This version of the form is not currently in use and is provided for reference only. Download this version of

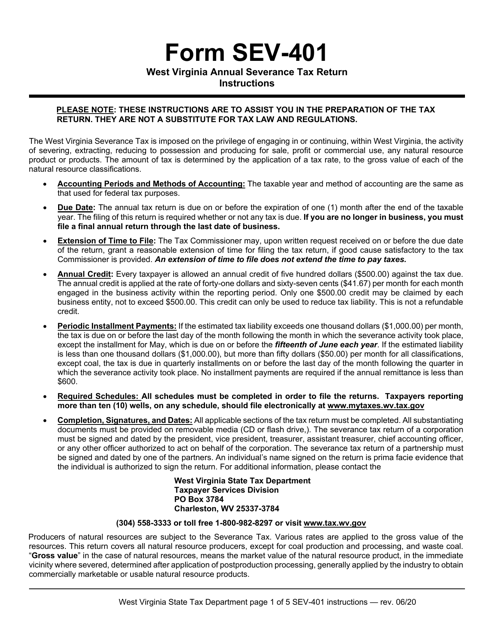

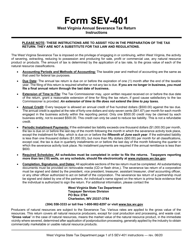

Instructions for Form SEV-401

for the current year.

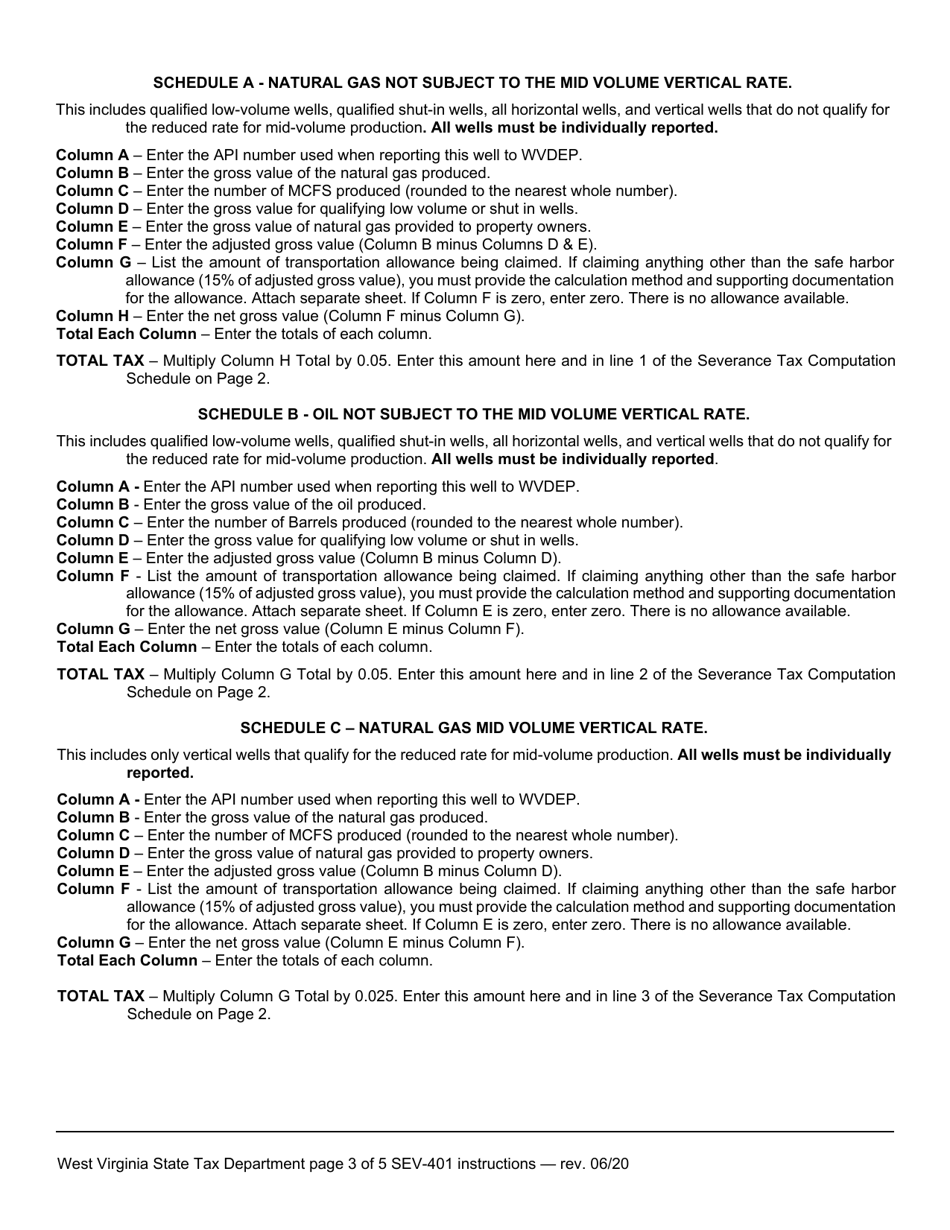

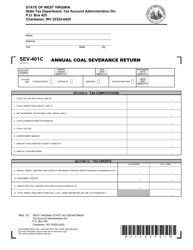

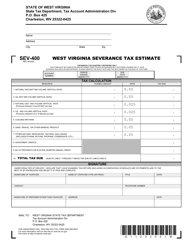

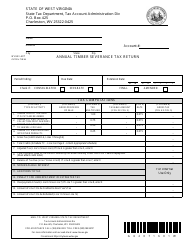

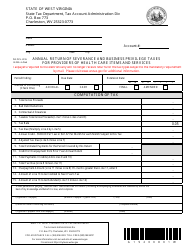

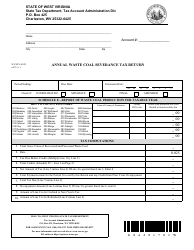

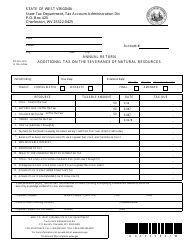

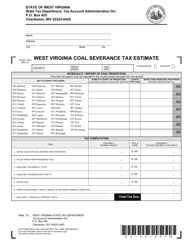

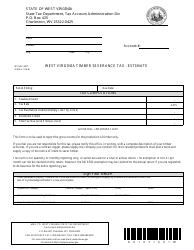

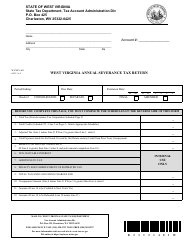

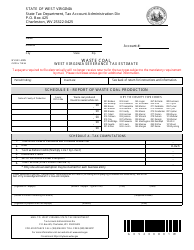

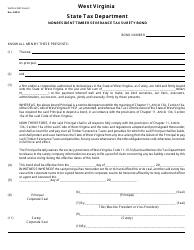

Instructions for Form SEV-401 West Virginia Annual Severance Tax Return - West Virginia

This document contains official instructions for Form SEV-401 , West Virginia Annual Severance Tax Return - a form released and collected by the West Virginia State Tax Department. An up-to-date fillable Form SEV-401 is available for download through this link.

FAQ

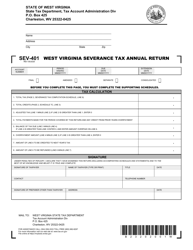

Q: What is Form SEV-401?

A: Form SEV-401 is the West Virginia Annual Severance Tax Return.

Q: Who needs to file Form SEV-401?

A: Anyone who is engaged in the severance of natural resources in West Virginia must file Form SEV-401.

Q: What is the purpose of Form SEV-401?

A: The purpose of Form SEV-401 is to report and remit the annual severance tax on natural resources extracted or produced in West Virginia.

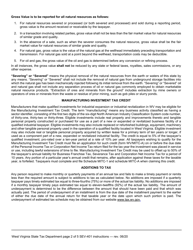

Q: When is Form SEV-401 due?

A: Form SEV-401 is due on or before the last day of the month following the end of the calendar year.

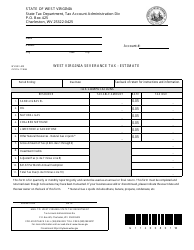

Q: What information is required on Form SEV-401?

A: Form SEV-401 requires information such as the name and address of the taxpayer, the type of natural resource severed, the total quantity severed, and the amount of tax due.

Q: Are there any penalties for late filing of Form SEV-401?

A: Yes, there are penalties for late filing of Form SEV-401, including interest charges and potential legal action.

Q: Is there any additional documentation required with Form SEV-401?

A: Depending on the nature of the severance activity, additional documentation such as production reports or sales records may be required.

Instruction Details:

- This 5-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the West Virginia State Tax Department.