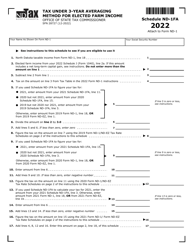

This version of the form is not currently in use and is provided for reference only. Download this version of

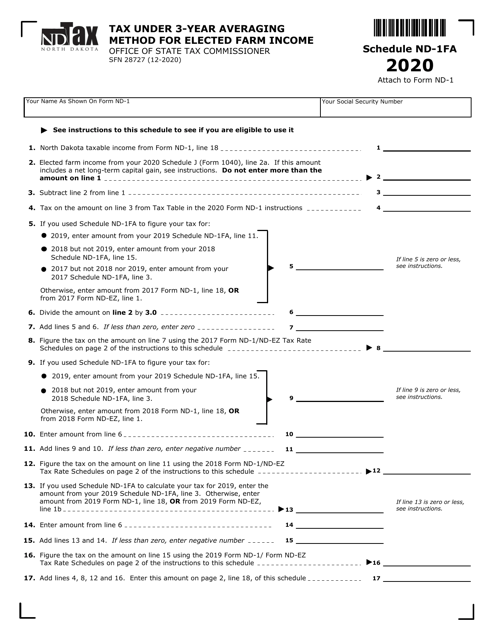

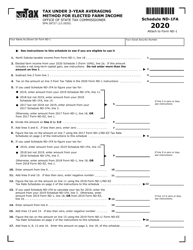

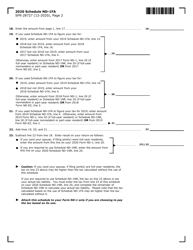

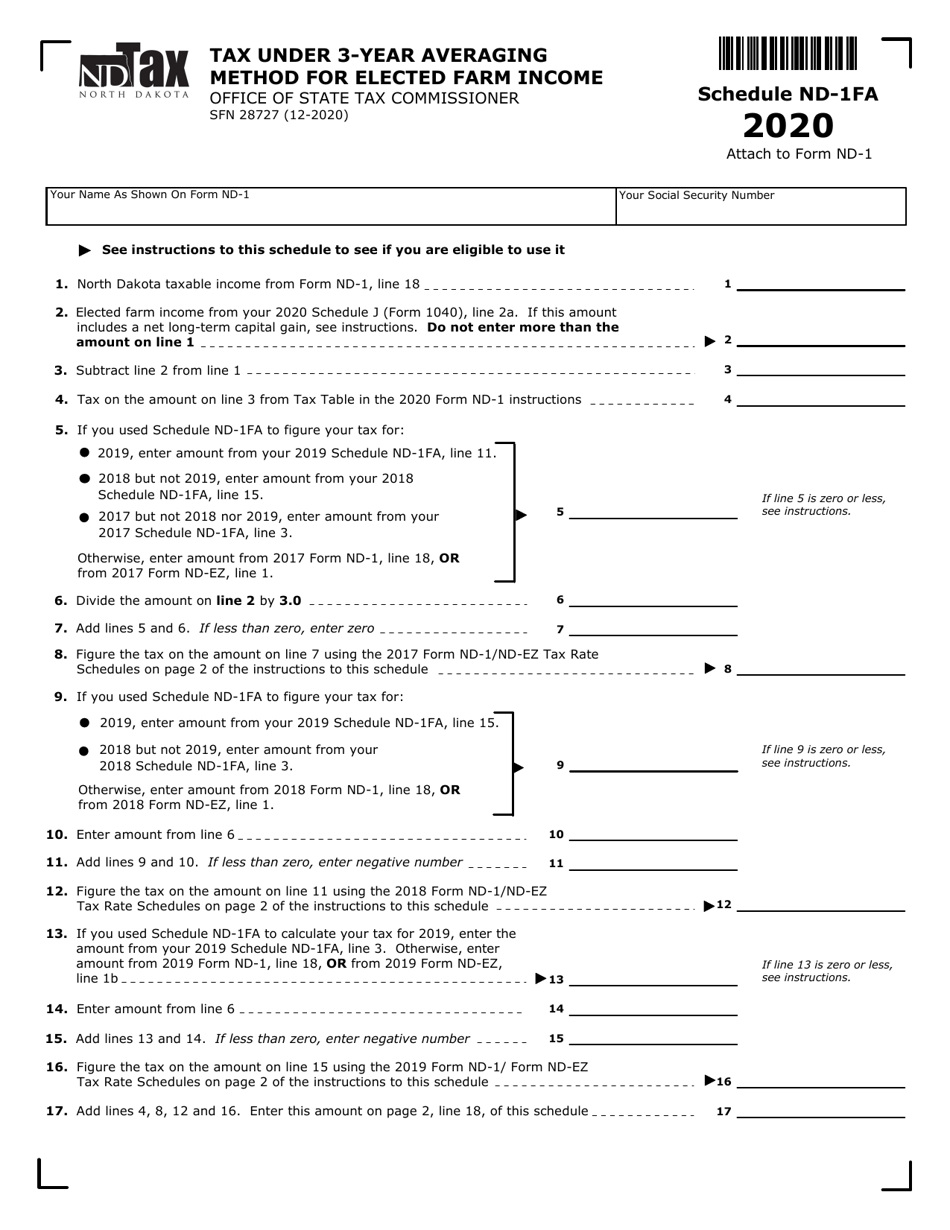

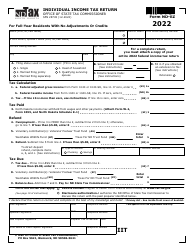

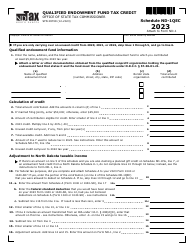

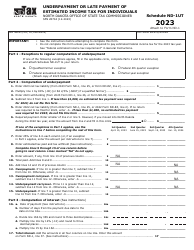

Form SFN28727 Schedule ND-1FA

for the current year.

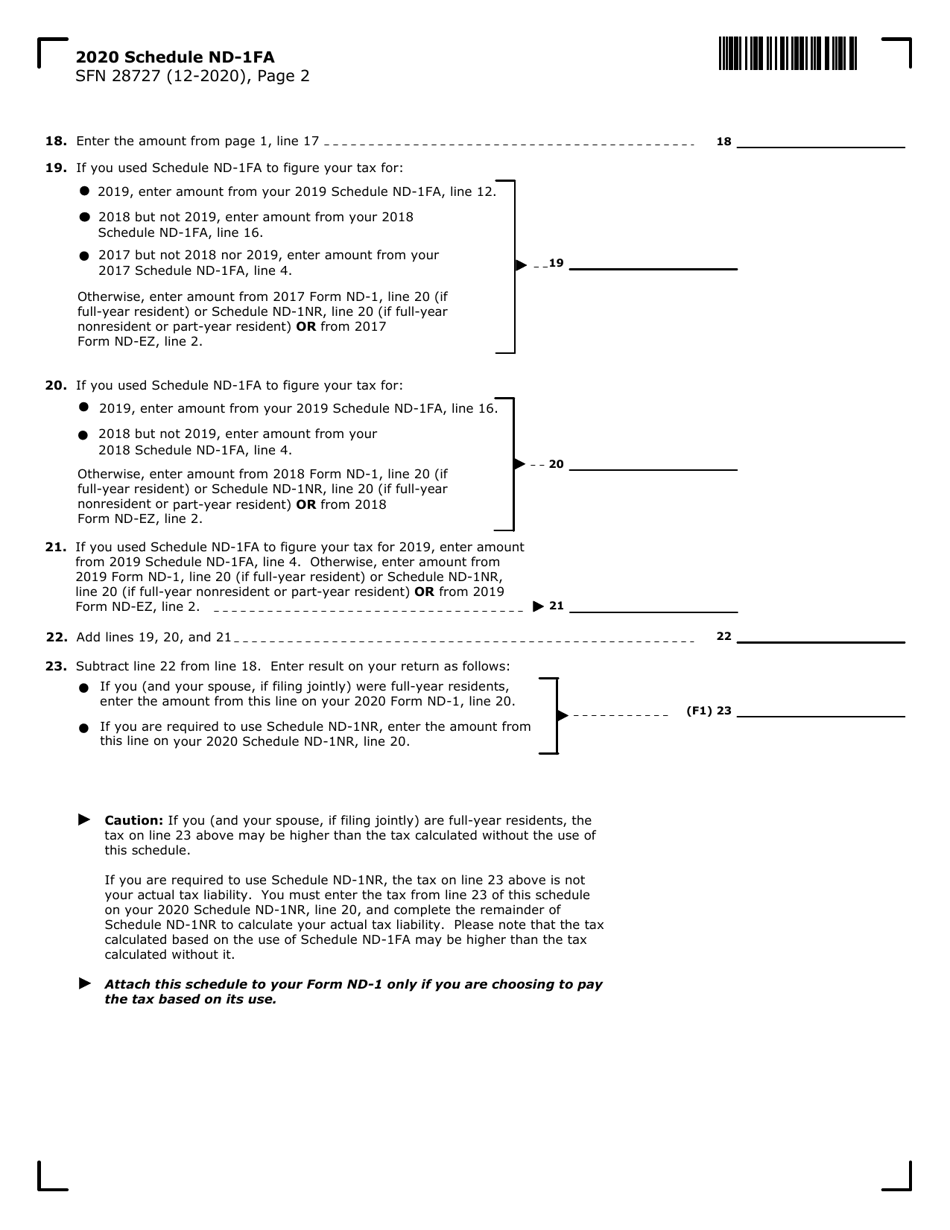

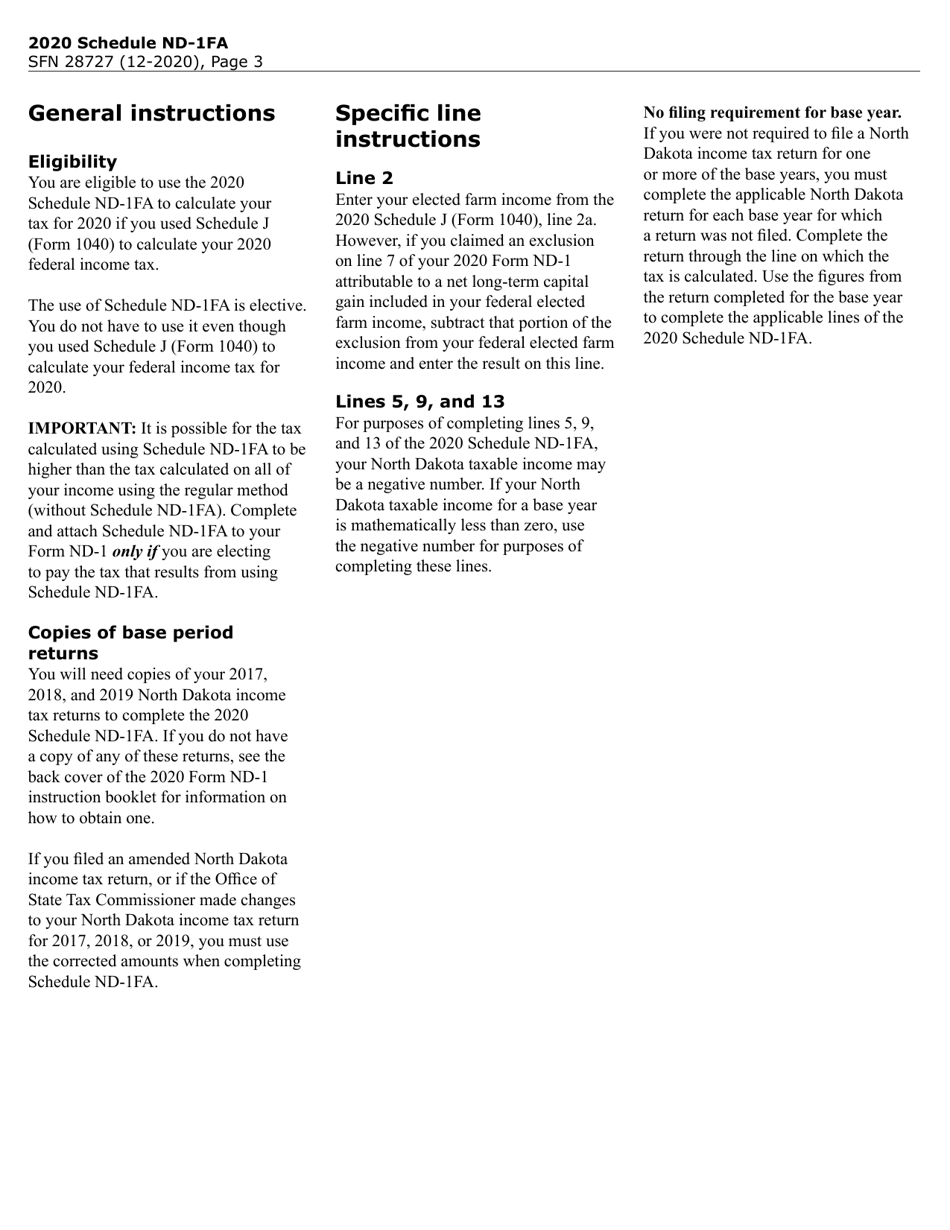

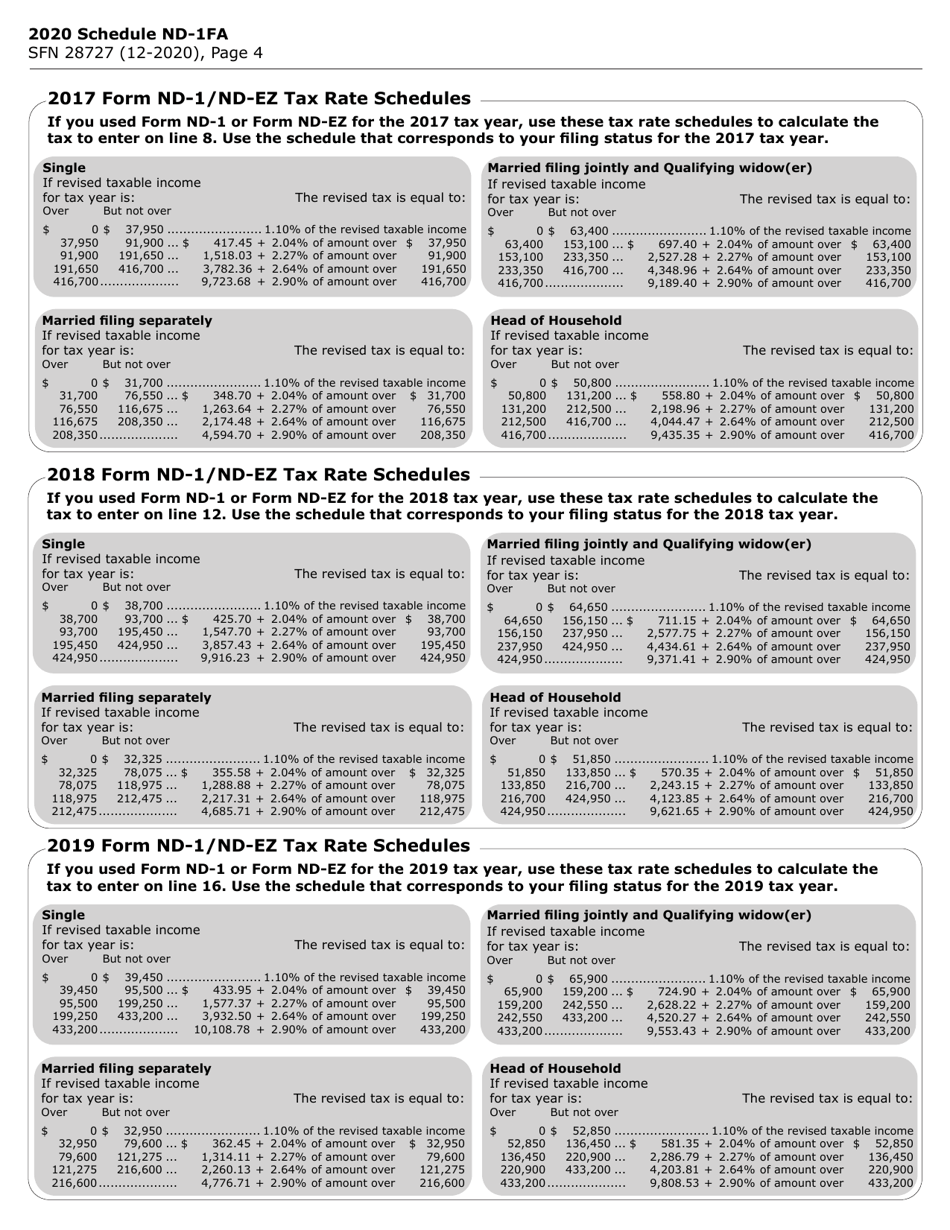

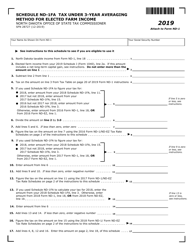

Form SFN28727 Schedule ND-1FA Tax Under 3-year Averaging Method for Elected Farm Income - North Dakota

What Is Form SFN28727 Schedule ND-1FA?

This is a legal form that was released by the North Dakota Office of State Tax Commissioner - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

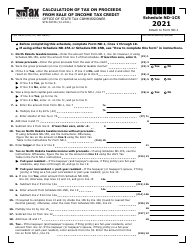

Q: What is Form SFN28727?

A: Form SFN28727 is a form used to schedule the ND-1FA tax under the 3-year averaging method for elected farm income in North Dakota.

Q: What is the ND-1FA tax?

A: The ND-1FA tax is a tax calculation method for elected farm income in North Dakota.

Q: What is the 3-year averaging method?

A: The 3-year averaging method is a tax calculation method that allows farmers to average their income over a three-year period.

Q: Who can use the 3-year averaging method?

A: Farmers in North Dakota who meet certain criteria can use the 3-year averaging method for their elected farm income.

Q: What is elected farm income?

A: Elected farm income refers to the income derived from farming activities that is eligible for the 3-year averaging method.

Q: Why would someone choose the 3-year averaging method?

A: Farmers may choose the 3-year averaging method to reduce their tax liability by spreading out their income over a longer period.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the North Dakota Office of State Tax Commissioner;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SFN28727 Schedule ND-1FA by clicking the link below or browse more documents and templates provided by the North Dakota Office of State Tax Commissioner.