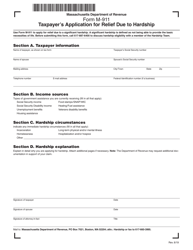

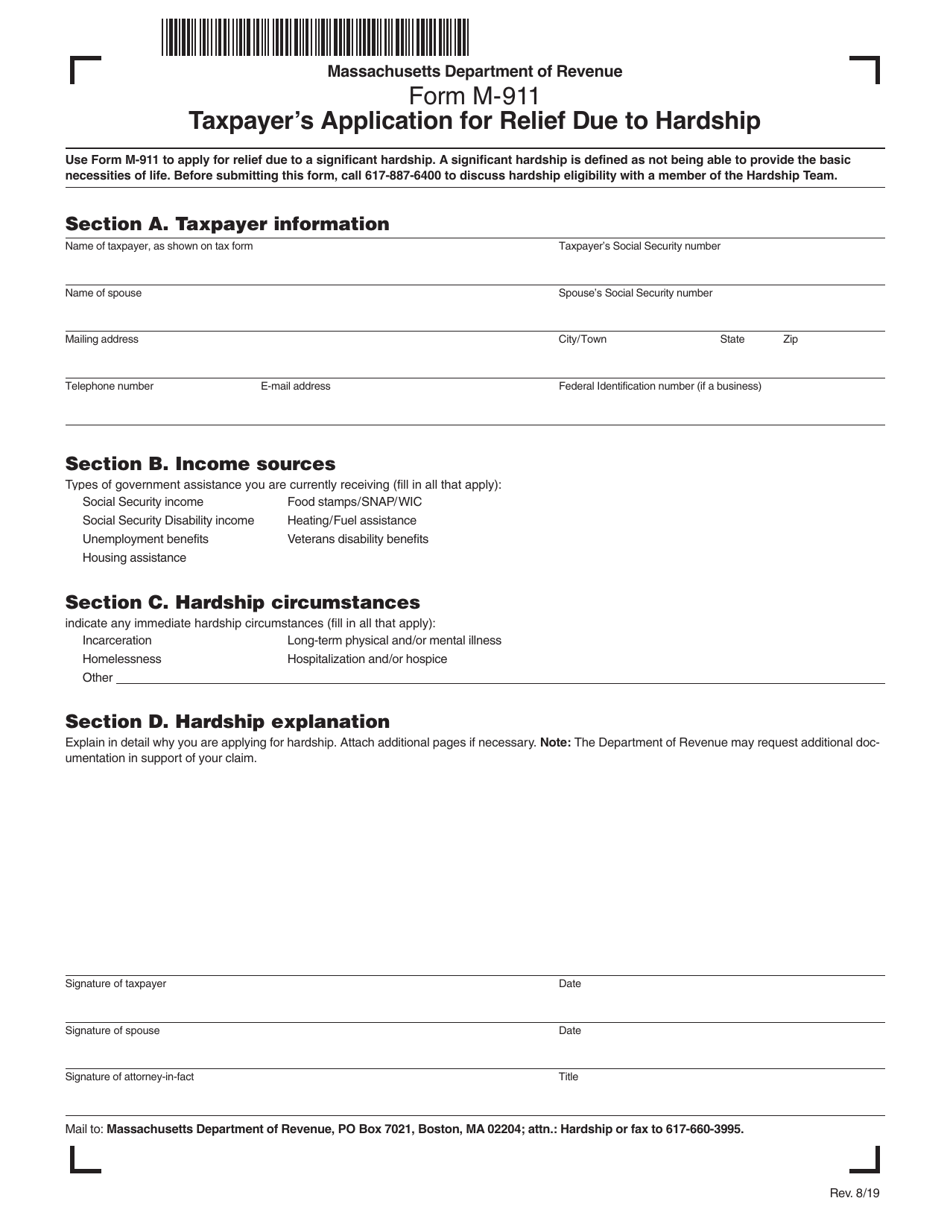

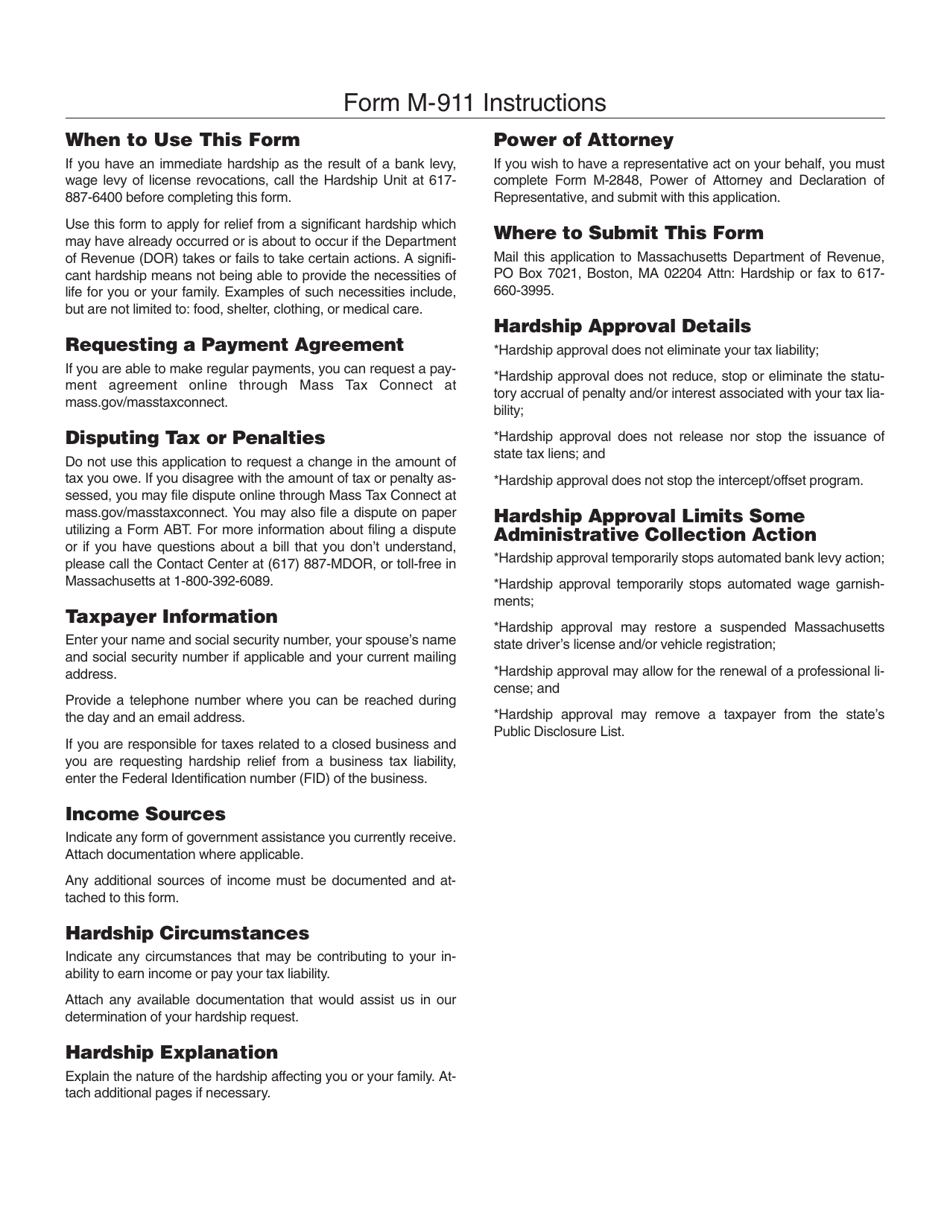

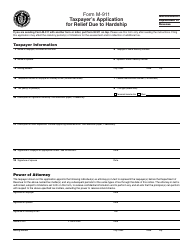

Form M-911 Taxpayer's Application for Relief Due to Hardship - Massachusetts

What Is Form M-911?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form M-911?

A: Form M-911 is the Taxpayer's Application for Relief Due to Hardship in Massachusetts.

Q: Who can use Form M-911?

A: Individuals who are facing financial hardship and need relief from their tax liabilities in Massachusetts.

Q: What is the purpose of Form M-911?

A: The purpose of this form is to request relief from tax liabilities in Massachusetts due to financial hardship.

Q: What should I include with my Form M-911?

A: You should include any supporting documentation that demonstrates your financial hardship, such as income statements, bank statements, and proof of expenses.

Q: What happens after I submit Form M-911?

A: The Massachusetts Department of Revenue will review your application and supporting documentation to determine if you qualify for relief.

Q: Is there a deadline for submitting Form M-911?

A: Yes, you must submit the form within three years from the date the tax return was due or within one year from the date of assessment, whichever is later.

Q: Can I appeal a denial of relief?

A: Yes, if your application for relief is denied, you have the right to appeal the decision.

Form Details:

- Released on August 1, 2019;

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form M-911 by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.