This version of the form is not currently in use and is provided for reference only. Download this version of

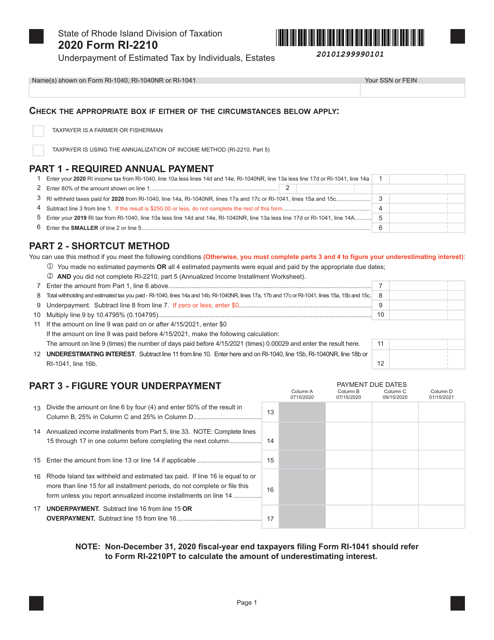

Form RI-2210

for the current year.

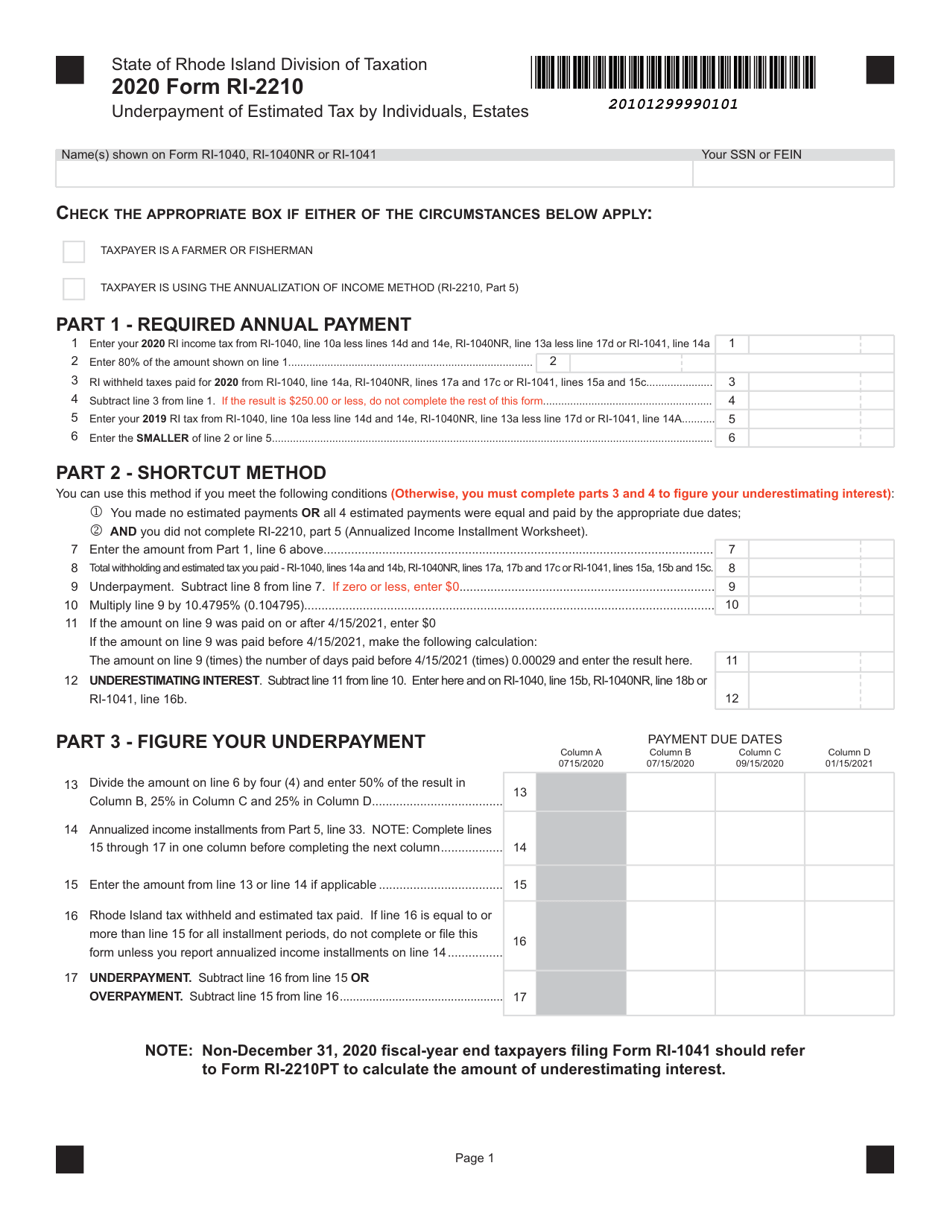

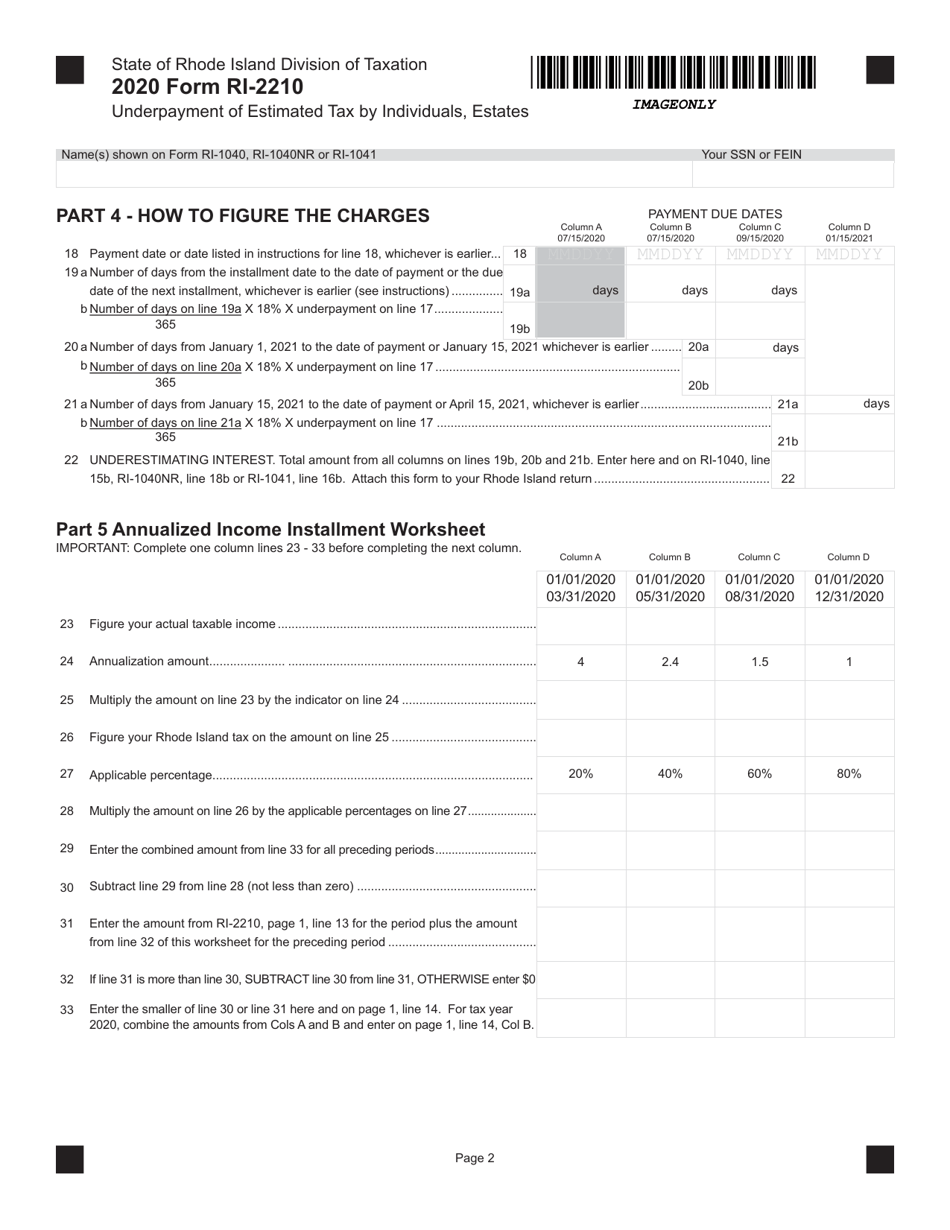

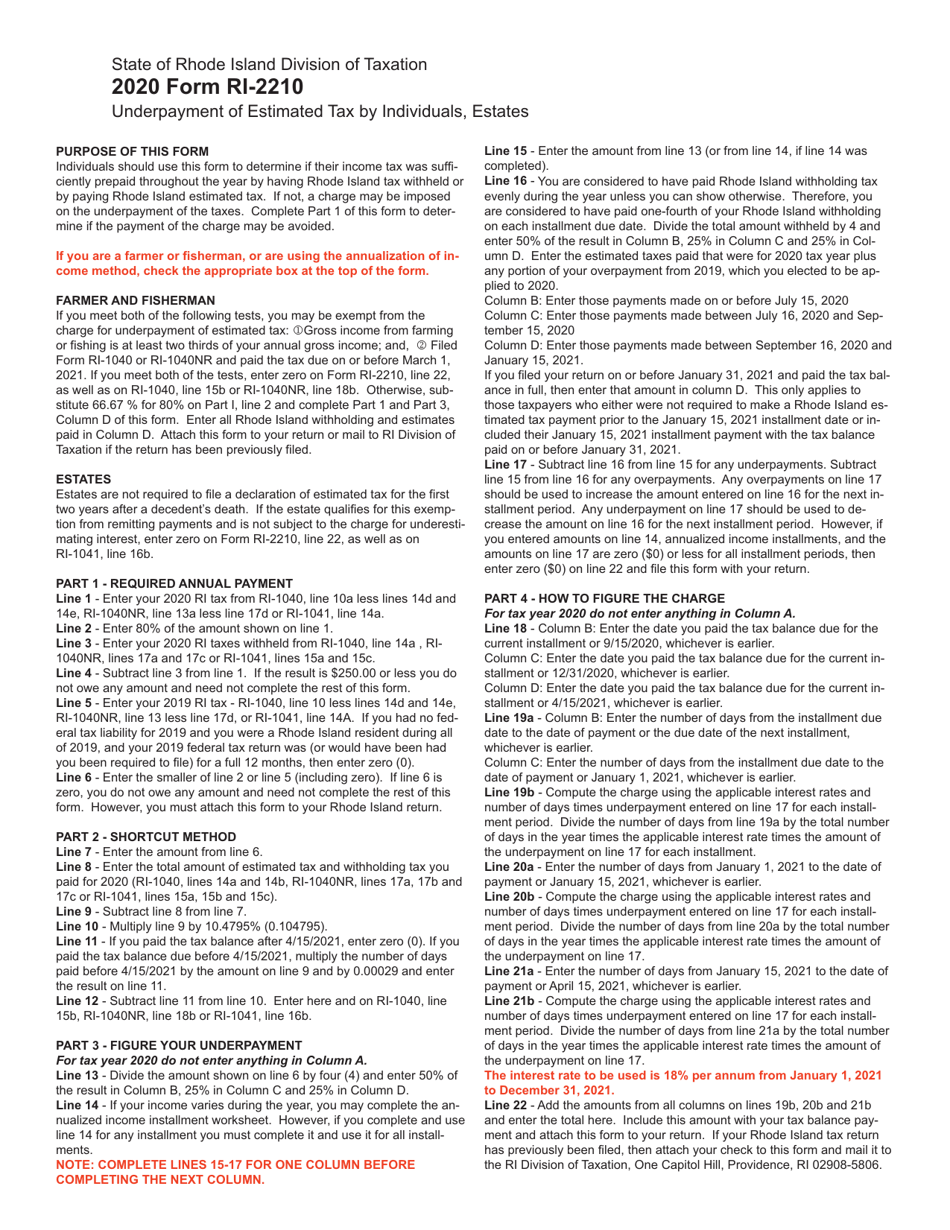

Form RI-2210 Underpayment of Estimated Tax by Individuals, Estates - Rhode Island

What Is Form RI-2210?

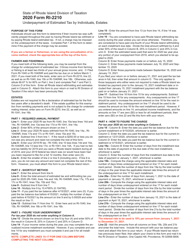

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form RI-2210?

A: Form RI-2210 is used to calculate the underpayment of estimated tax by individuals and estates in Rhode Island.

Q: Who needs to file form RI-2210?

A: Individuals and estates who have underpaid their estimated tax in Rhode Island may need to file form RI-2210.

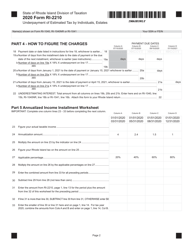

Q: How do I calculate the underpayment of estimated tax?

A: Form RI-2210 provides a worksheet to help you calculate your underpayment of estimated tax.

Q: When is form RI-2210 due?

A: Form RI-2210 is generally due at the same time as your Rhode Island income tax return.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RI-2210 by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.