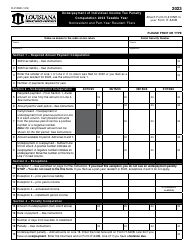

This version of the form is not currently in use and is provided for reference only. Download this version of

Form IT-540B

for the current year.

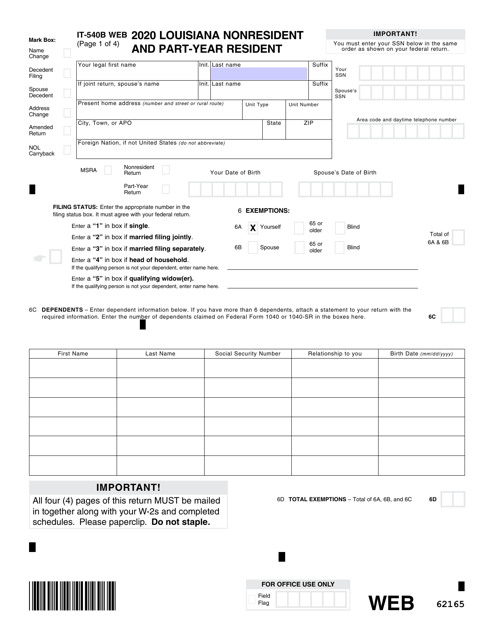

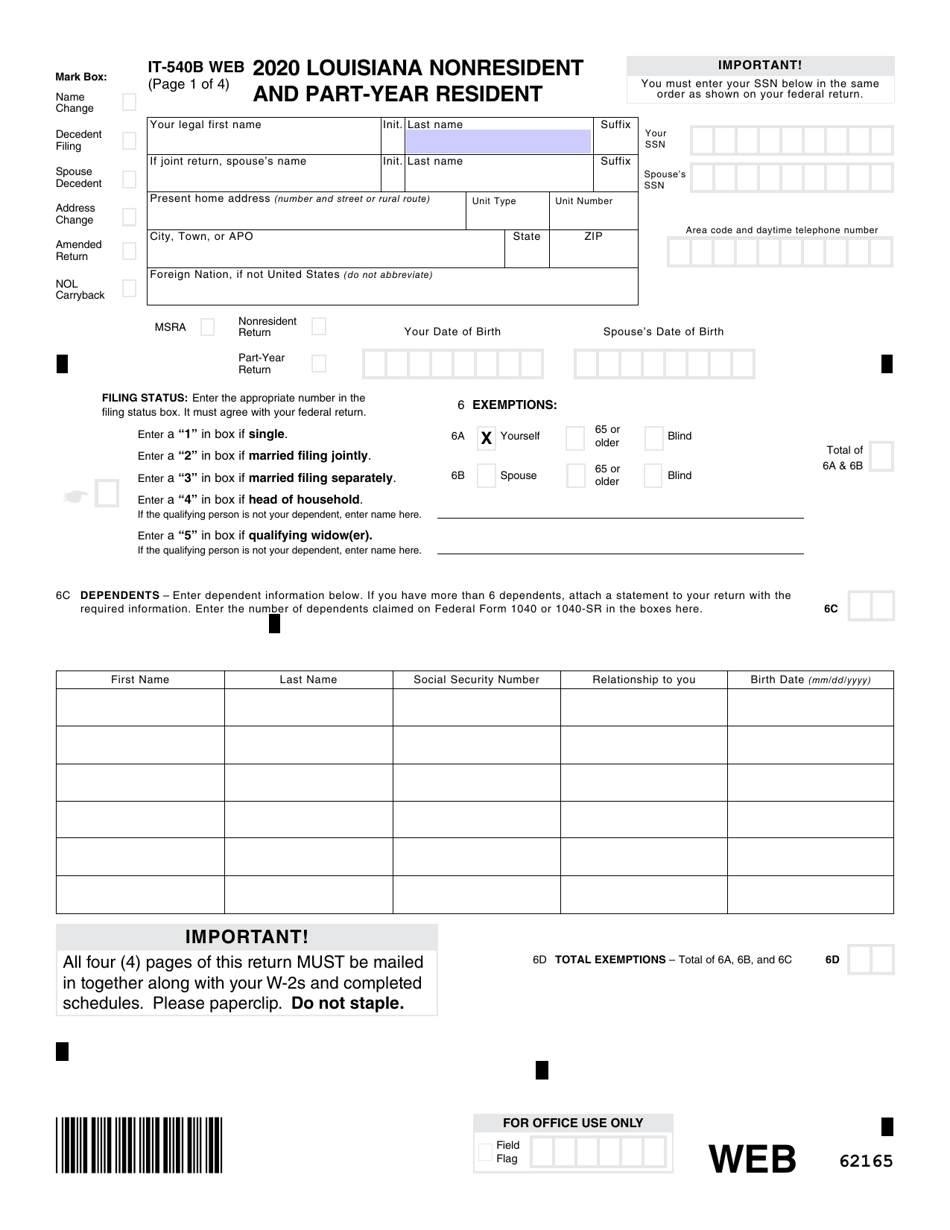

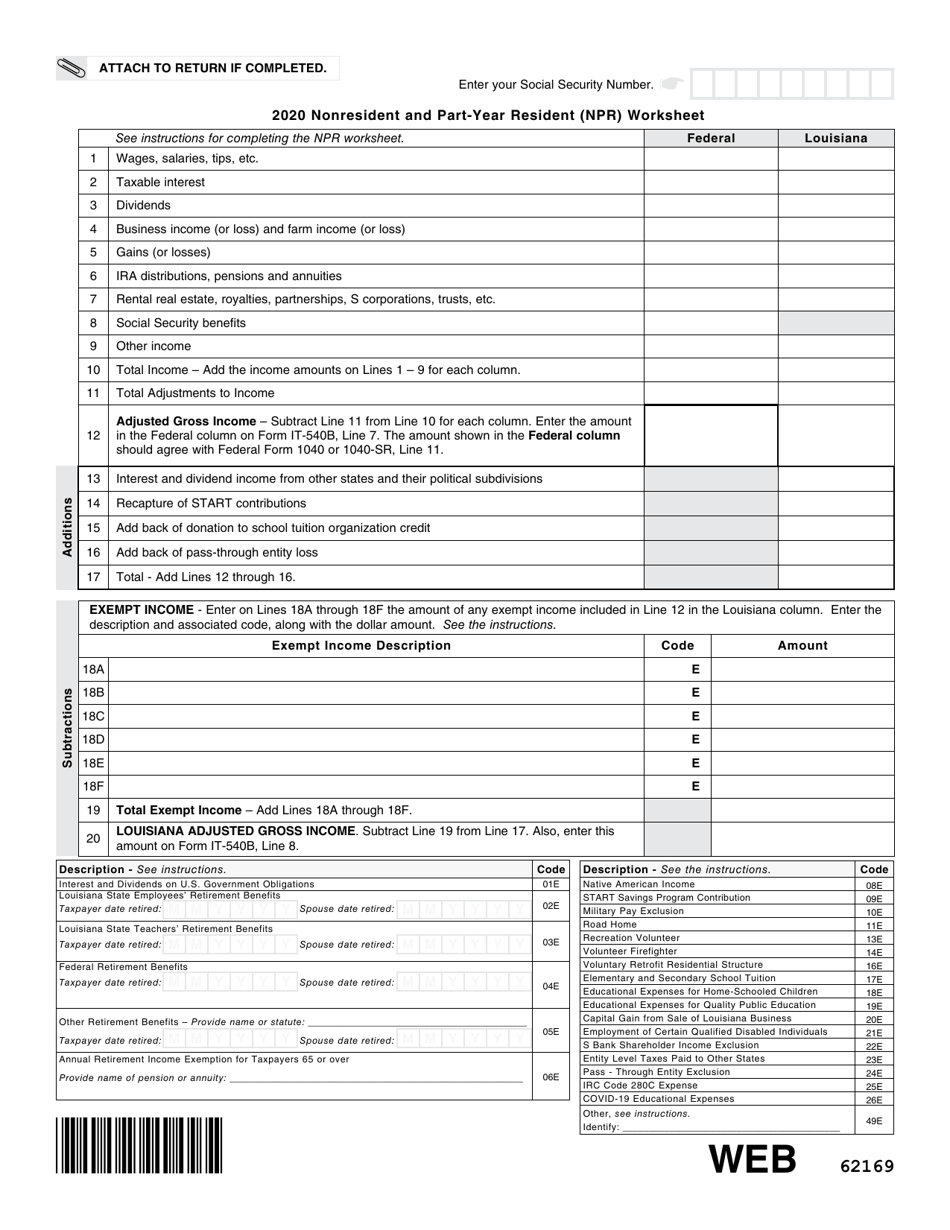

Form IT-540B Louisiana Nonresident and Part-Year Resident - Louisiana

What Is Form IT-540B?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-540B?

A: Form IT-540B is the Louisiana Nonresident and Part-Year Resident tax form.

Q: Who needs to file Form IT-540B?

A: Nonresidents and part-year residents of Louisiana who have income from Louisiana sources need to file Form IT-540B.

Q: What is a nonresident?

A: A nonresident is someone who is not a resident of Louisiana but has income from Louisiana sources.

Q: What is a part-year resident?

A: A part-year resident is someone who is a resident of Louisiana for only part of the tax year.

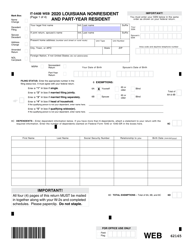

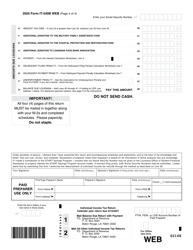

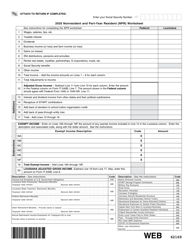

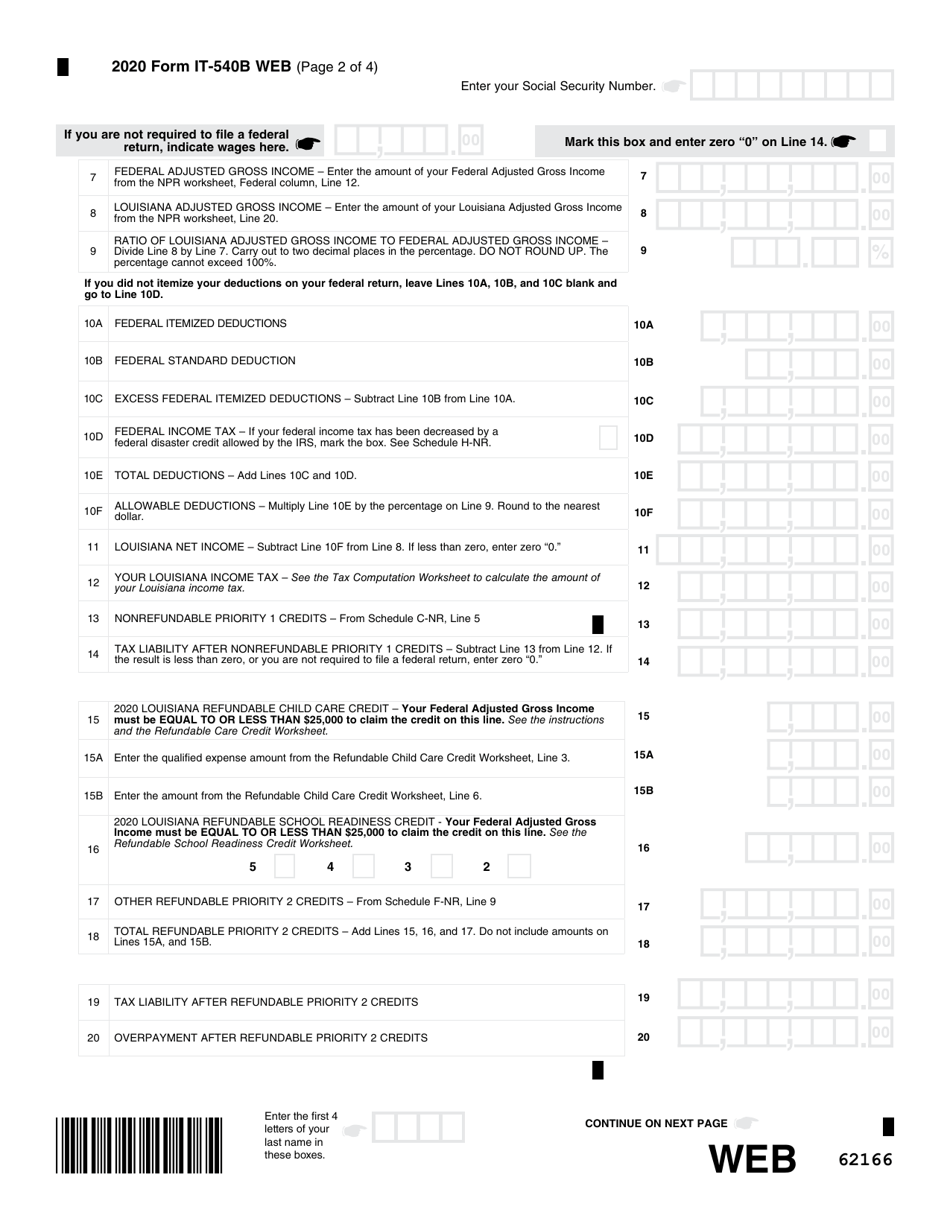

Q: What income should be reported on Form IT-540B?

A: You should report any income earned from Louisiana sources, including wages, self-employment income, rental income, and other sources.

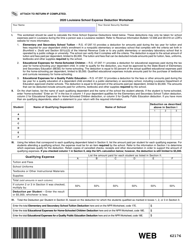

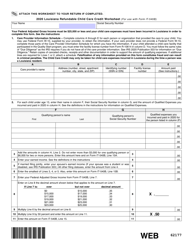

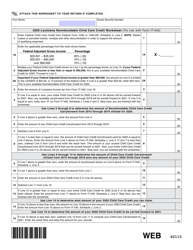

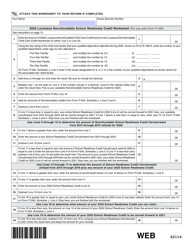

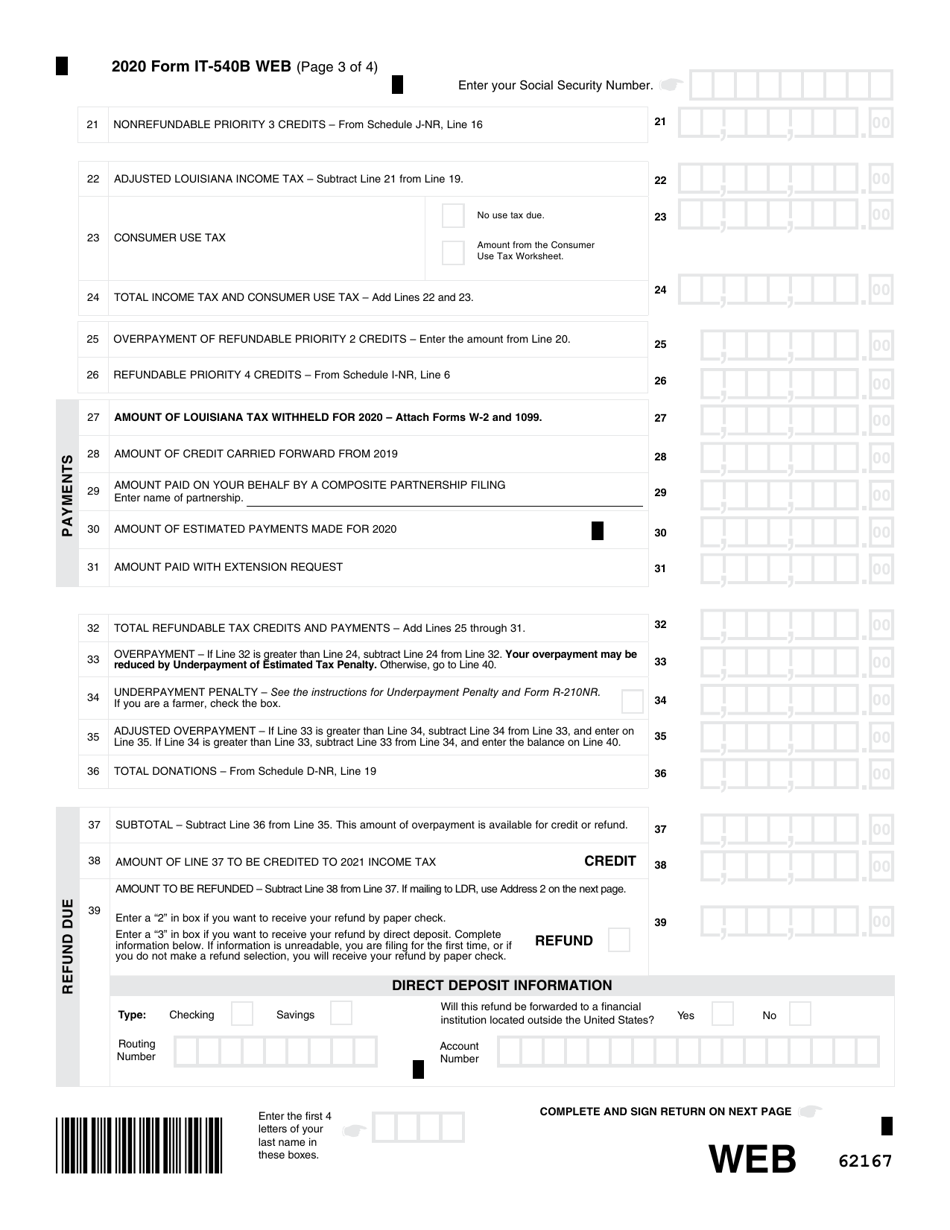

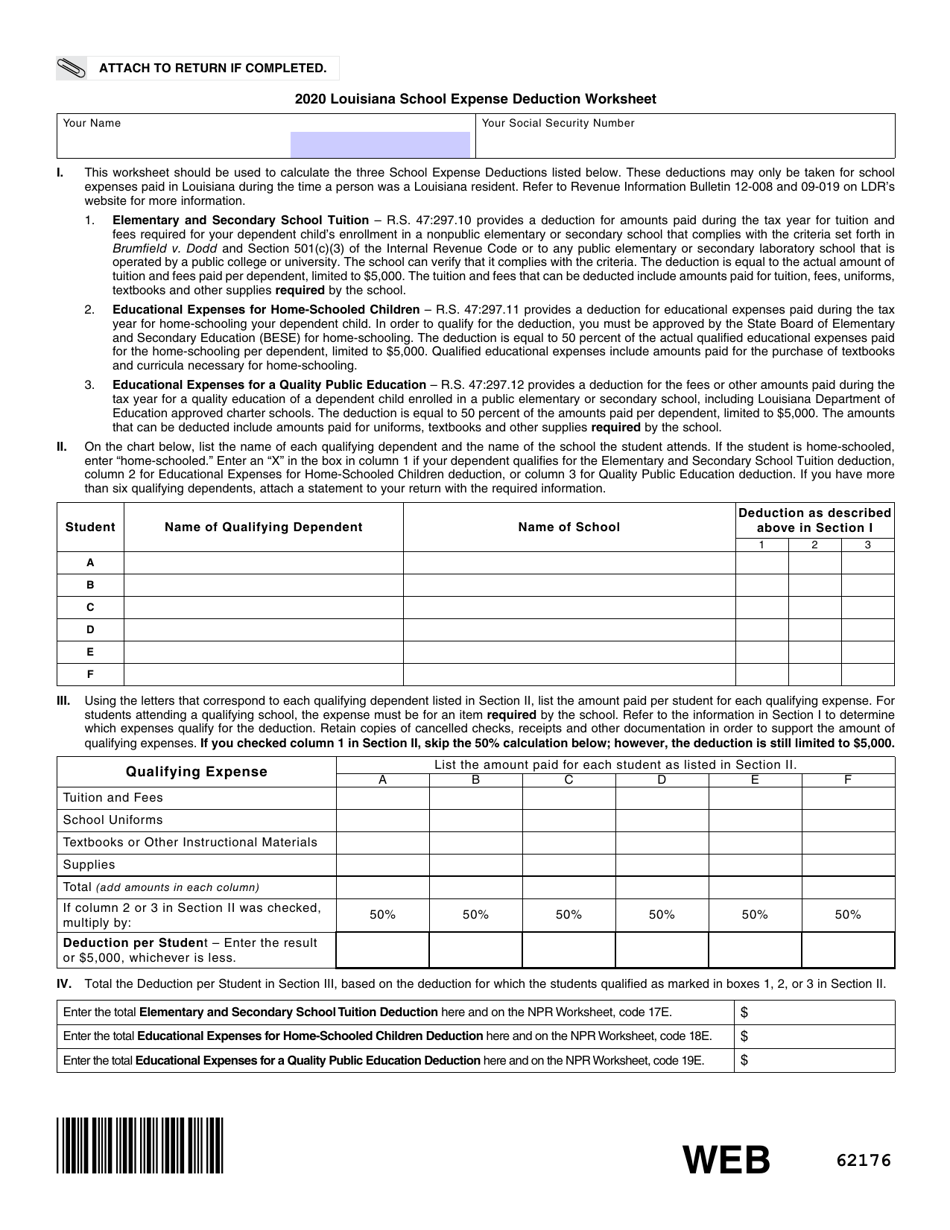

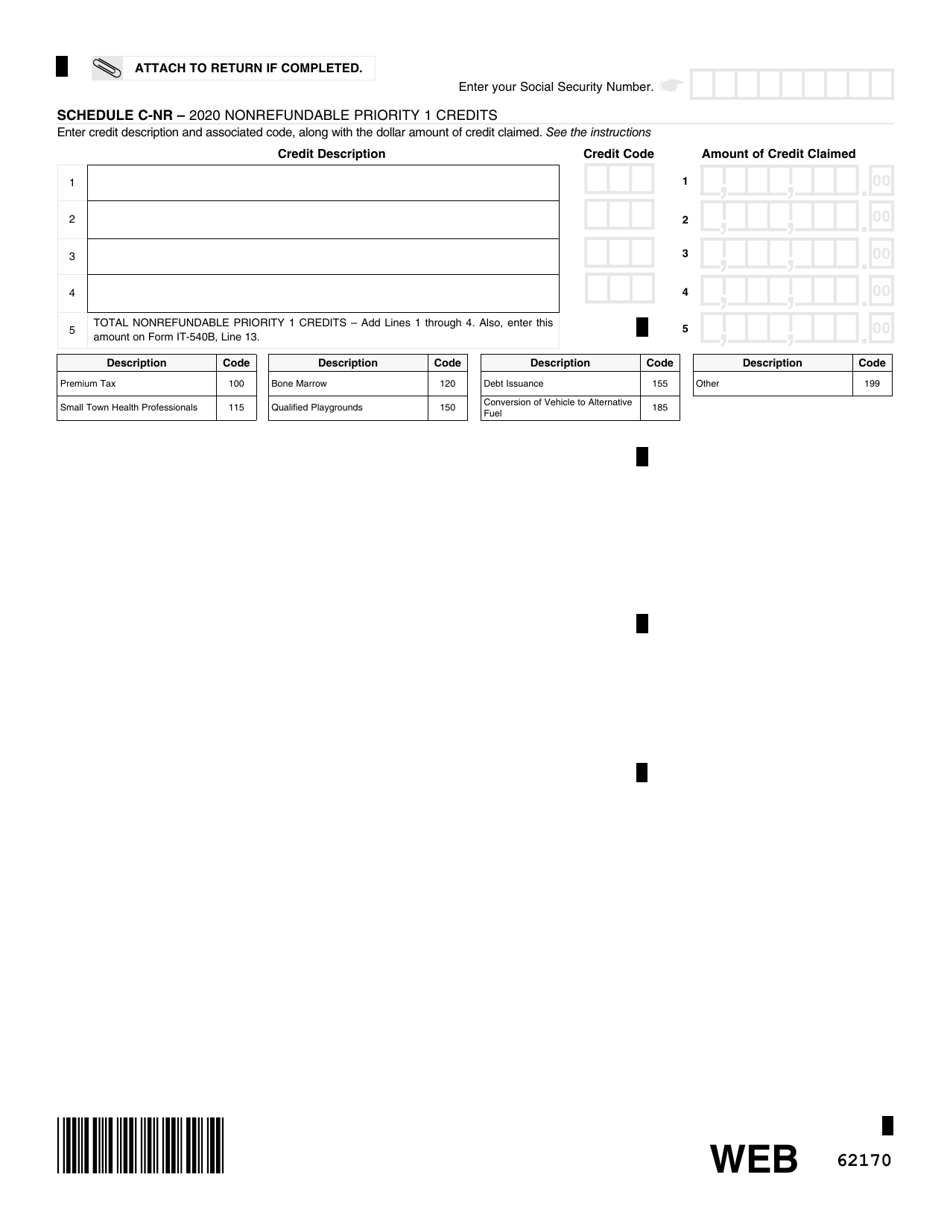

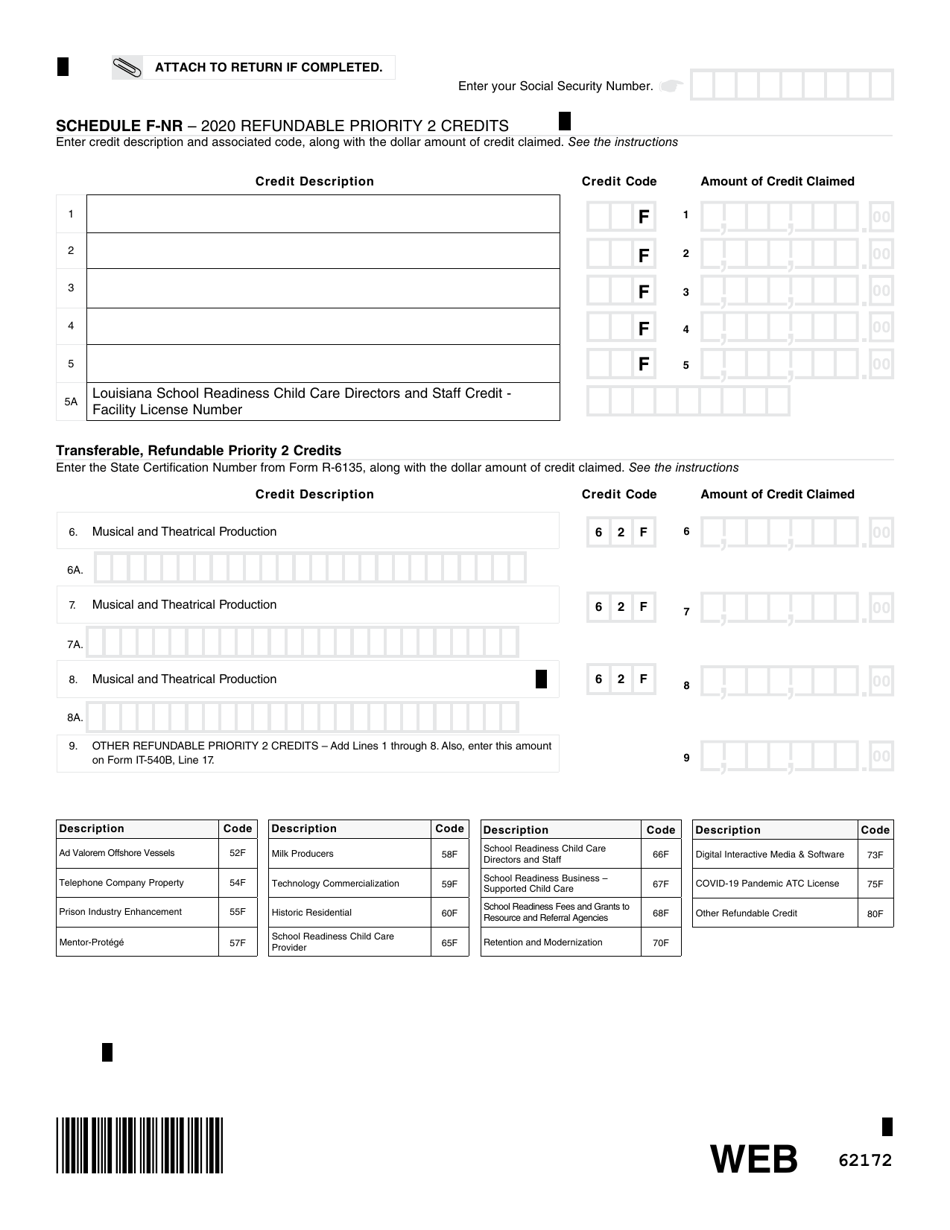

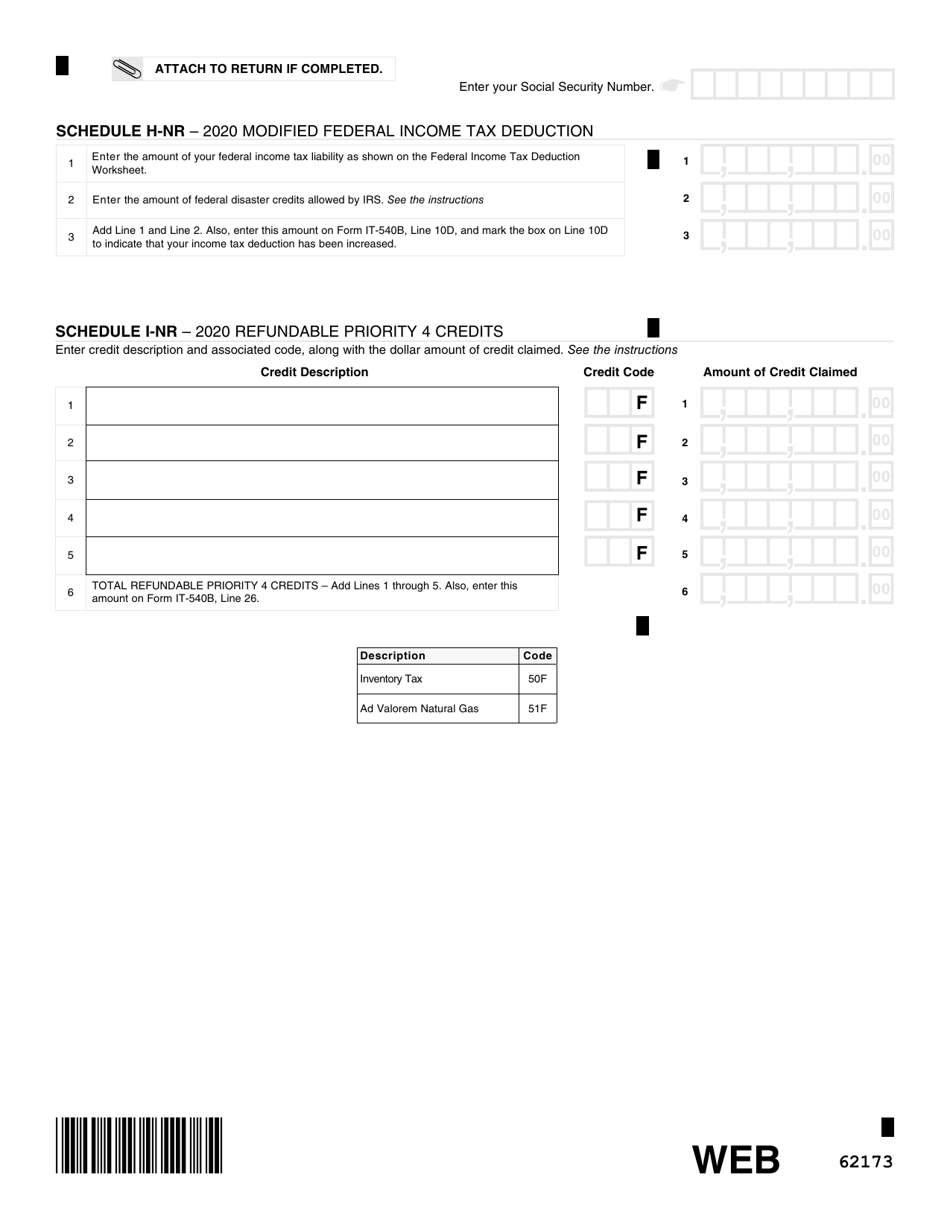

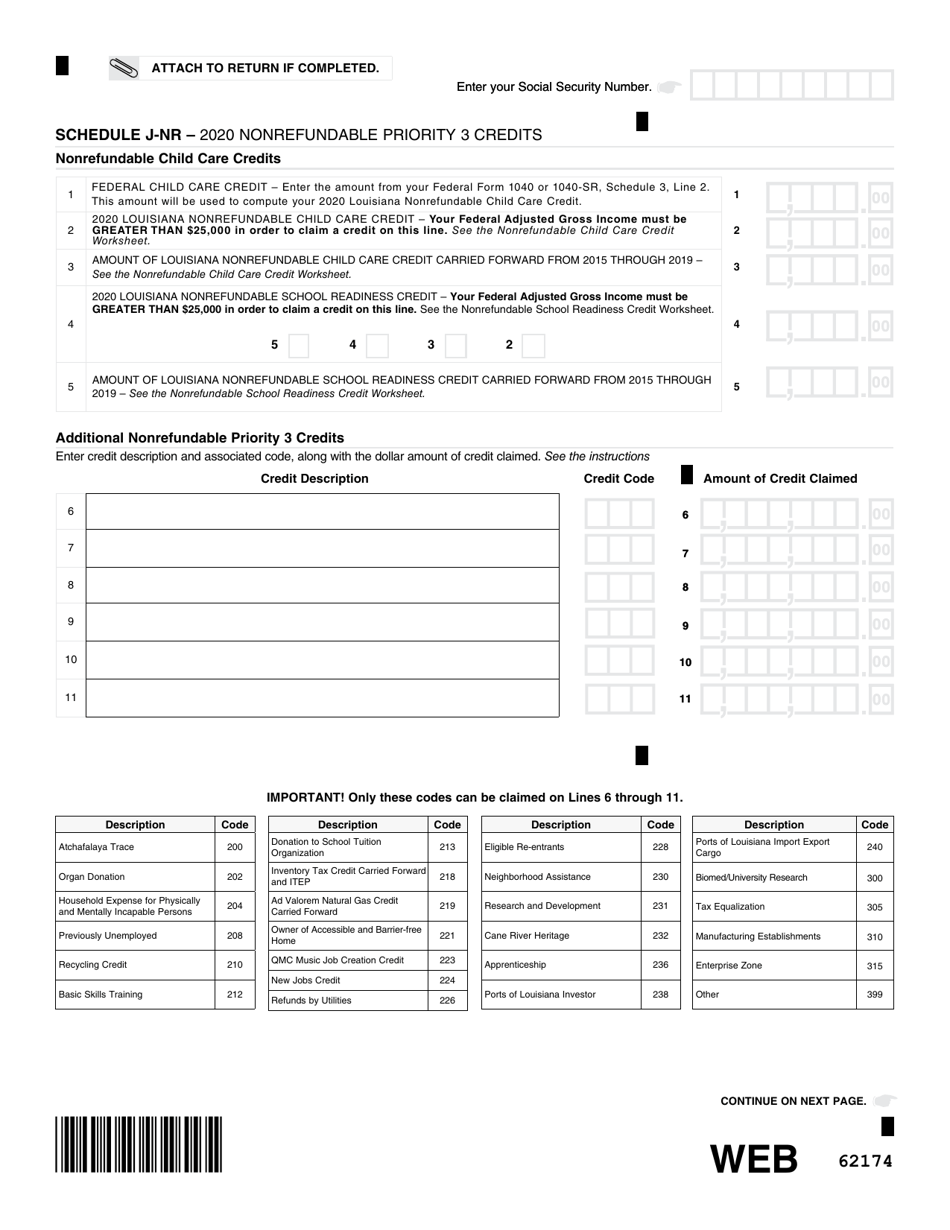

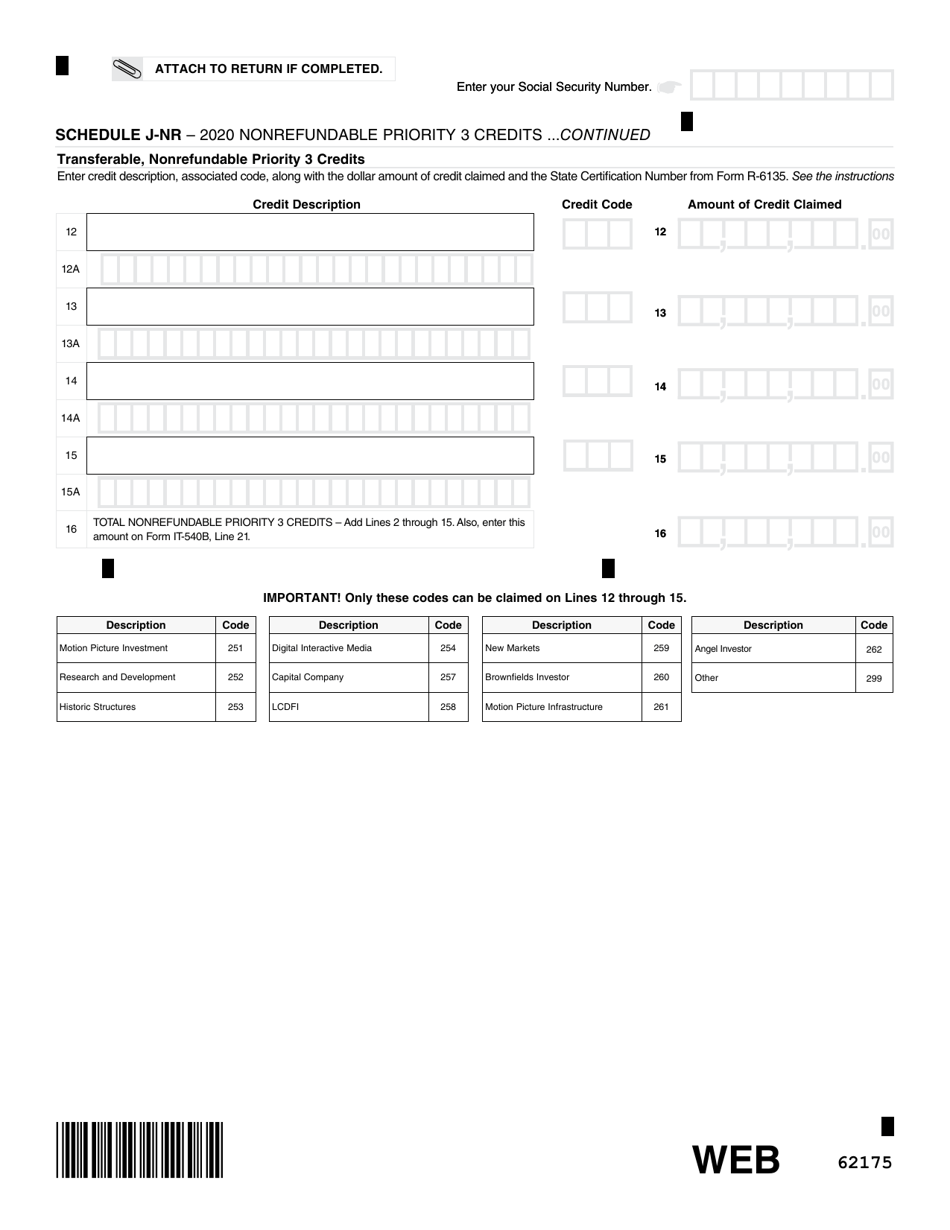

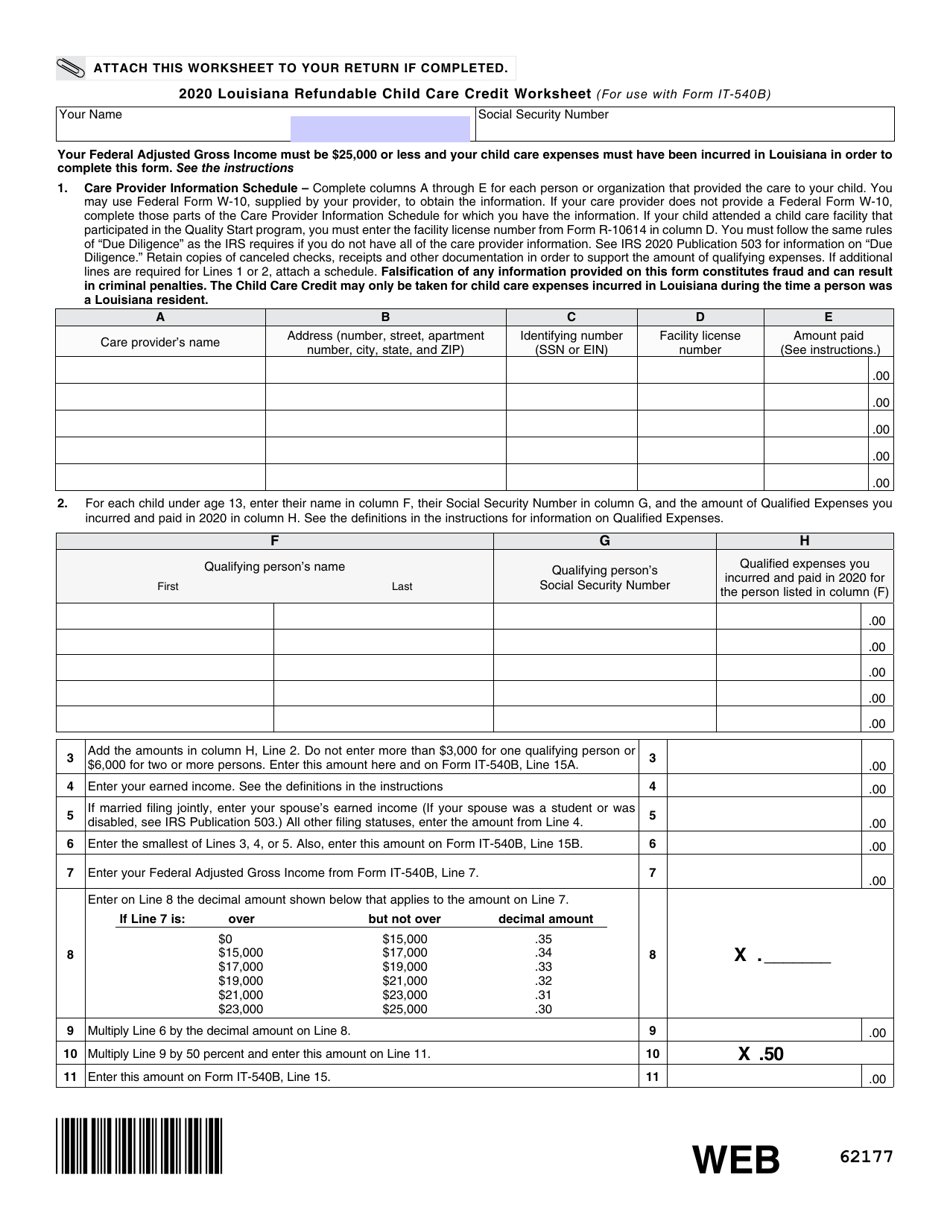

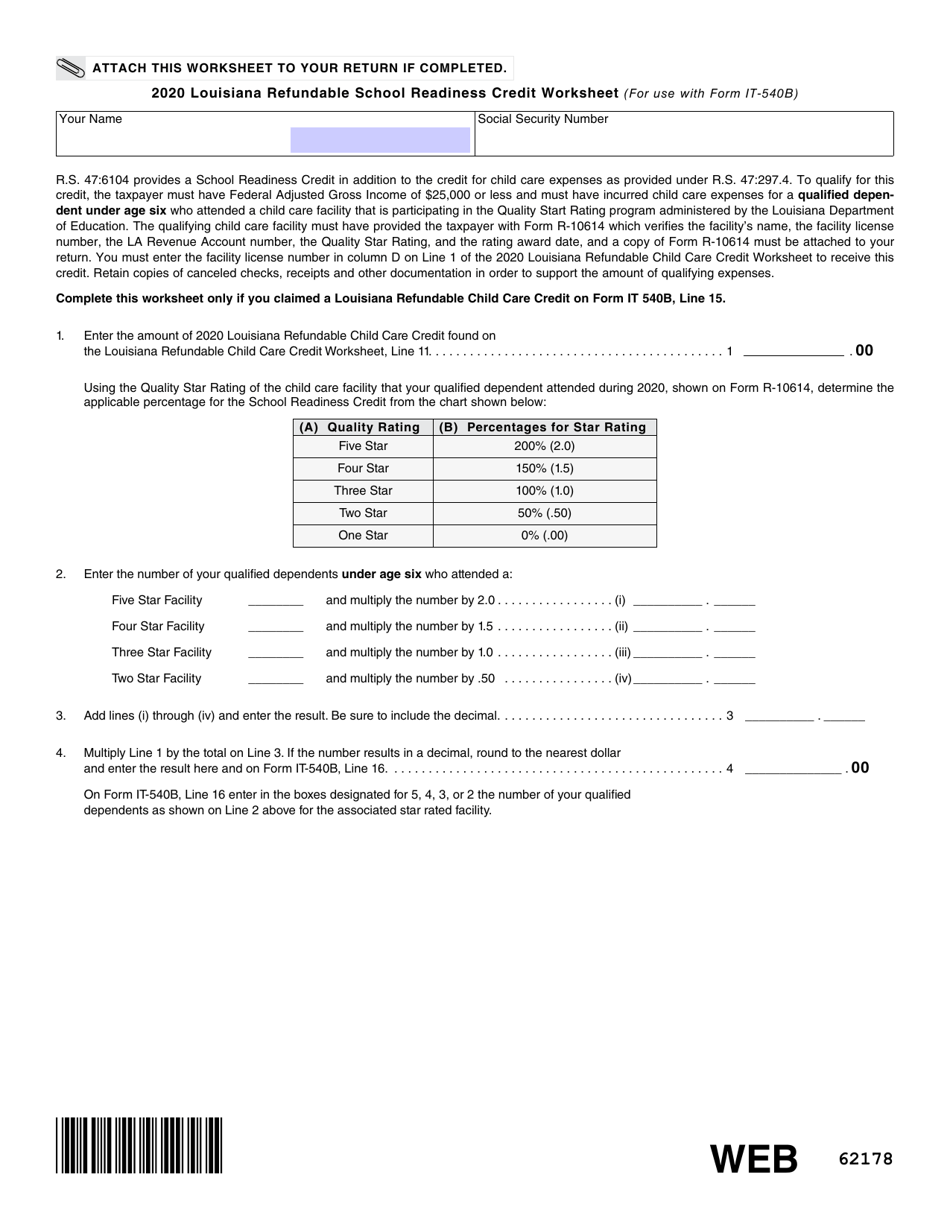

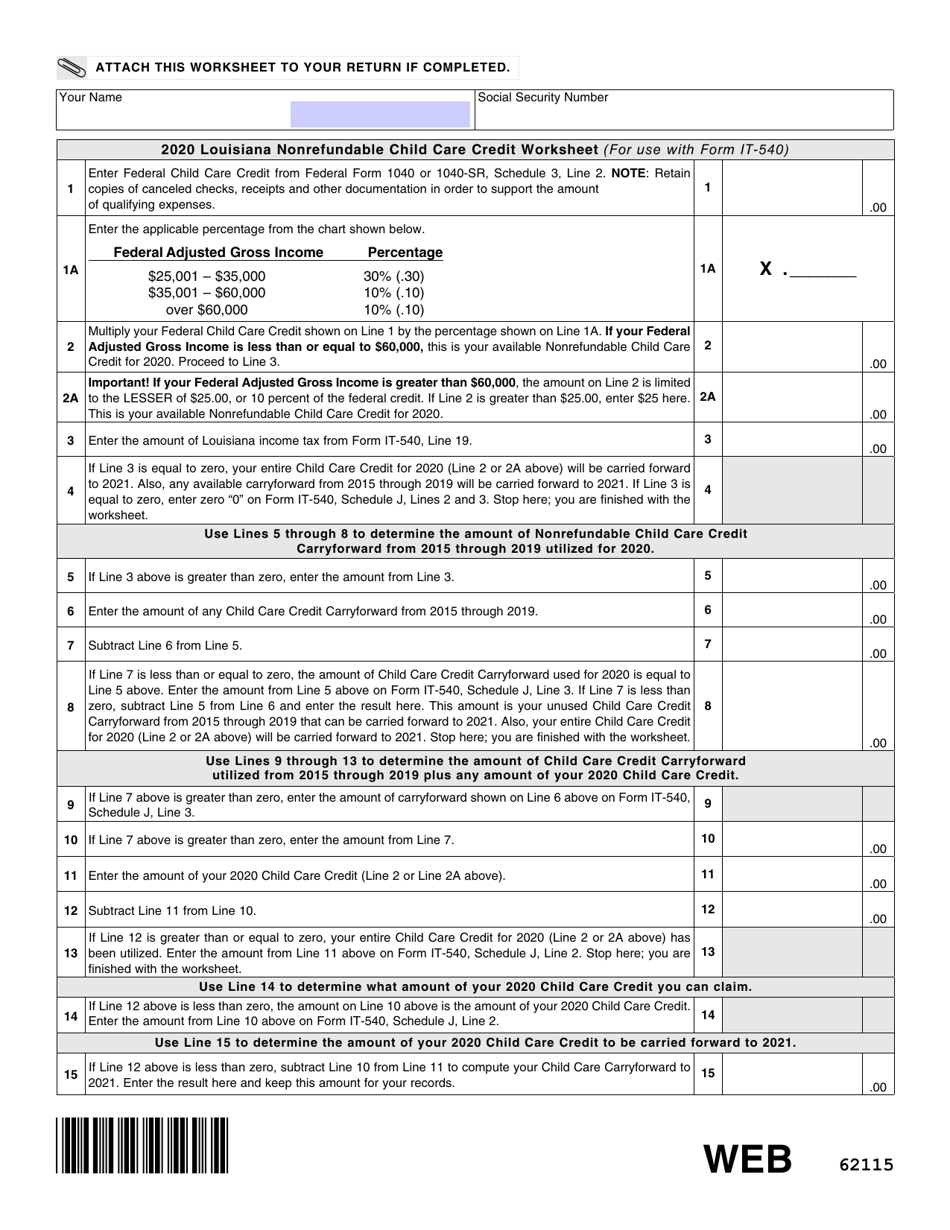

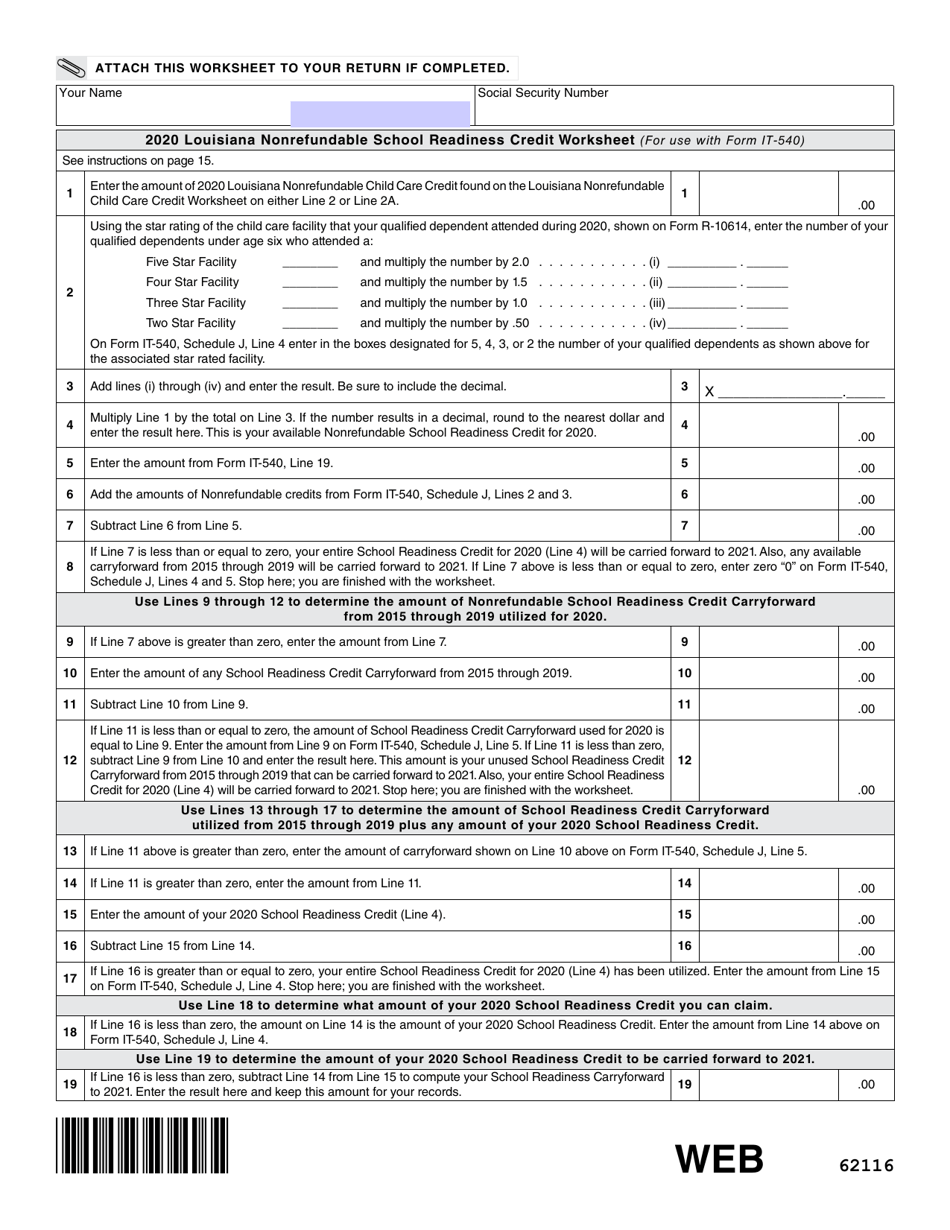

Q: Are there any deductions or credits available on Form IT-540B?

A: Yes, there are various deductions and credits available on Form IT-540B, such as the federal deduction for state income tax paid, child care credit, and education credit.

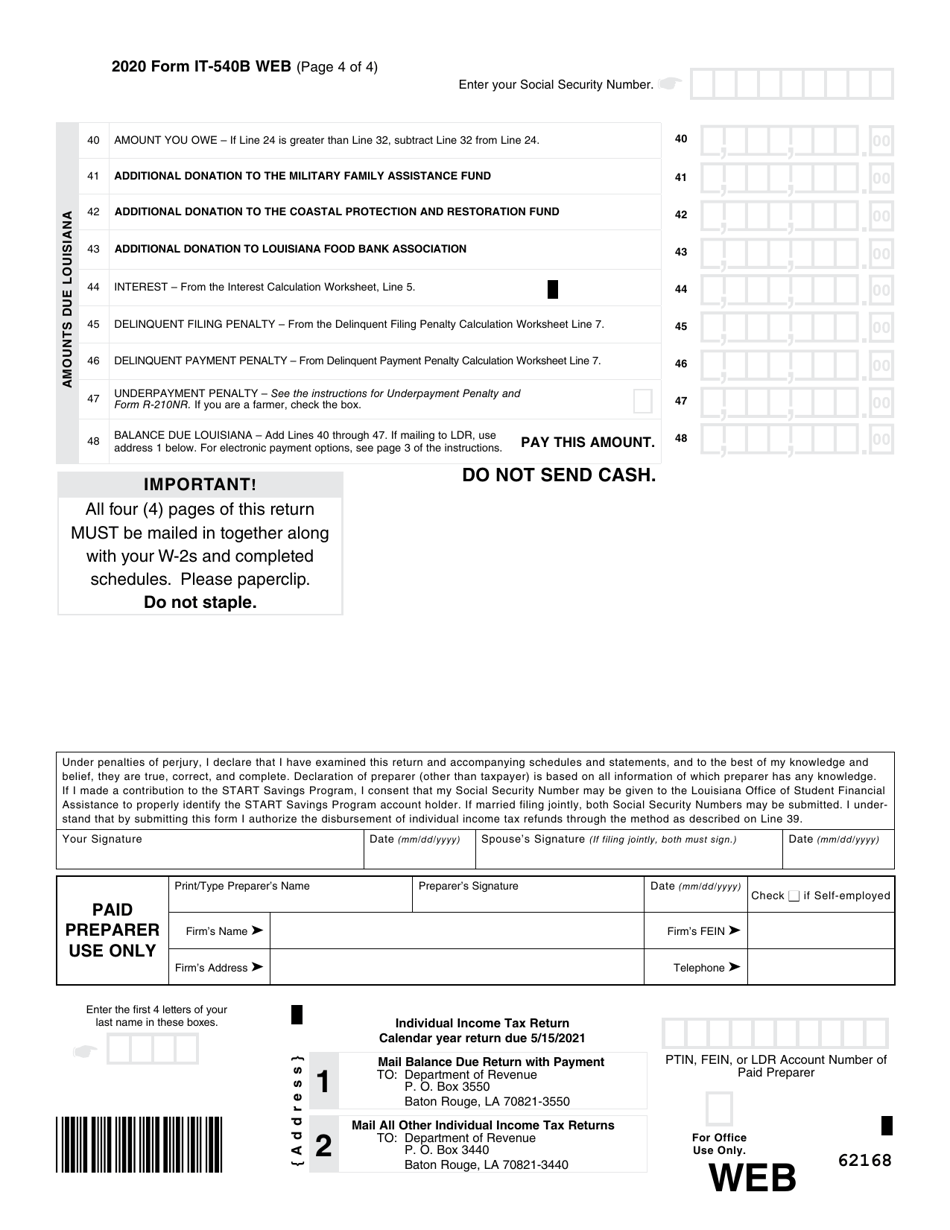

Q: When is Form IT-540B due?

A: Form IT-540B is due on the same date as the federal income tax return, usually April 15th.

Q: Can I e-file Form IT-540B?

A: Yes, you can e-file Form IT-540B if you meet the eligibility requirements. Check with the Louisiana Department of Revenue for more information.

Q: Do I need to include supporting documents with Form IT-540B?

A: You may need to include supporting documents, such as W-2 forms, 1099 forms, and any other relevant tax documents, depending on your individual situation.

Form Details:

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-540B by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.