This version of the form is not currently in use and is provided for reference only. Download this version of

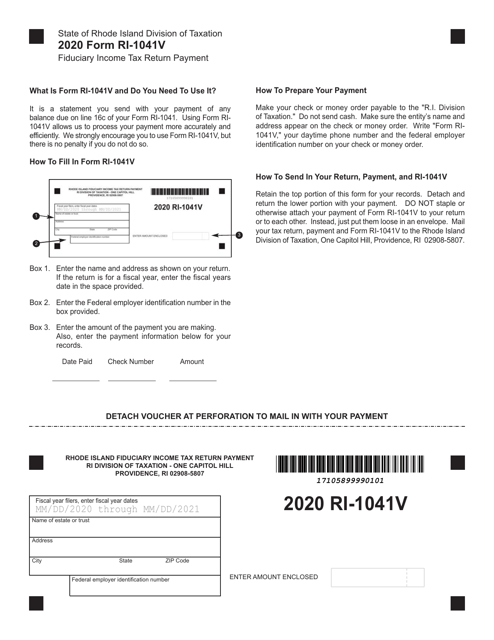

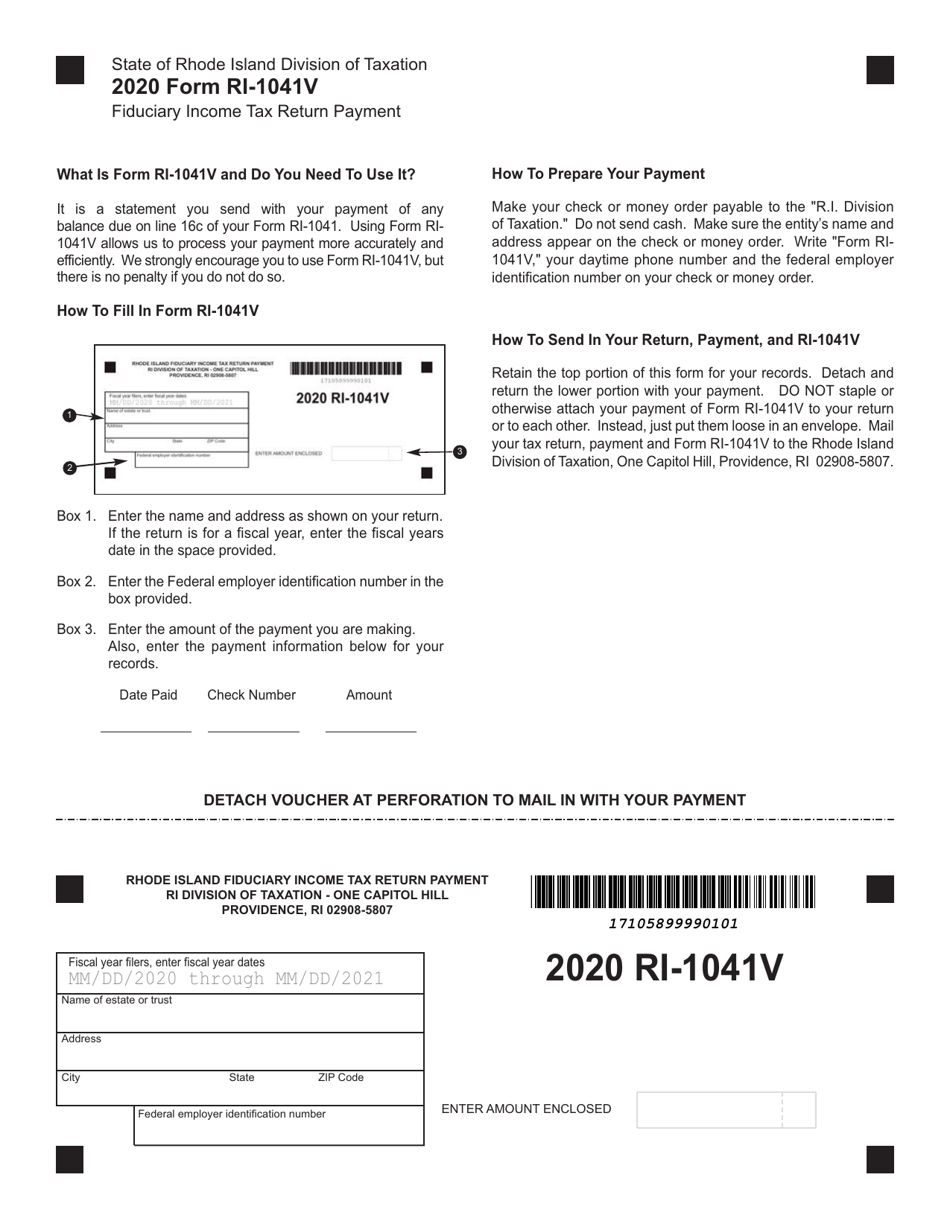

Form RI-1041V

for the current year.

Form RI-1041V Fiduciary Income Tax Return Payment Voucher - Rhode Island

What Is Form RI-1041V?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RI-1041V?

A: Form RI-1041V is the Fiduciary Income Tax Return Payment Voucher specifically for Rhode Island.

Q: Who needs to use Form RI-1041V?

A: Fiduciaries who are filing their income tax returns in Rhode Island need to use Form RI-1041V.

Q: What is the purpose of Form RI-1041V?

A: The purpose of Form RI-1041V is to provide a payment voucher to submit with the payment for the Rhode Island Fiduciary Income Tax Return.

Q: Can I file Form RI-1041V electronically?

A: No, Form RI-1041V cannot be filed electronically. It must be submitted by mail with the payment.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RI-1041V by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.