This version of the form is not currently in use and is provided for reference only. Download this version of

Schedule M

for the current year.

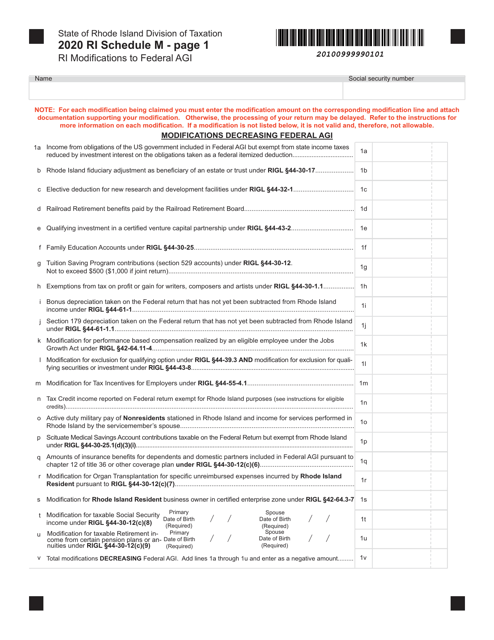

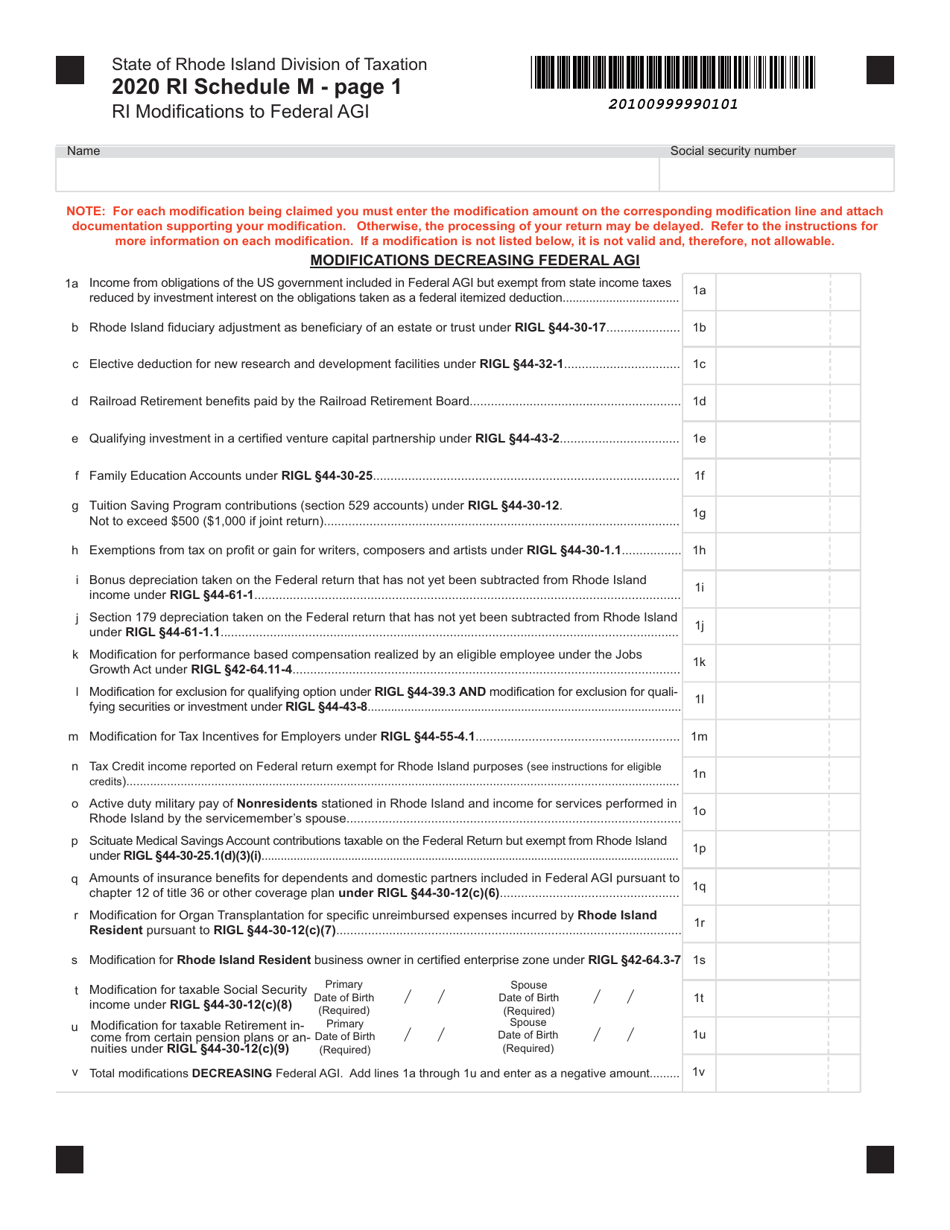

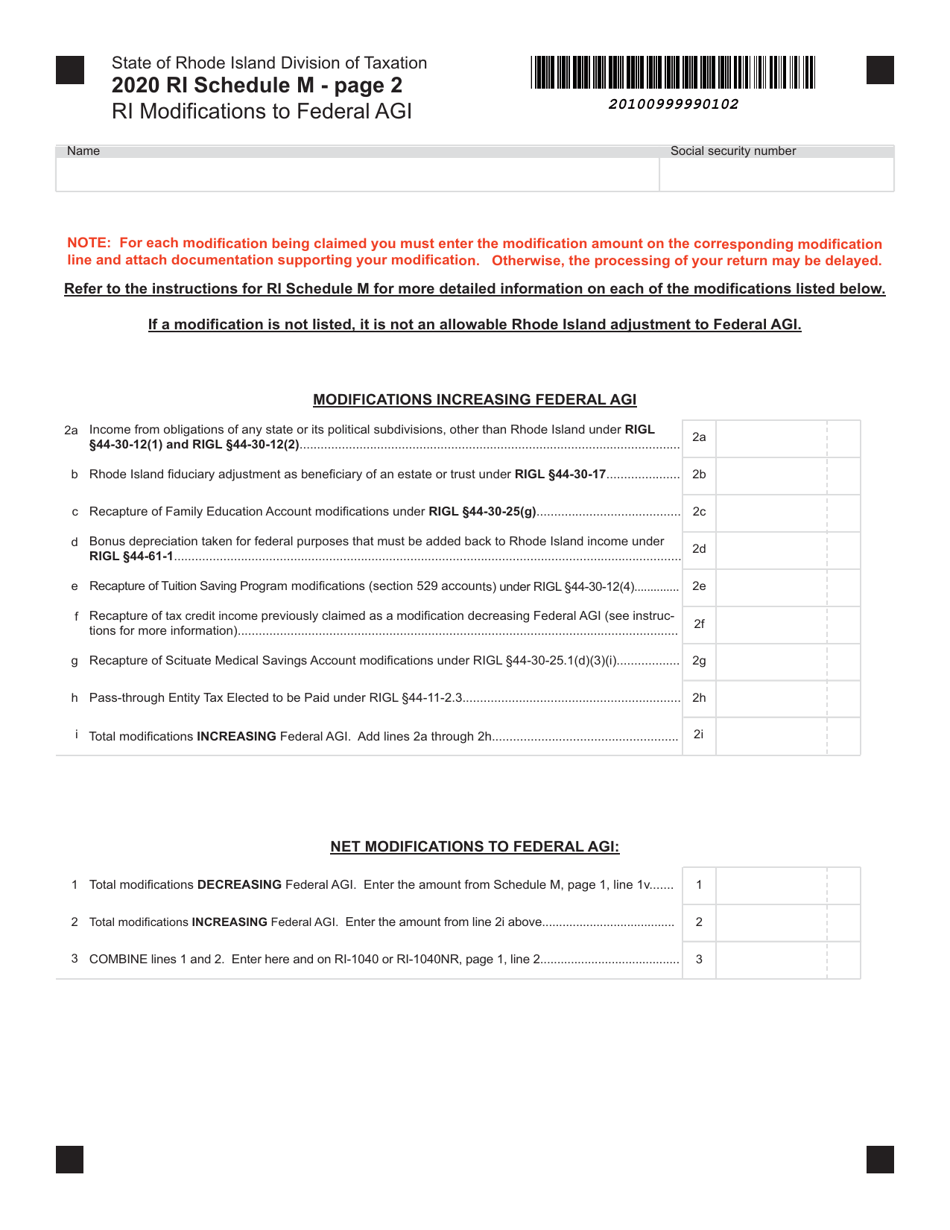

Schedule M Ri(modifications to Federal Agi - Rhode Island

What Is Schedule M?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule M Ri?

A: Schedule M Ri refers to the modifications to Federal Adjusted Gross Income (AGI) specific to the state of Rhode Island.

Q: What is Federal Adjusted Gross Income (AGI)?

A: Federal Adjusted Gross Income (AGI) is the income amount used to calculate federal income tax.

Q: Why does Rhode Island have modifications to Federal AGI?

A: Rhode Island applies modifications to Federal AGI in order to determine the state's taxable income.

Q: What are some examples of modifications made to Federal AGI in Rhode Island?

A: Examples include Rhode Island income tax refunds, certain retirement income exclusions, and deductions for certain insurance premiums.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule M by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.