This version of the form is not currently in use and is provided for reference only. Download this version of

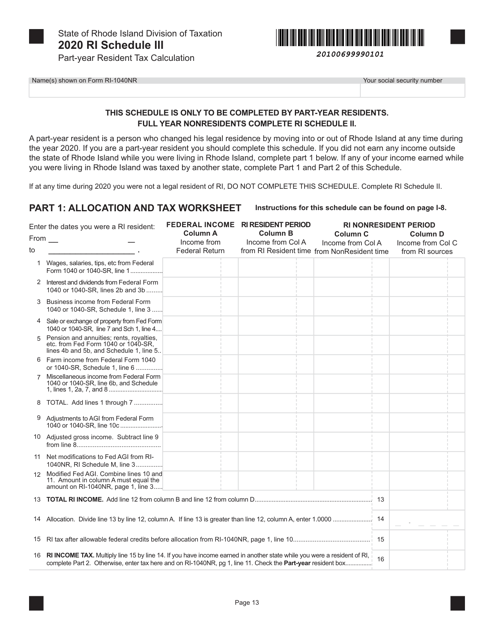

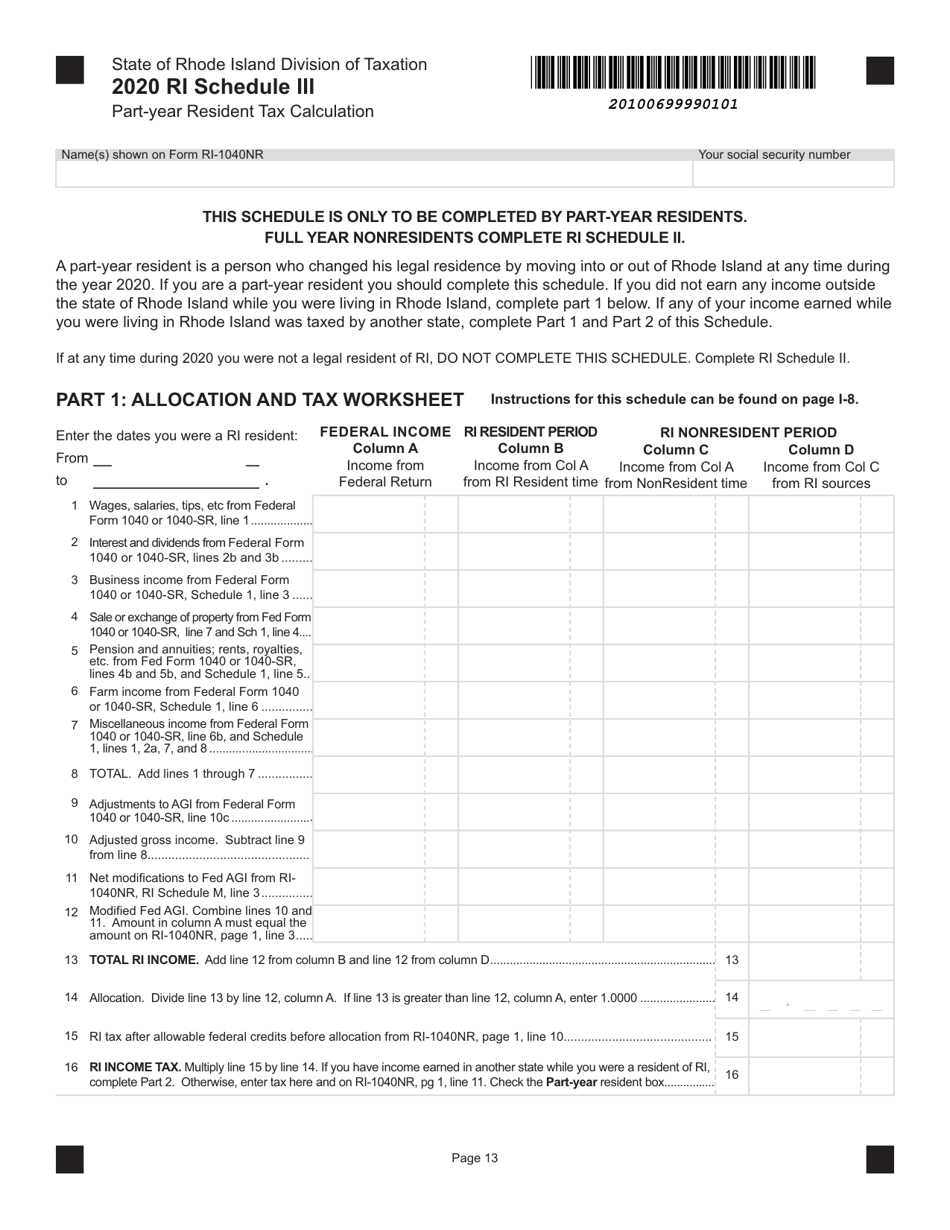

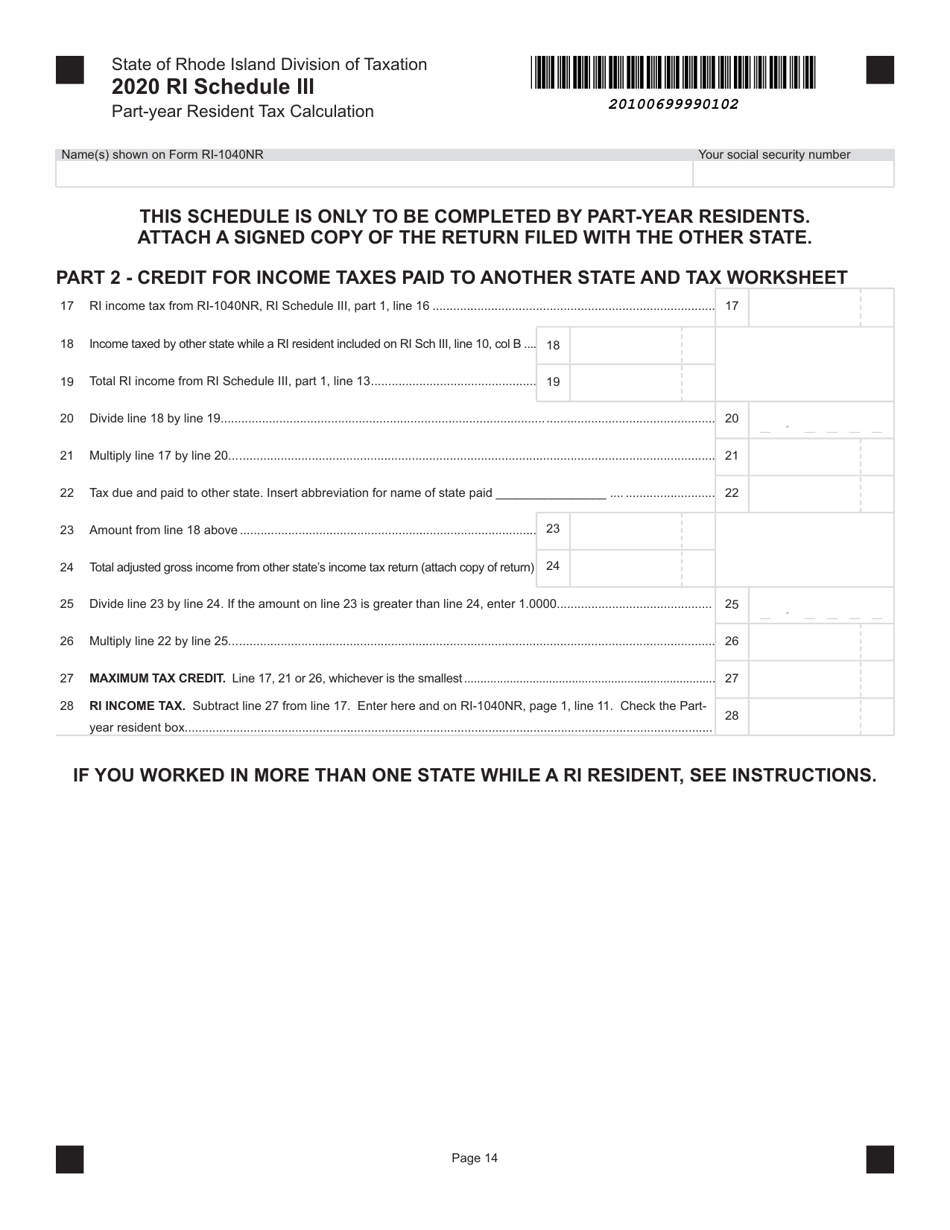

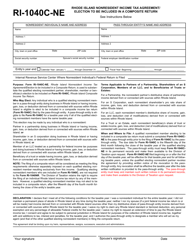

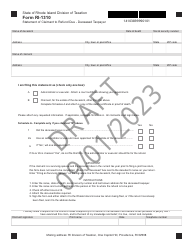

Form RI-1040NR Schedule III

for the current year.

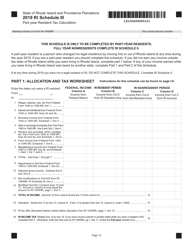

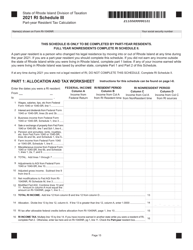

Form RI-1040NR Schedule III Part-Year Resident Tax Calculation - Rhode Island

What Is Form RI-1040NR Schedule III?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island.The document is a supplement to Form RI-1040NR, Nonresident Individual Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form RI-1040NR Schedule III?

A: The Form RI-1040NR Schedule III is a tax form used by part-year residents of Rhode Island to calculate their state income tax.

Q: Who needs to file Form RI-1040NR Schedule III?

A: Part-year residents of Rhode Island need to file Form RI-1040NR Schedule III.

Q: What information is required to fill out Form RI-1040NR Schedule III?

A: You will need to provide your income and deductions for the period of time you were a resident of Rhode Island.

Q: When is the deadline for filing Form RI-1040NR Schedule III?

A: The deadline for filing Form RI-1040NR Schedule III is generally April 15th, or the same as the federal income tax deadline.

Q: Are there any special considerations for filing Form RI-1040NR Schedule III?

A: Part-year residents may need to prorate their income and deductions based on the number of days they were a resident of Rhode Island.

Q: What do I do if I have questions or need help filling out Form RI-1040NR Schedule III?

A: If you have questions or need help filling out Form RI-1040NR Schedule III, you can contact the Rhode Island Division of Taxation for assistance.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RI-1040NR Schedule III by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.