This version of the form is not currently in use and is provided for reference only. Download this version of

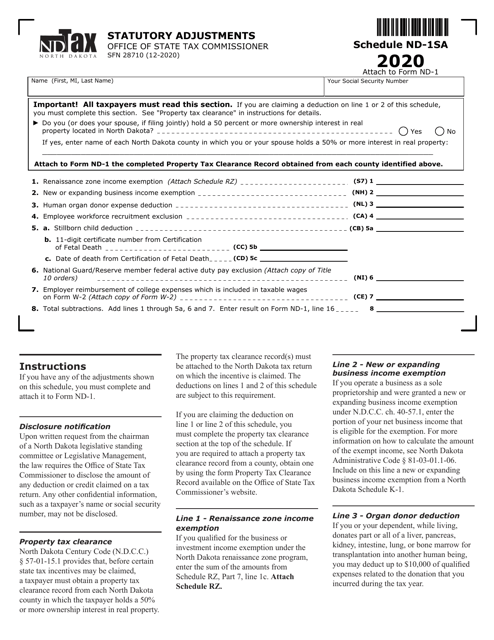

Form SFN28710 Schedule ND-1SA

for the current year.

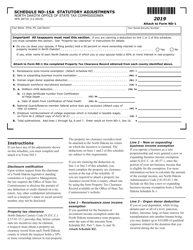

Form SFN28710 Schedule ND-1SA Statutory Adjustments - North Dakota

What Is Form SFN28710 Schedule ND-1SA?

This is a legal form that was released by the North Dakota Office of State Tax Commissioner - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is SFN28710 Schedule ND-1SA?

A: SFN28710 Schedule ND-1SA is a form used for reporting statutory adjustments on North Dakota state tax returns.

Q: What are statutory adjustments?

A: Statutory adjustments are specific items that are required by law to be added or subtracted from the taxpayer's income for tax purposes.

Q: Who needs to file SFN28710 Schedule ND-1SA?

A: Taxpayers who have statutory adjustments to report on their North Dakota state tax returns need to file SFN28710 Schedule ND-1SA.

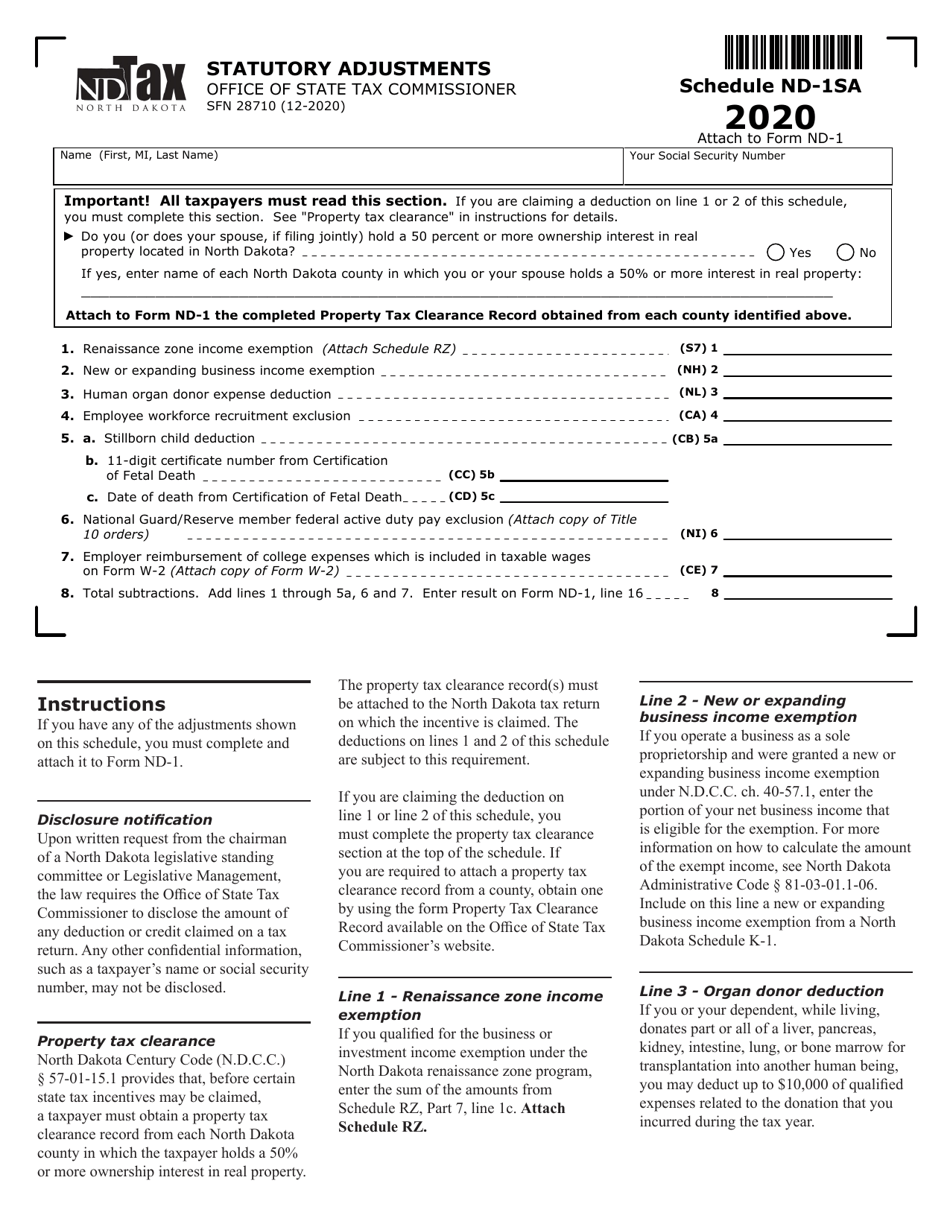

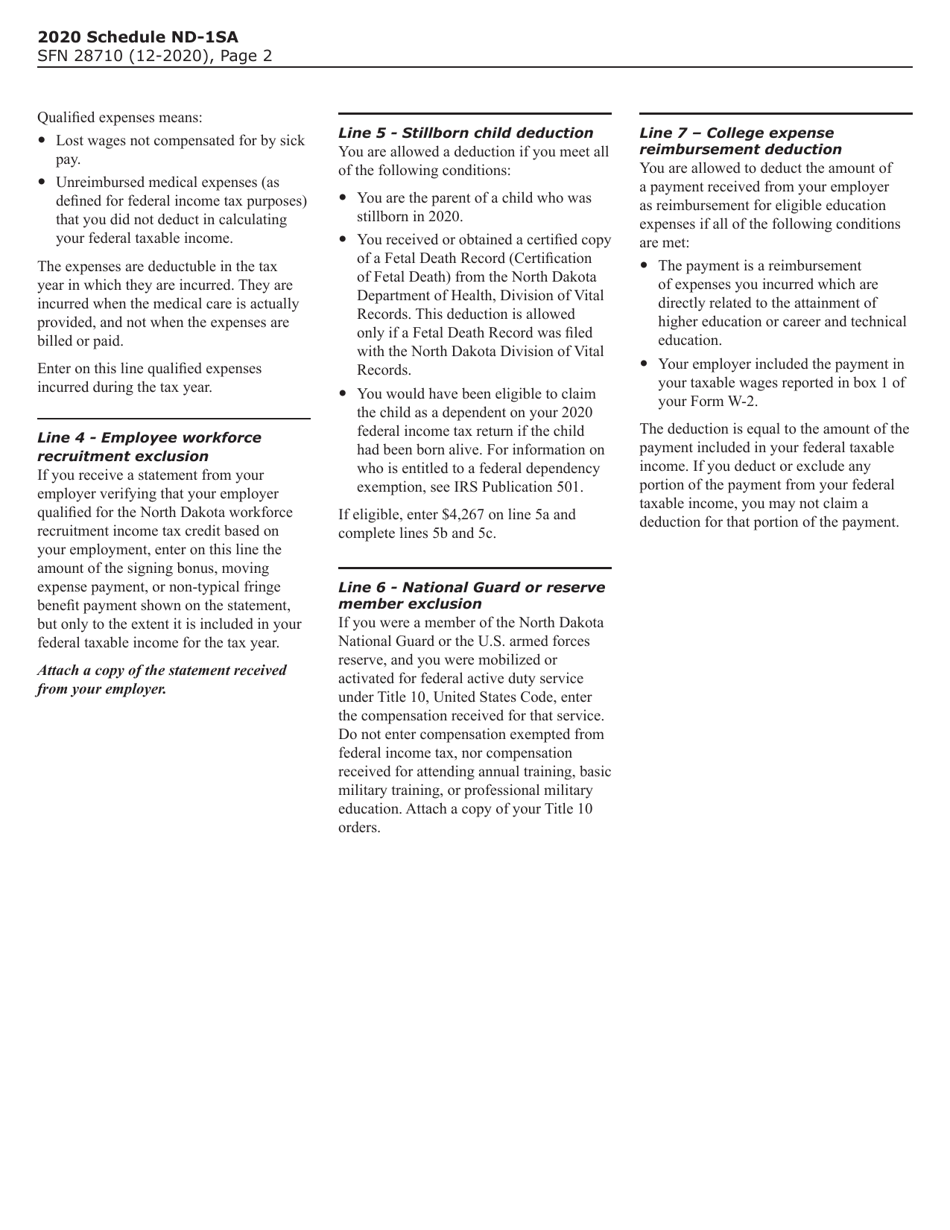

Q: How do I fill out SFN28710 Schedule ND-1SA?

A: You need to provide the necessary information and calculations related to the statutory adjustments as instructed on the form.

Q: When is the deadline to file SFN28710 Schedule ND-1SA?

A: The deadline to file SFN28710 Schedule ND-1SA is usually the same as the deadline for filing your North Dakota state tax return, which is April 15th.

Q: Are there any penalties for not filing SFN28710 Schedule ND-1SA?

A: Failure to file SFN28710 Schedule ND-1SA or reporting incorrect information may result in penalties or additional taxes owed.

Q: Can I e-file SFN28710 Schedule ND-1SA?

A: Yes, you can e-file SFN28710 Schedule ND-1SA if you are using an approved tax preparation software or working with a tax professional who offers e-filing services.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the North Dakota Office of State Tax Commissioner;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SFN28710 Schedule ND-1SA by clicking the link below or browse more documents and templates provided by the North Dakota Office of State Tax Commissioner.