This version of the form is not currently in use and is provided for reference only. Download this version of

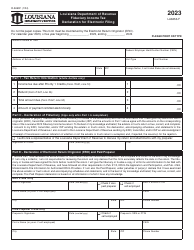

Form IT-541

for the current year.

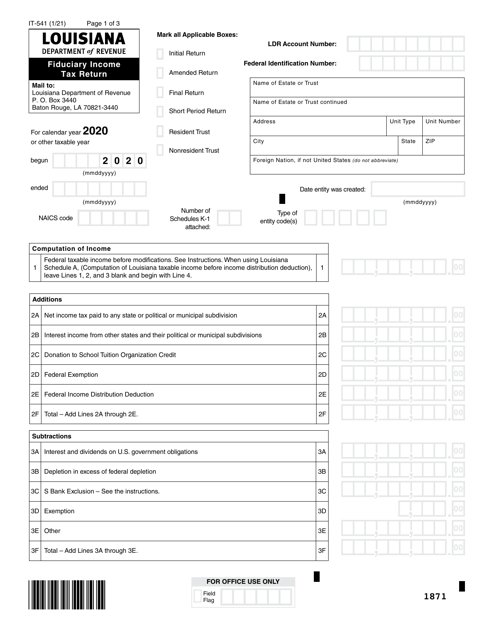

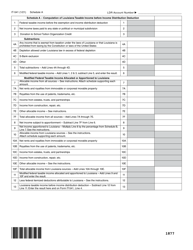

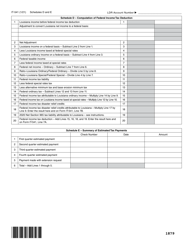

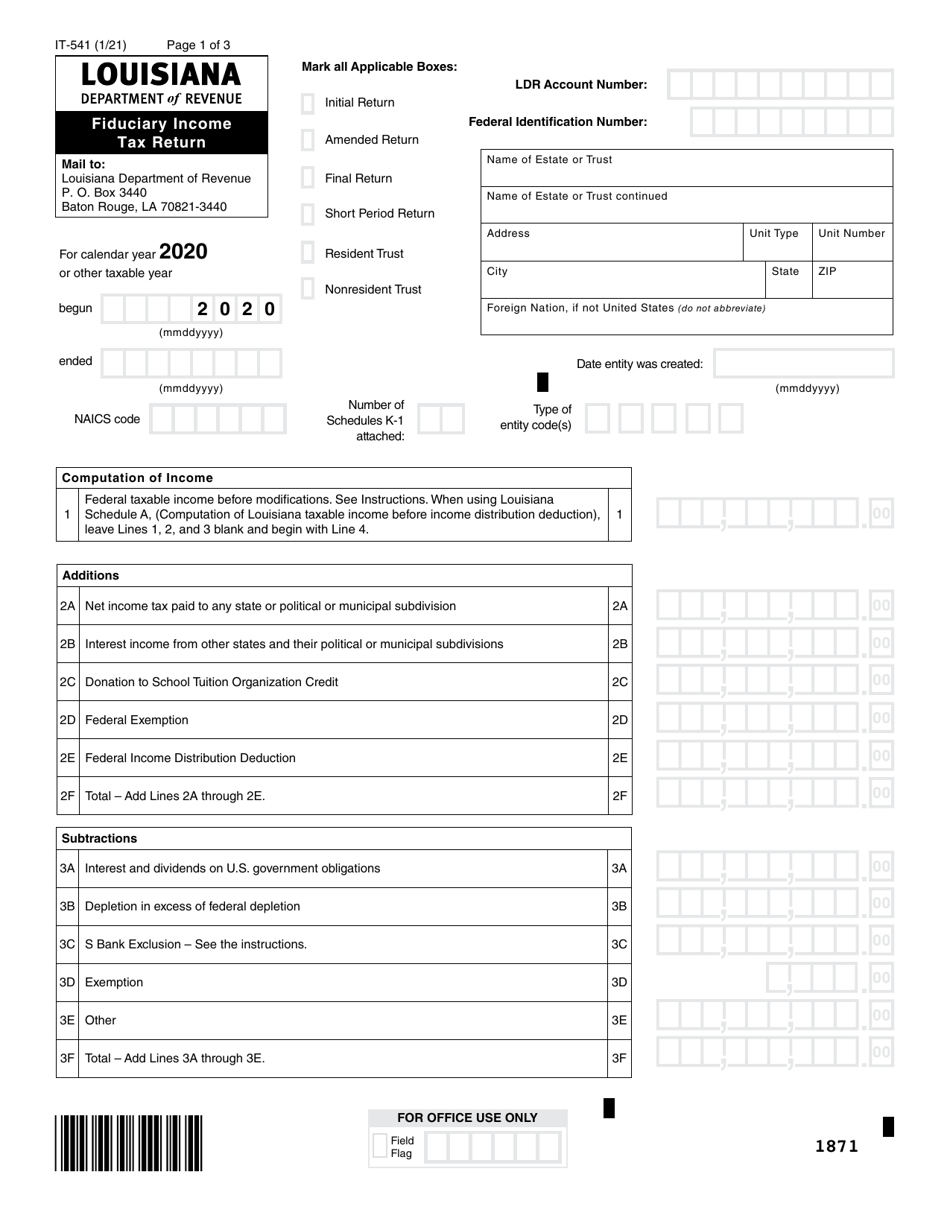

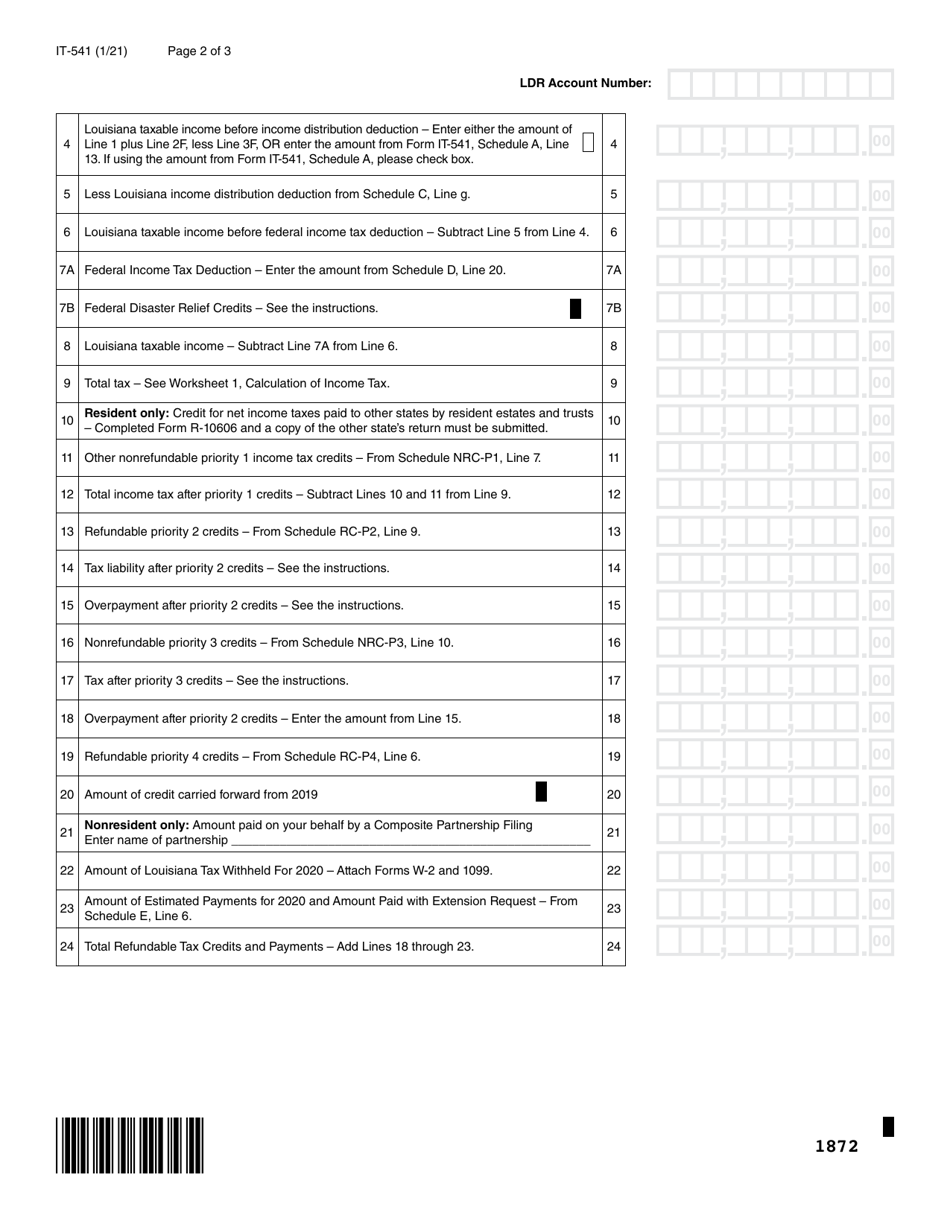

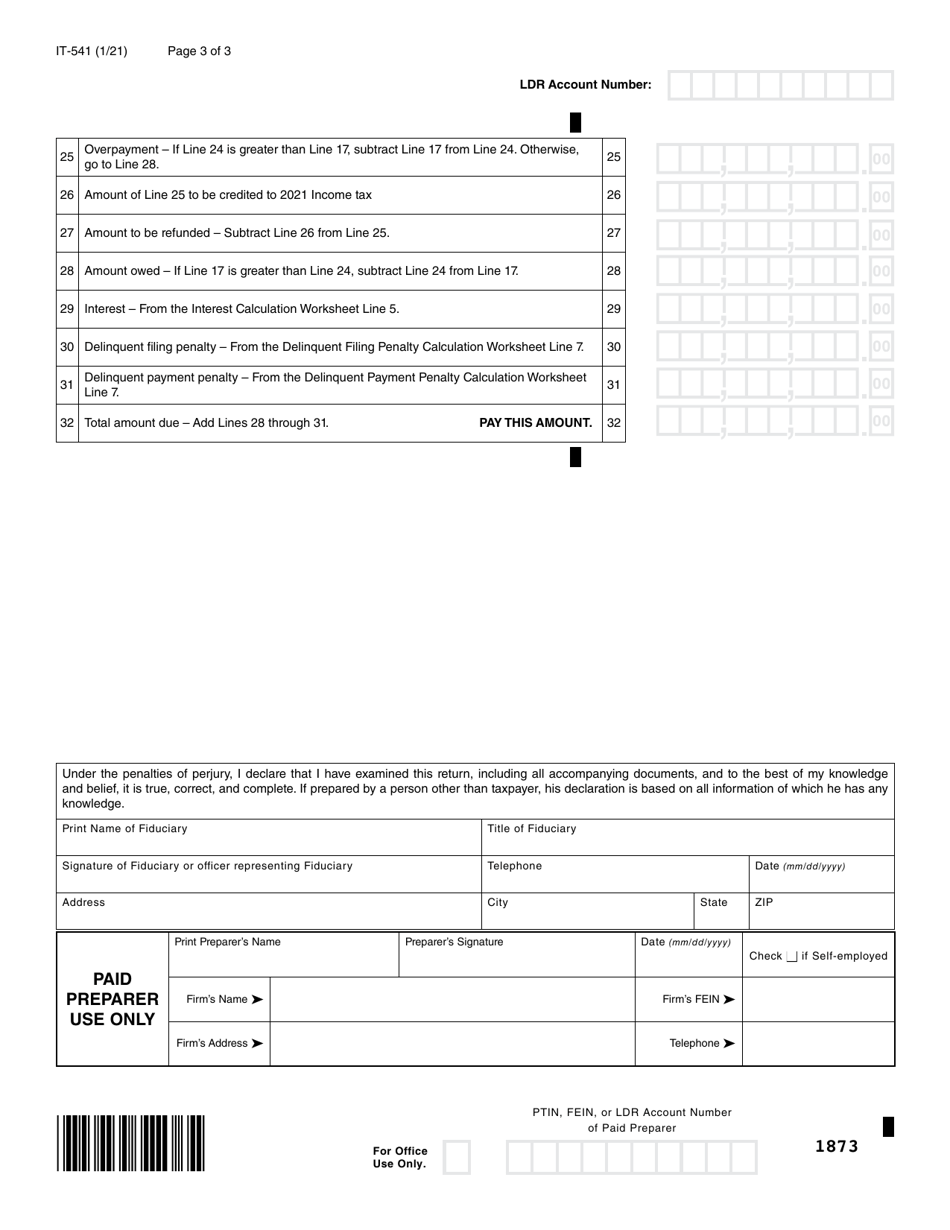

Form IT-541 Fiduciary Income Tax Return - Louisiana

What Is Form IT-541?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-541?

A: Form IT-541 is the Fiduciary Income Tax Return used in the state of Louisiana.

Q: Who needs to file Form IT-541?

A: Anyone acting as a fiduciary for an estate or trust in Louisiana needs to file Form IT-541.

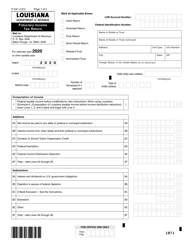

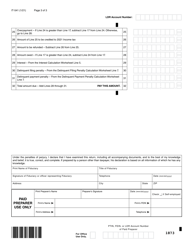

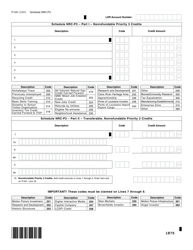

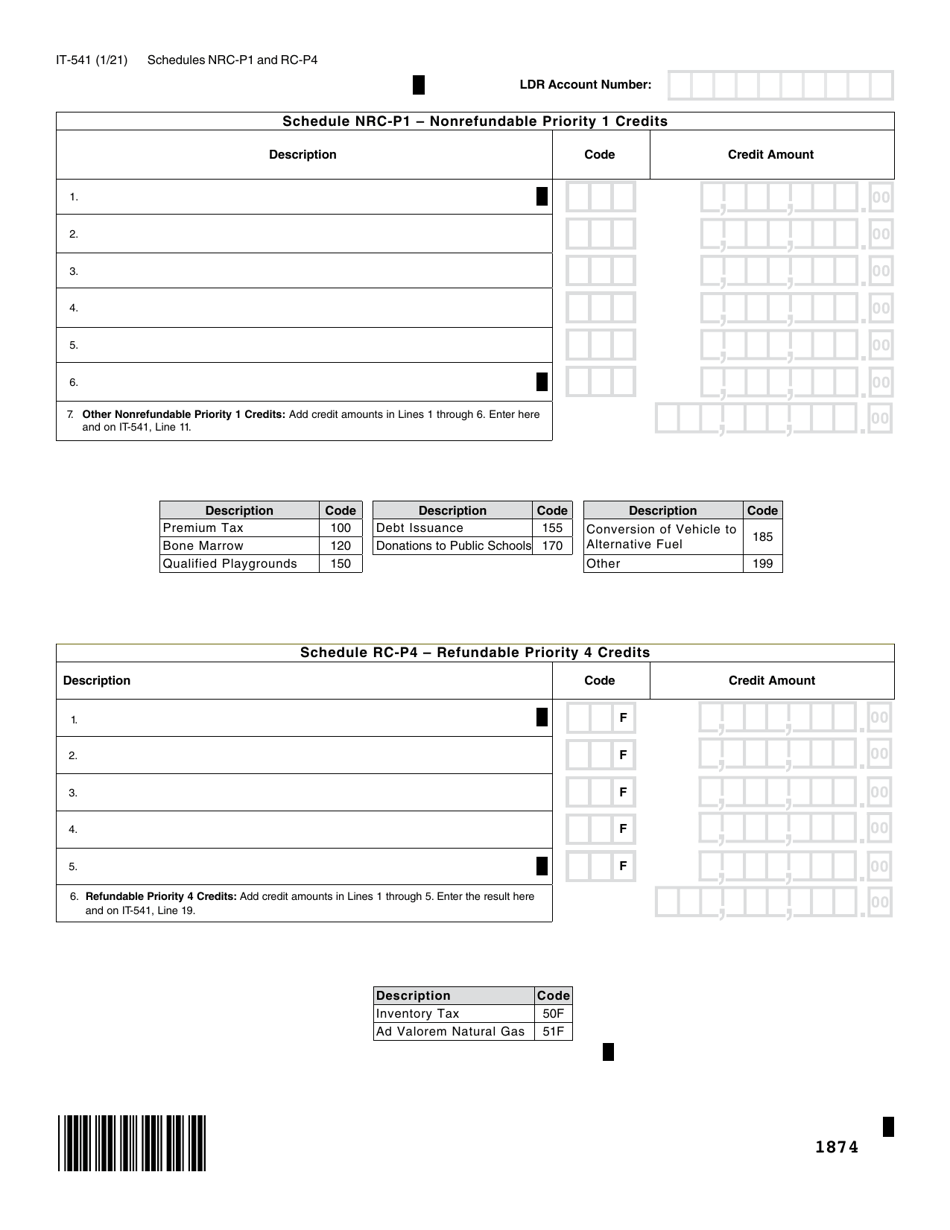

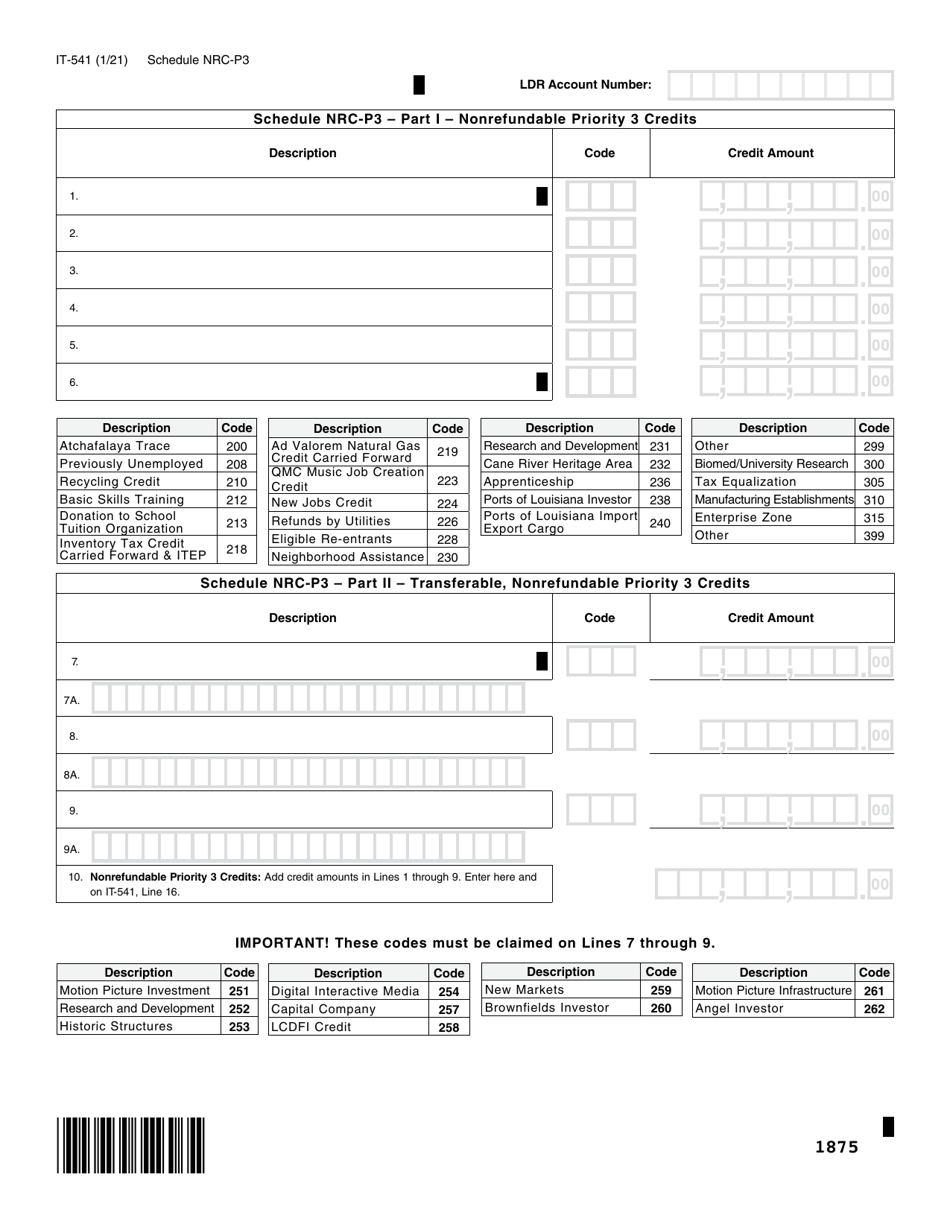

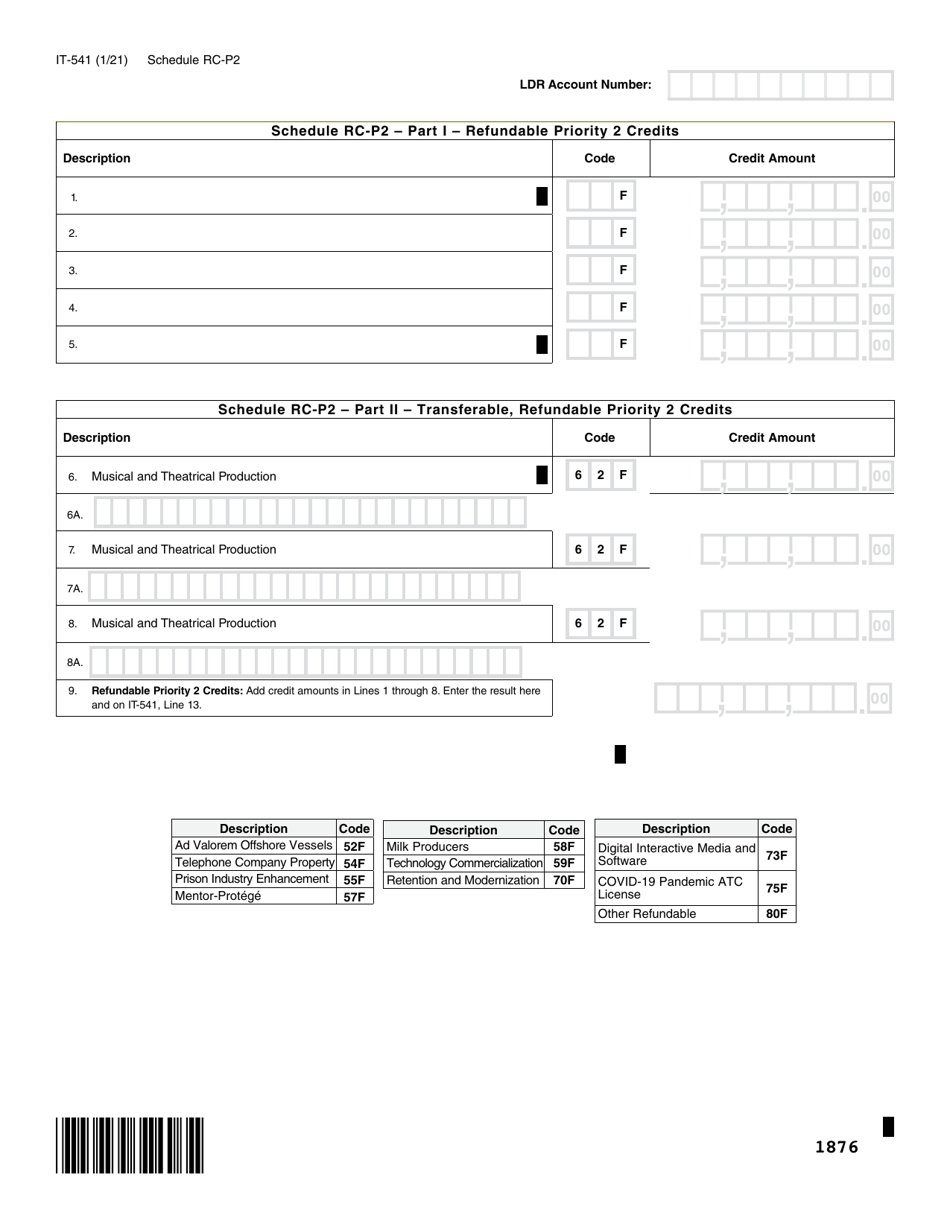

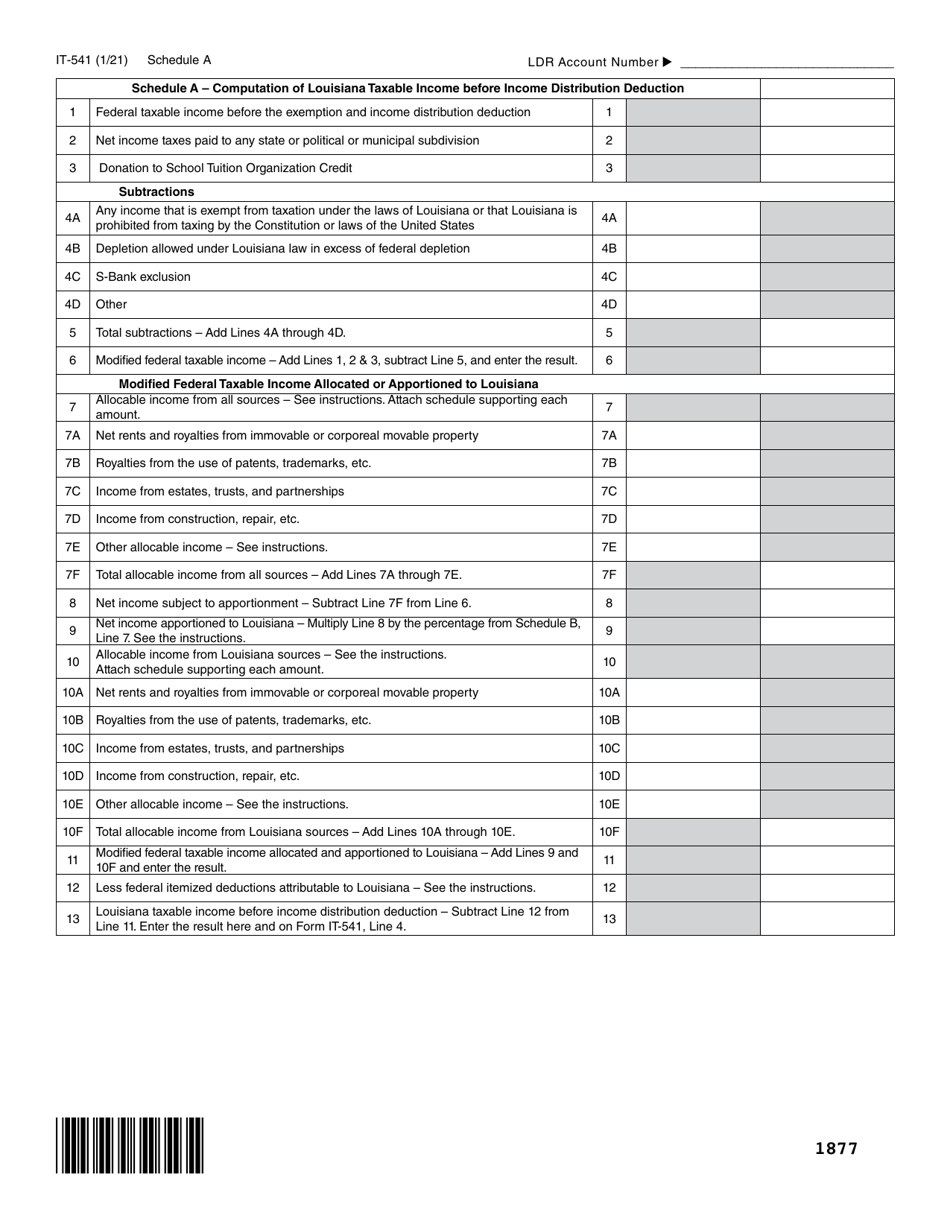

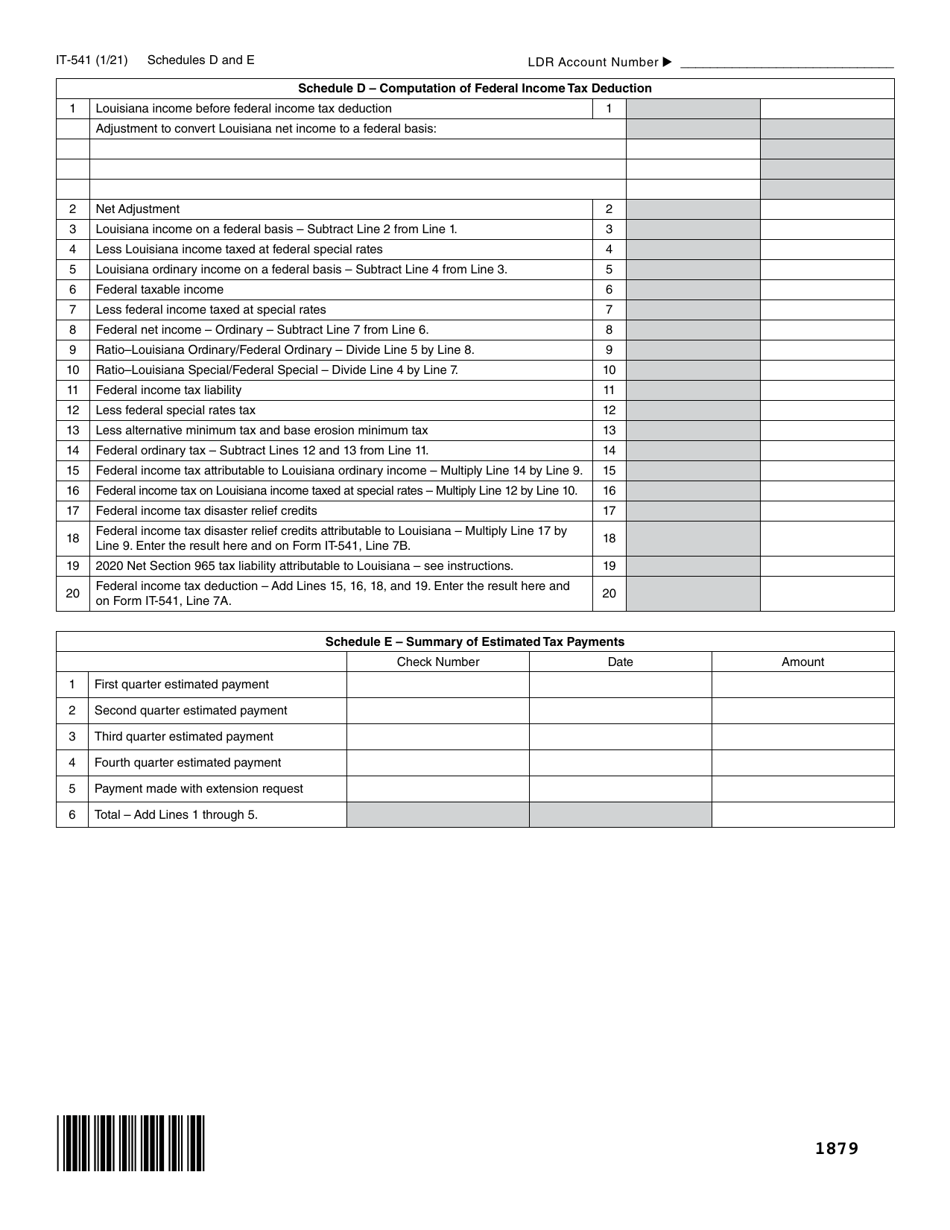

Q: What information is required on Form IT-541?

A: Form IT-541 requires information about the estate or trust's income, deductions, credits, and other details.

Q: When is the deadline to file Form IT-541?

A: Form IT-541 is due on or before the 15th day of the fourth month following the close of the taxable year.

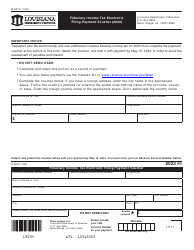

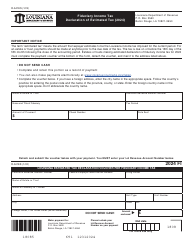

Q: Is there an extension available for filing Form IT-541?

A: Yes, an extension of time to file Form IT-541 can be requested, but any taxes owed must still be paid by the original due date.

Q: Do I need to include any supporting documents with Form IT-541?

A: Yes, certain schedules and supporting documents may need to be included with Form IT-541 depending on the specific circumstances.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-541 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.