This version of the form is not currently in use and is provided for reference only. Download this version of

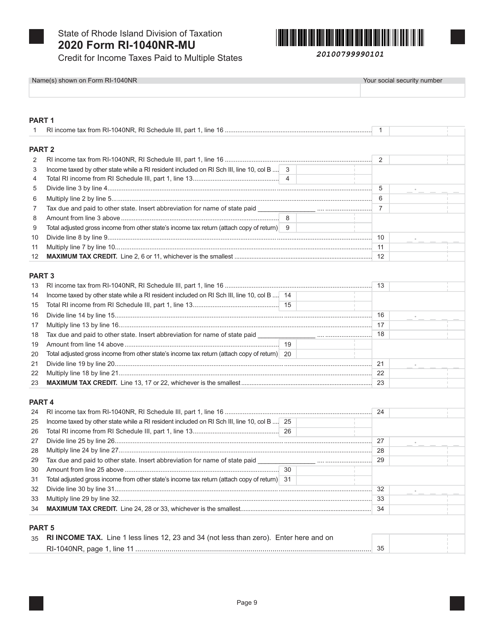

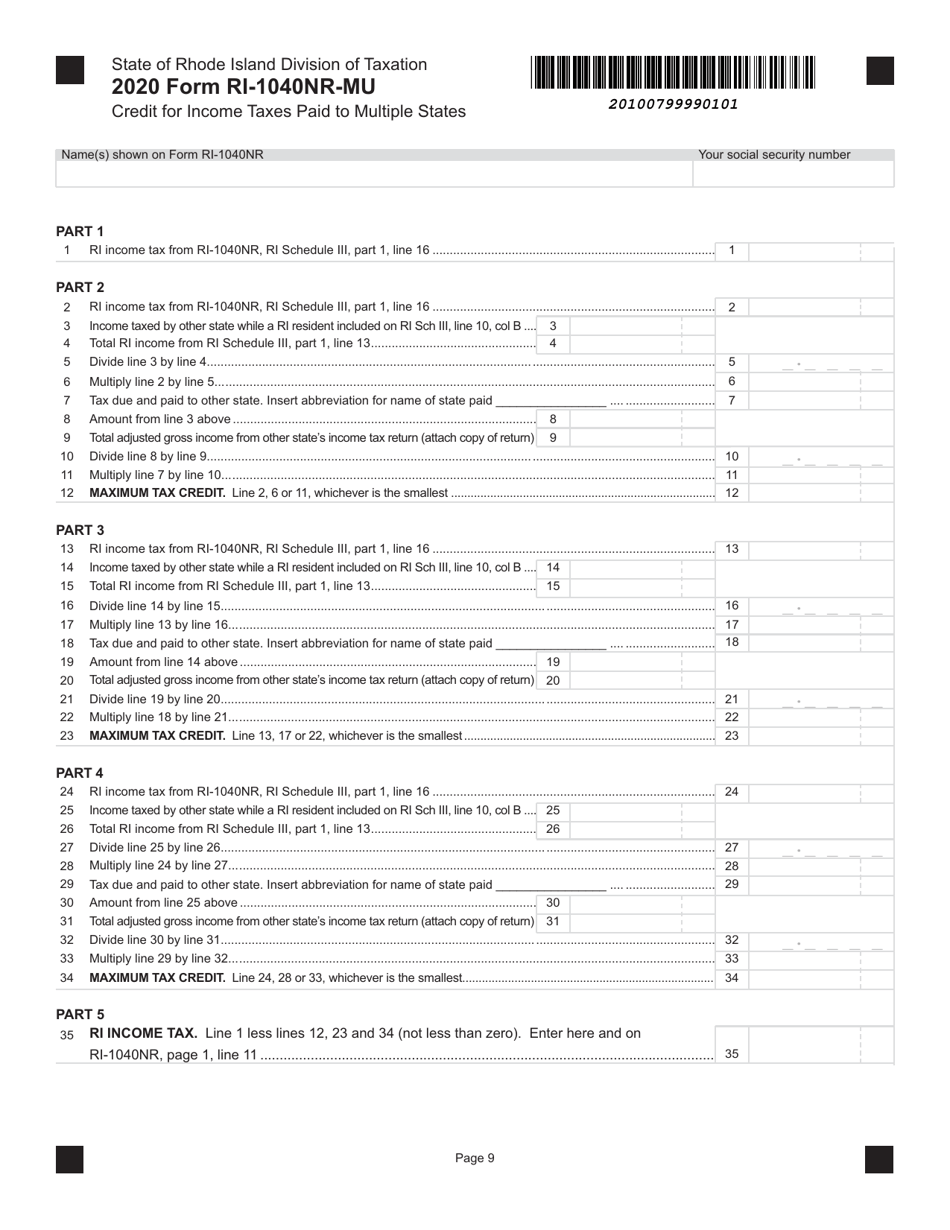

Form RI-1040NR-MU

for the current year.

Form RI-1040NR-MU Credit for Income Taxes Paid to Multiple States - Rhode Island

What Is Form RI-1040NR-MU?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RI-1040NR-MU?

A: Form RI-1040NR-MU is the Rhode Island tax form used by nonresidents or part-year residents to claim a credit for income taxes paid to multiple states.

Q: Who is eligible to use Form RI-1040NR-MU?

A: Nonresidents or part-year residents of Rhode Island who have income from other states and have paid income taxes to those states.

Q: What is the purpose of Form RI-1040NR-MU?

A: The purpose of this form is to calculate and claim a credit for income taxes paid to multiple states, reducing the taxpayer's overall tax liability.

Q: What information is required on Form RI-1040NR-MU?

A: The form requires information about the taxpayer's residence status, income from various states, and the taxes paid to those states.

Q: When is Form RI-1040NR-MU due?

A: The due date for Form RI-1040NR-MU is the same as the regular Rhode Island income tax return, which is typically April 15th.

Q: Is there a fee for filing Form RI-1040NR-MU?

A: No, there is no fee for filing Form RI-1040NR-MU, it is free to file.

Q: Do I need to include copies of my tax returns from other states with Form RI-1040NR-MU?

A: No, you do not need to include copies of your tax returns from other states with Form RI-1040NR-MU. However, you should keep them for your records.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RI-1040NR-MU by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.