This version of the form is not currently in use and is provided for reference only. Download this version of

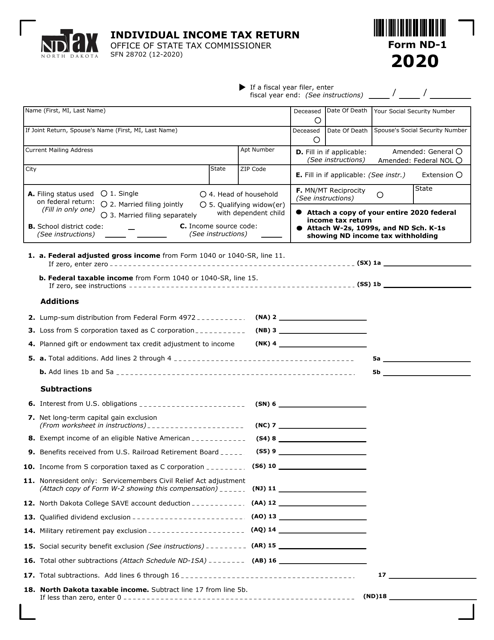

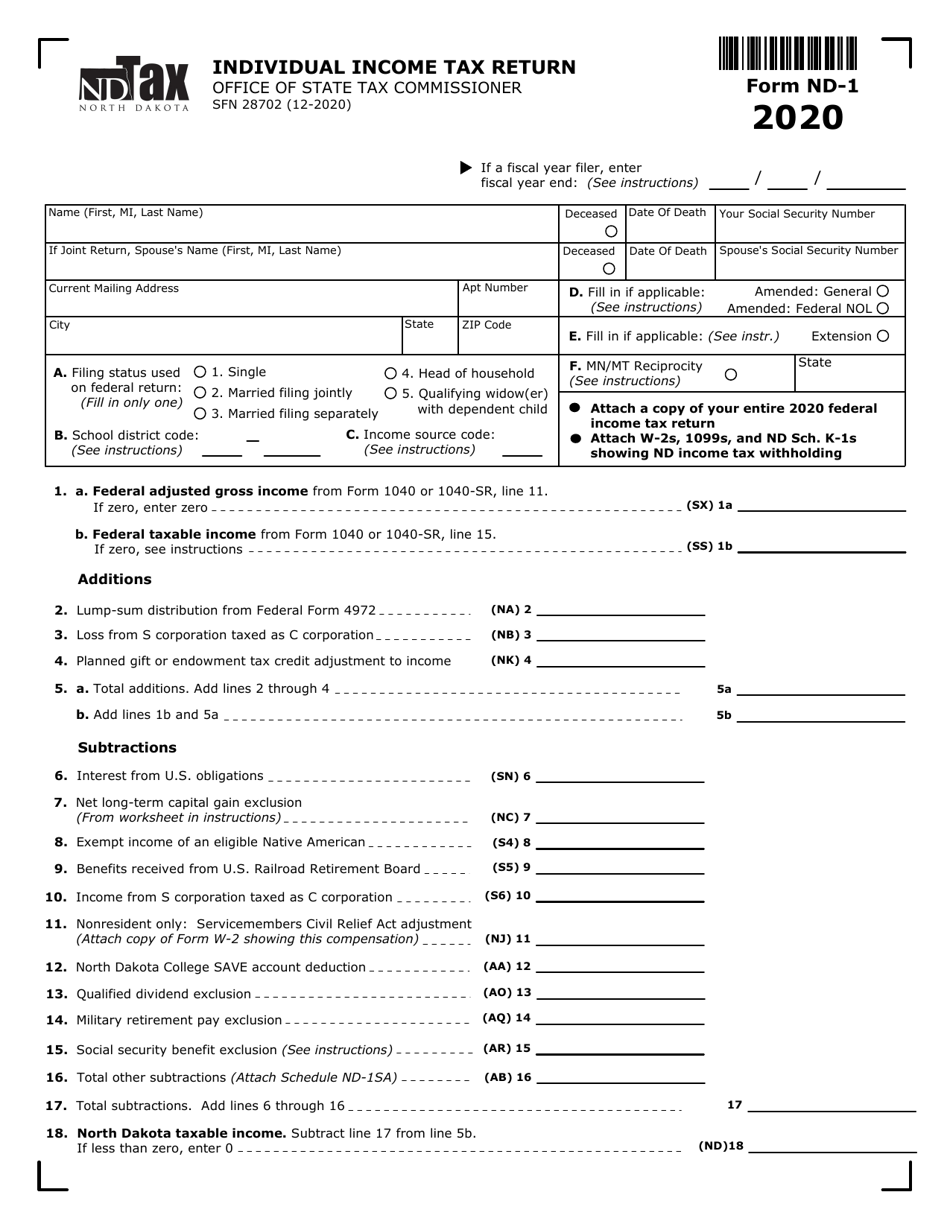

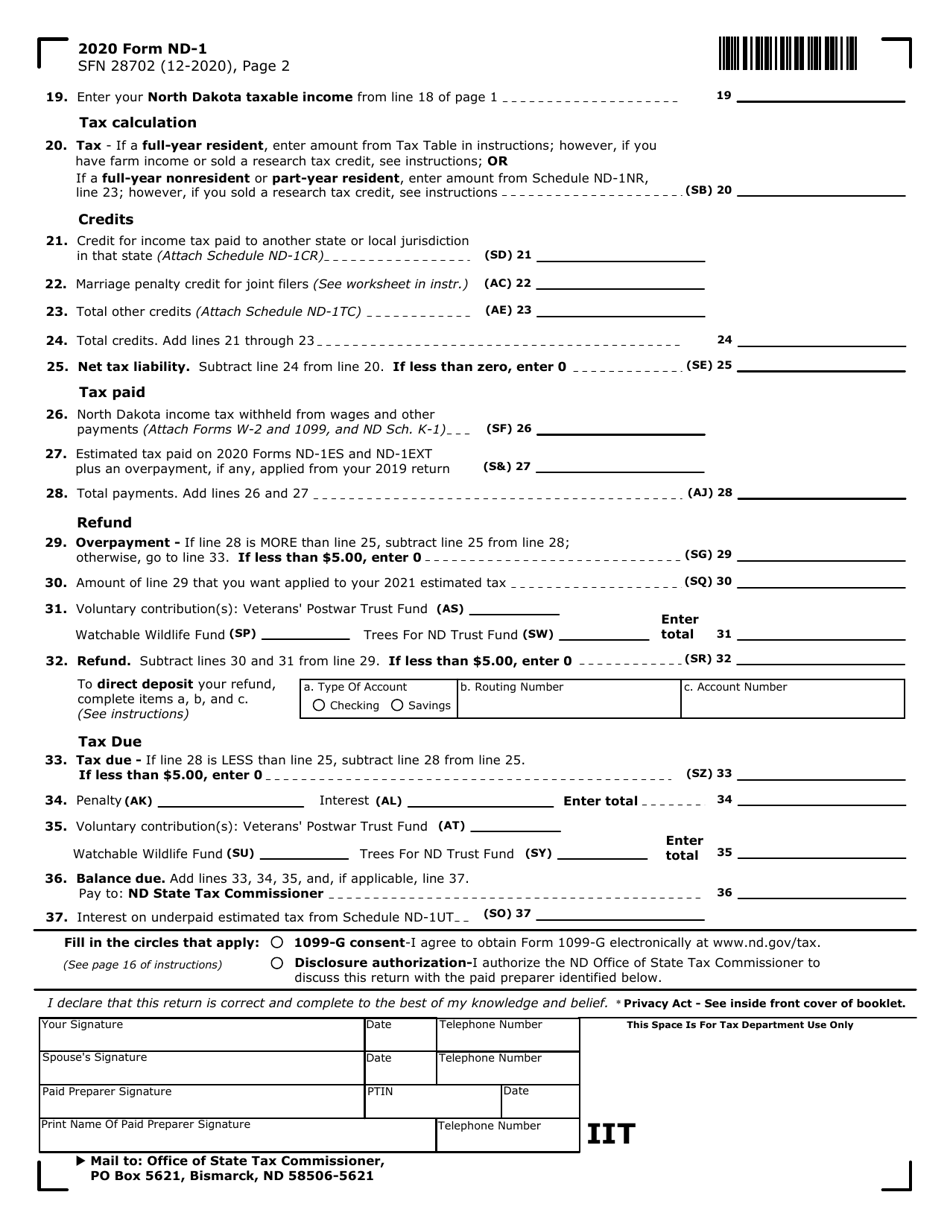

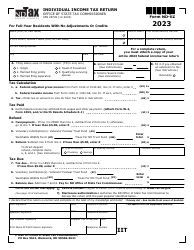

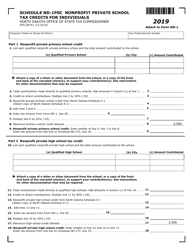

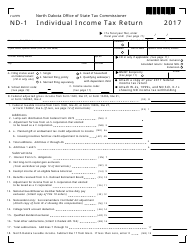

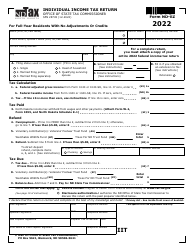

Form ND-1 (SFN28702)

for the current year.

Form ND-1 (SFN28702) Individual Income Tax Return - North Dakota

What Is Form ND-1 (SFN28702)?

This is a legal form that was released by the North Dakota Office of State Tax Commissioner - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ND-1?

A: Form ND-1 is the Individual Income Tax Return for residents of North Dakota.

Q: Who needs to file Form ND-1?

A: Residents of North Dakota who have taxable income or meet certain filing requirements need to file Form ND-1.

Q: What is the purpose of Form ND-1?

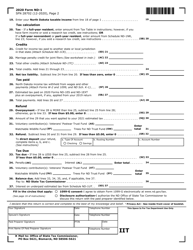

A: Form ND-1 is used to report income, deductions, and credits to calculate the tax liability or refund for North Dakota residents.

Q: When is the deadline to file Form ND-1?

A: The deadline to file Form ND-1 is April 15th, or the following business day if it falls on a weekend or holiday.

Q: Are there any specific instructions for completing Form ND-1?

A: Yes, the instructions for Form ND-1 provide detailed information on how to complete the form accurately.

Q: What if I need more time to file Form ND-1?

A: You can request a six-month extension to file your Form ND-1 using Form 101, Application for Automatic Extension of Time to File.

Q: What if I have questions or need assistance with Form ND-1?

A: You can contact the North Dakota State Tax Department directly or seek assistance from a tax professional.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the North Dakota Office of State Tax Commissioner;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ND-1 (SFN28702) by clicking the link below or browse more documents and templates provided by the North Dakota Office of State Tax Commissioner.