This version of the form is not currently in use and is provided for reference only. Download this version of

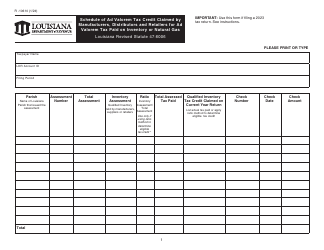

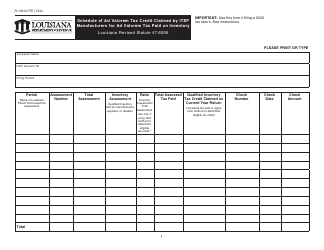

Form R-10606

for the current year.

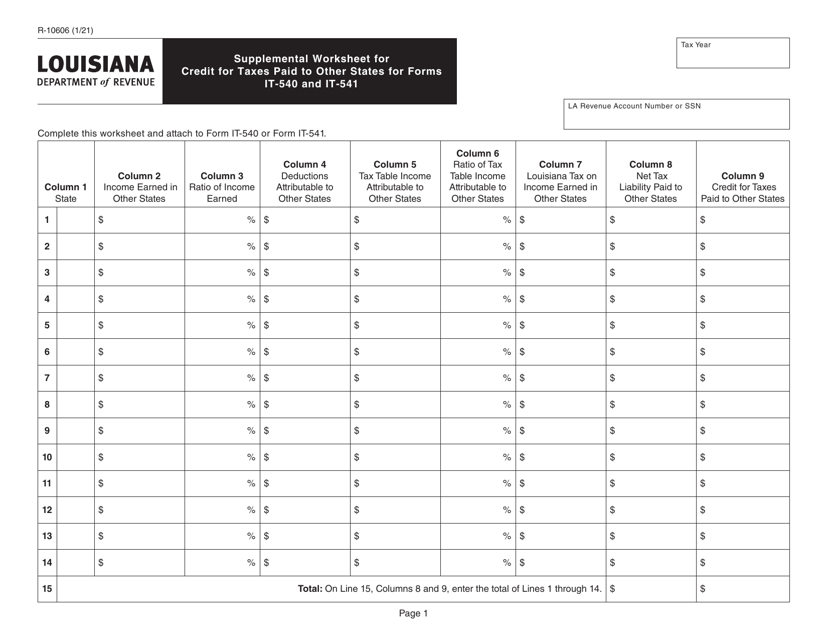

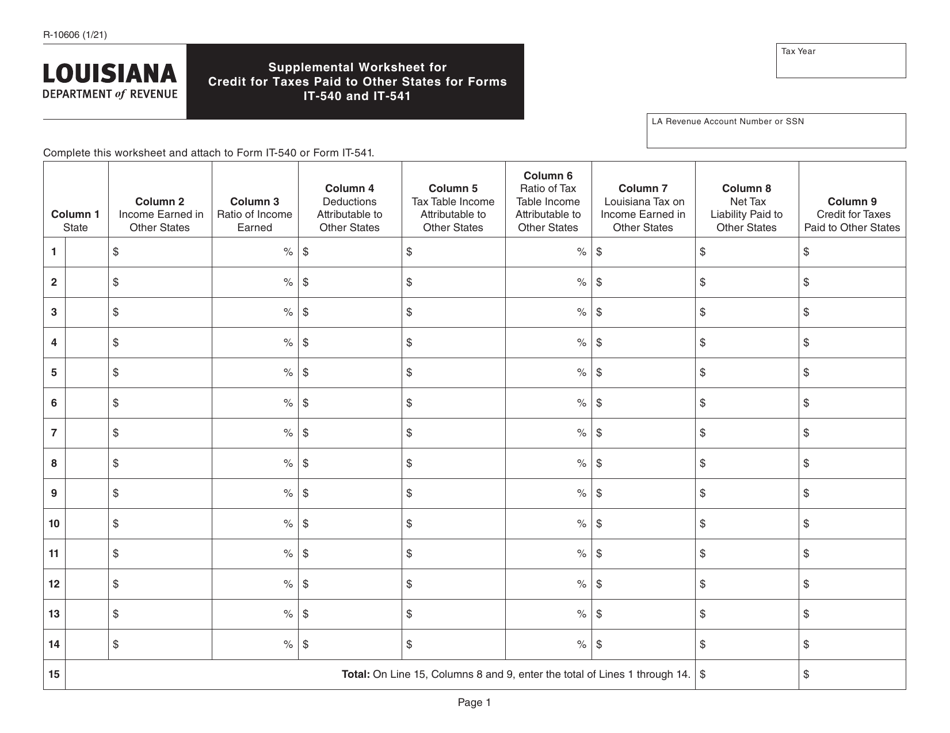

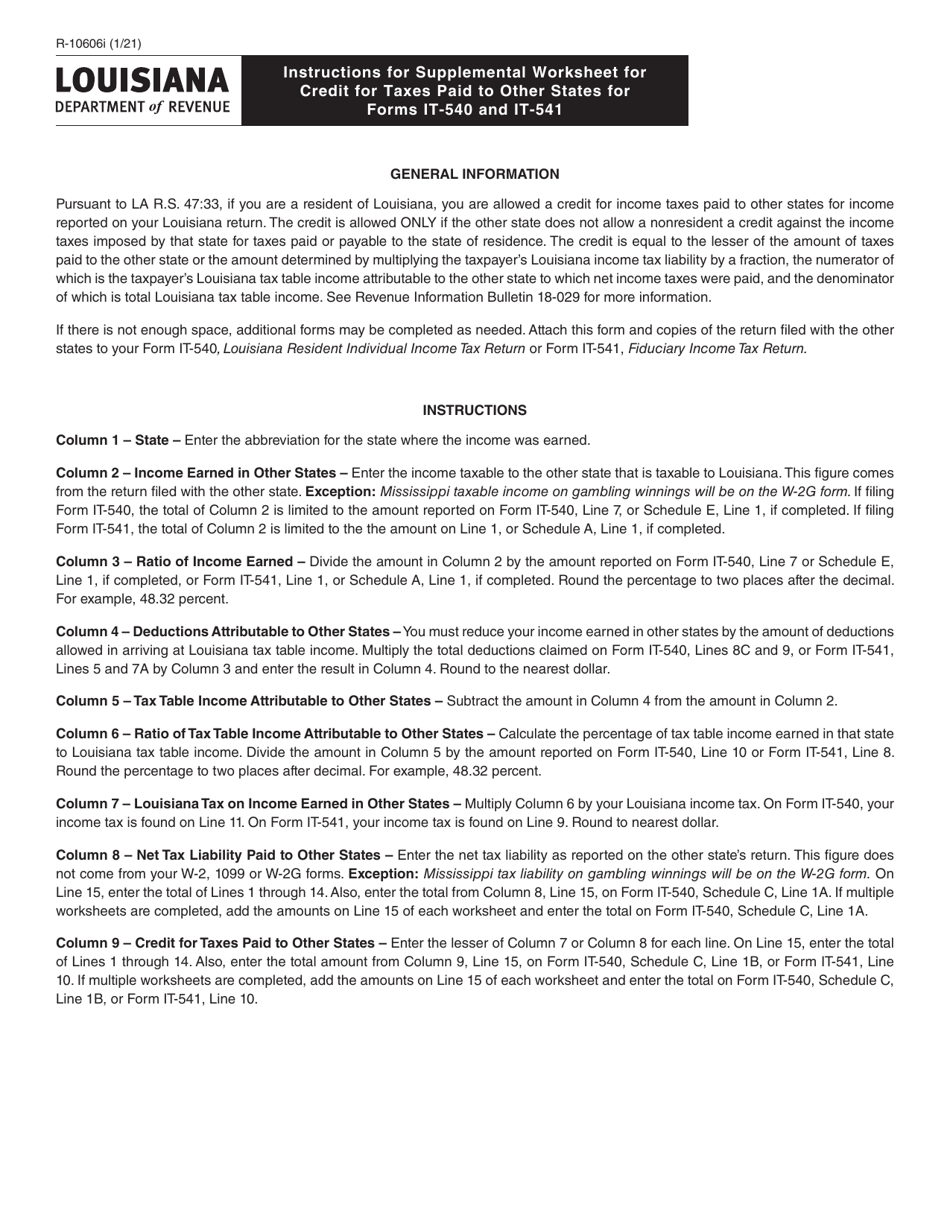

Form R-10606 Supplemental Worksheet for Credit for Taxes Paid to Other States for Forms It-540 and It-541 - Louisiana

What Is Form R-10606?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-10606?

A: Form R-10606 is a Supplemental Worksheet for Credit for Taxes Paid to Other States for Forms IT-540 and IT-541 in Louisiana.

Q: What is the purpose of Form R-10606?

A: The purpose of Form R-10606 is to calculate the credit for taxes paid to other states for Louisiana state income tax purposes.

Q: Who needs to fill out Form R-10606?

A: Individuals who have paid income taxes to other states and are claiming a credit on their Louisiana state income tax return need to fill out Form R-10606.

Q: What information do I need to complete Form R-10606?

A: You will need information about the taxes you paid to other states, including the state name, tax year, and amount of tax paid.

Q: When is the deadline to file Form R-10606?

A: Form R-10606 should be filed along with your Louisiana state income tax return by the regular due date, which is usually April 15th.

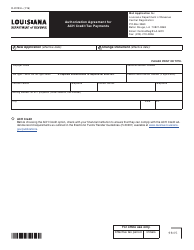

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-10606 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.