This version of the form is not currently in use and is provided for reference only. Download this version of

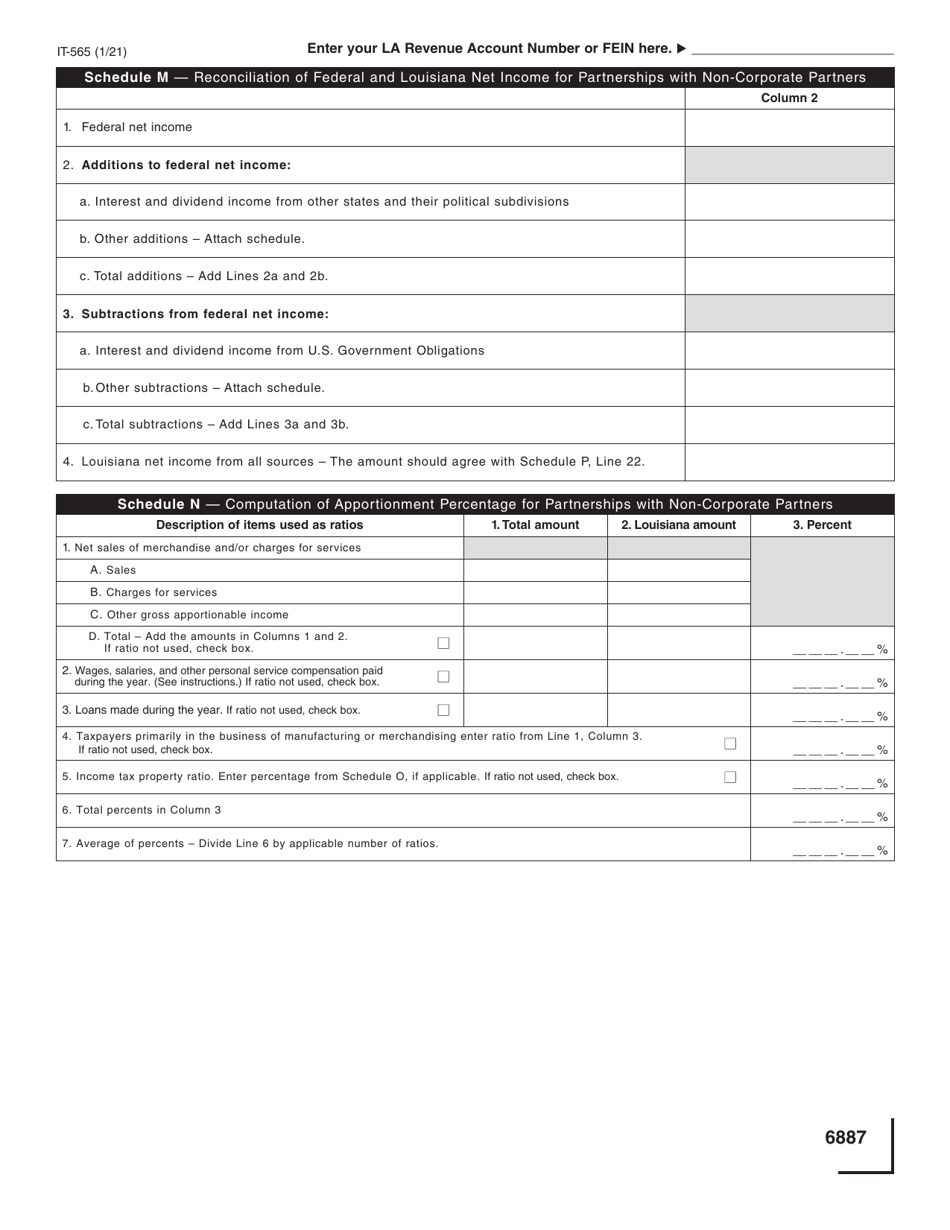

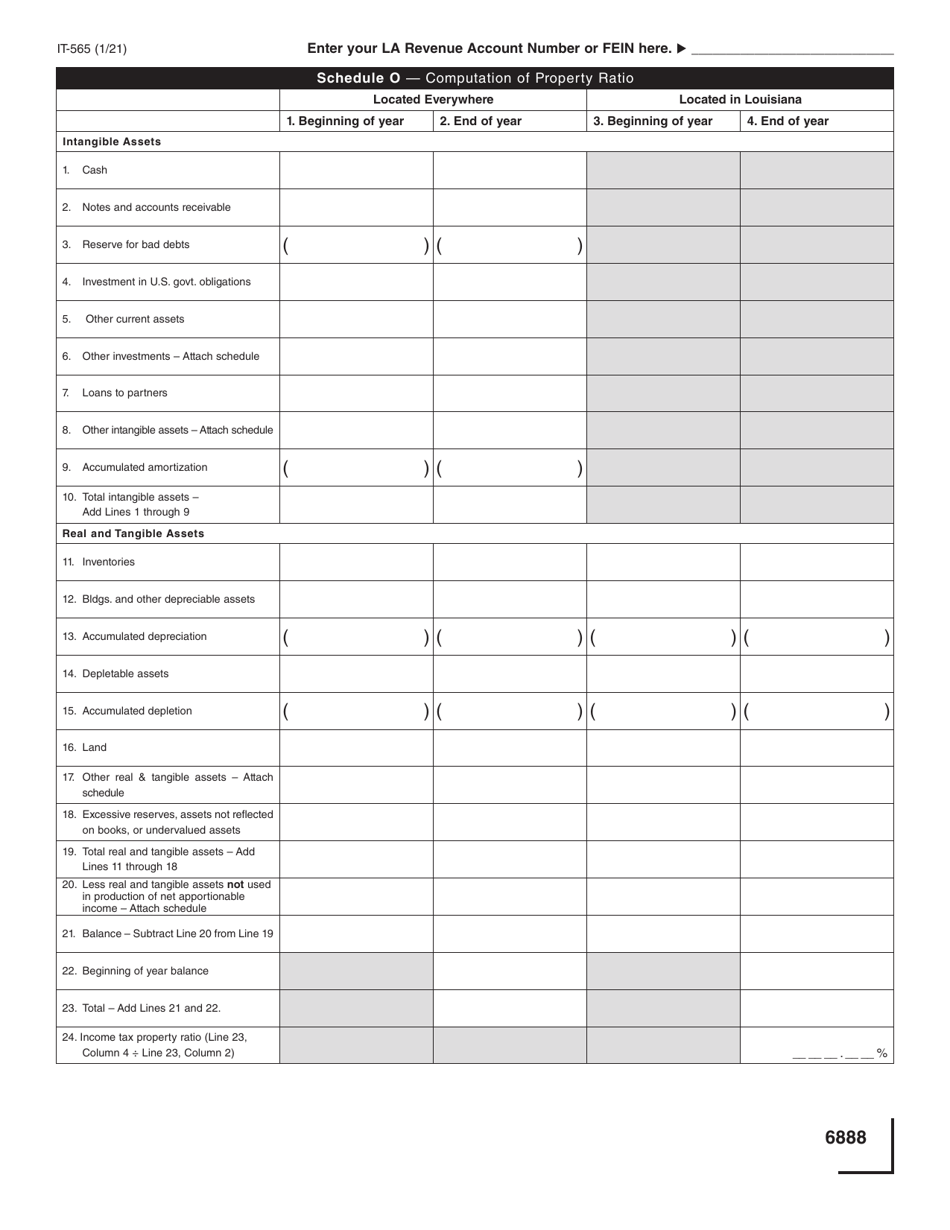

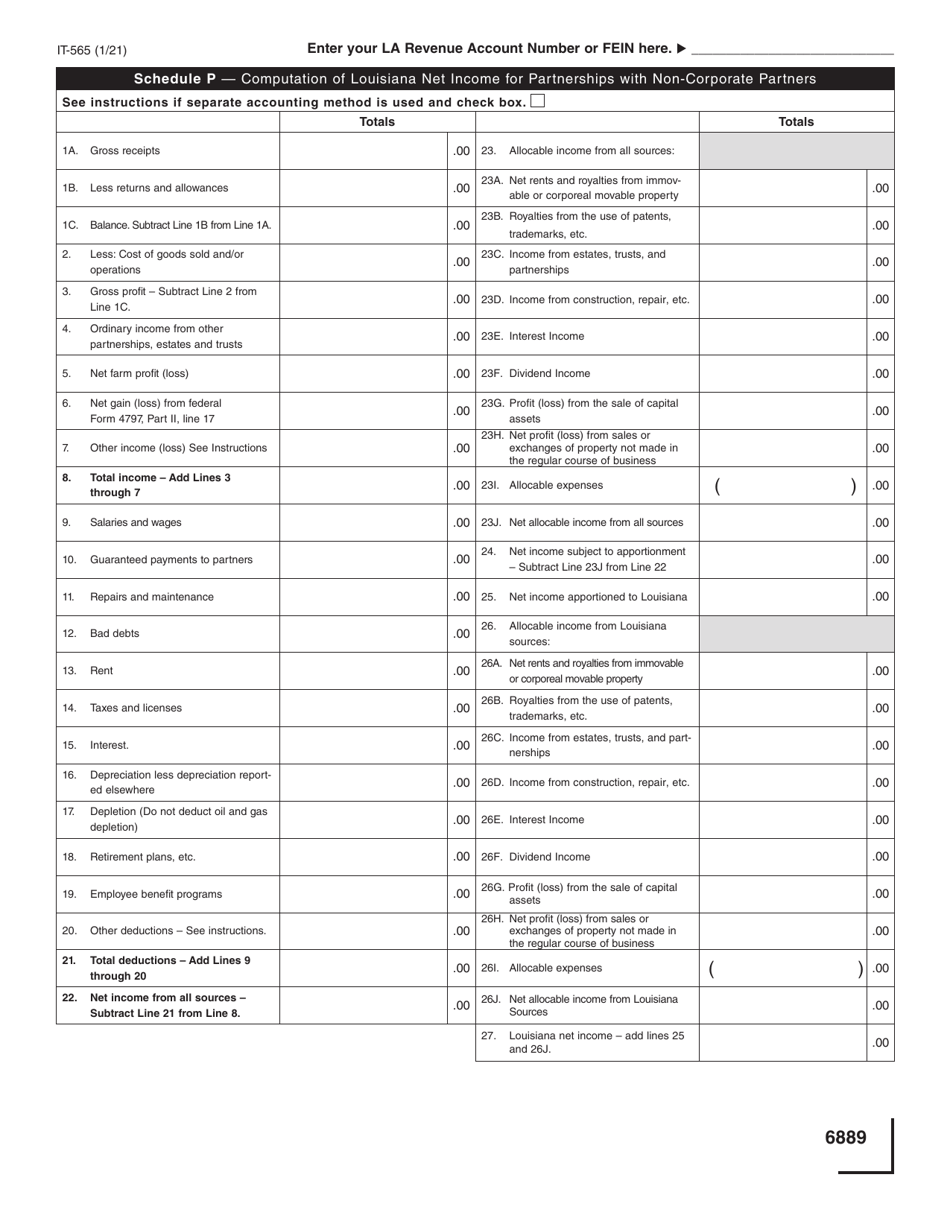

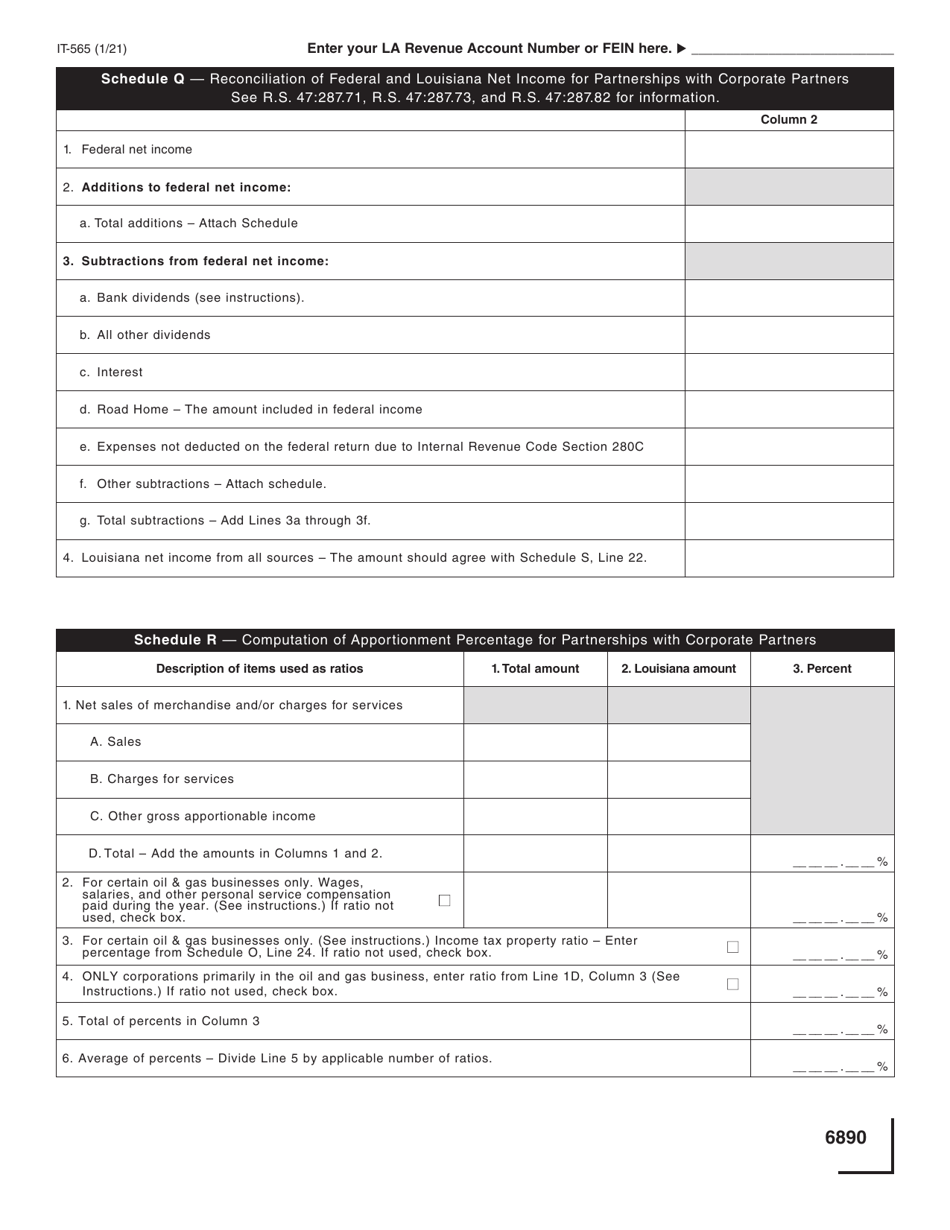

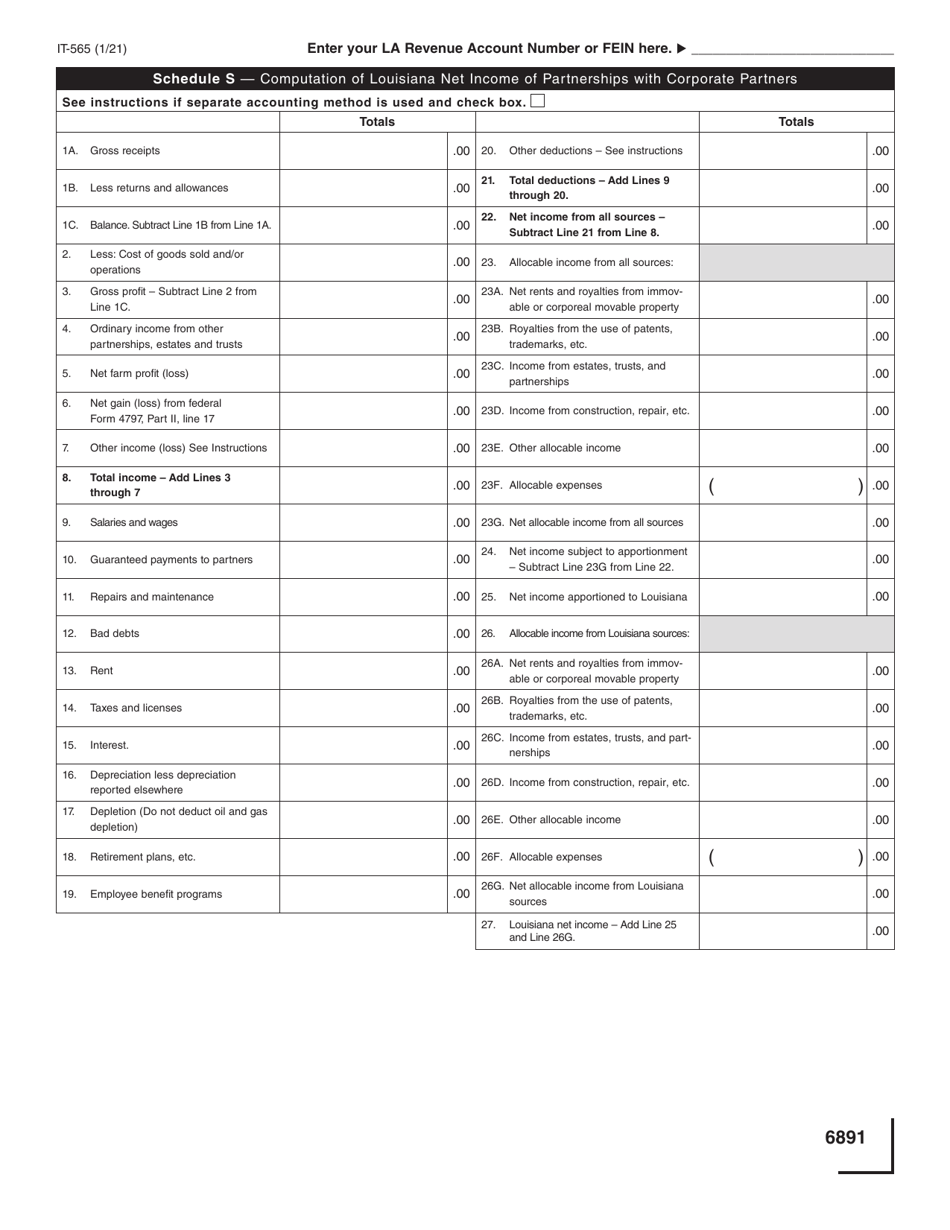

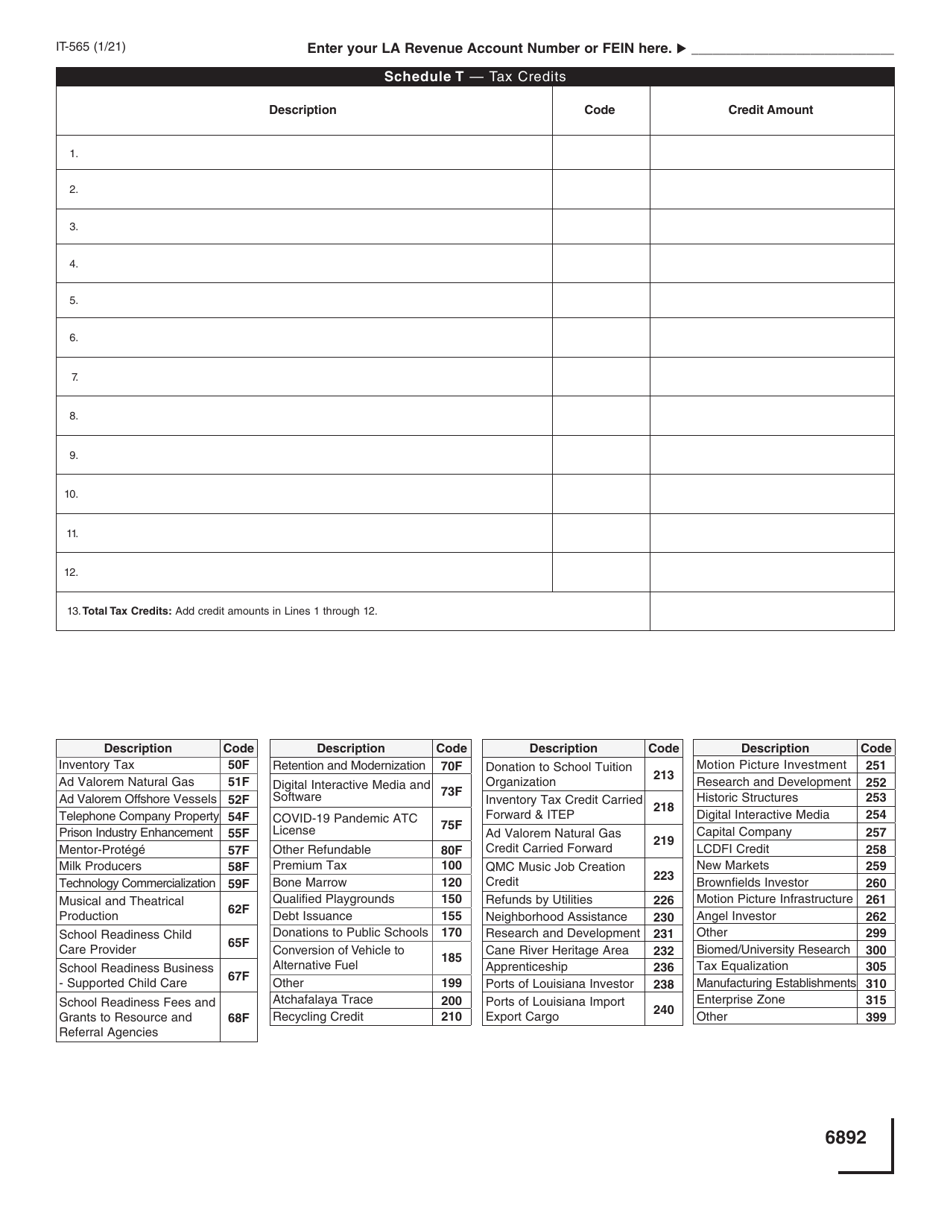

Form IT-565

for the current year.

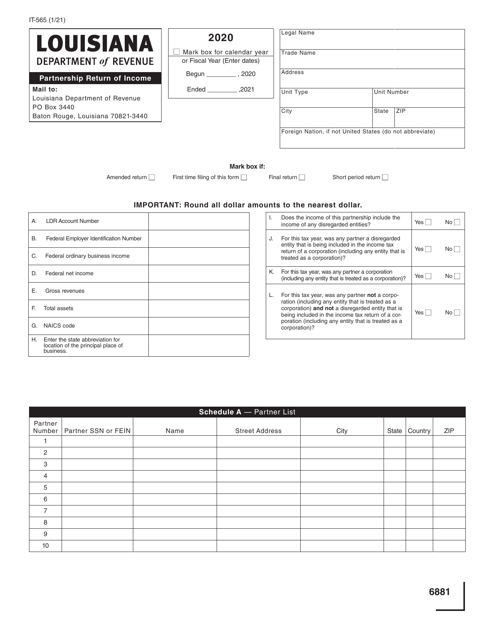

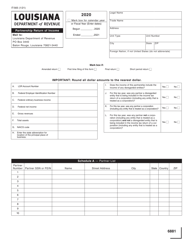

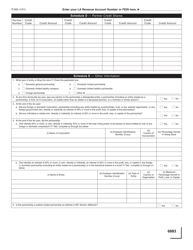

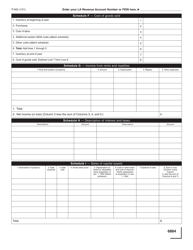

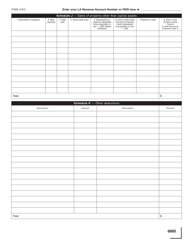

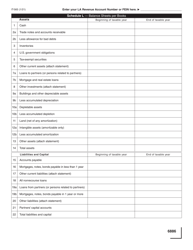

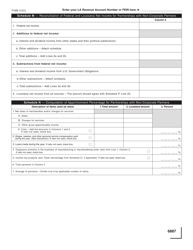

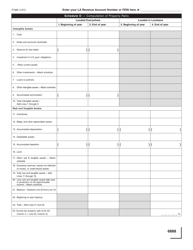

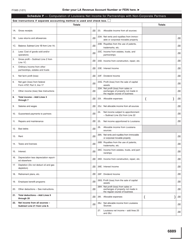

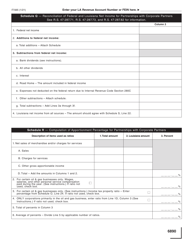

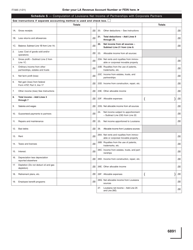

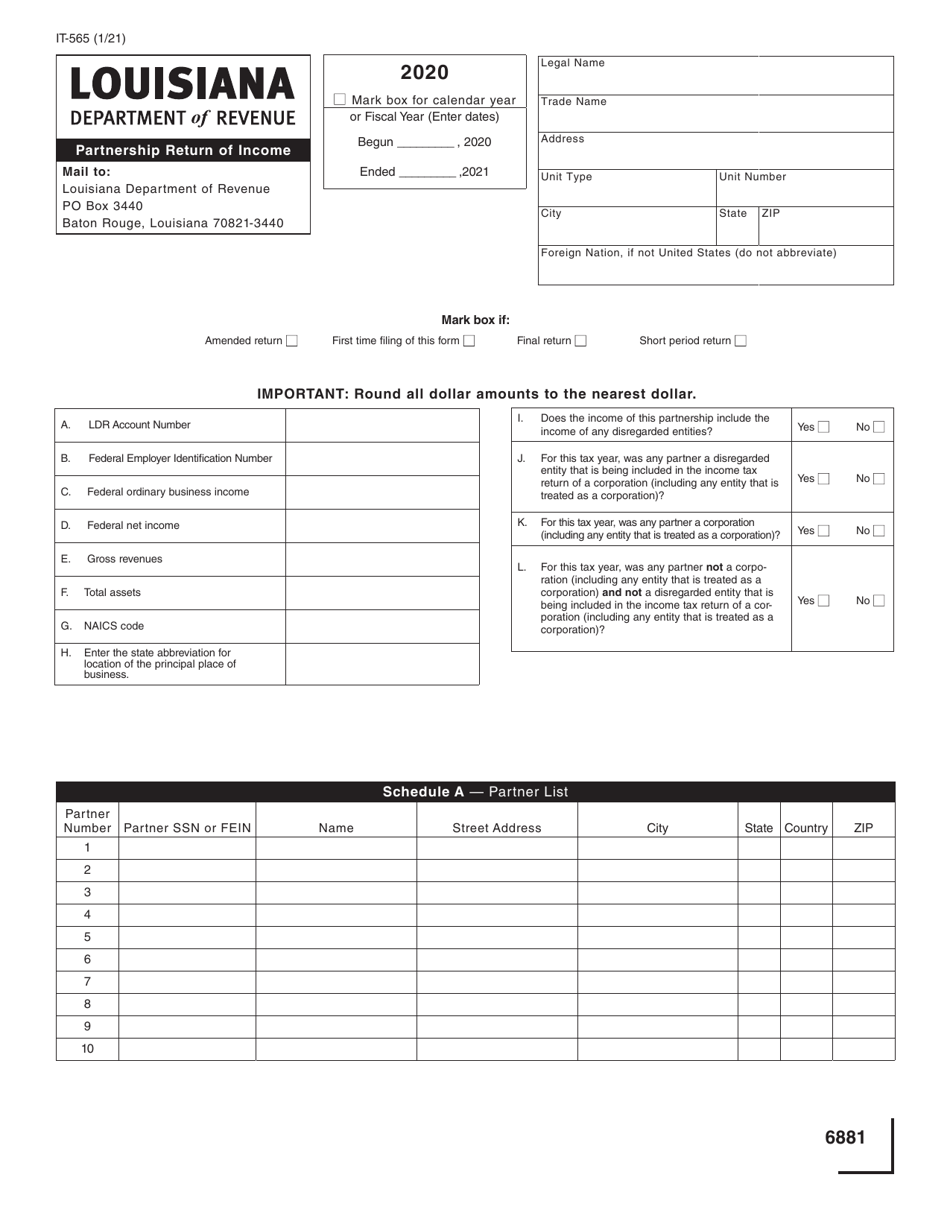

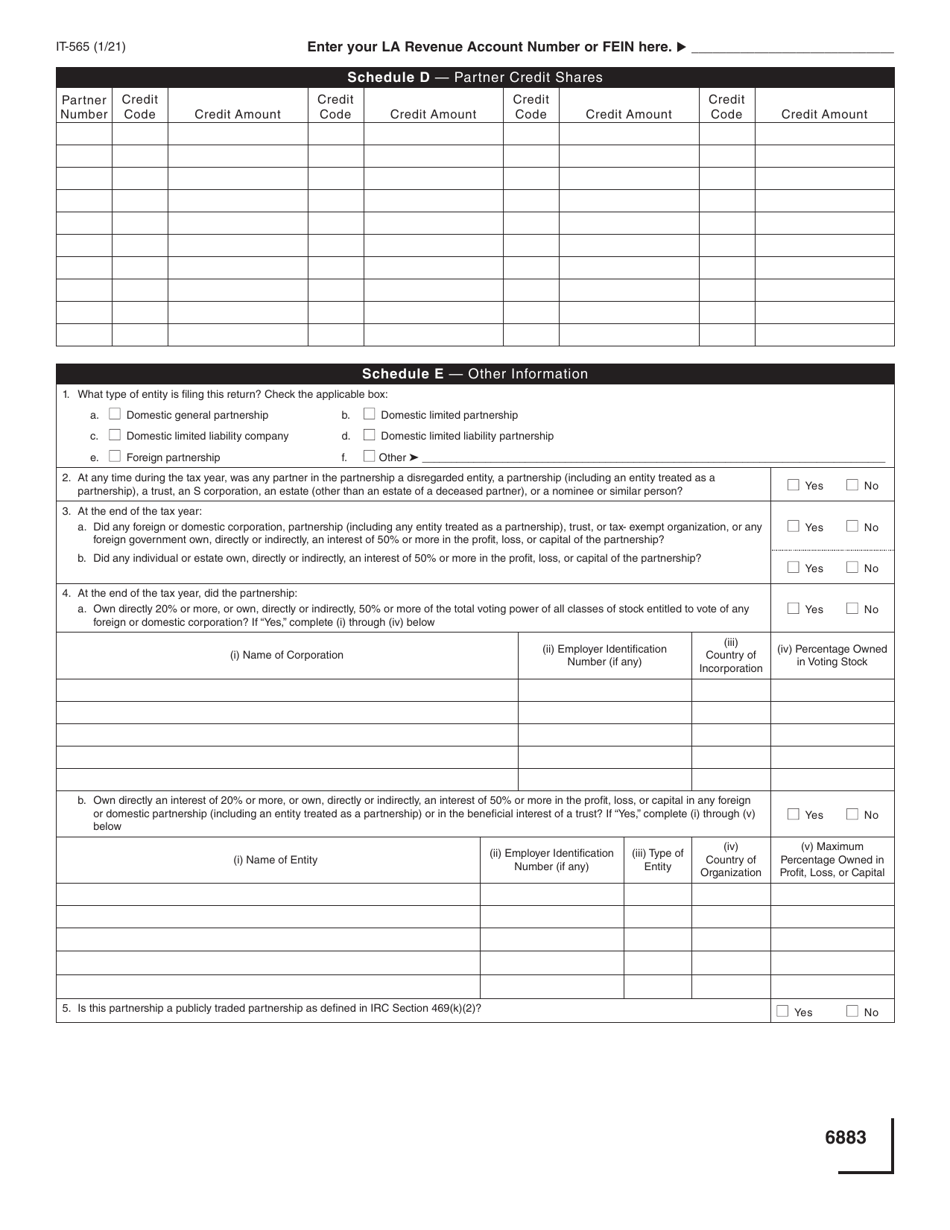

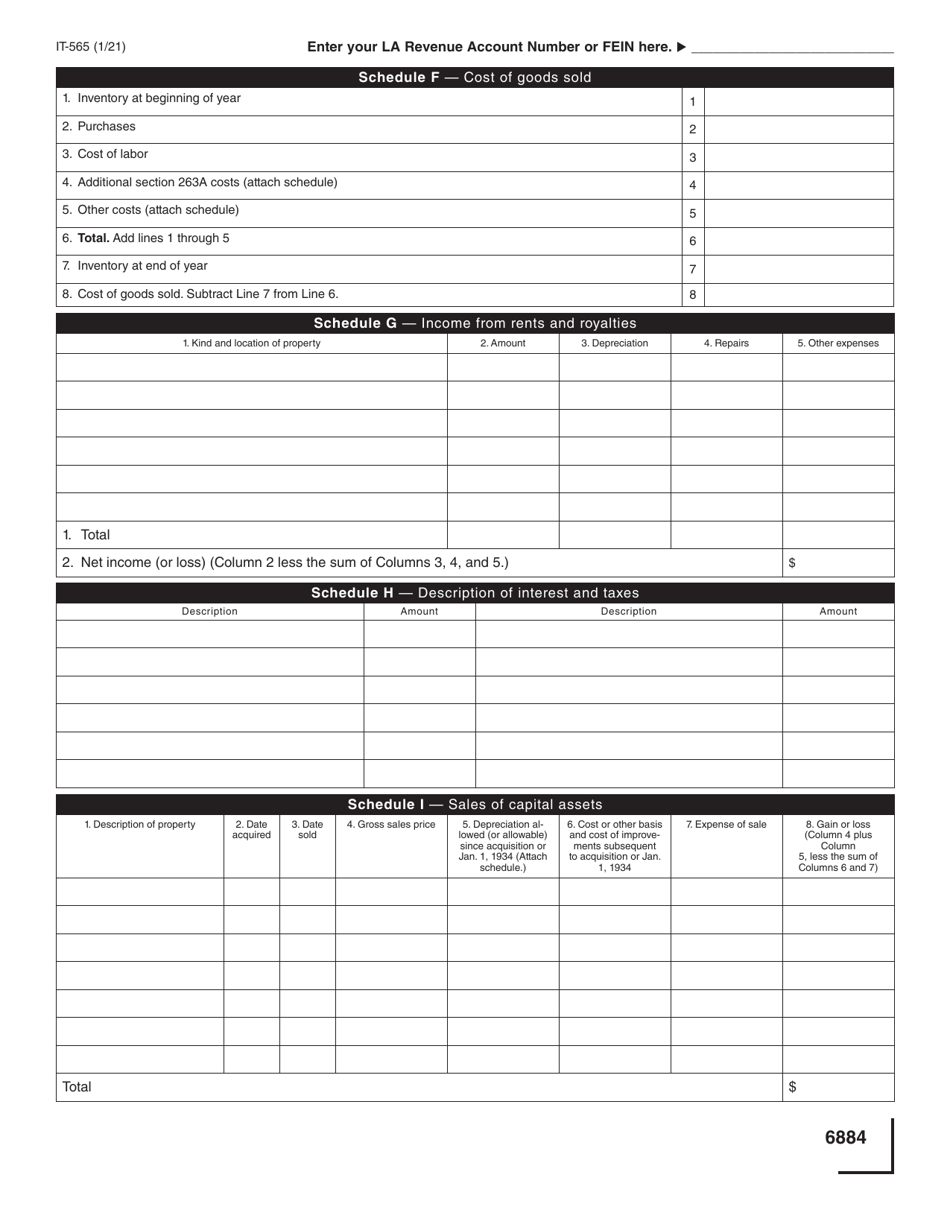

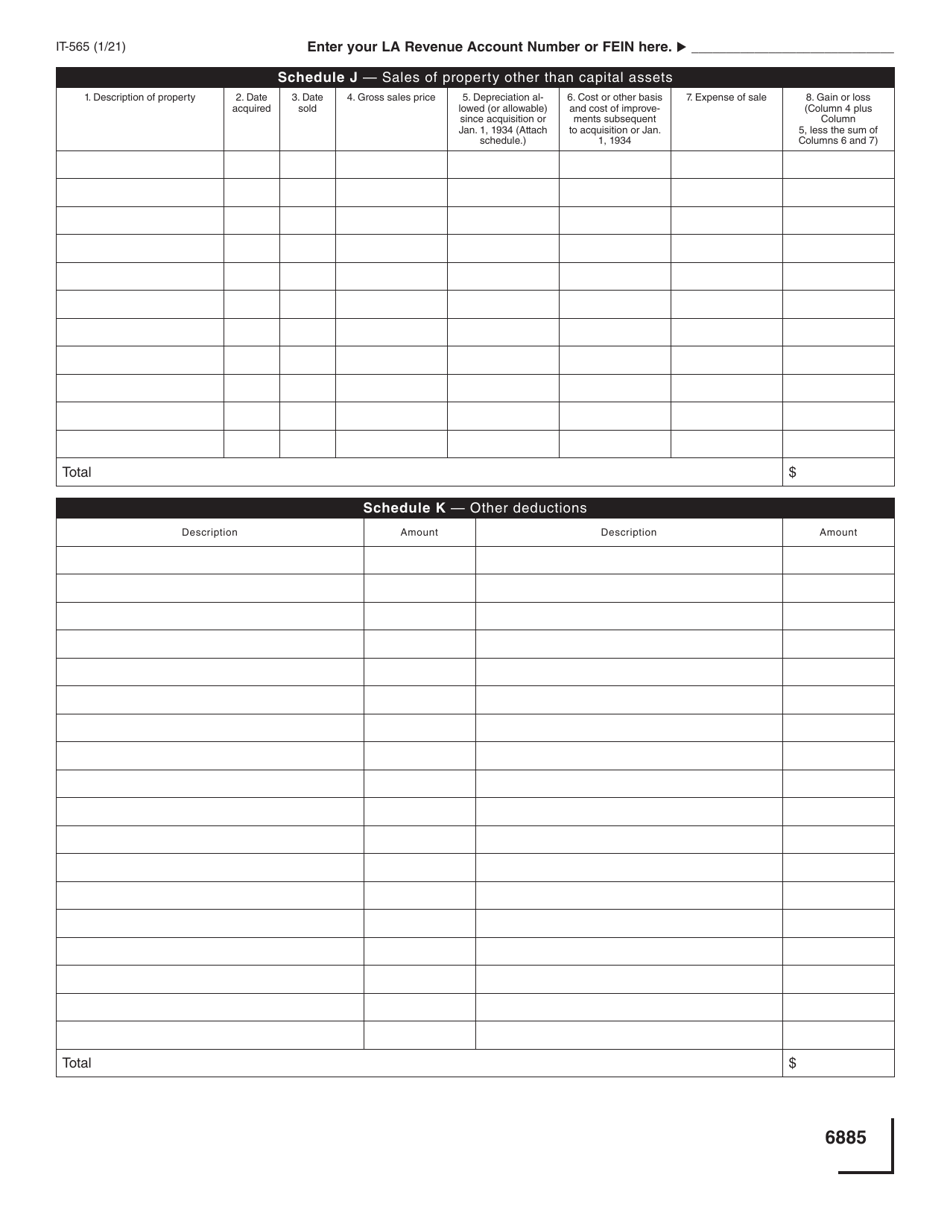

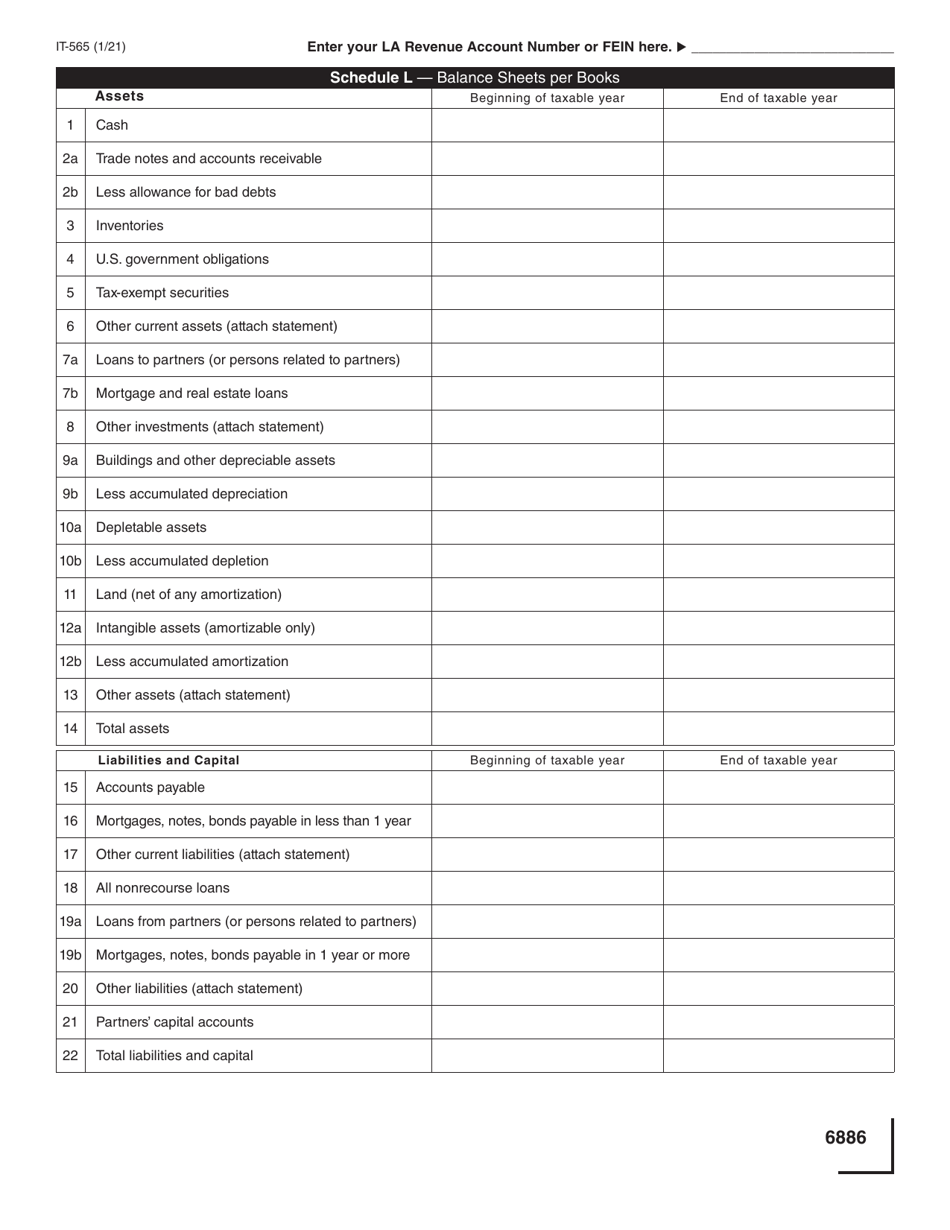

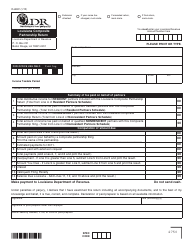

Form IT-565 Partnership Return of Income - Louisiana

What Is Form IT-565?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-565?

A: Form IT-565 is the Partnership Return of Income form used in Louisiana.

Q: Who needs to file Form IT-565?

A: Partnerships that are doing business in Louisiana or have income derived from Louisiana sources need to file Form IT-565.

Q: When is Form IT-565 due?

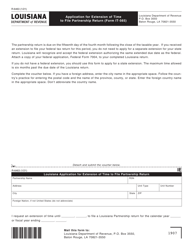

A: Form IT-565 is due on the 15th day of the 4th month following the close of the partnership's tax year.

Q: Are there any extensions available for filing Form IT-565?

A: Yes, partnerships can request an extension of time to file Form IT-565 by filing Form 770EXT.

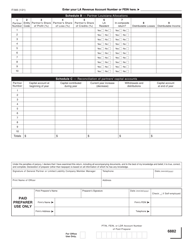

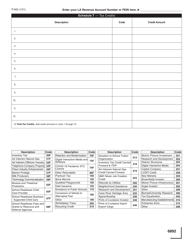

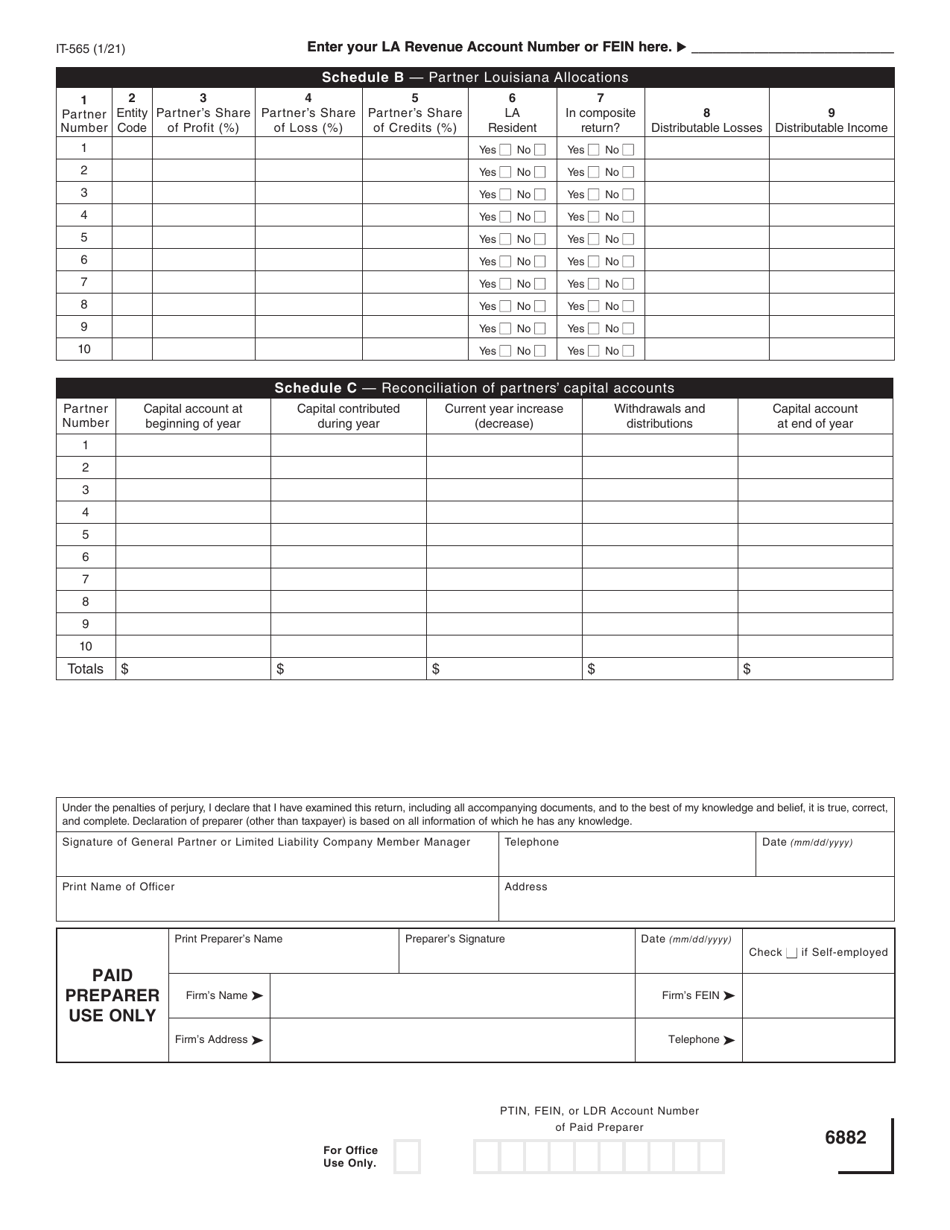

Q: What information do I need to complete Form IT-565?

A: You will need to provide information about the partnership, its income, deductions, and credits, as well as the names and addresses of partners.

Q: Can I file Form IT-565 electronically?

A: Yes, Louisiana accepts electronic filing of Form IT-565 through the Louisiana Taxpayer Access Point (LaTAP) system.

Q: Is there a fee for filing Form IT-565?

A: No, there is no fee for filing Form IT-565.

Q: What happens if I don't file Form IT-565?

A: Failure to file Form IT-565 or failure to pay the tax due may result in penalties and interest charges.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-565 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.