This version of the form is not currently in use and is provided for reference only. Download this version of

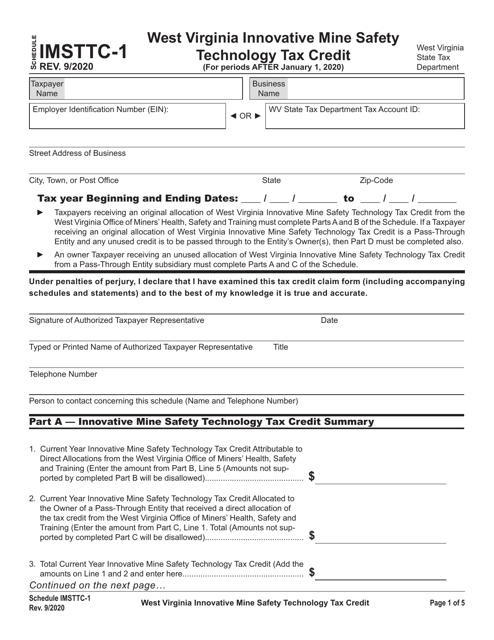

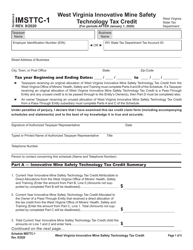

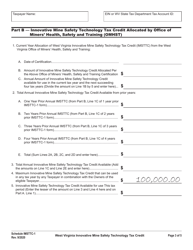

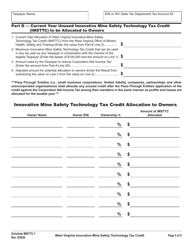

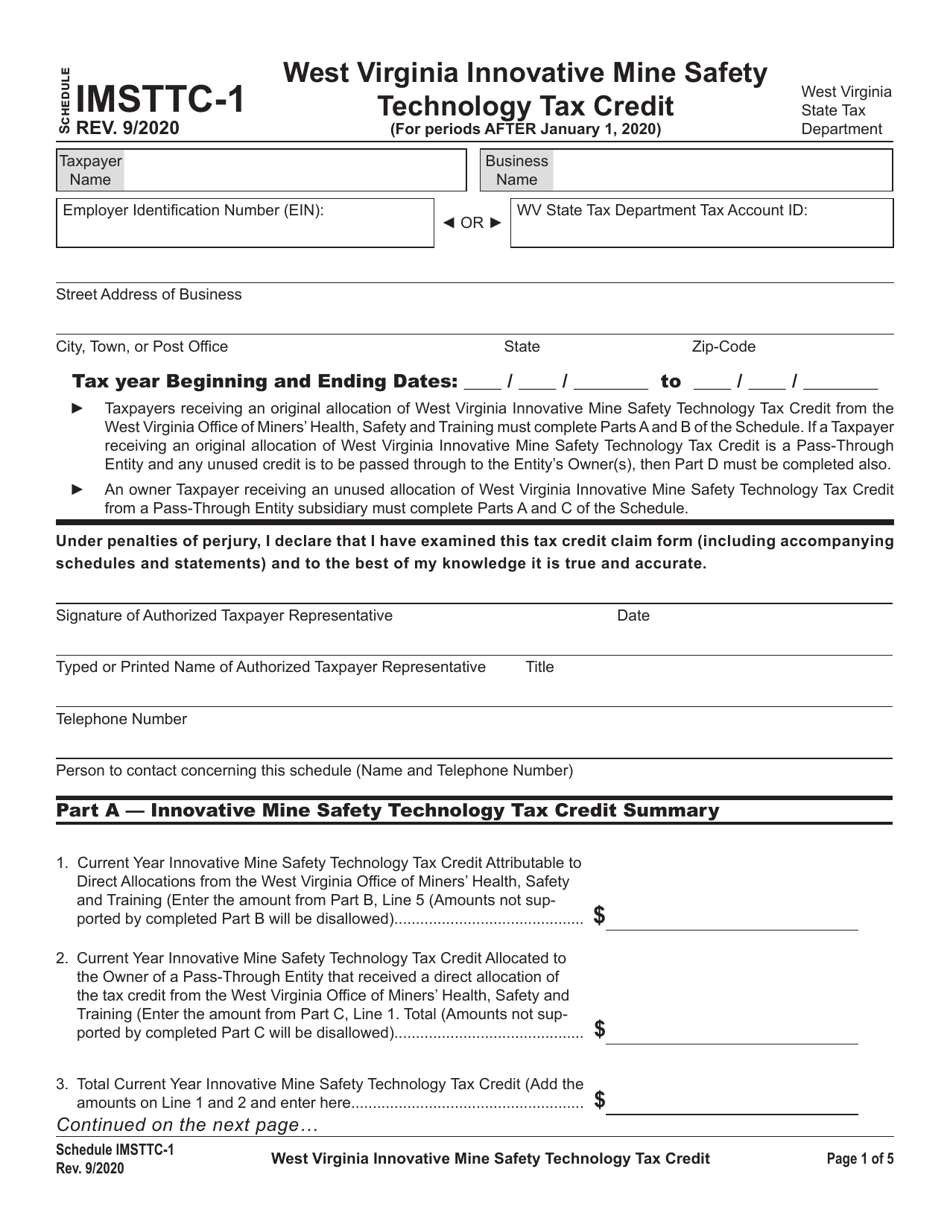

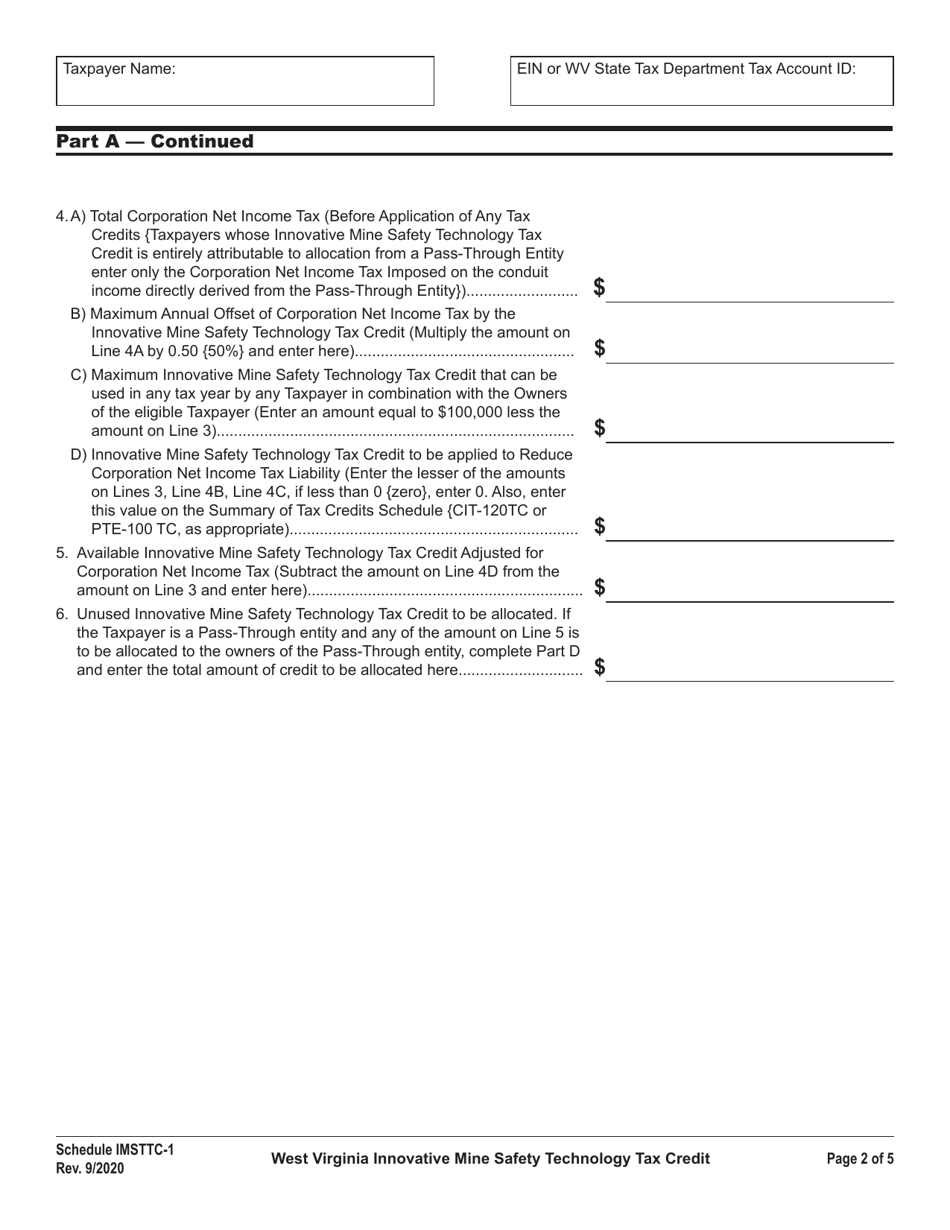

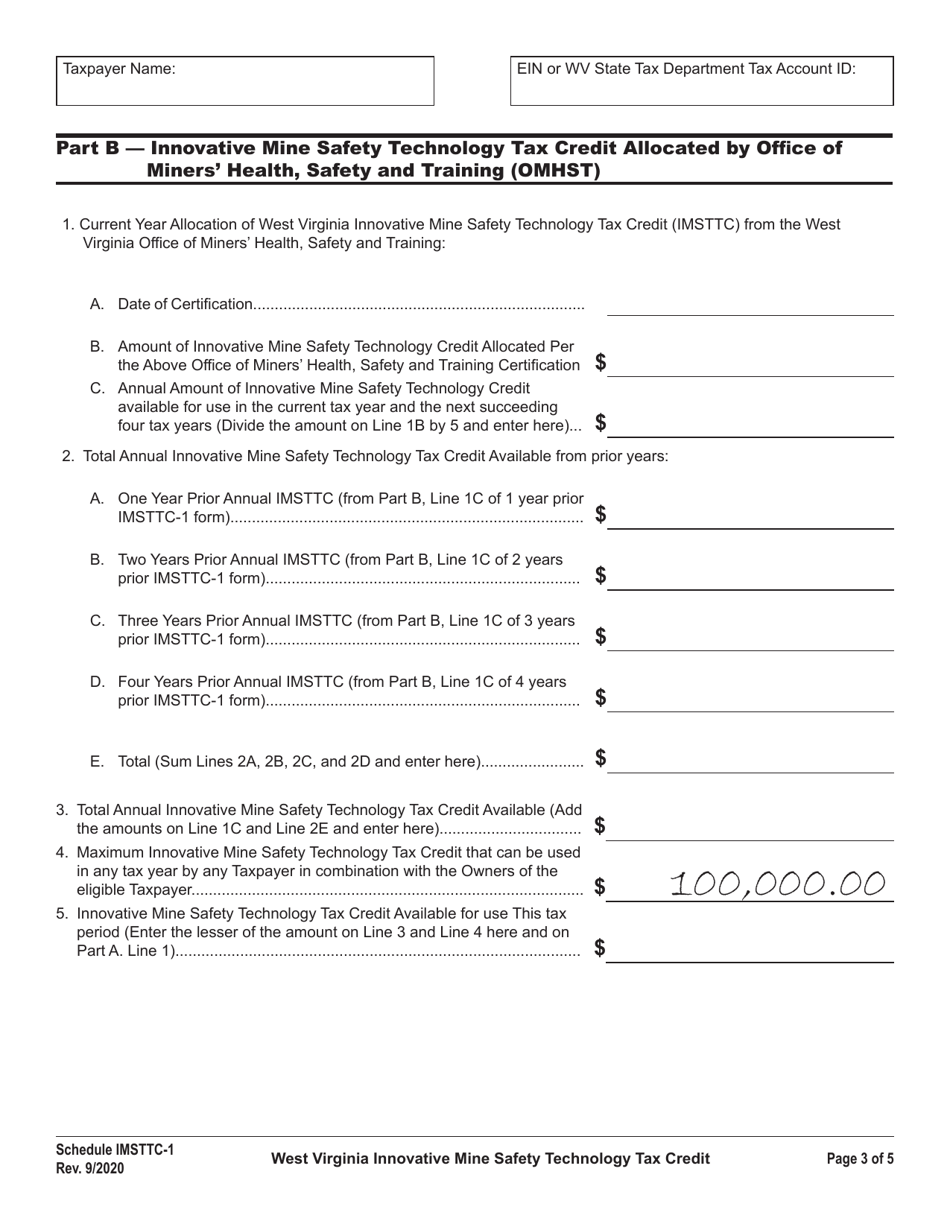

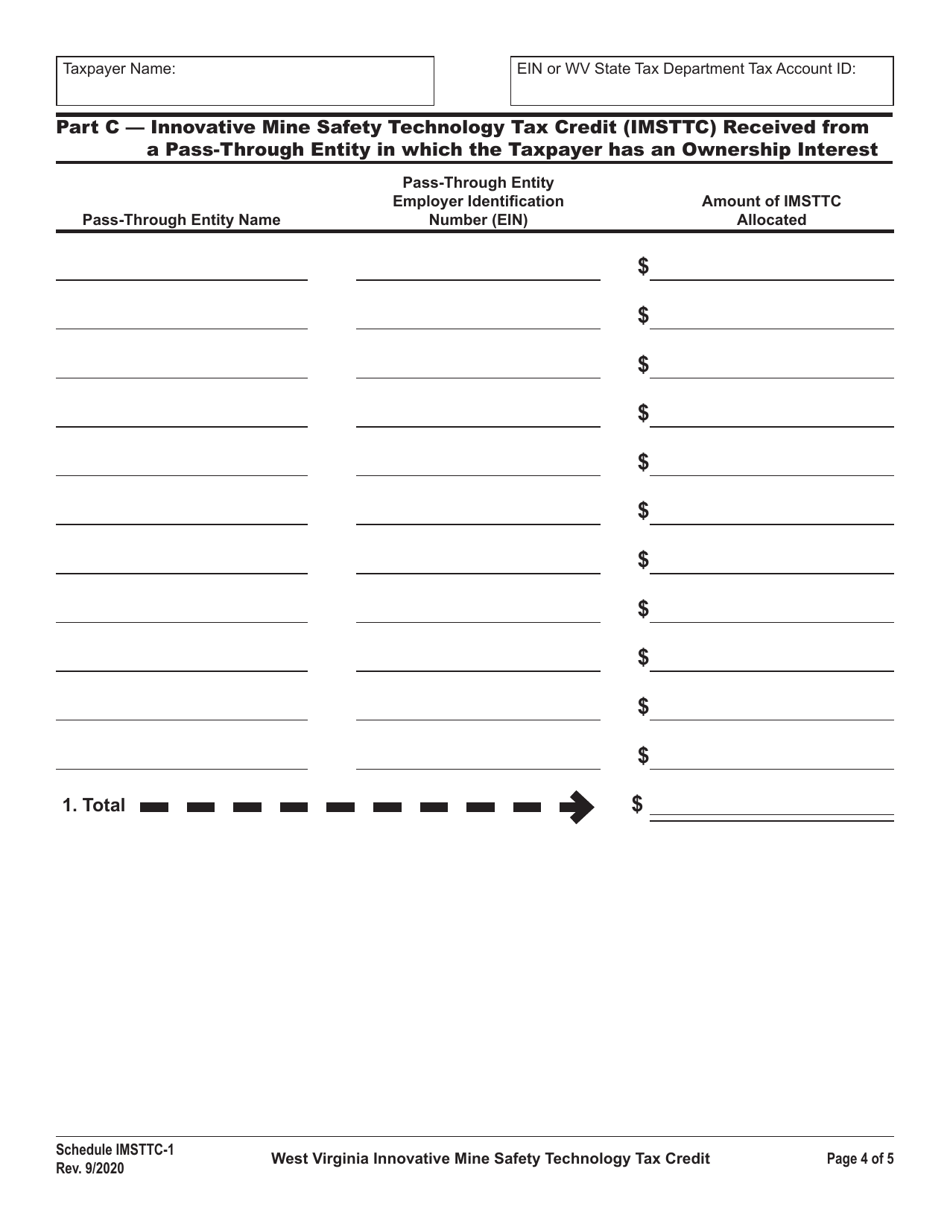

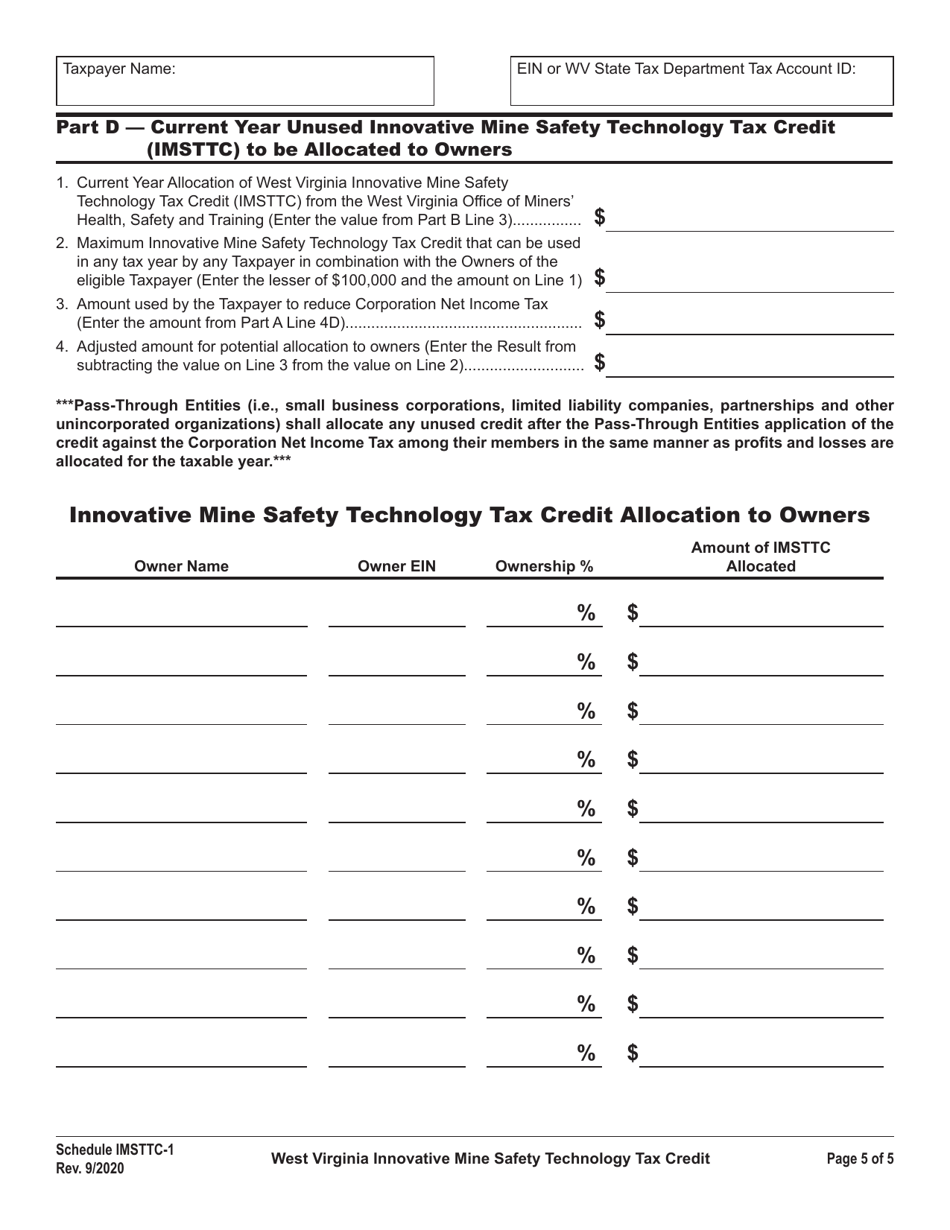

Schedule IMSTTC-1

for the current year.

Schedule IMSTTC-1 West Virginia Innovative Mine Safety Technology Tax Credit - West Virginia

What Is Schedule IMSTTC-1?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is IMSTTC-1?

A: IMSTTC-1 stands for Innovative Mine Safety Technology Tax Credit.

Q: What is the purpose of IMSTTC-1?

A: The purpose of IMSTTC-1 is to incentivize the development and use of innovative mine safety technologies in West Virginia.

Q: What does the IMSTTC-1 tax credit provide?

A: The IMSTTC-1 tax credit provides tax incentives for companies that develop or use innovative mine safety technologies in West Virginia.

Q: Who is eligible for IMSTTC-1?

A: Companies operating in the mining industry in West Virginia may be eligible for IMSTTC-1.

Q: How can companies apply for IMSTTC-1?

A: Companies can apply for IMSTTC-1 by submitting an application to the West Virginia Department of Revenue.

Q: Are there any specific requirements for the innovative mine safety technologies?

A: Yes, the innovative mine safety technologies must meet certain criteria specified by the West Virginia Department of Revenue.

Q: Is there a deadline for applying for IMSTTC-1?

A: Yes, the deadline for applying for IMSTTC-1 is typically specified by the West Virginia Department of Revenue.

Form Details:

- Released on September 1, 2020;

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule IMSTTC-1 by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.