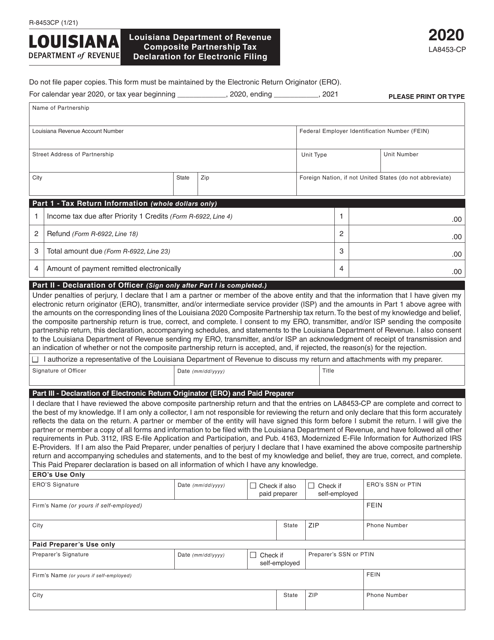

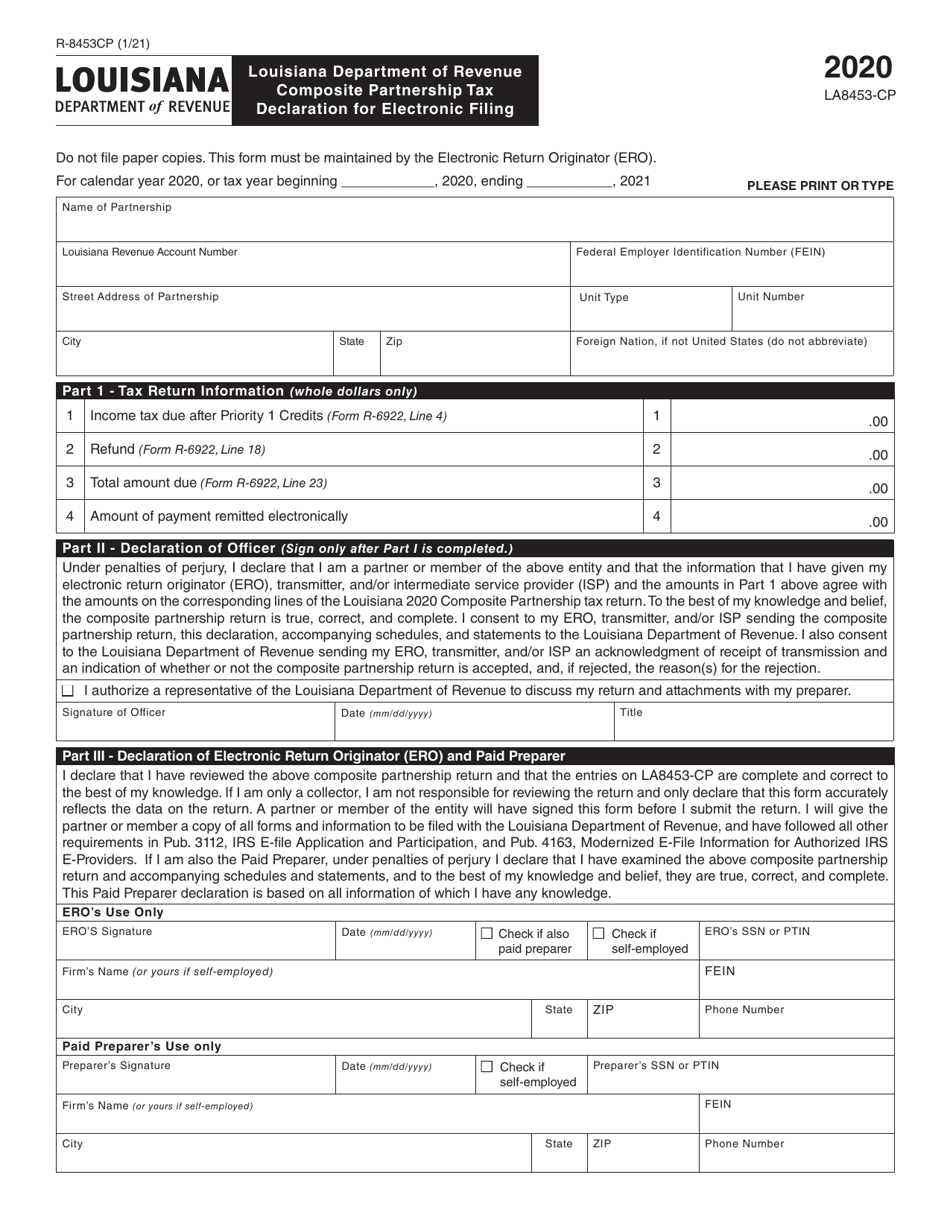

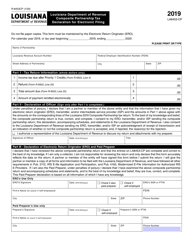

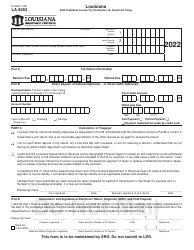

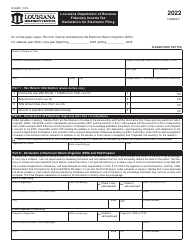

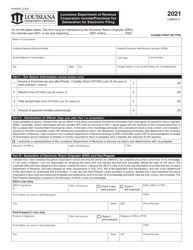

Form R-8453CP (LA8453-CP) Composite Partnership Tax Declaration for Electronic Filing - Louisiana

What Is Form R-8453CP (LA8453-CP)?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-8453CP?

A: Form R-8453CP is the Composite Partnership Tax Declaration for Electronic Filing specifically for Louisiana.

Q: What is the purpose of Form R-8453CP?

A: The purpose of Form R-8453CP is to declare composite partnership tax information for electronic filing.

Q: Who should file Form R-8453CP?

A: Partnerships in Louisiana who have filed a composite partnership return.

Q: Can Form R-8453CP be filed electronically?

A: Yes, Form R-8453CP can be filed electronically.

Q: Is Form R-8453CP specific to Louisiana?

A: Yes, Form R-8453CP is a specific form for the state of Louisiana.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-8453CP (LA8453-CP) by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.