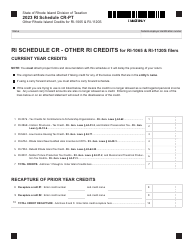

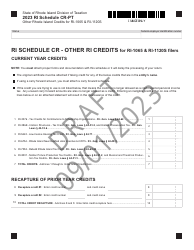

This version of the form is not currently in use and is provided for reference only. Download this version of

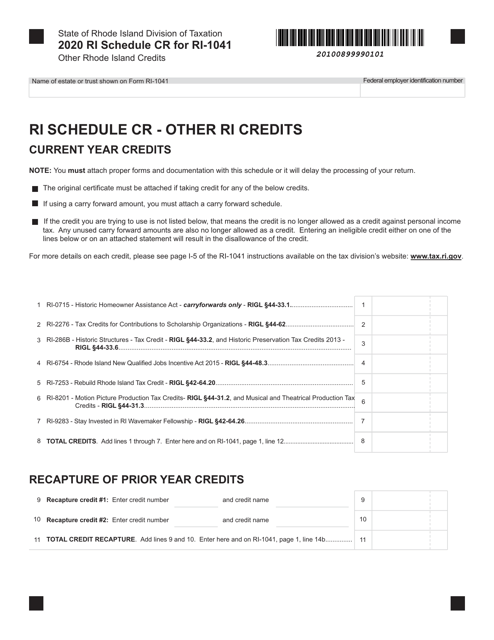

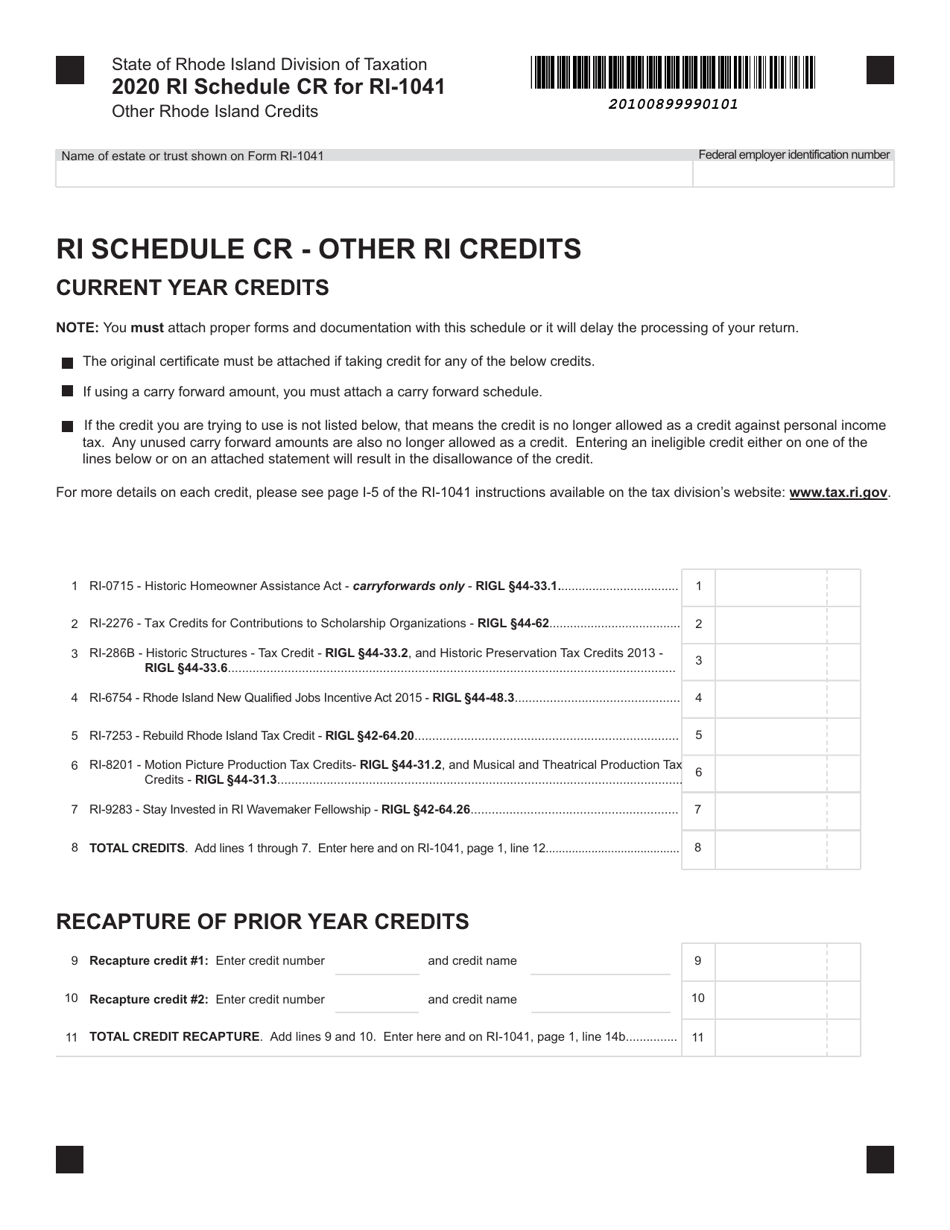

Form RI-1041 Schedule CR

for the current year.

Form RI-1041 Schedule CR Other Rhode Island Credits - Rhode Island

What Is Form RI-1041 Schedule CR?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island.The document is a supplement to Form RI-1041, Fiduciary Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RI-1041 Schedule CR?

A: Form RI-1041 Schedule CR is a tax form used to claim other Rhode Island credits for estates and trusts.

Q: What are other Rhode Island credits?

A: Other Rhode Island credits refer to tax credits that can be claimed by estates and trusts in Rhode Island, in addition to the standard tax credits.

Q: Who needs to file Form RI-1041 Schedule CR?

A: Estates and trusts that are required to file a Rhode Island income tax return and have eligible tax credits to claim should file Form RI-1041 Schedule CR.

Q: What information is required to complete Form RI-1041 Schedule CR?

A: To complete Form RI-1041 Schedule CR, you will need to provide information about your estate or trust and the specific tax credits you are claiming.

Q: When is the deadline to file Form RI-1041 Schedule CR?

A: The deadline to file Form RI-1041 Schedule CR is the same as the deadline for filing the Rhode Island income tax return for estates and trusts.

Q: Can I e-file Form RI-1041 Schedule CR?

A: Yes, you can e-file Form RI-1041 Schedule CR if you are filing your Rhode Island income tax return electronically.

Q: Are there any penalties for not filing Form RI-1041 Schedule CR?

A: Failure to file Form RI-1041 Schedule CR or providing false information may result in penalties imposed by the Rhode Island Department of Revenue.

Q: Can I claim multiple Rhode Island credits on Form RI-1041 Schedule CR?

A: Yes, you can claim multiple Rhode Island credits on Form RI-1041 Schedule CR, as long as you meet the eligibility requirements for each credit.

Q: Do I need to attach any additional documents to Form RI-1041 Schedule CR?

A: You may need to attach supporting documents or worksheets to Form RI-1041 Schedule CR, depending on the specific credits you are claiming.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RI-1041 Schedule CR by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.