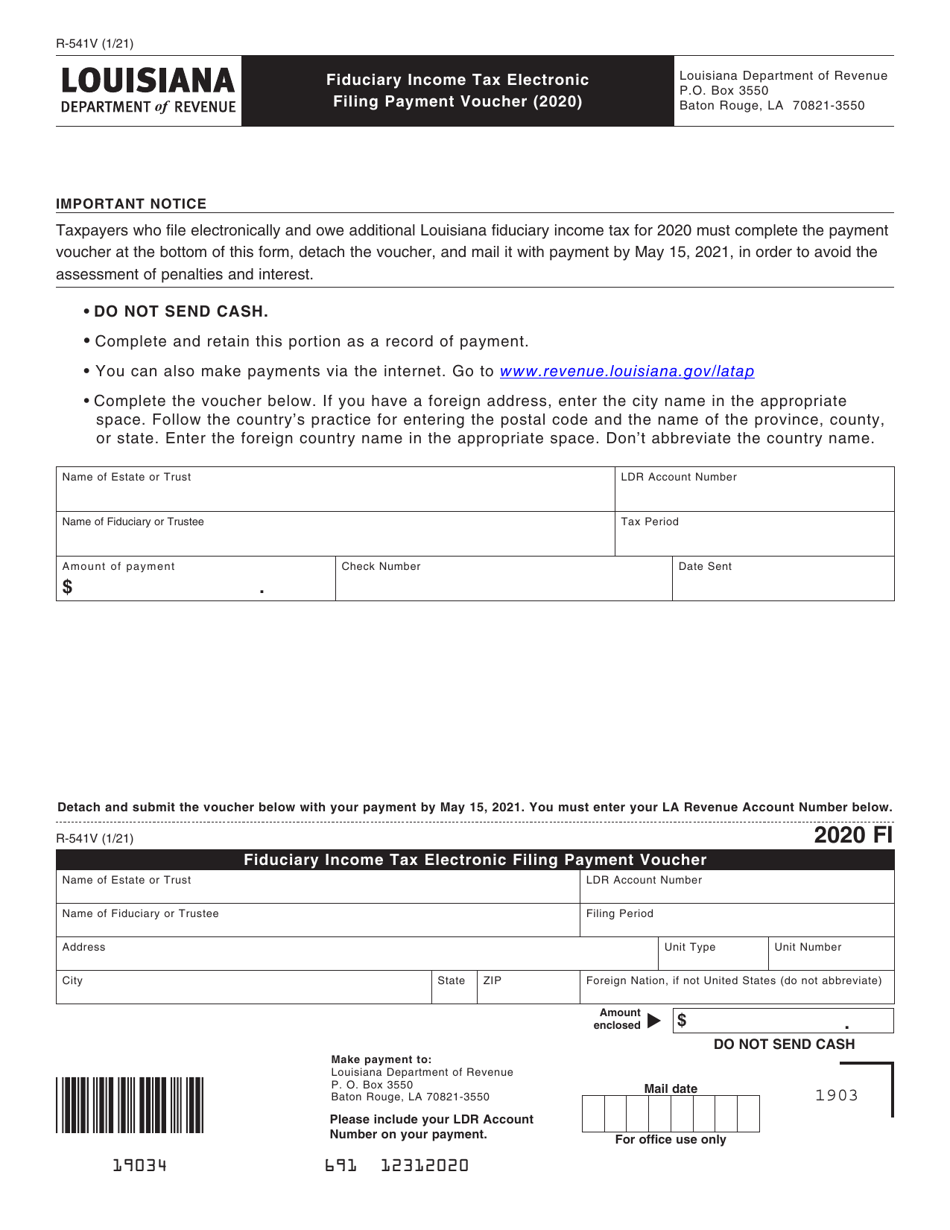

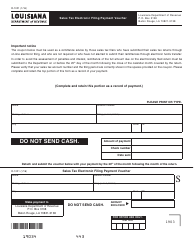

Form R-541V

for the current year.

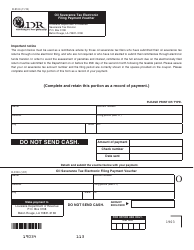

Form R-541V Fiduciary Income Tax Electronic Filing Payment Voucher - Louisiana

What Is Form R-541V?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-541V?

A: Form R-541V is the Fiduciary Income TaxElectronic Filing Payment Voucher for Louisiana.

Q: What is the purpose of Form R-541V?

A: The purpose of Form R-541V is to make electronic payment for fiduciary income tax in Louisiana.

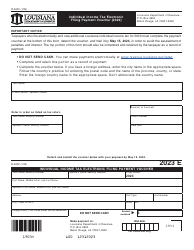

Q: Who needs to file Form R-541V?

A: Anyone who is filing a fiduciary income tax return in Louisiana and wants to make an electronic payment needs to file Form R-541V.

Q: Is Form R-541V only for electronic filing?

A: Yes, Form R-541V is specifically for electronic filing and payment.

Q: Can I make a payment without filing Form R-541V?

A: No, if you want to make an electronic payment for fiduciary income tax in Louisiana, you must file Form R-541V.

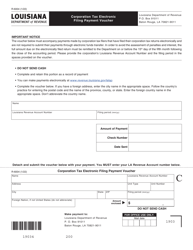

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-541V by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.