This version of the form is not currently in use and is provided for reference only. Download this version of

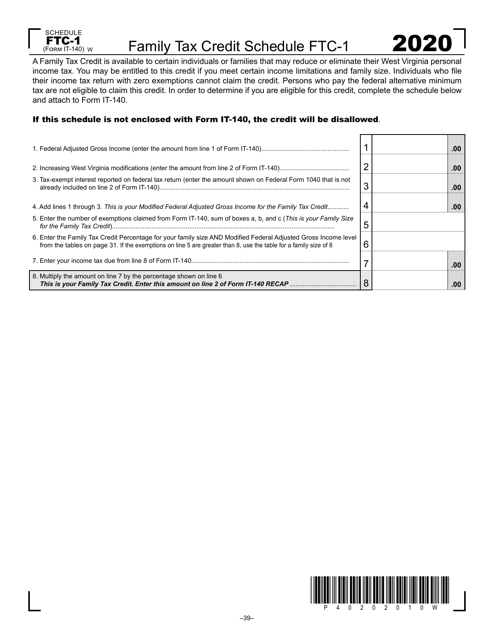

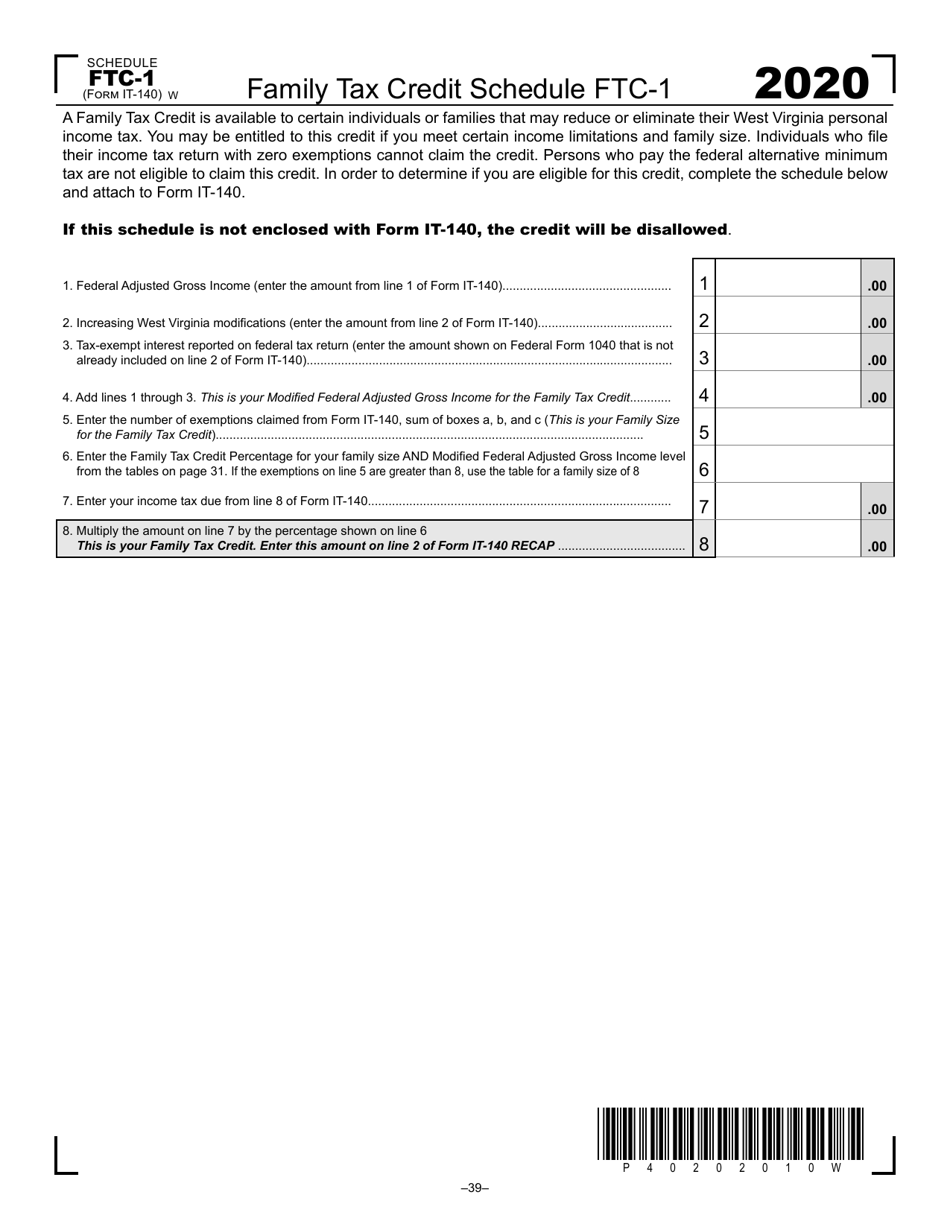

Form IT-140 Schedule FTC-1

for the current year.

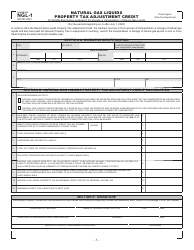

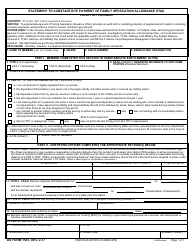

Form IT-140 Schedule FTC-1 Family Tax Credit Schedule - West Virginia

What Is Form IT-140 Schedule FTC-1?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-140 Schedule FTC-1?

A: Form IT-140 Schedule FTC-1 is the Family Tax Credit Schedule for West Virginia.

Q: What is the purpose of Form IT-140 Schedule FTC-1?

A: Form IT-140 Schedule FTC-1 is used to claim the family tax credit on your West Virginia state tax return.

Q: Who needs to file Form IT-140 Schedule FTC-1?

A: You need to file Form IT-140 Schedule FTC-1 if you are a resident of West Virginia and are eligible for the family tax credit.

Q: Is the family tax credit refundable?

A: No, the family tax credit in West Virginia is non-refundable. It can only be used to offset your West Virginia state tax liability.

Form Details:

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form IT-140 Schedule FTC-1 by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.