This version of the form is not currently in use and is provided for reference only. Download this version of

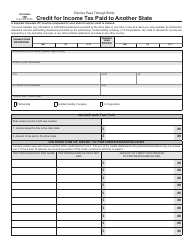

Form IT-140 Schedule E, H

for the current year.

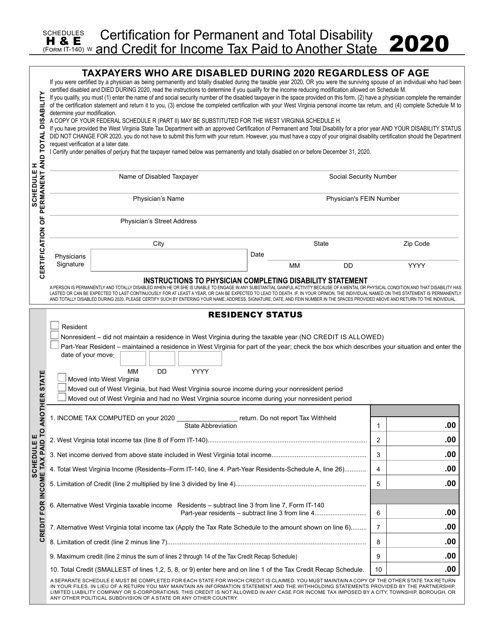

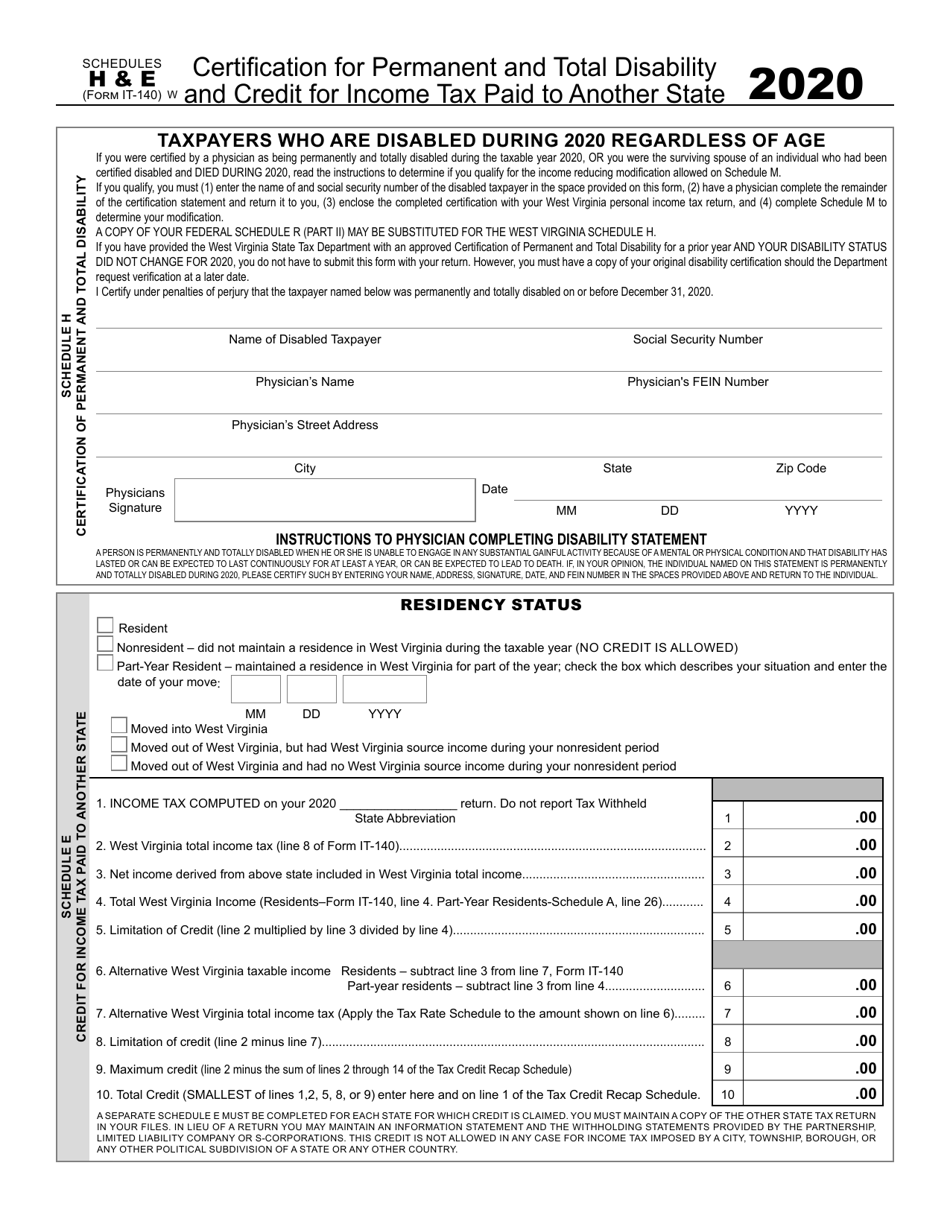

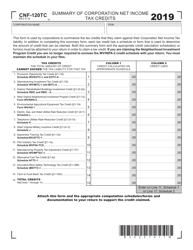

Form IT-140 Schedule E, H Certification for Permanent and Total Disability and Credit for Income Tax Paid to Another State - West Virginia

What Is Form IT-140 Schedule E, H?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-140 Schedule E, H Certification for Permanent and Total Disability and Credit for Income Tax Paid to Another State in West Virginia?

A: Form IT-140 Schedule E, H is a form used in West Virginia to certify permanent and total disability and claim a credit for income tax paid to another state.

Q: Who needs to file Form IT-140 Schedule E, H in West Virginia?

A: Individuals who are permanently and totally disabled and are claiming a credit for income tax paid to another state need to file Form IT-140 Schedule E, H in West Virginia.

Q: How do I complete Form IT-140 Schedule E, H in West Virginia?

A: The form requires you to provide your personal information, disability certification, details of income tax paid to another state, and any supporting documentation. It is important to carefully review the instructions provided with the form to ensure accurate completion.

Q: Can I e-file Form IT-140 Schedule E, H in West Virginia?

A: No, West Virginia does not currently support electronic filing for Form IT-140 Schedule E, H. You must mail the completed form to the West Virginia State Tax Department.

Q: Are there any deadlines for filing Form IT-140 Schedule E, H in West Virginia?

A: The deadline for filing Form IT-140 Schedule E, H is the same as the deadline for filing your West Virginia income tax return, which is typically April 15th or the next business day if it falls on a weekend or holiday.

Form Details:

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form IT-140 Schedule E, H by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.