This version of the form is not currently in use and is provided for reference only. Download this version of

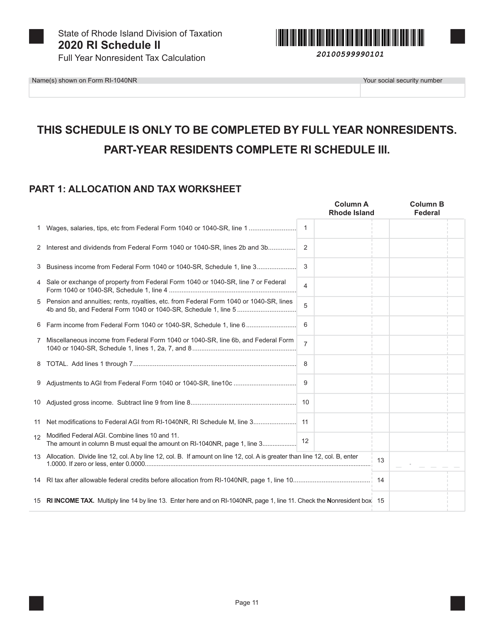

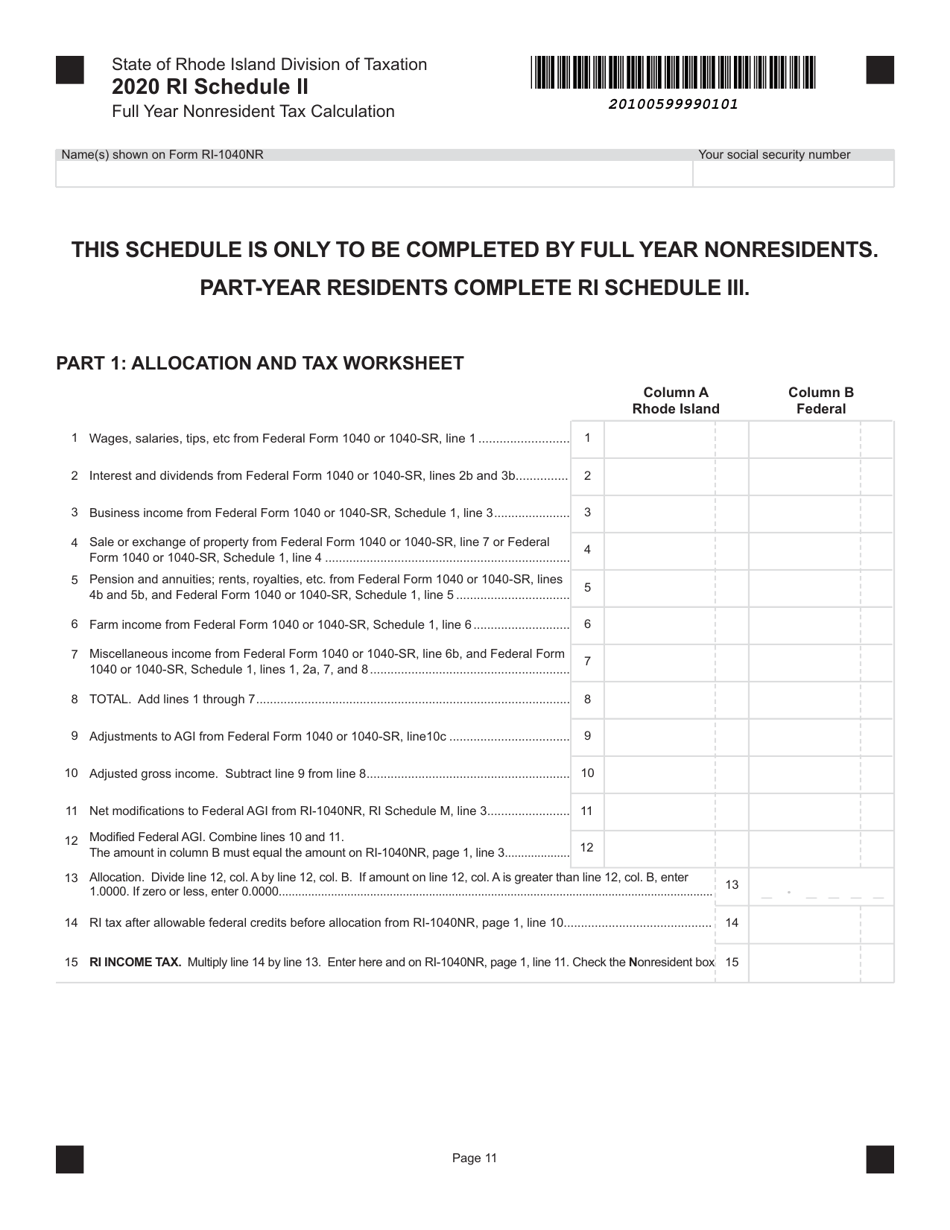

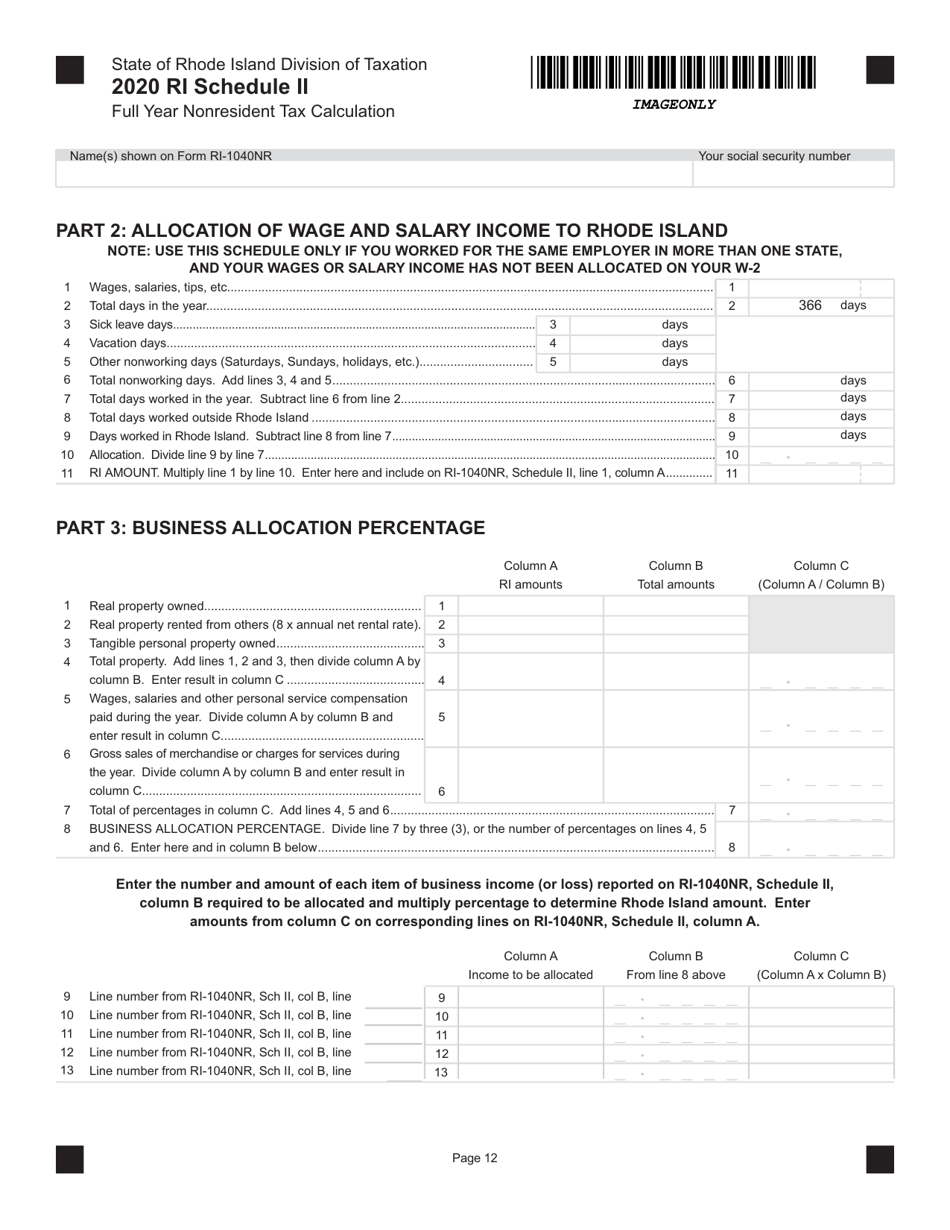

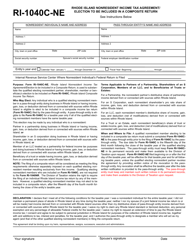

Form RI-1040NR Schedule II

for the current year.

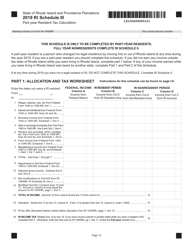

Form RI-1040NR Schedule II Full Year Nonresident Tax Calculation - Rhode Island

What Is Form RI-1040NR Schedule II?

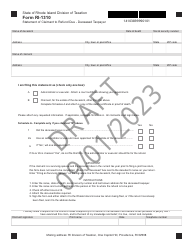

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island.The document is a supplement to Form RI-1040NR, Nonresident Individual Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

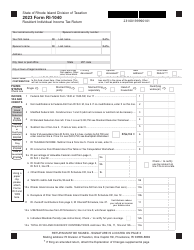

Q: What is the RI-1040NR Schedule II?

A: RI-1040NR Schedule II is a form used for calculating nonresident tax in Rhode Island.

Q: Who needs to use the RI-1040NR Schedule II?

A: Nonresidents who earned income in Rhode Island and need to calculate their tax liability.

Q: What information is needed to fill out the RI-1040NR Schedule II?

A: You will need to provide your personal information, details about your income earned in Rhode Island, deductions, and credits.

Q: How do I calculate my nonresident tax using the RI-1040NR Schedule II?

A: Follow the instructions on the form to calculate your taxable income, apply the appropriate tax rates, and determine your tax liability.

Q: Are there any special considerations for nonresident taxpayers in Rhode Island?

A: Yes, nonresident taxpayers in Rhode Island may be eligible for certain deductions and credits that can help reduce their tax liability.

Q: What if I have questions or need assistance with the RI-1040NR Schedule II?

A: You can contact the Rhode Island Division of Taxation directly for assistance with the form or any related questions.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RI-1040NR Schedule II by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.