This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

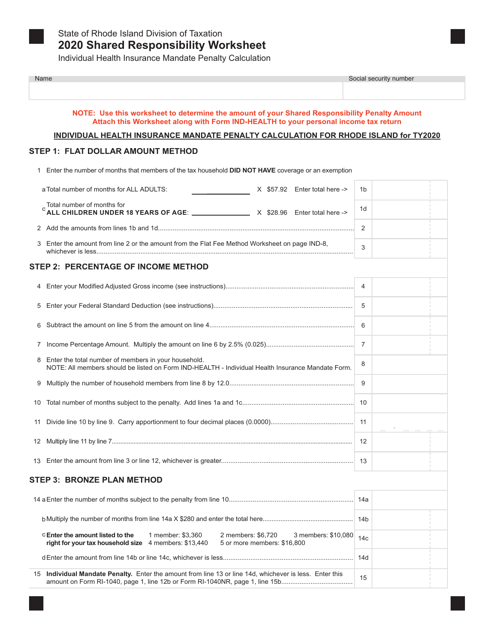

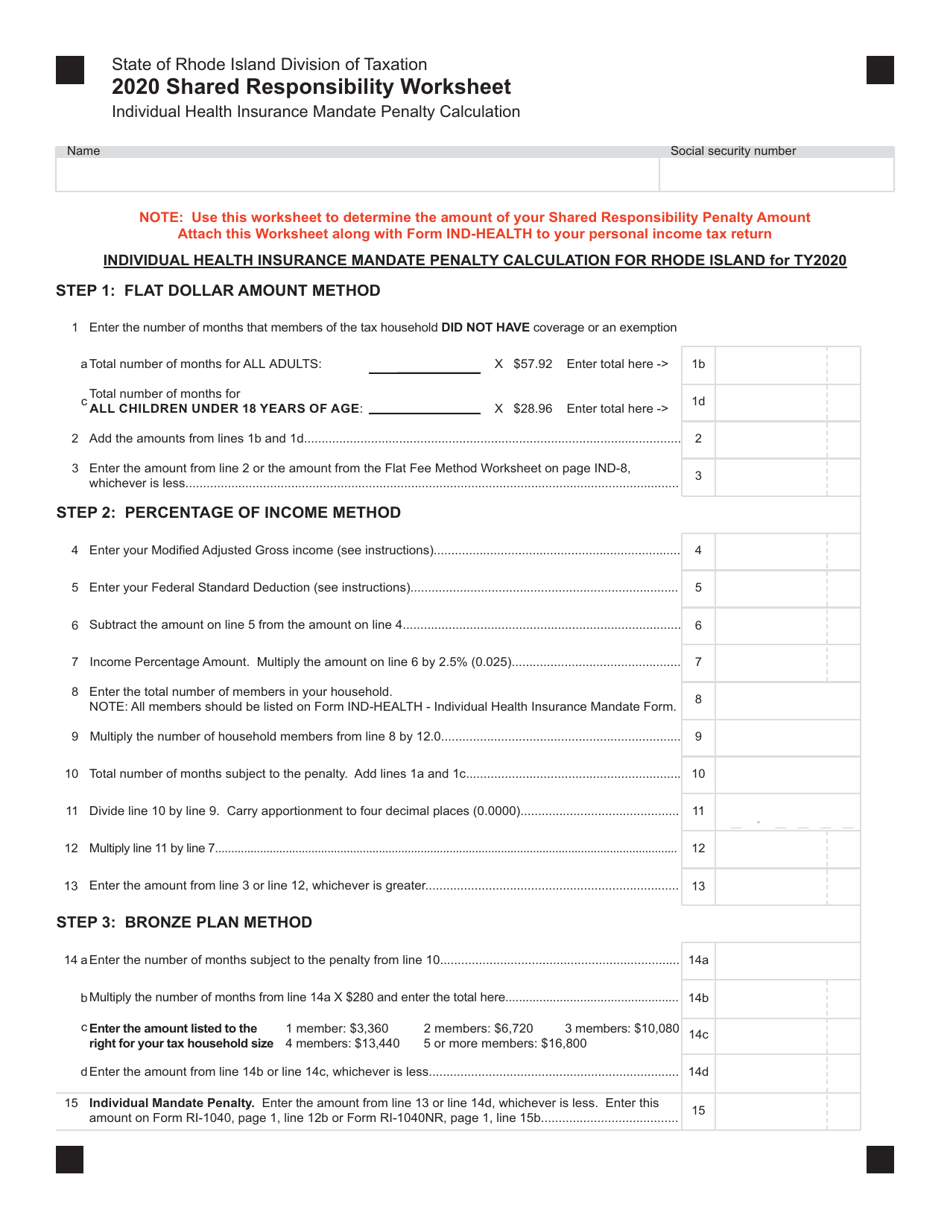

Shared Responsibility Worksheet - Rhode Island

Shared Responsibility Worksheet is a legal document that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island.

FAQ

Q: What is the Shared Responsibility Worksheet?

A: The Shared Responsibility Worksheet is a document that helps taxpayers in Rhode Island determine if they are required to pay the individual shared responsibility penalty for not having health insurance.

Q: Who is required to fill out the Shared Responsibility Worksheet?

A: Residents of Rhode Island who were uninsured for any part of the tax year may need to fill out the Shared Responsibility Worksheet.

Q: What information is needed to fill out the Shared Responsibility Worksheet?

A: Taxpayers will need to provide information about their health insurance coverage, including the months they were insured and any exemptions they may qualify for.

Q: How does the Shared Responsibility Worksheet determine if a taxpayer owes a penalty?

A: The worksheet calculates the penalty based on the number of months the taxpayer was uninsured and whether they qualify for any exemptions.

Q: What happens if a taxpayer owes a penalty based on the Shared Responsibility Worksheet?

A: If a taxpayer owes a penalty, it will be included in their Rhode Island state income tax return and may be subject to interest and penalties if not paid in full.

Q: Is there a way to avoid the penalty calculated by the Shared Responsibility Worksheet?

A: Yes, taxpayers may qualify for exemptions if they meet certain criteria, such as having a low income or experiencing a hardship.

Q: What should I do if I have questions or need assistance with the Shared Responsibility Worksheet?

A: If you have questions or need assistance, you can contact the Rhode Island Division of Taxation or seek help from a qualified tax professional.

Form Details:

- The latest edition currently provided by the Rhode Island Department of Revenue - Division of Taxation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.