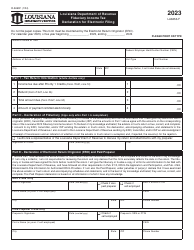

This version of the form is not currently in use and is provided for reference only. Download this version of

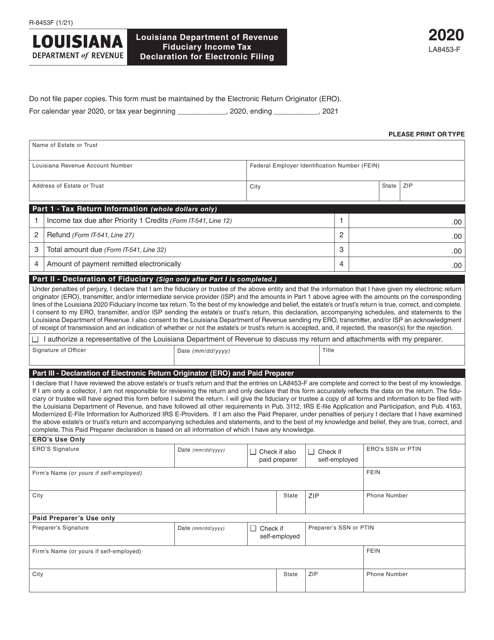

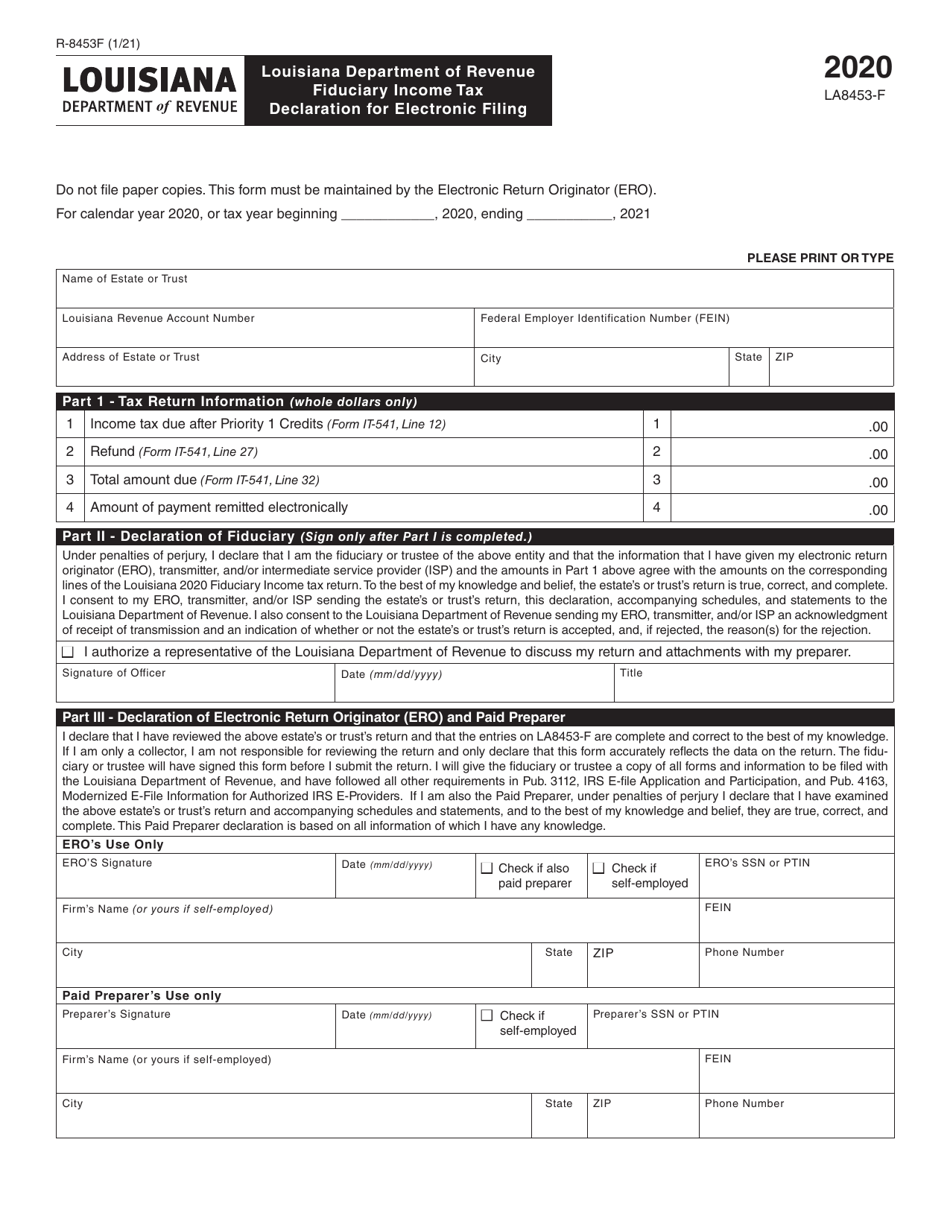

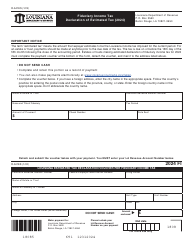

Form R-8453F (LA8453-F)

for the current year.

Form R-8453F (LA8453-F) Fiduciary Income Tax Declaration for Electronic Filing - Louisiana

What Is Form R-8453F (LA8453-F)?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-8453F (LA8453-F)?

A: Form R-8453F (LA8453-F) is the Fiduciary Income Tax Declaration for Electronic Filing specifically for the state of Louisiana.

Q: What is the purpose of Form R-8453F (LA8453-F)?

A: The purpose of Form R-8453F (LA8453-F) is to declare fiduciary income tax information for electronic filing in Louisiana.

Q: Who needs to file Form R-8453F (LA8453-F)?

A: Fiduciaries who are filing their income tax electronically in the state of Louisiana need to file Form R-8453F (LA8453-F).

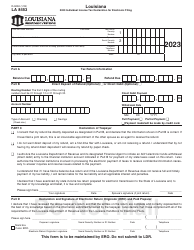

Q: How do I fill out Form R-8453F (LA8453-F)?

A: You need to provide your personal and fiduciary information, calculate your income and deductions, and sign the form to complete it.

Q: Are there any specific instructions for filing Form R-8453F (LA8453-F)?

A: Yes, you should review the instructions provided by the Louisiana Department of Revenue to ensure accurate completion and submission of the form.

Q: Can I file Form R-8453F (LA8453-F) electronically?

A: Yes, Form R-8453F (LA8453-F) is specifically designed for electronic filing of fiduciary income tax in Louisiana.

Q: What should I do if I made a mistake on Form R-8453F (LA8453-F)?

A: If you made a mistake on Form R-8453F (LA8453-F), you may need to file an amended return or contact the Louisiana Department of Revenue for further guidance.

Q: Is there a deadline for filing Form R-8453F (LA8453-F)?

A: Yes, the deadline for filing Form R-8453F (LA8453-F) is the same as the deadline for filing your fiduciary income tax return in Louisiana.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-8453F (LA8453-F) by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.