This version of the form is not currently in use and is provided for reference only. Download this version of

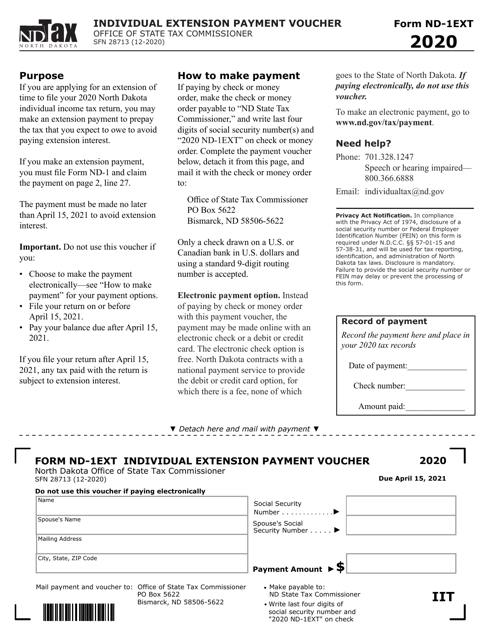

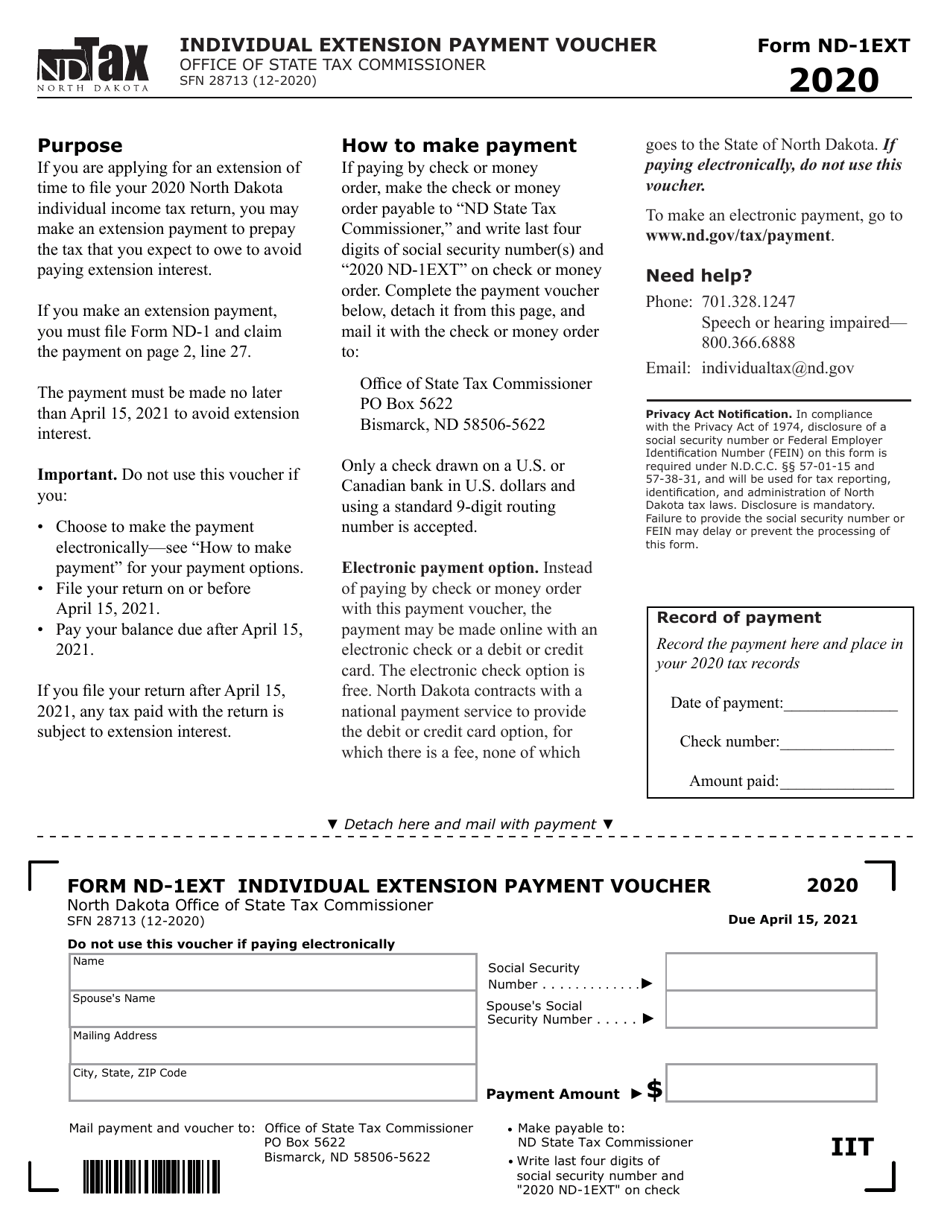

Form ND-1EXT (SFN28713)

for the current year.

Form ND-1EXT (SFN28713) Individual Extension Payment Voucher - North Dakota

What Is Form ND-1EXT (SFN28713)?

This is a legal form that was released by the North Dakota Office of State Tax Commissioner - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ND-1EXT?

A: Form ND-1EXT is the Individual Extension Payment Voucher for North Dakota.

Q: What is the purpose of Form ND-1EXT?

A: Form ND-1EXT is used to make a payment for an individual tax extension in North Dakota.

Q: Do I need to file Form ND-1EXT?

A: You only need to file Form ND-1EXT if you are making a payment for an individual tax extension in North Dakota.

Q: What information is required on Form ND-1EXT?

A: Form ND-1EXT requires your name, address, social security number, payment amount, and the tax year for which the extension is being filed.

Q: When is Form ND-1EXT due?

A: Form ND-1EXT and the payment must be submitted by the original tax filing deadline. The extension provides additional time to file, but not to pay taxes owed.

Q: Can I e-file Form ND-1EXT?

A: Currently, North Dakota does not offer electronic filing for Form ND-1EXT. It must be submitted by mail or in person.

Q: Is there a penalty for late payment with Form ND-1EXT?

A: Yes, there may be penalties and interest for late payments or underpayment of taxes. It is important to pay on time to avoid additional charges.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the North Dakota Office of State Tax Commissioner;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ND-1EXT (SFN28713) by clicking the link below or browse more documents and templates provided by the North Dakota Office of State Tax Commissioner.