This version of the form is not currently in use and is provided for reference only. Download this version of

Form R-10610

for the current year.

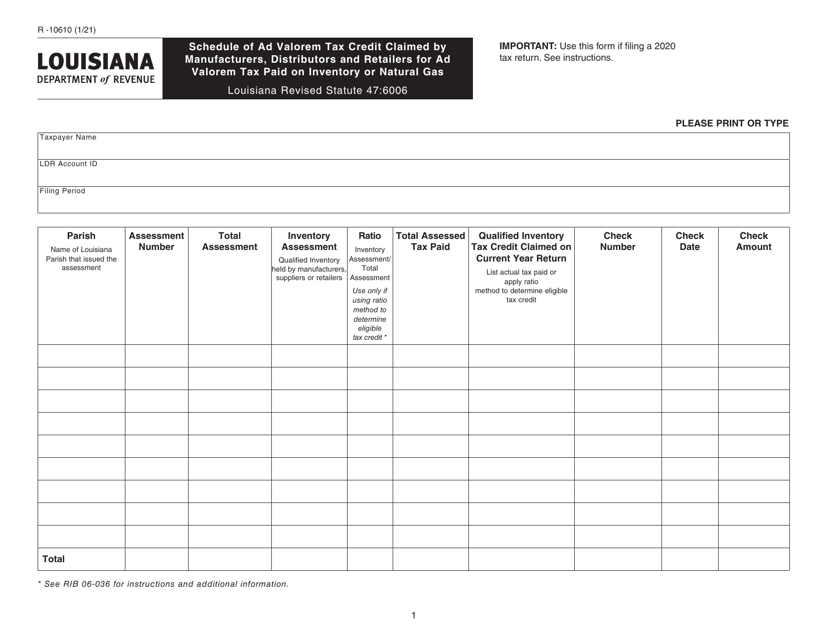

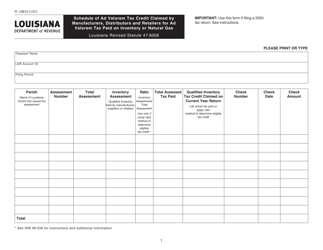

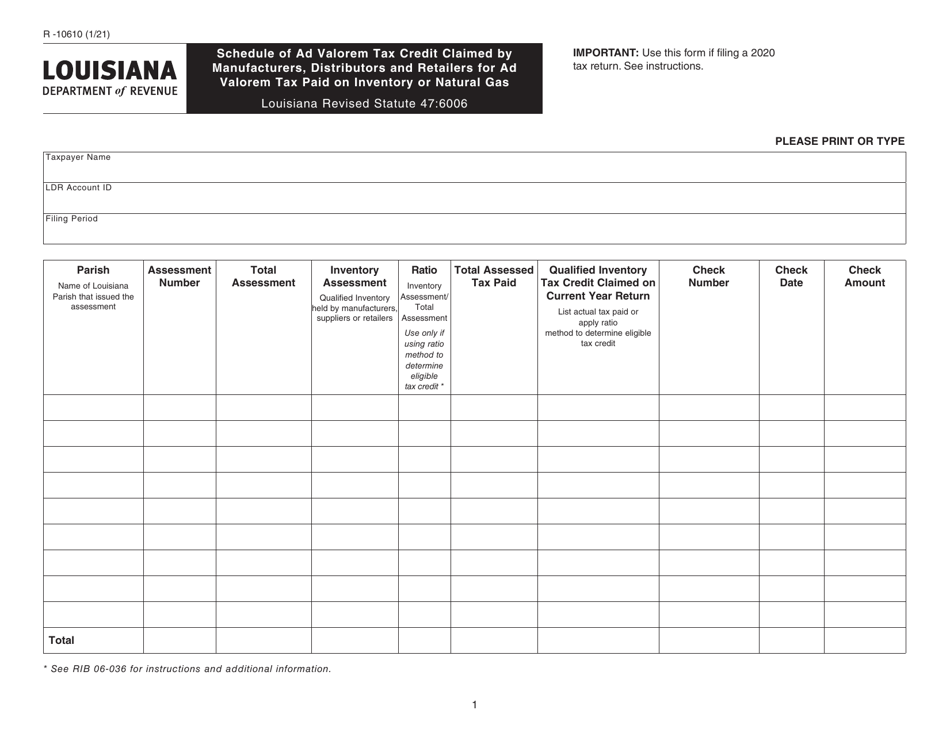

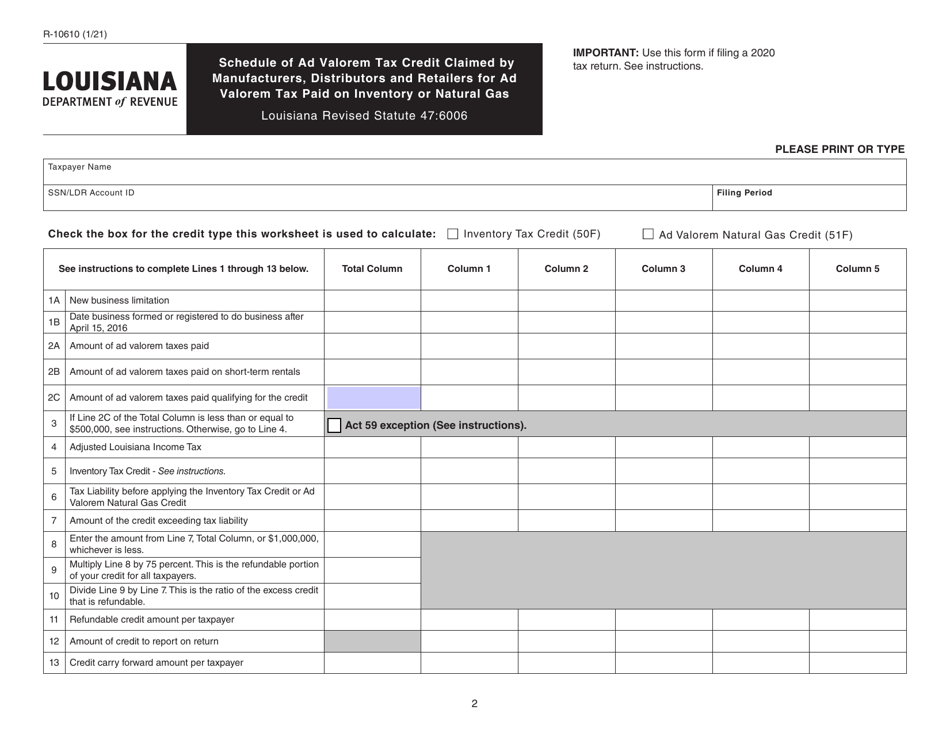

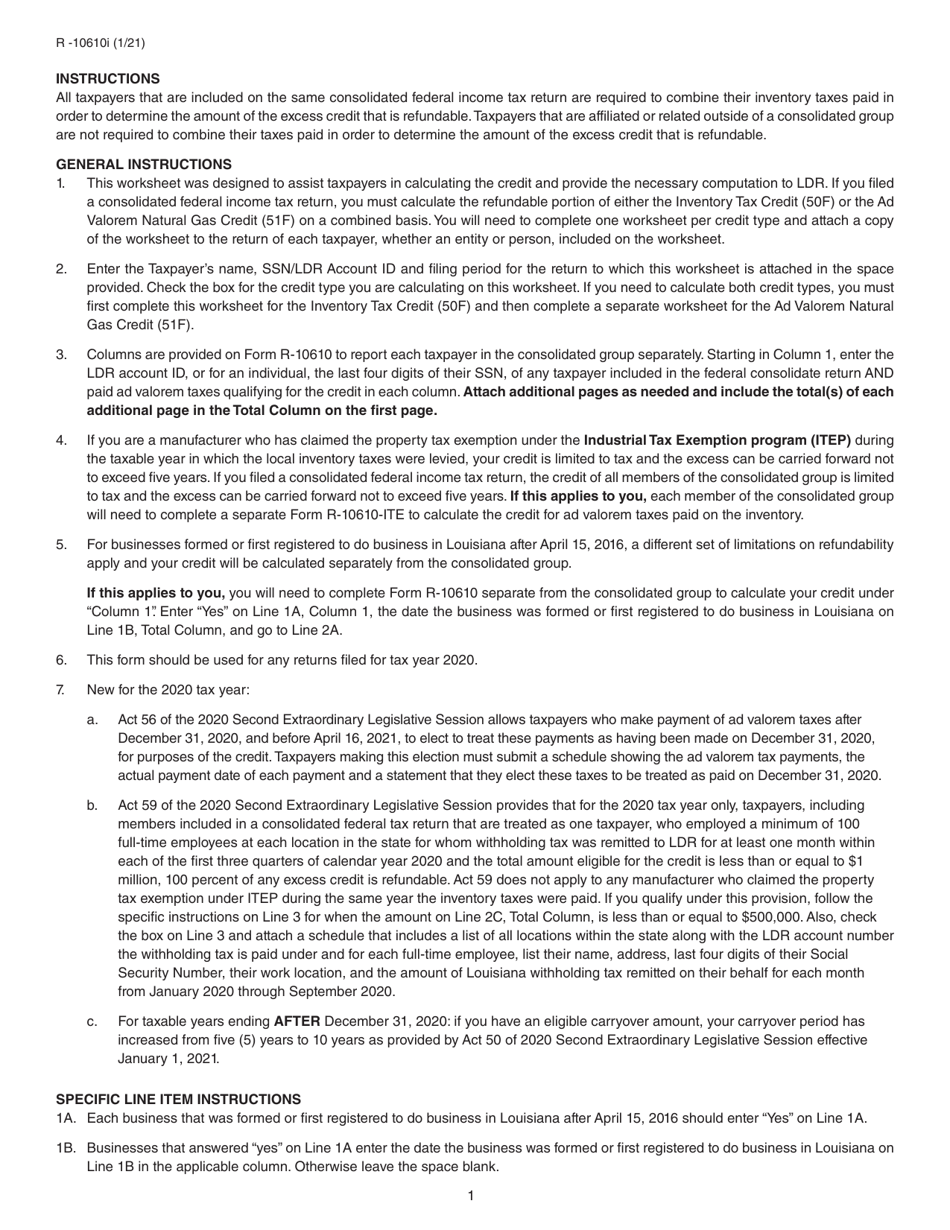

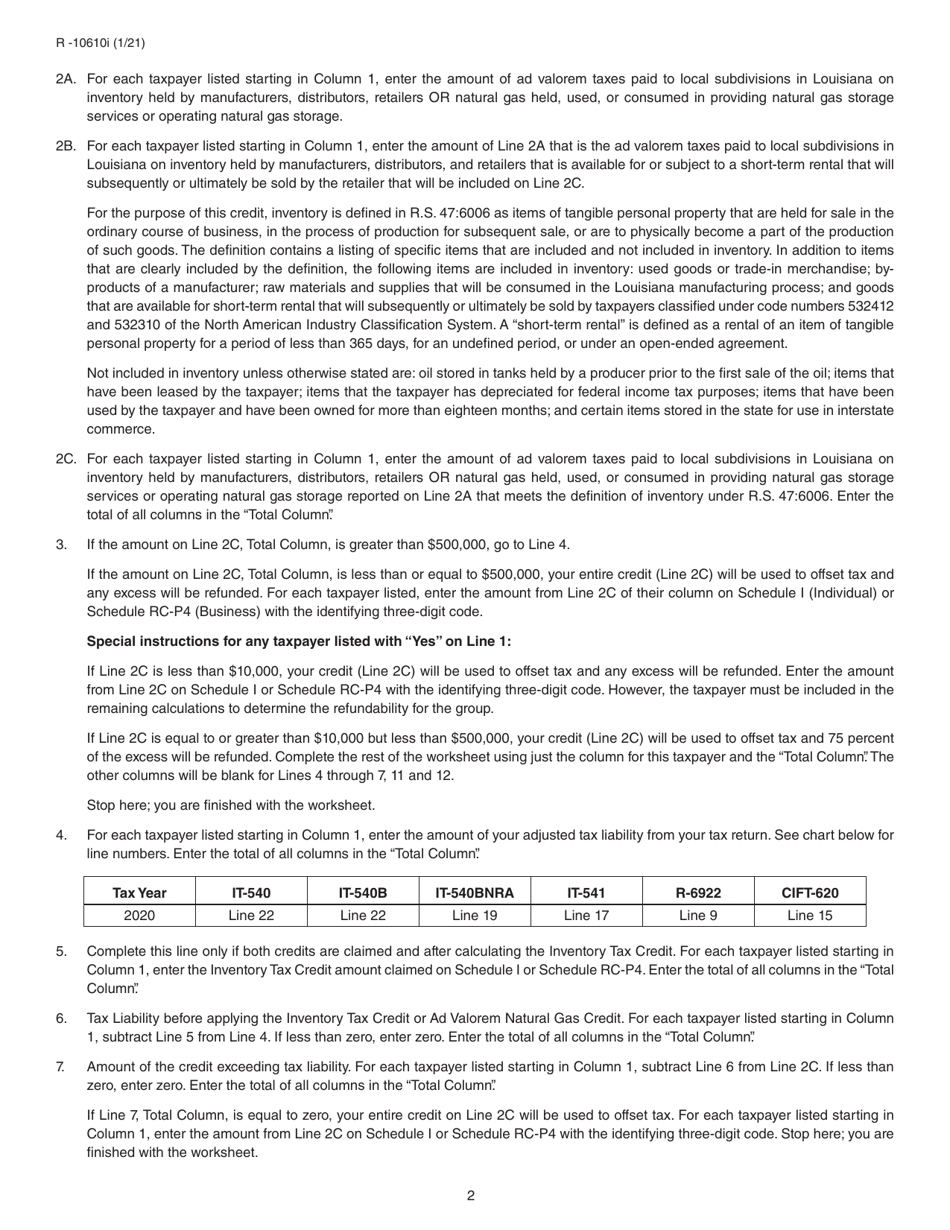

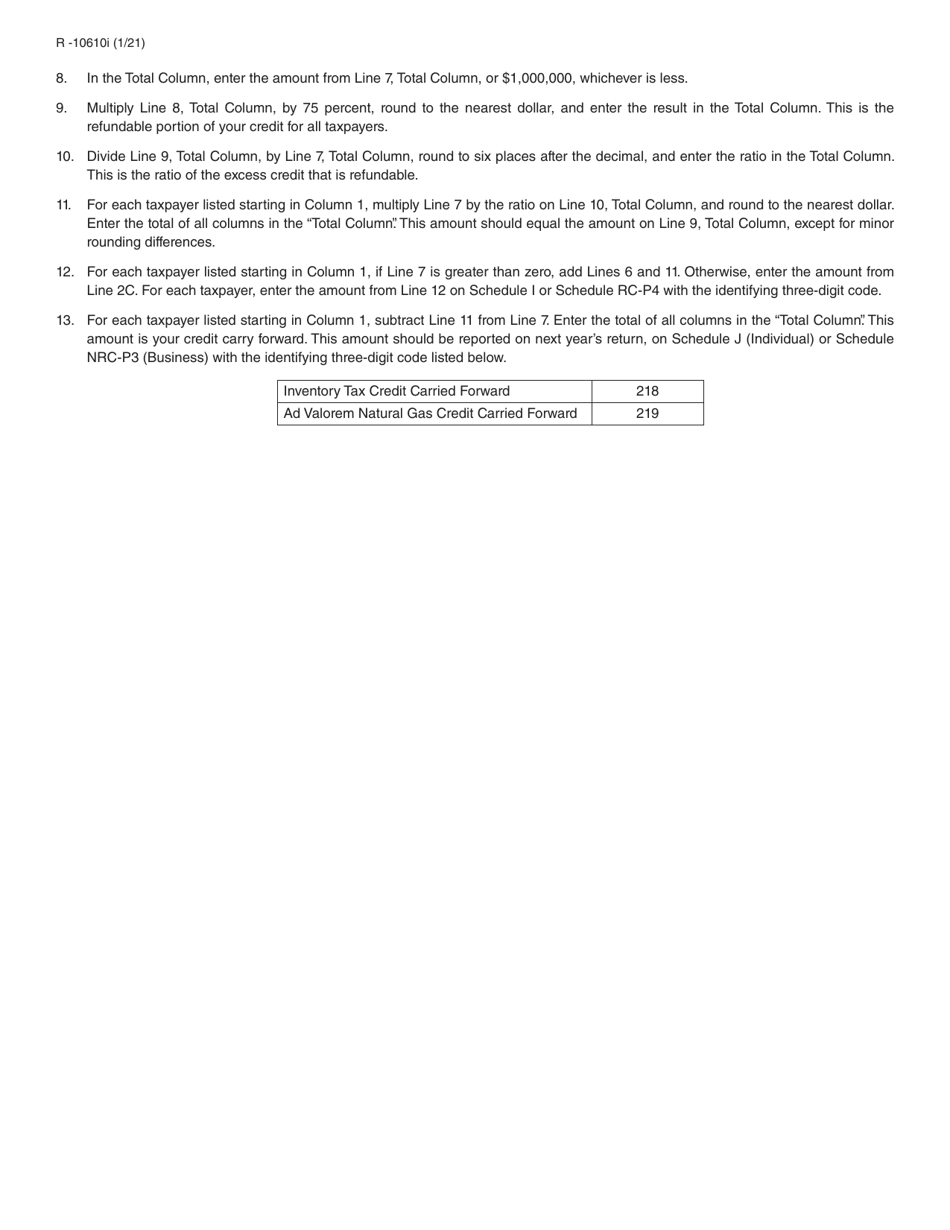

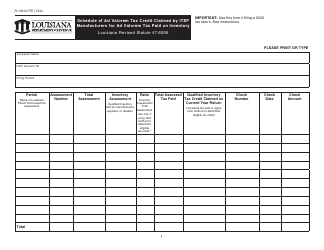

Form R-10610 Schedule of Ad Valorem Tax Credit Claimed by Manufacturers, Distributors and Retailers for Ad Valorem Tax Paid on Inventory or Natural Gas - Louisiana

What Is Form R-10610?

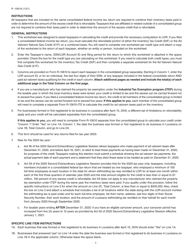

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-10610?

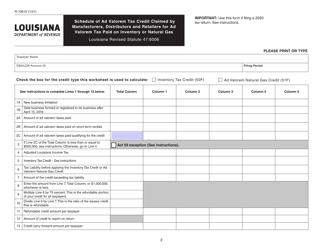

A: Form R-10610 is a document used by manufacturers, distributors, and retailers in Louisiana to claim a credit for ad valorem tax paid on inventory or natural gas.

Q: Who can use Form R-10610?

A: Manufacturers, distributors, and retailers in Louisiana can use Form R-10610 to claim a credit for ad valorem tax paid on inventory or natural gas.

Q: What is ad valorem tax?

A: Ad valorem tax is a tax on the value of property, such as inventory or natural gas, that is used to fund local government services.

Q: What can the credit be claimed for?

A: The credit can be claimed for ad valorem tax paid on inventory or natural gas.

Q: Why would a manufacturer, distributor, or retailer claim this credit?

A: They would claim this credit to reduce their tax liability and potentially save money.

Q: Are there any eligibility requirements to claim the credit?

A: Yes, there may be specific requirements and limitations for claiming the credit. It is best to consult the instructions and guidelines provided with the form or seek professional assistance.

Q: When is the deadline to file Form R-10610?

A: The deadline to file Form R-10610 varies and may depend on the taxpayer's accounting period. It is important to check the instructions and guidelines provided with the form for the specific deadline.

Q: What other documentation is required to claim the credit?

A: Additional documentation, such as proof of payment of ad valorem tax and supporting schedules, may be required to claim the credit. It is important to review the instructions and guidelines provided with the form.

Q: What happens after filing Form R-10610?

A: After filing Form R-10610, the taxpayer's claim will be reviewed by the Louisiana Department of Revenue. If approved, the taxpayer may receive a credit against their tax liability.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-10610 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.